The Malaysian capital markets have been financing the domestic economy and mobilising savings, despite the unprecedented conditions since 2020. High levels of domestic liquidity, coupled with the authorities proactive measures, have helped maintain an orderly market and ensure limited disruptions to the overall capital market…Read more

An Overview of the Investment Management/Environment

-To provide an overview of the investment management/environment in Malaysia particularly in the capital market.

-To provide with an understanding of the economic fundamentals.

-The main objective of a company is to maximize its Shareholder value.

-To pursue this objective especially in maximizing Shareholder value, companies should adopt appropriate strategies formulated and implemented through the strategic management process.

Introduction

In the past decade, the gross domestic product (GDP) of Asia economies has been growing at an annual of 7.5%. It has grown considerably faster than the traditional “industrial” economies and is reflected by the sizable net capital and rapid market capitalization for Bursa Malaysia (Formerly known as the Kuala Lumpur Stock Exchange), which increased from RM444 billion in 2000 to a peak of RM1,106 billion in 2007 before the global financial meltdown in 2008.

Generally speaking, the industrial economy concerns those activities combining factors of production (facilities, supplies, work, knowledge) to produce material goods intended for the market. A distinction is generally made between manufacturing industry and extraction industries, but the precise perimeter of industry in each statistical operation is given by the list of the items taken into account in the economic classification to which the operation refers.

The section will be discussing the investment management/ environment of the Malaysian capital market in context of the development of:

(a) the capital market and related technology,

(b) the secondary markets,

(c) the expansion of the securities laws and regulations, and

(d) the capital market outlook for Malaysia.

The objective of this topic is to provide an overview of issues relating to the investment management/environment in Malaysia.

Development of the Capital Market and its Technology

FDIs inflow into Malaysia for the last two decades has been favourable due to the sustained economic growth and the strong commitment of the government. The Malaysian capital market, which represents a vital part of the financial market infrastructure, has witnessed significant changes and development over the last two decades. The make-up of the capital market can generally be described in the following manner:

– The markets that are collectively and generally referred to as the capital market consist of: (i) the equity market, (ii) the private and public debt securities market, (iii) the financial derivatives market, and (iv) the Islamic capital market.

– The objectives of the capital market comprise all kinds of financial transactions, in particular, securities trading and broking, merges and acquisition exercises, financial risk management, underwriting, restructuring, as well as other corporate financial activities.

– Active participants in the Malaysian capital market usually fall under one of the following categories:

(a) Foreign and local markets

– institutional investors, e.g. Employees Provident Fund (EPF), and,

– retail investors

(b) Foreign and local issuers

(c) Market intermediaries

– stock and futures brokers

– investment banks

– unit trust companies

– discount houses and

– fund managers

(d) Market institutions

– exchanges

– clearing and depository institutions, and

– issuing houses

Note:

The regulatory framework comprises several regulating different aspects of the market, with the Securities Commission Malaysia (SC) being the lead regulator of the capital market. The SC was established under the Securities Commission Act 1993 and is responsible for monitoring the activities of market institutions and regulating all persons licensed under the Capital Markets and Services Act 2007. In addition, the SC is also responsible for the development of the Malaysian capital market. Some of the other authorities include Bank Negara Malaysia (BNM) and market institutions such as Bursa Malaysia.

Market institutions

Market institutions in the Malaysian capital market essentially comprise the exchanges, clearing houses, issuing houses and the central depository.

Exchanges

Public trading of shares first started with the setting up of the Malaysian Stock Exchange (MSE) in 1960, which was restructured in 1976 to become the Kuala Lumpur Stock Exchange (KLSE), a new company bruited by guarantee.

In 1961, two trading rooms, one in Singapore and the other in Malaysia, were set up. The termination of currency interchangeability between Malaysia and Singapore in May 1973 led to the separation of the Stock Exchange of Malaysia and Singapore into the KLSE and the Stock Exchanged Singapore (SES). A strong link existed in that Malaysian incorporated companies were listed and traded through the SES and vice versa for Singapore incorporated companies.

