Mergers vs. Takeovers: What’s the Difference?

A merger involves the mutual decision of two companies to combine and become one entity. A takeover involves the purchase of a smaller company by a larger one. Mergers are often friendly deals while takeovers can sometimes be hostile if the target doesn’t wish to be acquired.

Mergers and takeovers are two types of business transactions. They involve consolidating two different companies into a single entity. Both of these deals come with operational advantages, including an increase in market share, improved efficiency, better company performance, increased shareholder value, and the potential for an increase in profitability. While mergers and takeovers may seem similar, there are inherent distinctions between them. For instance, mergers tend to be friendly deals between two companies while takeovers may be unwelcome by the target firm. Their motivations may also be different. We focus on the differences between these two types of transactions below…Read more

Rules on Take-Overs, Mergers and Compulsory Acquisitions

1.06 The Rules and the Code apply to any person who is, directly or indirectly, involved in a take–over, merger or compulsory acquisition, including all… Read more

Take-overs Code – Guidelines

Rules on Take-Overs, Mergers and Compulsory Acquisitions (pdf). (Issued: 15 August 2016) (Revised: 5 December 2017) (Applicable until: 28 December 2021)…Read more

Other Related articles:

Mergers and Acquisitions: Understanding Takeovers

Terms like “dawn raid,” “poison pill,” and “shark repellent” might seem like they belong in James Bond movies, but there’s nothing fictional about them—they are part of the world of mergers and acquisitions…Read more

Step-by-Step Process on Legal Takeover

Takeover refers to a transaction or a series of transactions hereby a person (individual, group of individuals or company) acquires control over the assets of a company either directly by becoming the owner of those assets or indirectly by obtaining control of the…Read more

A Guide to Malaysian Takeovers and Mergers Law

Malaysian Takeovers and Mergers Law is an essential in an active and dynamic equities market. This is because takeovers and mergers frequently involve enormous sums of money and involve multiple parties. Efficient regulation of this activity is critical for the market’s health and confidence…Read more

Contents

Learning Objectives

Introduction

Introduction to Take-Overs

General Principles and Rules on Take-Overs and Mergers

Types of Take-Over Offers

Processes and Procedures of Take-Over Offers

Roles and Responsibilities of a Capital Markets Services

Representative’s Licence (CMSRL) Holder

Penalties for contravention of the Code

Summary

Self-Assessment

Learning Objectives

At the end of this topic, you should be able to:

• Identify the laws and regulations related to take-overs and mergers

• Identify the regulatory bodies involved in take-over and merger activities

• Clarify the principles and rules pertaining to take-overs and mergers and the general provision of take-over legislation and their application

• Define what take-overs and mergers are and why they occur

• Identify what “control” in take-over offers is

• Explain the different types of take-over offers

• Identify and explain the process and procedure in take-over and merger activities

• Explain the relevant parties and their roles and obligations in take-over and merger activities

• Describe the roles and responsibilities of the Capital Markets Services Representative’s Licence (CMSRL) holder dealing in securities to his/her client due to the impact of the take- overs and mergers activities

• Discuss the penalties for contravention of the Capital Markets and Services Act 2007 (CMSA), the Malaysian Code on Take-overs and Mergers 2016 and the Rules on Take-overs, Mergers and Compulsory Acquisitions (2016), etc.

Introduction

This topic discusses the legal framework of take-overs and mergers in Malaysia. In this topic, we will consider the various types of take-over offers and understand how they occur. We also analyse the legislation governing companies in relation to a take-over bid and offer.

Introduction to Take-Overs

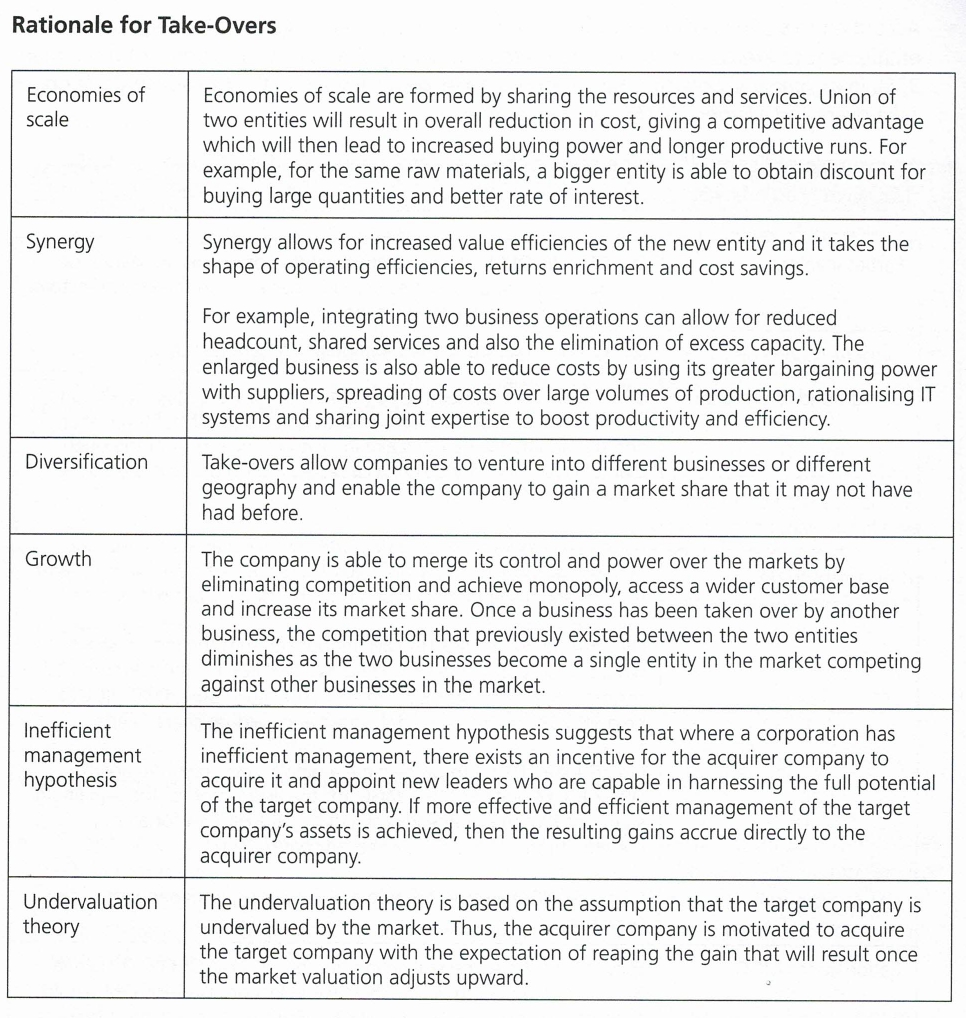

What are Take-Overs?

A take-over is a transaction or series of transactions whereby a person (individual, group of individuals or company) acquires control over the target company via share or assets acquisition.

Take-overs are either mandatory (i.e. an acquirer is required to make a take-over offer once specified events have occurred) or voluntary. Take-overs can either be hostile or friendly depending on the response from the target company.

