In this topic, the process of Portfolio Management and evaluation of its performance are explained.

Contents:

Introduction

Market Efficiency

Definition

– Impact of an efficient market

– Efficient hypothesis

– Implications of an efficient capital market foe technical and fundamental analysis.

– Implications of efficient markets for portfolio management

Security Analysis

– Fundamental analysis

– Technical analysis

– Fundamental analysis vs technical analysis

An Introduction to Portfolio Management

– Development of investment policy statement

– Asset allocation

– Portfolio monitoring and rebalancing

Evaluation of Investment Performance

– Factors to consider in evaluating performance

– Estimating portfolio returns

– Performance evaluation

– Performance attribution analysis

Summary

Self-Assessment / Activity

Introduction

According to Investopedia.com, Portfolio Management is the art and science of selecting and overseeing a group of investments that meet the long-term financial objectives and risk tolerance of a client, a company, or an institution. Some individuals do their own investment portfolio management. That requires a basic understanding of the key elements of portfolio building and maintenance that make for success, including asset allocation, diversification, and rebalancing.

Are our market efficient? What are the implication of efficient market for portfolio management and management? These are some of the questions that will be addressed in this topic. the efficient Market Hypothesis is one of the foremost theorist, that affect portfolio management and investments. The Efficient Market Hypothesis basically states that capital markets are efficient and that prices of securities will adjust independently and rapidly to new information.

In the sections that follow, we shall broadly discuss the efficient levels of market efficiency as well as its implications on fundamental and technical analysis and portfolio management. In addition, this topic will also provide a brief introduction to portfolio management and the portfolio management process. We shall also be looking at different methods of performance evaluation.

Objectives:

Define the levels of market efficiency

Discuss the implications of market efficiency on technical and fundamental analysis and portfolio management.

Discuss what fundamentals analysis and technical analysis entail and their major differences.

Examine the portfolio management process, and

Discuss methods of performance evaluation.

Market Efficiency

Definition

Market efficiency refers to the degree to which market prices reflect all available, relevant information. If markets are efficient, then all information is already incorporated into prices, and so there is no way to “beat” the market because there are no undervalued or overvalued securities available.

The term was taken from a paper written in 1970 by economist Eugene Fama, however Fama himself acknowledges that the term is a bit misleading because no one has a clear definition of how to perfectly define or precisely measure this thing called market efficiency. Despite such limitations, the term is used in referring to what Fama is best known for, the efficient market hypothesis (EMH).

The EMH states that an investor can’t outperform the market, and that market anomalies should not exist because they will immediately be arbitraged away. Fama later won the Nobel Prize for his efforts. Investors who agree with this theory tend to buy index funds that track overall market performance and are proponents of passive portfolio management.

A market efficient when all relevant and ascertainable is reflected in the price of the security. It also means that all security prices will adjust rapidly to the introduction of any new information. Such a market can also be referred to as an informationally efficient market.

Impact of an efficient market

– Efficient hypothesis

– Implications of an efficient capital market foe technical and fundamental analysis.

– Implications of efficient markets for portfolio management

Security Analysis

– Fundamental analysis

– Technical analysis

– Fundamental analysis vs technical analysis

An Introduction to Portfolio Management

– Development of investment policy statement

– Asset allocation

– Portfolio monitoring and rebalancing

Evaluation of Investment Performance

– Factors to consider in evaluating performance

– Estimating portfolio returns

– Performance evaluation

– Performance attribution analysis

Summary

Self-Assessment / Activity

1. ____________________ decomposes the performance results in order to determine the source of over-performance or under-performance of the portfolio manager.

A. Performance appraisal

B. Performance attribution analysis

C. Sensitivity analysis

D. Market analysis

Note:

Portfolio performance evaluation is an essential aspect of the investment process that allows investors and portfolio managers to assess the effectiveness of their investment strategies.

The main goal of performance evaluation is to determine whether the chosen investment strategy is achieving the desired risk and return objectives.

2. Allocation of a portfolio’s fund according to the classes of asset is called:

A. performance measurement

B. performance evaluation

c. asset allocation

D. performance attribution.

3. The dollar-weighted rate of return measures;

A. the opportunity cost of forgoing consumption, given no inflation.

B. the risk-adjusted rate of return of a portfolio

C. the discount rate that equates all cash flows to or from the portfolio, including the ending market value, with the beginning market value of the portfolio.