A significant event in the KLSE’s history was the delisting of Singapore incorporated companies from KLSE, and of Malaysia Incorporated companies from the SES, as of 1 January 1990.

The KLSE, the first formal market institution to serve the capital market, played a pivotal role in the establishment and development of the market that has progressed over the years. Since its inception in 1973 and the subsequent launch of the Second Board in 1988, efforts have been made to enhance the function and performance of the exchange, including the establishment of a clearing house and a trading system.

The second stock exchange, the Malaysian Exchange of Securities Dealing and Automated Quotation Bhd (MESDAQ), was launched in 1997 and commenced trading in 1999. It was mandated to enhance Malaysia’s capital market environment by creating a new platform for companies seeking investors and vice versa. Its aim was specifically to help raise capital for high growth technology-based companies. In March 2002, as part of the consolidation process of the exchanges, MESDAQ was merged with the KLSE, and known as the MESDAQ Market.

On 14 April 2004, KLSE changed the name to Bursa Malaysia Berhad, following the demutualisation exercise and was listed on the Main Board of Bursa Malaysia Securities Berhad on 18 March 2005. On 3 August 2009, following the introduction of a new framework for listings and equity fund-raising, a merger of the Main and Second Boards formed the current Main Market. The MESDAQ Market was also revamped as a result of the new framework and is now known as the ACE Market.

In addition, the Kuala Lumpur Options and Financial Futures Exchange (KLOFFE) was set up in 1995. It commenced operations in the same year. KLOFFE introduced its first product, namely the KLSE Composite Index (KLCI) futures contract in 1995, followed by the KLSE CI options contract in December 2000. Another derivatives exchange is the Commodity and Monetary Exchange of Malaysia (COMMEX), which was formed in 1998 as a result of the merger between Malaysia Monetary Exchange (MME) and the Kuala Lumpur Commodity Exchange (KLCE). Contracts traded on COMMEX were the Crude Palm Oil (CPO) Futures and the three-month Kuala Lumpur Interbank Offer Rate (KLIBOR) futures. On 11 June 2001, both KLOFFE and COMMEX merged to form the Malaysia Derivatives Exchange (MDEX), which operated as the only derivatives exchange in Malaysia. MDEX was later renamed Bursa Malaysia Derivatives Berhad (Bursa Derivatives) following the demutualisation exercise in 2004.

Clearing houses

Bursa Malaysia Securities Clearing Sdn Bhd (Bursa Clearing), formerly known as the Securities Clearing Automated Network Services Sdn Bhd (SCANS), was initially formed to facilitate the clearing system and to elevate trading activities to a more efficient level. Bursa Clearing is used for real-time reporting on transactions and is the clearing house for the securities exchange.

Meanwhile, Bursa Malaysia Derivatives Clearing Bhd, formerly known as the Malaysian Derivatives Clearing House (MDCH), acts as the clearing house for contracts traded on markets operated by Bursa Malaysia Derivatives. The clearing house is vital in the overall management of systemic risk in the market. Regulated under the Rules of Bursa Malaysia Derivatives Clearing Bhd, the clearing house has established rules to govern its contractual relationship with the member companies of Bursa Malaysia Derivatives.

Issuing houses

There are two issuing houses in Malaysia, namely the Malaysian Issuing House Sdn Bhd (MN) and Equiniti Services Sdn Bhd (Equiniti).

The issuing house is responsible for the issue of new securities to be listed on Bursa Malaysia. The involvement of the issuing house commences from the application of new securities up to the allotment of the said securities. In general, an issuing house acts as an agent of the issuer (the company) and the liaison between the public, the issuer and the authorities. The functions of an issuing house include, inter alia, the

management and administration of share applications forms, the organisation of the balloting of the shares (for an IPO) as well as the allotment of the shares and issuance of the Statement of Allotment and final shareholder allotment list to be given to the Bursa Malaysia Depository Sdn Bhd. The issuing house also acts as a stakeholder responsible for holding all payments for the application of securities in a trust account, prior to the crediting of the said payments upon allotment of the securities.