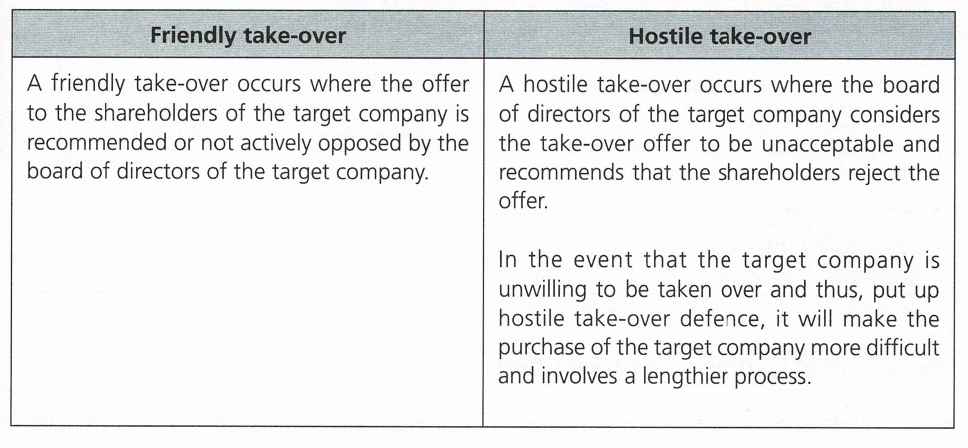

The table below illustrates the difference between a hostile and friendly take-over:

Distinction between Take-Overs and Mergers

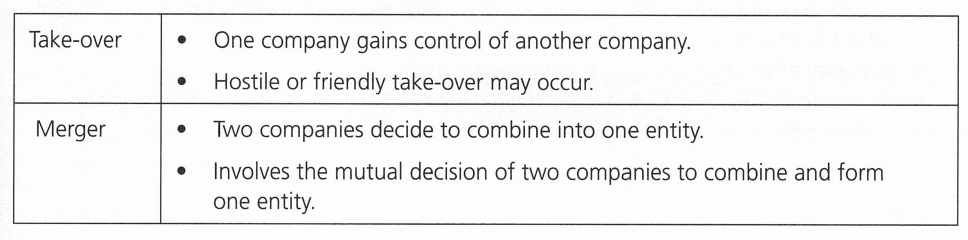

The table below illustrates the difference between a take-over and merger:

Share or Asset Acquisition

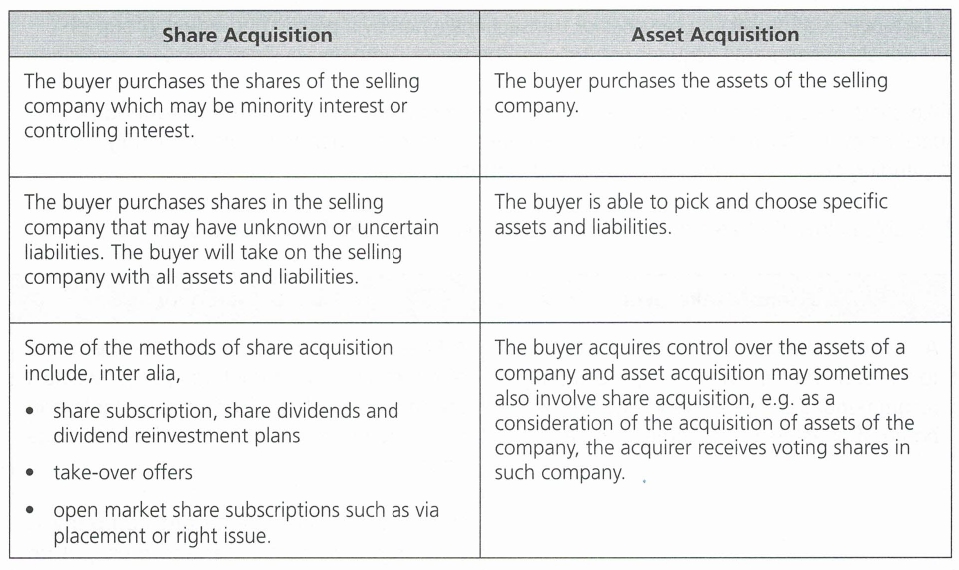

There are two methods is acquire the control of another company a share acquisition or an asset acquisition.

The Concept of Control in Take-Over Offers

• “Control” of a company is a vital concept in the context of take-over offer as it determines when mandatory offer is applicable to the acquirer. Under the Capital Markets and Services Act 2007 (CMSA), a take-over offer refers to an offer made to acquire all or part of the voting shares or voting rights, or any class of voting shares or voting rights, in a company and includes:

(i) a take-over or merger transaction howsoever effected which has the effect or potential effect of obtaining or consolidating control in the company

(ii) a partial offer, or

(iii) a take-over offer by a parent company for the voting shares or voting rights in its subsidiary.

• According to s.216 (1) of the CMSA, “control” means the acquisition or holding of, or entitlement to exercise or control the exercise of, voting shares or voting rights of more than 33% in a company, or such other amount as may be prescribed in the Malaysian Code on Take-overs and Mergers 2016, howsoever effected.

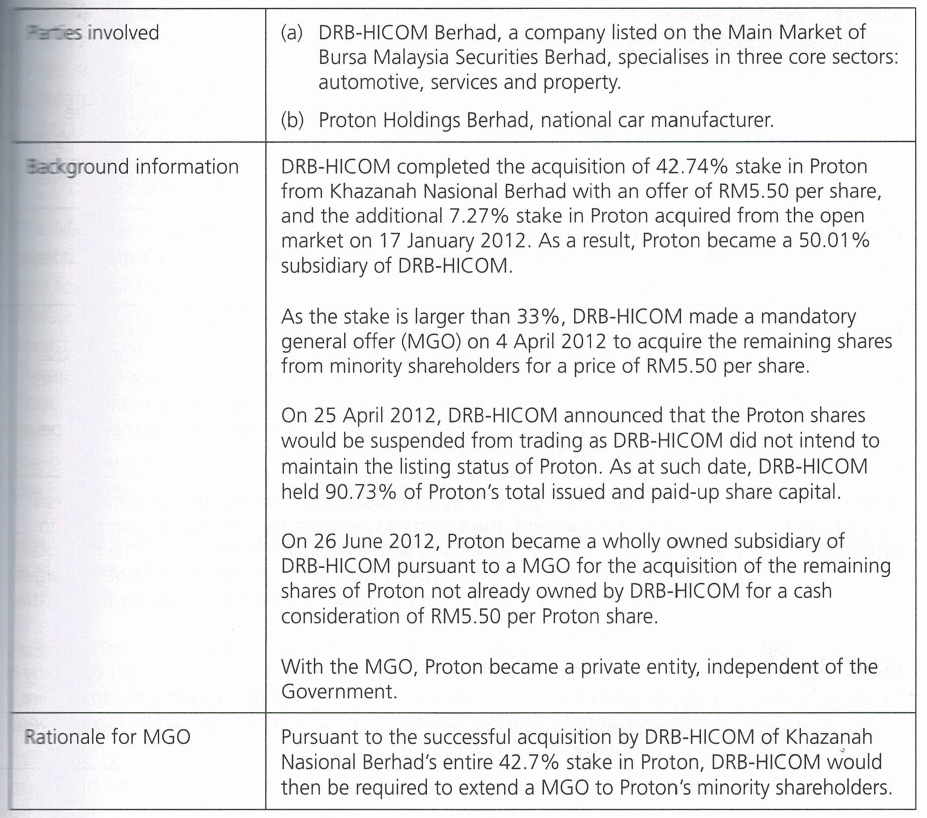

• An example of “control” can be seen in the mandatory general offer of Proton by DRB-HICOM in March 2012.

