This topic is about the analysis of financing decisions which covering the topic of debt financing, equity financing and dividend policy. The dividend policy is also classified in the subject of financing decisions although it could just as well be investment decision because dividend policy can have an effect on both financing and investment decisions.

Debt financing is the opposite of equity financing, which entails issuing stock to raise money. Debt financing occurs when a firm sells fixed income products, such as bonds, bills, or notes. Unlike equity financing where the lenders receive stock, debt financing must be paid back.

Summary

Debt financing is simply about rising funds for a business via debt. For the purpose of this subject, we have identified borrowing in the form of bank loans, leases and corporate bonds. Borrowers can access borrowings through loans offered by financial institutions. A loan is an arrangement in which a bank lends money to a borrower who agrees to repay, usually along with interest, at some predetermined future dates. The types of loans available in the market are divided into three broad categories namely, long terms loans, trade loans and working funds or short-term loans. In this topic, we have also looked at the numerous financing methods for trade transactions available to both sellers and buyers.

Leasing is another form of financing. it involves the purchase of machinery or equipment by the lender who will then rent out the assets to the lessee. The lessor has the ownership claim over the productive assets while the lessee acquires the right to use the asset leased. However, the lessee may arrange with the lessor to purchase the leased assets at the end of the lease period.

We have also introduced bond financing. We have discussed the methods of valuing bonds as well as the implications and effects of volatility on the value of bonds. Due to the development of bond features, valuation of bonds is no longer confined to simple present value computations. Bonds with embedded options, such as convertible bonds, would require the use of option valuation models to enable them to be priced. As such, in the section of this topic, we have examined the common features of a convertible bond and introduced a method for valuing the same.

Self-Assessment / Activity

1. ABC Ltd has a constant overdraft balance of RM100,000 up to 15 March 20X9. Subsequently, the company drew down an additional RM50,000 and the overdraft remains unchanged up to 1 April 20X9. At 7.5% per annum, what would be the interest accrued for the month of March in ABC Ltd’s account?

A. RM 318.49

B. RM 801.37

C. RM 832.19

D. RM 955.48

2. _____________ is the periodic interest payment paid to the bondholder before and at the maturity of the bond.

A. Coupon payment

B. Yield

C. Nominal value

D. Capital gains

3. All things constant, the price and yield on a bond are:

A. not related

B. inversely related

C. positively related

D. constant

4. The number of shares for which each convertible bond can be exchanged is called:

A. conversion price

B. conversion ratio

C. conversion premium

D. market value

5. Which of the following statements is CORRECT about ZERO-COUPON BONDS?

A. Zero-coupon bonds provide periodic payments

B. Zero-coupon bonds are sold at a higher price relative to straight bonds.

C. Holders of zero-coupon bonds do not enjoy any capital gains as the price of the bond increase as it approaches maturity.

D. The price of a zero-coupon bond is the present value of the nominal value of maturity.

Use the following information to answer questions 6 and 7.

Consider two bonds, Bond A and B, with a nominal value of RM1,000 and a coupon rate of 6% per year. Both bonds have similar risk characteristics and differ only in their term to maturity. Bond A is term to maturity is 5 years while Bond B’s term to maturity is 10 years. The current yield is 6%.

6. If the yields increase by 2% points, the percentage price change of Bond A is:

A. -13.42%

B. -7.97%

C. 7.97%

D. 13.42%

7. If yields by 2% points, the percentage price change of Bond B is:

A. -13.33%

B. -7.99%

C. 7.99%

D. 13.33%

8. The duration of a bond is a function of the bond’s:

I time to maturity

II coupon rate

III yield

IV price of the bond

A. I and II

B. I and III only

C. I, II and III only

D. All of the above

9. The convexity of bonds is more important when interest rates are:

A. low

B. high

C. expected to change very little

D. less than the coupon rate on the bond

10. The number of shares for which each convertible bond can be exchanged is called:

A. yield to maturity

B. term to maturity

C. modified duration

D. convexity

11. A modified duration of a 8% coupon bond paying interest semi-annually with a duration of 4.5 years and a yield of 10% is:

A. 4.09

B. 4.25

C. 4.29

D. 4.35

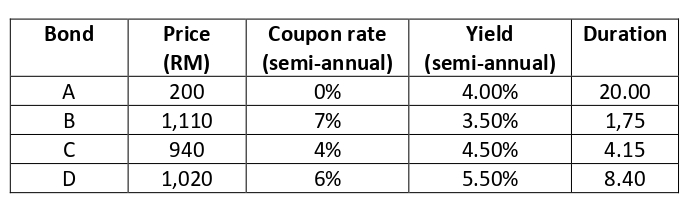

Use the following information to answer questions 12 and 13

Sarah and Rani were debating on the direction of interest rates over the next 12 months. Sarah believes that interest rates are going to increase by as much as 2% over the next 12 months. Rani, on the other hand, expects interest rates to decline by around 2% over the next 12 months. With this in mind, consider the following information pertaining to the selected quality bonds:

12. Based on Sarah’s expectations on the direction of interest rates, which of the above bonds would you buy that would MAXIMISE your total earning return over the next 12 months?

A. A and B only

B. B and C only

C. C and D only

D. A only

13. If you concur with Rani’s expectations of interest rate movements in the the future, which of the bonds would you buy that would MAXIMISE your total return?

A. A and B only

C. A and C only

C. A and C only

D. D only