Central depository

In 1990, the Bursa Malaysia Depository Sdn Bhd (Bursa Depository), formerly known as Malaysian Central Depository Sdn Bhd (MCD), was established to provide central clearing and settlement of securities. Bursa Depository operates and maintains a Central Depository System (CDS) in respect of shares, loan stocks, debentures or other securities of corporations whereby all investors, individual or corporate, are required them to trade in prescribed securities. The CDS was aimed at replacing the practice of holding and moving physical scrip of quoted securities with a safe and dependable computerised book entry system (i.e. scripless trading).

Since the capital market acts as a catalyst to mobilise both short- and long-term capital to finance investments that are imperative for the economic growth of the country, it is important that the development of the capital market and its continued growth are based on the collective efforts of the SC, other government authorities and the industry.

The Malaysian Markets

The success of primary markets depends on the availability of efficient secondary markets. A secondary market is a market trades in assets that have been issued in the primary markets. For a secondary market to function properly, efficient supporting institutional infrastructure such as market-based benchmarks, efficient clearing and settlement systems, credit rating agencies and central information systems are required.

In order to be efficient, a secondary market needs to provide:

(i) a liquid market for the assets traded;

(ii) a good price discovery function;

(iii) a source for diversifying and transferring investment risk; and

(iv) goodwill for firms.

The secondary plays a major role in the capital mobilization process. In Malaysia, we have three major secondary markets. There are secondary markets for bonds, equities and derivatives instruments.

1. Secondary bond market

The two main sectors of the Malaysian bond market are the government and private sectors.

Government bonds

Government bonds are initially issued to meet the investment needs of the saving sector e.g. the Employees Provident Fund and to partially fund the budget deficit of the Federal Government. Its issue was then expanded mainly to finance public sector development expenditure.

Some main types of money market instruments traded as government bonds in Malaysia are:

(i) Malaysian Government Securities

Malaysian Government Securities (MGS) have traditionally dominated the Malaysian bond market. They are long-term debt securities issued for the purpose of financing developmental expenditure. MGS are fixed rate coupon bearing bonds with a maturity of 3 to 20 years. In December 2006. Callable MGS also introduced, providing the government with the option of rendering the issue at par by giving advance notice to the bond holders. Both MGS and Callable MGS are issued via competitive auction by BNM, with the lowest yield being offered as the successful bidders and the weighted average yield of successful bids as the coupon rate. The secondary market for MGS is liquid with average daily transaction volume ranging from RM100 million to RM500 million. MGS are largely held by financial institutions and the Employee Provident Fund. However, with the increasing sophistication in the Malaysia’s capital market, more new instruments have emerged to complement MGS.

(ii) Malaysia Treasury Bills

Malaysian treasury Bills (MTBs) are short-term debt securities sold by BNM on behalf of the Federal Treasury to raise short-term funds for government working capital and are issued on a discount basis through tenders submitted by principle dealers.

(iii) Bank Negara Monetary Notes

Bank Negara Monetary Notes (BNMN) are issued to replace the Bank Negara Bills (BNBs) issued earlier on, for the purpose of managing liquidity in the conventional financial market. The maturity of these issuances has been lengthened from 1 year to 3 years. New BNMN may be issued either on a discounted or on a coupon-bearing basis, depending on the investors’ demand.

(iv) Government Investment Issues

Government investment issues (GIIs) are long-term government certificates and government bonds issued based on Islamic principles. The issuance of GIIs is authorised by the Government Funding Act 1983. GIIs are registered as liquid assets.

Corporate Bonds

Corporate bonds are essentially debt instruments issued by the private sector which usually carry a define maturity period and a stated payment of interest. the increasing role of the private sector as the main engine of economic growth and for the implementation of the government privatisation plans in the mid-1980s have initiated the development of the private debt securities market.

The corporate bond market was launched with the establishment of Cagamas Berhad (Cagamas) – Malaysia’s National Mortgage Corporation – in 1986. It started with Cagamas purchasing housing mortgages from loan originators and repackaging them into fixed-rate bearer bonds that are tradable on the inter-bank market, thereby providing liquidity to banks. Cagamas is the second largest debt issuer after the Government. A detail explanation of corporate bonds is covered in topic 9 – Debt Financing.