• The above concept of “control” must be distinguished from the term “statutory control”. ‘Statutory control” is defined under Rule 2.01 of the Rules on Take-Overs, Mergers and Compulsory Acquisitions (2016) as holding of more than 50% of the voting shares or voting in a company.

Legal Framework

Key Laws and Regulations

(a) Capital Markets and Services Act 2007 (CMSA)

The CMSA is the main legislation governing take-overs. The CMSA regulates and provides for matters pertaining to the activities, markets and intermediaries in the capital markets. The CMSA confers the Securities Commission Malaysia (SC) the power to provide recommendations to the Minister of Finance and to administer the Malaysian Code on Take-Overs and Mergers 2016 in accordance with the provisions of the CMSA. The CMSA also stipulates for compulsory acquisition by offerors in a take-over and minority shareholders rights under said situation.

(b) Malaysian Code on Take-Overs and Mergers 2016

The Malaysian Code on Take-Overs and Mergers 2016 is administered by the SC and is prescribed the Minister of Finance pursuant to s.217 (1) of the CMSA. Prior to the coming into force of the Code, the take-overs and mergers in Malaysia are governed by the Malaysian Code on Take-Overs and Mergers 2010 (Old Code). On 15 August 2016, the Minister of Finance revoked the Old Code and replaced it with the Malaysian Code on Take-Overs and Mergers 2016. The Code (and the Rules on Take-Overs, Mergers and Compulsory Acquisitions (2016) which are issued by the SC) is applicable to take-overs and merger transactions after 15 August 2016 except for transactions commenced or undertaken before the commencement of the Code. In such instance, the transactions shall be dealt with under the provisions of the Old Code as if the Old Code has not been revoked.

The Code is a short-form document which sets out 12 overarching general principles serving as statements of standards of commercial behaviour that must be observed and complied with by all persons engaged in any take-overs or mergers.

(c) Rules on Take-Overs, Mergers and Compulsory Acquisitions (2016)

On 15 August 2016, the SC issued the Rules on Take-Overs, Mergers and Compulsory Acquisitions (2016), which superseded the Practice Notes issued under the Old Code. The Rules are issued as a guideline pursuant to s.377 of the CMSA and outline the procedures and conduct pertaining to take-overs, mergers and compulsory acquisitions for purposes of interpreting the application of Division 2 Part VI of the CMSA and the Code.

(d) Companies Act 2016 (CA)

The Companies Act 2016 (CA) governs among others, the conduct and affairs of companies, director’s duties and disclosure requirements on substantial shareholding in a company, which complement the processes and procedures of take-over offer provided by the CMSA, the Code and the Rules.

(e) Bursa Malaysia Securities Berhad Listing Requirements

A company listed on Bursa (whether on the Main Market, ACE Market or LEAP market) is also required to comply with its respective market’s listing requirements% which may contain rules that govern matters such as the conduct of a listed company, the procedures in a take-overs, continuing listing obligations including public spread requirements and continuing disclosure.

Regulatory Bodies

The SC is the only regulatory body overseeing take-over and merger transactions in Malaysia.

However, other regulatory bodies may be involved depending on the types of take-over offers.

The SC is established under the Securities Commission Malaysia Act 1993 and it is an authority which regulates take-overs in Malaysia and administers the CMSA, Malaysian Code on Take- Overs and Mergers 2016 and Rules on Take-Overs, Mergers and Compulsory Acquisitions (2016) and other guidelines, directions, practice notes, regulations and any ruling issued by the SC. The SC ensures that the disclosure and other requirements pertaining to take-overs are adhered to by the company. The SC may also grant exemption from compliance with Division 2 Part VI of the CMSA, the Code, the Rules and other guidelines, directions, practice notes and any ruling issued by the SC.

Other regulatory bodies that may be involved in take-overs include:

(a) Bursa Malaysia Berhad

Bursa Malaysia Berhad is an exchange holding company approved under s.15 of the CMSA. It operates as a fully integrated exchange, offering a complete range of products which includes equities, erivatives, futures and options, offshore, Islamic assets, exchange-related facilities and other investment choices. Bursa Malaysia Securities Berhad, a wholly owned subsidiary of Bursa Malaysia Berhad, is the main regulator with the primary responsibility to provide, operate and maintain securities exchange.

(b) Companies Commission of Malaysia (CCM)

The Companies Commission of Malaysia (CCM) is a statutory body formed under the Companies Commission of Malaysia Act 2001 and regulates companies and businesses.

(c) Bank Negara Malaysia

Bank Negara Malaysia is a statutory body governed by the Central Bank of Malaysia Act 2009 and serves, among others, to act as the financial adviser and banker to the Malaysian government and promote monetary and financial stability of the country. The approval of Bank Negara Malaysia is required in relation to the take-overs of financial institutions.

(d) Labuan International Financial Exchange (LFX)

The Labuan International Financial Exchange (LFX) is an international financial exchange based in Labuan, the international business financial centre for Malaysia. It is a full-fledged exchange with listing facilities and is wholly owned by Bursa Malaysia Berhad.

(e) Labuan Financial Services Authority (LFSA)

The Labuan Financial Services Authority (LFSA) is a statutory body formed under the Labuan Financial Services Authority Act 1996 and responsible for the development and administration of the Labuan International Business and Financial Centre (Labuan IBFC). The LFSA’s main role is to license and regulate licensed entities operating within the Labuan IBFC.

General Principles and Rules on Take-Overs and Mergers

The general principtes and rules on take-overs and mergers are contained in the CMSA, Malaysian Code on Take-Overs and Mergers 2016 and Rules on Take-Overs, Mergers and Compulsory Acquisitions (2016).

Capital Markets and Services Act 2007 (CMSA)

Division 2 Part VI of the CMSA (i.e. ss.216-225) stipulates the provisions governing take-overs, mergers and compulsory acquisitions. A summary of the above division is as follows:

(a) Compliance with the Code, Rules, etc. — this provision mandates compliance with the provisions of the Code, Rules and other guidelines, directions, practice notes and any rulings issued by the SC and provides penalty for contravention. See para. 5.1 of this Chapter for further details on contravention.

(b) Power of the SC to appoint independent adviser — this provision confers the SC with the power to appoint an independent adviser, in circumstances where the offeree has failed to appoint an independent adviser, if it is in the interest of the shareholders of the offeree.

(c) Prohibition against communication — this provision prohibits communication of any matter by an independent adviser and his/her employee except to the SC, person specified by the SC and to the independent adviser by whom the employee is employed, unless for purposes of carrying into effect the provisions of the CMSA or for any proceedings.

(d) Access to information, etc. – this provision requires access to be given to any information, books, accounts and records of, and any assets held by the offeree relating to his/her business, upon request by an independent adviser.

