This topic covers a apart of the investment decisions. it is about an overview of the progression of portfolio theory. covering three formal portfolio theories: the Markowitz Portfolio Theory, Capital Asset Pricing Model and the Arbitrage Pricing Theory. These theories provide a model to compute an asset’s return in relation to its risks.

Contents:

Introduction

Risk Aversion and Utility

Markowitz Portfolio Theory

Capital Asset Pricing Model

Arbitrage Pricing Theory

Summary

Self-Assessment

Question 1 and 2 are to be based on the following information:

Two investors, A and B are considering the purchase of a security with an expected return of 16% per annum and a variance of 40. A’s level of risk aversion is-1 and B’s level of risk aversion is 5.

1. Which of the following statements in relation to the risk averseness of investors A and B is TRUE?

A. A is more risk-averse than B

B. A and B has the same level of risk aversion

C. B is more risk-averse than A

D. None of the above

2. What is A and B’s level of utility?

A. U(A) = 15.0; U(B) = 16.2

B. U(A) = 16.2; U(B) = 15.0

C. U(A) = 18.6; U(B) = 5.1

D. U(A) = 12.5; U(B) = 8.2

3. The beta in CAPM measures:

A. The amount of systematic risk of a company

B. The sensitivity of market returns with its own series

C. The sensitivity of portfolio returns to the market returns

D. The sensitivity of one asset’s returns against another in a portfolio.

4. Which one of the following statements is FALSE about BETA?

A. It is a determinant of the investor’s required rate of return for a company.

B. It is used in the portfolio investment decision

C. Betas can be positive or negative

D. Historical betas are designed to capture fundamental change to the company.

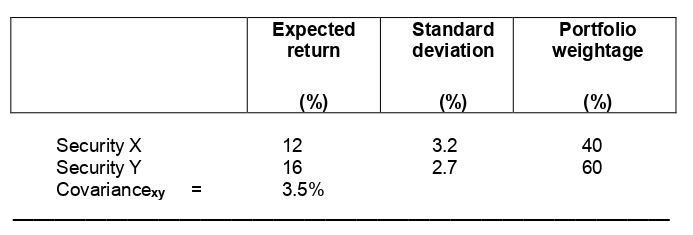

5. Assume that a portfolio comprises the following securities:

Compute the expected return of the portfolio (E(Rp)) variance of the portfolio (Varp).

A. E(R) – 13.5%, Varp = 4.38%

B. E(R) – 14.8%, Varp = 5.55%

C. E(R) – 14.4%, Varp = 5.94%

D. E(R) – 15.3%, Varp = 4.38%