D. the compounded rate of growth of the initial portfolio market value during the evaluation period.

4. ___________________ is a measure of market risk.

A. Beta – Beta (β) is a measure of the volatility—or systematic risk—of a security or portfolio compared to the market as a whole (usually the S&P 500). Stocks with betas higher than 1.0 can be interpreted as more volatile than the S&P 500. Beta is used in the capital asset pricing model (CAPM), which describes the relationship between systematic risk and expected return for assets (usually stocks). CAPM is widely used as a method for pricing risky securities and for generating estimates of the expected returns of assets, considering both the risk of those assets and the cost of capital.

B. Standard deviation – Standard deviation is a statistical measurement of how far a variable, such as an investment’s return, moves above or below its average (mean) return. An investment with high volatility is considered riskier than an investment with low volatility; the higher the standard deviation, the higher the risk. A traditional bell curve is a good way to visualize the concept of an investment’s returns over an extended period of time.

c. Alpha – Alpha (α) is a term used in investing to describe an investment strategy’s ability to beat the market, or its “edge.” Alpha is thus also often referred to as “excess return” or the “abnormal rate of return” in relation to a benchmark, when adjusted for risk. Alpha is often used in conjunction with beta (the Greek letter β), which measures the broad market’s overall volatility or risk, known as systematic market risk.

D. Gamma

5. An index that measures the excess return of a portfolio relative to the portfolio’s total risk using standard deviation is known as:

A. information ratio

B. Jensen Index

C. Treynor Index

D. Sharpe Index

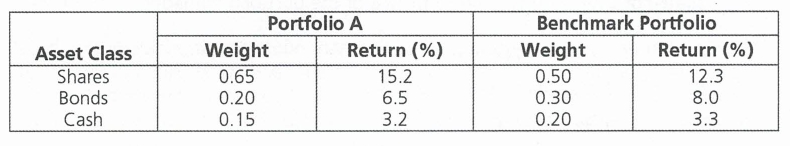

Question 6-9 are based on the following below information:

Note: A rate of return (RoR) is the net gain or loss of an investment over a specified time period, expressed as a percentage of the investment’s initial cost. When calculating the rate of return, you are determining the percentage change from the beginning of the period until the end.

6. The expected rate of return of portfolio A is:

A. 11.42%

B. 11.66%

C. 12.01%

D. 12.62%

7. What is the rate of return of the benchmark portfolio?

A. 8.88%

B. 9.21%

C. 9.32%

D. 10.53%

8. What is the selection effect portfolio A?

A. -1.45%

B. 1.55%

C. 1.57%

D. 1.63%

9. The allocation effect a portfolio A is:

A. -0.93%

B. -0.65%

C. 0.88%

D. 0.93%

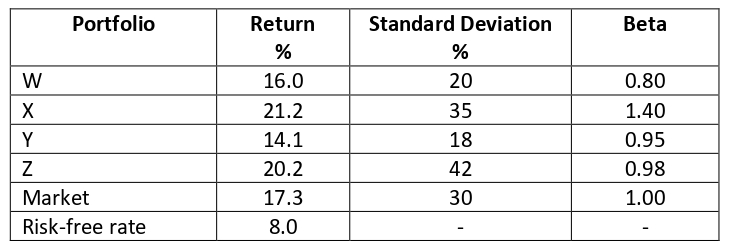

Question 10 – 12 is based on the following table:

10. The HENSEN ALPHA for portfolio Z is:

A. 2.20

B. 3.09

C. 3.34

D. 5.26

Note:

Alpha = R(i) – (R(f) + B x (R(m) – R(f)))

where:

R(i) = the realized return of the portfolio or investment

R(m) = the realized return of the appropriate market index

R(f) = the risk-free rate of return for the time period

B = the beta of the portfolio of investment with respect to the chosen market index

11. The TREYNOR INDEX for portfolio W is:

A. 6.6

B. 7.8

C. 8.6

D. 10.0

Note:

Treynor Ratio = (PR – PFR)/PB = (16 – 8)/0.8 = 10

where:

PR= Portfolio return

RFR= Risk free rate and

PB= Portfolio beta

12. which portfolio ranks the best under the Sharpe Index?

A. W

B. X

C. Y

D. Z