(e) Exemptions by the SC — this provision confers the SC with the power to exempt any person or take-over offer from the provisions of Division 2 Part VI of the CMSA, the Code, guidelines, directions, practice notes and any ruling issued by the SC.

(f) Action by the SC in cases of non-compliance — this provision sets out the action that the SC may take in cases of non-compliance with the Code, guidelines, directions, practice notes and rulings. See para. 5.2 of this Chapter for further details on contravention.

(g) False or misleading documents, information, etc. — this provision prohibits submission of false or misleading documents or information, provision of documents or information with material omission or engagement in conduct knowing to be or likely to be misleading or deceptive. See para. 5.3 of this Chapter for further details on contravention.

(h) Compulsory acquisition — this provision sets out the requirements for compulsory acquisition by an offeror who has made a take-over offer for all the shares or all the shares in any particular class in an offeree and received acceptances of not less than nine-tenths in the nominal value of the offer shares. See para. 5.4 of this Chapter for further details on contravention.

(i) Right of minority shareholders in a take-over offer — this provision allows minority shareholders to require the offeror to acquire their shares on terms of the take-over offer or such other terms as may be agreed. This provision is applicable in a situation where a take-over offer has been accepted by holders of not less than nine-tenths in the value of all the shares to which the take-over offer relates or shares of any class to which the take-over offer relates before the end of the period within which the take-over offer can be accepted.

Malaysian Code on Take-Overs and Mergers 2016

The Code, which is supplemented by the detailed provisions of the Rules, sets out 12 general principles and standards of commercial behaviour to be observed and complied with by all persons engaged in any take-overs or mergers. The following is a summary of the principles:

(a) All shareholders of an offeree of the same class shall be treated equally and have equal opportunities to participate in benefits accruing from the take-over offer.

(b) The acquirer or offeror and the offeree’s board of directors shall act in good faith.

(c) The acquirer or offeror shall ensure that he/she is able to implement the offer in full.

(d) An offeree shall appoint a competent independent adviser to provide comments, opinion, information and recommendation on the take-over offer.

(e) All parties shall make full and prompt disclosure of all relevant information.

(f) Relevant and sufficient information and reasonable time shall be provided.

(g) Documents or advertisements addressed to the shareholders shall be prepared with the same standard of care as a prospectus within the meaning of the CMSA.

(h) Selective disclosure to the shareholders is prohibited.

(i) While the offeror’s boards of directors and the offeree’s board of directors, and their respective advisers and associates have a primary duty to act in the best interests of their shareholders, any guidelines and rulings issued by the SC may restrict undertaking of certain actions.

(j) A take-over offer shall be made to all shareholders within the same class for all the voting shares or voting rights in the offeree and as for an approved partial offer, the offeror shall accept such voting shares or voting rights in the same proportion from each shareholder in order to achieve the specified percentage of holding in the offeree.

(k) The offeree’s board of directors shall act in the interests of its shareholders as a whole and shall not deny the shareholders the opportunity to decide on the take-over offer.

(l) The period in which an offeree is subject to a take-over or merger shall not be longer than what is reasonable.

Rules on Take-Overs, Mergers and Compulsory Acquisitions (2016)

The following is a summary of the major provisions of the Rules:

• Types of take-over offers

Take-over offers under the Rules can either be voluntary or mandatory.

• Independent adviser

The board of directors of the offeree shall appoint an independent adviser to provide comments, opinions, information and recommendation on a take-over offer in an independent advice circular. The independent adviser shall be responsible for all comments, opinions, information and recommendations disclosed in the independent advice circular.

The appointed adviser shall be independent and shall declare its independence from any conflict of interest or potential conflict of interest to the Sc.

• Announcement

The offer must be put forward to the board of the offeree before the offer is announced to the public. Announcements must be made by the offeror, potential offeror or the offeree pursuant to the requirements under the Rules.

See para. 4.2 of this Chapter for further details on announcements.

• Submission of documents

The offer documents, independent advice circular together with the offeree board circular must be submitted to the SC for comment within the prescribed time.

See para. 4.1 of this Chapter for further details on timeline for submission of documents related to take-over offer.

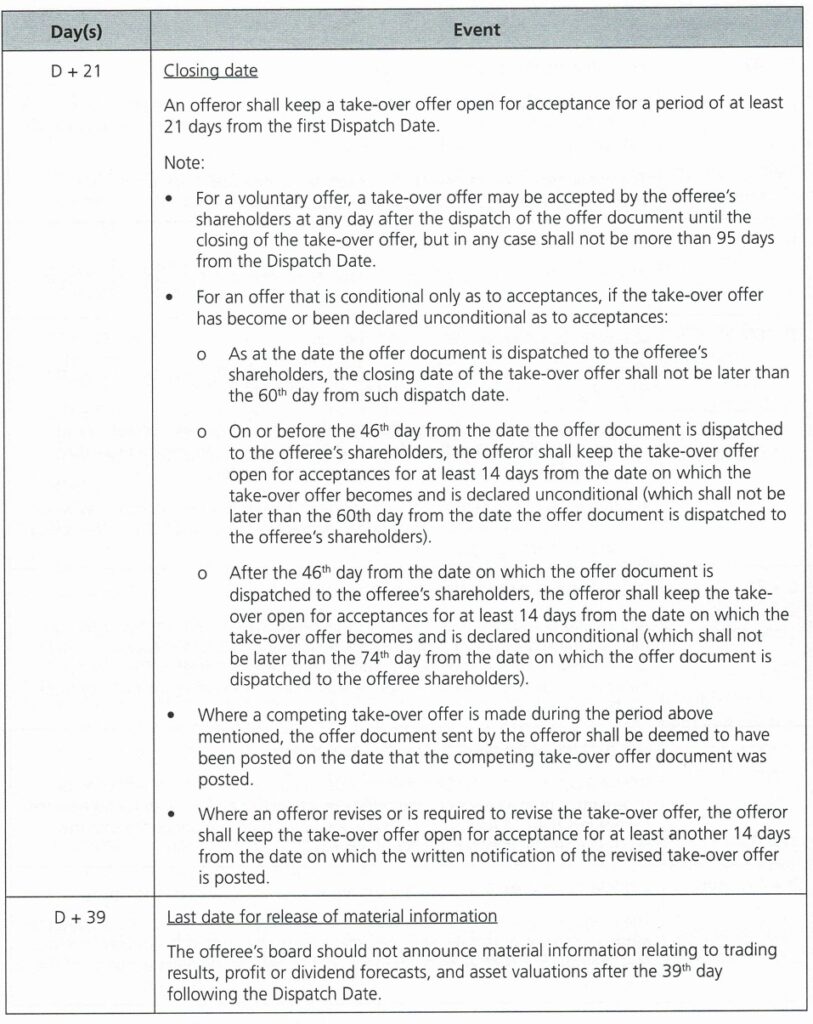

• Duration of take-over offer

An offeror shall keep a take-over offer open for acceptance for a period of at least 21 days from the date the offer document is first posted. In the case of a voluntary offer, a take-over offer may be accepted by offeree shareholders at any day after the dispatch of the offer document until the closing of the take-over offer, but in any case shall not be more than 95 days from the dispatch of the offer document.

See para. 4.1 of this Chapter for further details on duration of take-over offer (Closing date).

• Announcement of results of offer

Before 9.00 a.m. on the market day following the day on which a take-over offer is due to close, or becomes or is declared unconditional (whether as to acceptances or in all respects), or is revised or extended, an offeror must make an announcement in accordance with the listing requirements, or by way of a press notice where relevant, and inform the SC in writing, the matters prescribed under the Rules.

• Settlement of consideration

The offeror, in any take-over offer, shall pay the cash consideration to all persons accepting the take-over offer within 10 days.

• Management of affairs of offeree

No nominee of the offeror or person acting in concert (PAC) shall be appointed to the board of the offeree, nor may an offeror and PAC exercise voting shares or voting rights in the offeree, until the offer document has been dispatched, except with the consent of the SC.

• Frustration of offer

The Rules prohibit the board of the offeree from taking any action or making any decision (other than in the ordinary course of business) which can effectively result in any bona fide take-over offer being frustrated or the shareholders being denied an opportunity to decide on the merits of a take-over offer notwithstanding the take-over offer is unfavourable, unless shareholders’ approval at a general meeting is obtained.

• Evidence of ability to implement take-over offer

Where the take-over offer is for cash or includes an element of cash, the Rules compel the offeror to ensure, and his/her financial adviser to be satisfied, that the take-over offer would not fail due to the insufficient financial capability of the offeror and every offeree shareholder who wishes to accept the take-over offer would be paid in full.

• Favourable deals

Except approved by the SC in writing, arrangements between selected shareholders of the offeree and the offeror or PAC which have favourable conditions that are not to be extended to all shareholders are restricted during the take-over offer or when such offer is reasonably in contemplation or for six months after the close of such offer. The Rules also provide guidance on the considerations in determining whether this restriction applies to, among others, finders’ fees, repayment of shareholders’ loans, top-up arrangements and management incentives.

• Dealings during offer period

There are certain restrictions imposed on dealing during the offer period, dealing during securities exchange offers and dealing in offeree company securities by certain offeree company associates.

• Prompt registration

The board of directors and officers of an offeree should use their best endeavours to ensure the prompt registration of transfers during an offer period so that shareholders can freely exercise their voting and other rights.

• Restrictions following offers and possible offers

Unless approved by the Sc, the offeror and all PAC with the offeror shall not, within 12 months from the date of the announcement that a take-over offer has been withdrawn, has lapsed or failed:

o Announce a take-over offer or possible take-over offer for the offeree, or

o Acquire any voting shares or voting rights of the offeree if the offeror would thereby become obliged to make a mandatory offer.

• Compulsory acquisition and right of minority shareholders

Where an offeror makes a take-over offer for more than one class of shares, separate offers shall be made for each class and the offeror shall state, if the offeror intends to avail itself of any powers of compulsory acquisition under s.222 of the CMSA, that the section will be used in respect of each class separately. The foregoing provides for fair treatment to minority shareholders and their shares should be acquired on the terms of the take-over offer, or if the take-over offer contains two or more alternative sets of terms, on the terms which are specified in the take-over offer as being applicable to the dissenting shareholders.

• Dual listing

Where the offeree has a primary listing outside of Malaysia and a secondary listing in Malaysia, the SC may consider disapplying the Rules subject to the applicant being able to demonstrate that the relevant take-over regulation in the foreign jurisdiction accords an equivalent level of protection to offeree shareholders as provided under the Rules.

Types of Take-Over Offers

The Rules on Take-Overs, Mergers and Compulsory Acquisitions (2016) cover two main offers — voluntary and mandatory.

• Voluntary Offer

A voluntary offer is a take-over offer for the voting shares or voting rights of a company made by a person when he/she has not incurred an obligation to make a mandatory offer.

Voluntary offer is not one which the bidder is compelled to make by law, and is an offer made by a bidder who may or may not hold shares in a company, to purchase all or part of the shares from all current shareholders of a company.

Para. 6.01 (2) of the Rules provides that the acceptance of the offer shall be conditional upon the offeror having received acceptances which would result in the offeror holding in aggregate more than 50% of the voting shares or voting rights in the offeree. The voluntary offer may be conditional upon a higher level of acceptances but not less than the statutory control.

A voluntary offer may include any conditions except defeating conditions where the fulfillment of which depend on:

(a) The subjective interpretation or judgment of the offeror, or

(b) Whether or not a particular events happens, being an event that is within the control of the offeror.

(c) Partial offer

A sub-set of the voluntary offer is the partial offer. A partial offer means a voluntary take-over offer in which a person offers to acquire less than 100% of any class of the voting shares or voting rights of a company from all offeree shareholders.

A partial offer can only be made with the prior written approval of the SC and the SC may consider granting an approval in the situation where a partial offer would not result in the offeror and PAC obtaining control of the offeree or in the sitiiation where the offeror and PAC already have statutory control of the offeree and the partial offer is to obtain such percentage that would allow the offeree to maintain the public spread requirement under the listing requirements. Such restriction is imposed on a partial offer as the offer may be unfair to the offeree company’s shareholders who may not be able to dispose of all their shares, since it is the offeror which chooses the percentage of shareholding that it wishes to acquire.

• Mandatory Offer

A mandatory offer is one which an acquirer is compelled to make by law. Unless exempted by the SC, a mandatory offer shall apply to an acquirer in the following situations:

(i) Where the acquirer has obtained control in a company (i.e. acquisition or holding of, or entitlement to exercise or control the exercise of, more than 33% of the voting shares or voting rights)

(ii) Where the acquirer has triggered the “creeping threshold” (i.e. acquisition of more than 2% of the voting shares or voting rights of a company in any period of six months by an acquirer holding over 33% but not more than 50% of the voting shares or voting rights of the company, irrespective of how control has been effected or the creeping threshold has been triggered, including by way of a scheme.

The Rules provide a number of situations where a mandatory offer shall not apply to an acquirer under para. 4.02 and allows certain types of proposal or transaction to be exempted by the SC from the requirement of mandatory offer obligation as outlined in para.4.06.

The Rules provide that a voluntary offer will become a mandatory offer when the offeror or PAC acquires voting shares or voting rights (other than through acceptances) that trigger an obligation on the part of the offeror and the PAC to make a mandatory offer.

Persons Acting in Concert

According to the s.16 (2) of the CMSA, the PAC shall be construed as reference to persons who, pursuant to an agreement, arrangement or understanding, co-operate to:

• Acquire jointly or severally voting shares of a company for the purpose of obtaining control of that company, or

• Act jointly or severally for the purpose of exercising control over a company.

An agreement, arrangement or understanding can be formal or informal, written or oral, express or implied or whether or not having legal or equitable force.

Without prejudice to the generality of the above description of a PAC, s.216 (3) of the CMSA sets out the following presumptions for a person to be deemed as a PAC unless the contrary is established:

(a) A corporation and its related and associate corporations. Associated corporations are established when a corporation holds not less than 20% of the voting shares in another corporation

(b) A corporation and any of its directors, or the parent, child, brother, sister, an adopted child or a step child of any of its directors, or the spouse of any such director or any such relative, or any related trusts

(c) A corporation and any pension fund established by it

(d) A person and any investment company, unit trust or other fund whose investments such person manages on a discretionary basis

(e) A financial adviser and its client which is a corporation, where the financial adviser manages on a discretionary basis the corporation’s funds and has 10% or more of the voting shares in that corporation

(f) A person who owns or controls 20% or more of the voting shares of a corporation falling within paragraph (a) and any parent, child, brother, sister, an adopted child or a step child of such person, or the spouse of such person or any such relative, or any related trusts together with one or more persons falling within paragraph (a).

(g) Partners of a partnership

(h) An individual and any person who is accustomed to act in accordance with the instructions of the individual, and the close relative of, companies controlled by, or related trusts of, the individual

(i) A person, other than a licensed bank or a prescribed institution, who, directly or indirectly, provides finance or financial assistance, in connection with an acquisition of voting shares or voting rights, with a person who receives such finance or financial assistance.

Additionally, pursuant to s.216 (3A) of the CMSA, the Rules have specified persons who may be presumed to be PAC where the offeror is a real estate investment trust and business trust in relation to a take-over of an entity other than a corporation or a public company.

Processes and Procedures of Take-Over Offers

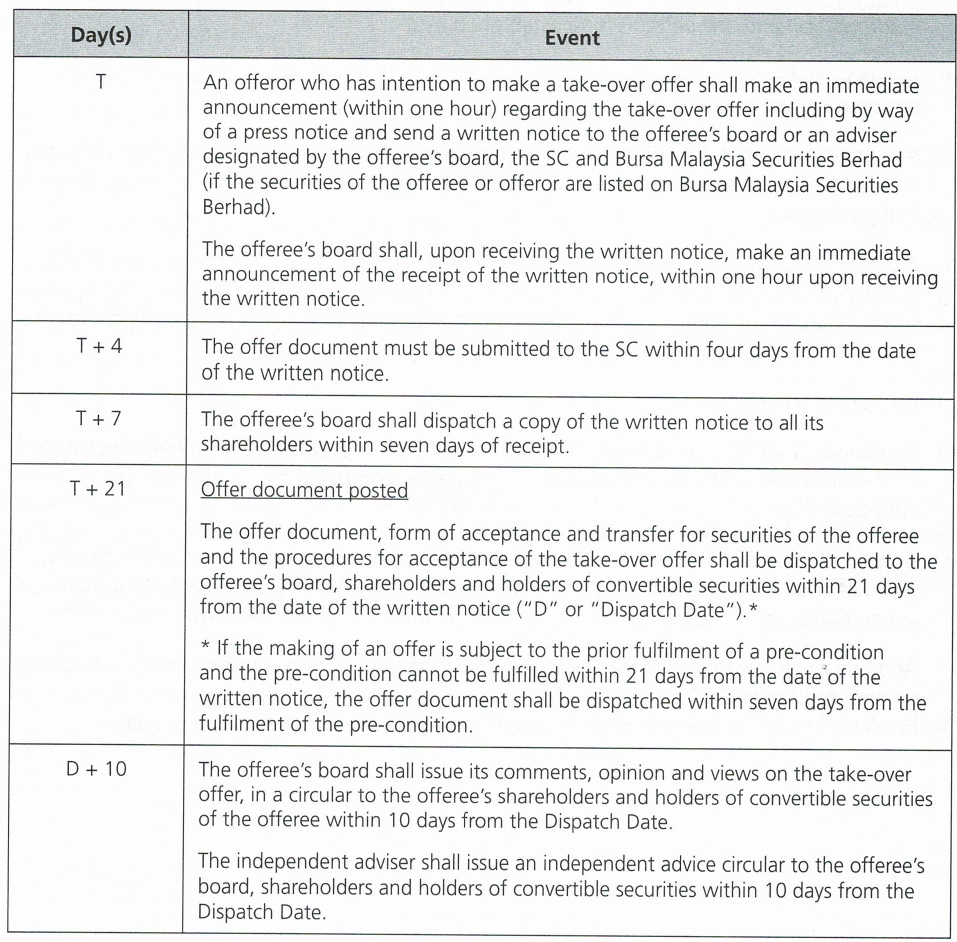

Take-Over Offer Timeline

In general, there is no prescribed timeline in which a business transaction must be completed. However, the Rules on Take-Overs, Mergers and Compulsory Acquisitions (2016) specify the timeline for announcements, acceptance, etc. once a firm intention to make an offer is announced until the offer is closed or lapsed. The timeline for a take-over offer is as follows:

Announcements and Notices

(a) Approach/Offer

The offer must be put forward to the board of the offeree before the offer is announced to the public.

If the offer or an approach with a view to an offer being made is not made by the ultimate offeror or potential offeror, as the case may be, the identity of the ultimate or potential offer must be disclosed at the outset to the board of the offeree.

A board of offeree is entitled, in good faith, to make enquiries to satisfy itself that the offeror will be able to implement the offer.

Prior to the announcement of an offer or possible offer, all persons privy to any confidential information relating to a take-over offer or proposed take-over offer, particularly price-sensitive information, must treat the information as secret and may only pass it to another person if it is necessary to do so and if that person is made aware of the need to maintain the confidentiality of the information. Advisers must at the very beginning of discussions warn clients of the importance of secrecy and security and draw attention to restrictions on dealings.

(b) Announcements to be made by the offeror or potential offeror Before the board of the offeree is approached, the responsibility for making an announcement will normally rest with the offeror or potential offeror.

The offeror or potential offeror should keep a close watch on the offeree share price and volume for signs of undue movement and must make an announcement:

(i) When, before the board of the offeree is approached, the offeree is the subject of rumour or speculation about a possible offer, or there is undue movement in its share price or significant increase in the volume of share turnover, and there are reasonable grounds for concluding that it is the offeror or potential offeror’s actions which have directly contributed to the situation.

(ii) Where negotiations or discussions are about to be extended to include more than a very restricted number of people (outside of those who need to know or are involved at that stage of the discussion and their immediate advisers), or

(iii) Upon the signing of the sale and purchase agreement for the voting shares or voting rights of the offeree which will lead to the acquirer being obliged to extend a mandatory offer obligation.

c) Announcements to be made by the offeree

Following an approach to the board of the offeree which may or may not lead to an offer, the primary responsibility for making an announcement will normally rest with the board of the offeree.

The offeree should closely monitor its share price and volume. The offeree must make an announcement when:

(i) The board of offeree receives notification of a firm intention to make an offer from the offeror or the offeror’s adviser, regardless of whether the board of offeree views the offer favourably or otherwise

(ii) Following an approach to the offeree, the offeree is the subject of rumour or speculation about a possible offer, or there is undue movement in its share price or a significant increase in the volume of share turnover, whether or not there is a firm intention to make an offer

(iii) Negotiations or discussions between the offeror or potential offeror and the offeree are about to be extended to include more than a very restricted number of people, or

(iv) The board of offeree is aware that there are negotiations or discussions between a potential offeror and the holder, or holders, of shares carrying more than 33% of the voting shares or voting rights of an offeree or when the board of offeree is seeking potential offerors, and:

– The offeree is the subject of rumour or speculation about a possible offer, or there is undue movement in its share price or a significant increase in the volume of share turnover, or

– More than a very restricted number of potential purchasers or offerors are about to be approached.

The offeror or potential offeror shall not attempt to prevent the board of offeree from making an announcement or requesting the stock exchange to grant a temporary suspension of trading at any time the board of the offeree thinks appropriate.

(d) Holding announcement

When an announcement is required to be made pursuant to paragraphs (b)(i) to (iii) and (c)(ii) to (iv) above, but the intention to make an offer is premature or has not been firmed up, the offeror, potential offeror or offeree is required to make a brief announcement that negotiations are taking place.

If no further announcement has been made within one month subsequent to an announcement pursuant to the above, the offeror, potential offeror or offeree shall make a monthly announcement setting out the progress of negotiations until the announcement of:

(i) The firm intention of the offeror to make a take-over offer

(ii) A decision not to proceed with a take-over offer, or

(iii) Negotiations being terminated by the offeror, potential offeror or offeree.

(e) Statements of intention not to make an offer

An announcement by a potential offeror or any party acting in concert with him/her that they do not intend to make a take-over offer or there is no possible take-over offer by them must be clear and unambiguous.

(f) Terms and pre-conditions in possible offer announcements

(i) A possible offer announcement must not include any conditions or pre-conditions which depend solely on subjective judgements by the potential offeror.

(ii) The SC must be consulted in advance if a person proposes to make a statement in relation to the terms on which an offer might be made for the offeree company before an announcement of a firm intention to make an offer.

(iii) If any such statement is made by or on behalf of a potential offeror, its directors, officials or advisers, the potential offeror will be bound by the statement if an offer for the offeree company is subsequently made.

(g) Announcement of firm intention

An offeror who has a firm intention to make a take-over offer shall:

(i) Make an immediate announcement regarding the take-over offer,

including by way of press notice

(ii) Send a written notice to:

— The board of the offeree or an adviser designated by the board of the offeree

— The SC

— The relevant stock exchange in Malaysia, if the securities of the offeree or the offeror are listed on the relevant stock exchange in Malaysia.

(iii) The announcement should be made only when an offeror has every reason to believe that he/she can and will continue to be able to implement the offer. Responsibility in this connection also rests on the main adviser to the offeror.

The offeror and PAC are prohibited from making any purchases of the offeree shares until the above announcement is made. These new requirements, coupled with the requirement for the board of the offeree to make an immediate announcement of the receipt of the written notice within one hour of receipt, and dispatch a copy of the written notice to all offeree shareholders within seven days of receipt, ensure that full information is disclosed to the offeree shareholders promptly. It also reduces the risk of the offeree or minority shareholders being disadvantaged by trading on those shares without knowledge of the take-over offer.

(h) No withdrawal of offer

Where there has been an announcement of an intention to make a take-over offer as per paragraph (d) (i) to (iii) above, the offeror shall not withdraw the take-over offer without the prior written consent of the SC.

Roles and Responsibilities of a Capital Markets Services

Representative’s Licence (CMSRL) Holder

S.59 (1) of the CMSA requires every person who acts as a representative in respect of any regulated activity or holds himself out as doing so to hold a Capital Markets Services Representative’s Licence (CMSRL) for that regulated activity or is a registered person with respect to that regulated activity.

If the CMSRL holder is an adviser, according to para. 3.01 of the Rules on Take-overs, Mergers and Compulsory Acquisitions (2016), he/she must comply with all the requirements and ensure that he/she explains to his/her client, the client’s responsibilities under the Rules and the

Malaysian Code on Take-overs and Mergers 2016, and use all reasonable effort to ensure that the client complies with the Rules and Code.

A CMSRL holder should, at the beginning of discussions and during the course of the relevant transaction, ensure that his/her client and any other person assisting such client in relation to the transaction understand the importance of secrecy and security of information.

A person who intends or is obliged to make a take-over offer or participate in other matters to which the Rules and Code apply shall seek advice from an adviser. For this purpose, only those who are listed in the Approved List under the Principal Adviser Guidelines are permitted to submit proposals under the Rules and Code. Notwithstanding the foregoing, the SC may, on a case-to-case basis, approve any person who has relevant expertise and experience in take-overs, mergers and compulsory acquisitions to submit any application under Division 2 Part VI of the CMSA. Such person must consult the SC at the earliest opportunity before making an application for his/her appointment as an adviser.

An adviser giving advice in relation to the Rules and Code shall provide objective and appropriate advice that would enable the person concerned to make an informed decision. In most of the situations, the CMSRL holder will become an insider as a result of possessing price sensitive information in the process of advising the client. In this instance, the CMSRL holder shall be reminded not to acquire, dispose of or procure, directly or indirectly, an acquisition or disposal of such securities.

The CMSRL holder shall not, directly or indirectly, communicate the price sensitive information if he/she knows or ought reasonably to know that the other person would tend to acquire or dispose of the securities to which the price sensitive information relates or procure a third person to acquire or dispose of the securities to which the price sensitive information relates.

A person who contravenes the above commits an offence and shall be punished on conviction to imprisonment for a term not exceeding 10 years and to a fine of not less than RM1 million.

Additionally, the CMSRL holder’s licence may be revoked or suspended as a result of failing to comply with the CMSA or any guidelines made under the CMSA.

Penalties for contravention of the Code

Failure to comply with the Code, the Rules, etc.

Under s.218 of the CMSA:

• A person who makes a take-over offer

• Subject to s.219 of the CMSA, an acquirer who has obtained control in a company who makes a take-over offer for the remaining voting shares, or

• Subject to s.219 of the CMSA, an acquirer who has obtained control acquire any additional voting shares in that company, not in accordance with the provisions of the Code, Rules and other guidelines, directions, practice notes and any rulings issued by the SC is guilty of an offence and shall, on conviction, be liable to a fine not exceeding RM1 million or to imprisonment for a term not exceeding 10 years or to both.

Action by the SC in cases of contravention with the Code, the Rules, guidelines, directions, practice notes and rulings.

The SC may take any of the following action under s.220 of the CMSA against the person in breach:

Direct such person to comply with, observe or give effect to any provisions of Division 2 Part VI of the CMSA, the Code, the Rules and other guidelines, directions, practice notes or rulings

• Impose a penalty on such person, but in any event not exceeding RM1 million

• Reprimand such person

• Require a stock exchange or derivatives exchange to deprive such person from having access to the facilities of the stock exchange or derivatives exchange

• Prohibit such person from having access to the capital market

• For listed corporations, require the stock exchange to suspend trading in the securities of the corporation or suspend the listing of the

orporation or remove the corporation or its class of securities from the official list

• For unlisted corporations, require any stock exchange to prohibit the listing of any of its securities

• Require such person to take such steps as the SC may direct to remedy the breach or mitigate the effect of such breach

• For an adviser, refuse to accept or consider any submission relating to any matter under Division 2 Part VI of the CMSA from such person.

The SC shall give a written notice to a person in breach of its intention to take the above action and shall give the person in breach an opportunity to be heard prior to it taking any action.

False or misleading documents, information, etc.

• Where any document or information is required to be submitted to the SC in relation to a take-over offer, merger or compulsory acquisition, an acquirer, an offeror, a person making a compulsory acquisition or effecting a merger or an offeree (including their officers or associates), a financial adviser, an expert or any other person commits an offence under s.221 of the CMSA if such person:

o Submits or cause to be submitted any document or information that is false or misleading

o Provides or cause to be provided any document or information from which there is material omission, or

o Engages in conduct that he/she knows to be misleading or deceptive or is likely to mislead or deceive.

• The penalty on conviction is a fine of up to RM3 million and imprisonment for up to 10 years.

• It shall be a defence to a prosecution or any proceeding for a contravention of s.221 (1) of the CMSA if it is proved that the defendant, after making enquiries as were reasonable in the circumstances, had reasonable grounds to believe, and did until the time of the provision of the document or information or engaging in the conduct was of the belief that:

o The document or information was true and not misleading

o The omission was not material

o There was no material omission, or

o The conduct in question was not misleading or deceptive.

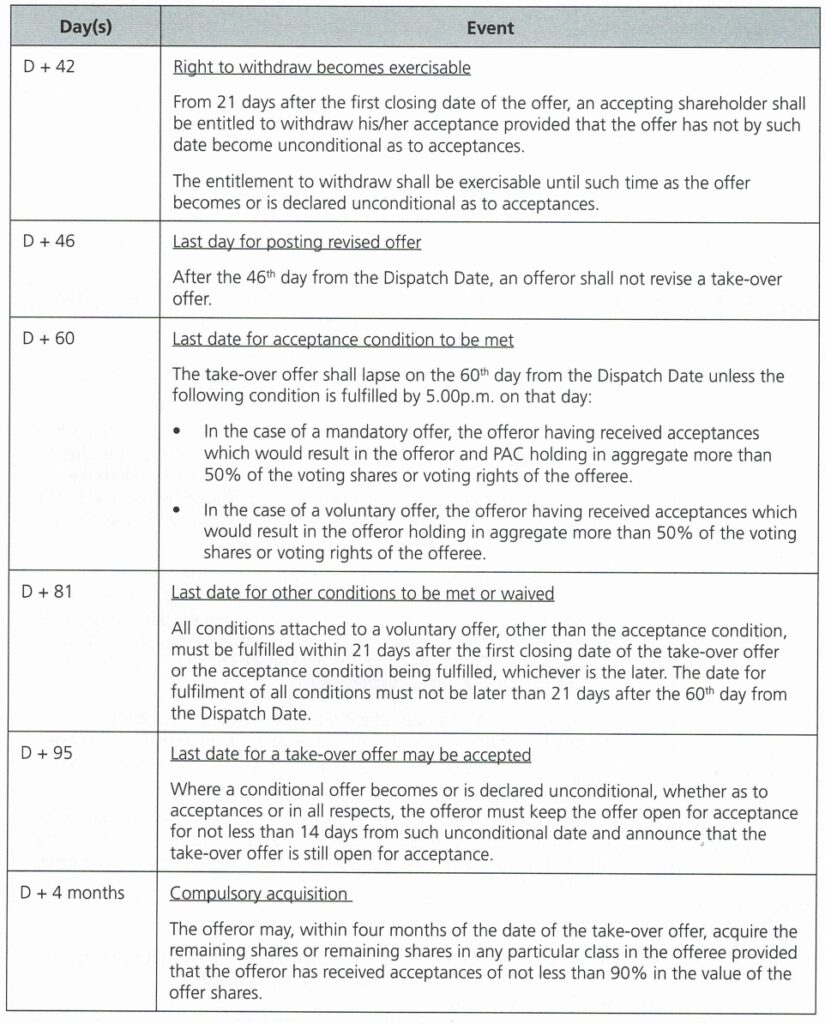

Compulsory Acquisition

The CMSA under s.222 (1) sets out where an offeror:

(a) has made a take-over offer for all the shares or all the shares in any particular class in an offeree; and

(b) has received acceptances of not less than nine-tenths in the nominal value of the offer shares, the offeror may, within four months of the date of the take-over offer, acquire the remaining shares or remaining shares in any particular class in the offeree, by issuing a notice in the form or manner specified by the SC to such effect, to all dissenting shareholders provided that the notice:

• is issued within two months from the date of achieving the conditions under the paragraphs (a) and (b); and

• is accompanied by a copy of a statutory declaration by the offeror that the conditions for the giving of the notice are satisfied;

For the purpose of paragraph (b) above, the acceptances shall not include shares already held at the date of the take-over offer by the offeror or persons acting in concert.

Where an offeror has given notice to any dissenting shareholder under s.222 (1), the dissenting shareholder may, by demand in writing, within one month from the date of such notice, require the offeror to provide in writing the names and addresses of all other dissenting shareholders as

shown in the register of members, and the offeror may only acquire the shares of the dissenting shareholders after 14 days from the posting of those names and addresses to the dissenting shareholder.

Upon giving of the notice and statutory declaration under s.222 (1), the offeror shall in accordance with s.222 (7) acquire those shares on the terms of the take-over offer or, if the take-over offer contained two or more alternative sets of terms, on the terms which were specified in the take-over offer as being applicable to the dissenting shareholders.

• A person commits an offence under s.222 of the CMSA if he/she:

o Sends a copy of a notice or statutory declaration which is not in the prescribed manner, or

o Makes a statutory declaration or sends a statement knowing that the declaration or the statement, as the case may be, to be false, or without having reasonable grounds for believing it to be true.

• Where a person is charged for the above offence, it is a defence for him/her to prove that he/she took reasonable steps for securing compliance.

Summary

Take-over laws are put in place to ensure an orderly process of change in control and protection of shareholders.

As such, it is pertinent for Capital Markets Services Representative’s Licence (CMSRL) holders to understand their role under the Capital Markets and Services Act 2007 (CMSA) and the legal framework of take-overs and mergers, in particular the provisions in the CMSA, the Malaysian Code on Take-overs and Mergers 2016 and the Rules on Take-overs, Mergers and

Compulsory Acquisitions (2016), and where relevant explain to their client, the client’s roles and responsibilities to ensure the client’s compliance with the applicable laws. They should be aware, among others, of the following:

• Types of take-over offer involved (mandatory or voluntary) which may entail different processes and procedures

• Documents issued or statement made in relation to a take-over offer must satisfy the highest standard of accuracy and information must be given adequately and fairly presented

• Announcements, documents, submission and timeline involved

• Conduct during the take-over offer.

Self-Assessment

1. Which of the following are types of take-over offers stipulated in the Rules of Take-Overs, Mergers And Compulsory, Acquisition (2016)?

I. Partial

II. Voluntary

III. Regulatory

IV. Mandatory

A. I and II Only

B. II and III Only

C. I, II, IV Only

D. All of the above

2. Which of the following are the main parties involved in the process of take-overs and mergers?

I. Offerer

II. Offerree

III. Advisors

IV. Trustee

A. I and II Only

B. II and III Only

C. I, II and III Only

D. All of the above

3. Which of the following statements are FALSE in relation to the Malaysian Code on Take-Overs and Mergers 2016 and the Rules on take-overs, Mergers and Compulsory Acquisition (2016)?

I. A partial offer is a sub-set of a voluntary offer

II. The codes applies to the public companies that have more than 50 shareholders and

III. Parties involved in the take-over and merger processes are offeror, offeree and board of directors of an offeree

III. The Codes set out 14 general principles that shall be observed and complied by all persons engaged in any take-over or merger transaction.

A. I and III only

B. II and IV only

C. I, II and III only

D. III and IV only