The Malaysian bond market consist of listed and unlisted bonds. Unlisted bonds are largely traded over-the-counter (OTC) while listed bonds are traded through Bursa Malaysia’s Electronic Trading Platform (ETP). Bonds listed on Bursa Malaysia are also known as loan stocks.

For OTC trading, quotes are typically obtained directly from money brokers and dealers over the telephone. However, all trading in the OTC market must be reported in the Bursa Malaysia’s ETP and settled through BNM’s Real Time Electronic Transfer of Funds and Securities (RENTAS), comprising the interbank Funds Transfer System (IFTS, which deals with large-value fund transfers) and Scripless Security Trading System (SSTS, which allows the book-entry settlement and recording of holdings of scripless debt securities).

Bursa Malaysia’s ETP was introduced in March 2008 as a single electronic trade reporting and trading platform for the domestic bond market. The system takes over the function of BNM’s Bond Information Dissemination System (BIDS) for mandatory reporting of all secondary bond market transactions and is expected to enhance price transparency and liquidity in the secondary bond trading. The ETP also interfaces with other systems such as the FAST (Fully Automated System for Tendering) as well as

information providers, such as Bloomberg and Reuters.

The secondary market enables potential investors to trade securities after the securities are issued and the availability of liquidity is extremely important for the development of the bond market.

Credit rating Agencies

The establishment of a credit rating agency is essential for the success of the bond market and it promotes transparency and investor confidence in the market. Credit rating is an objective and impartial third party opinion on the ability and willingness of an issuer of a debt instrument to make full and timely payments of principal and interest over the life of that instrument.

the first rating agency, Rating agency Malaysia (RAM) was set up in 1990 to provide independent credit ratings to corporate debt securities and to boost the private debt securities market. Subsequently, the second rating institution, Malaysia Rating Corporation (MARC), was established and launched in 1996. The rating agencies undertake ratings of private debt securities, Islamic capital market instruments, assert-backed securities, corporate and financial institutions.

2. Secondary equity market

Bursa Malaysia governed by various Acts of Parliament including the Capital Market and Services Act 2007, Securities Industry (Central Depositories Act), Securities Commission Act 1993 as well as Companies Act 1965. It is a self-regulatory organization, obligated to ensure that its participating organisation adhere to the rules of conduct for fair, ethical and efficient practices. Like all exchanges, Bursa Malaysia has listing requirement and a regulatory framework, which work to promote investors confidence and protection. The regulatory framework is reviewed and changed over time to reflect changes in the investment environment.

in mid 2009, the Malaysian government announced several measures to revamp the fundraising framework with more efficient rules broadened the ease of financing through the merger of the Main and Se4cond Boards of the exchange as well as the repositioning of MESDAQ as a sponsor-drivers market for a wide range of companies. The new framework entailed the meaning of Bursa Malaysia’s Main and Second Boards into a single board for established corporations known as Main Market. In addition, the MESDAQ Market was transformed into the ACE Market, opened to companies of all sizes and from all economic sectors. The two new markets became operational on 3 August 2009.The KLSE Composite Index (KLCI), known as FTSE Bursa Malaysia KLCI since 6 July 2009, is used as the benchmark index by investors. The FTSE Bursa Malaysia KLCI is one of the most widely-followed indices in the financial community in Malaysia as it serves to reflect the performance of the Malaysian stock market as a whole.

The FTSE Bursa Malaysia KLCI is based on 30 companies listed on the Main Market of Bursa Malaysia and is calculated as follows:

(Current aggregate market value / Base aggregate market value) X 100

The FTSE Bursa Malaysia Emas Index, on the other hand , is computed based on all the companies listed on the FTSE Bursa Malaysia Top 100 Index and FTSE Bursa Malaysia Small Cap Index. The respective sectoral indices are computed based on the companies segregated into each respective sector. The bases of computation for these indices are similar to the computation of the FTSE Bursa Malaysia KLCI.

3. Secondary derivatives market

The derivatives market in Malaysia commenced with the establishment of the Kuala Lumpur Commodity Exchange (KLSE) in July 1980. The initial futures contract traded on KLSE was Crude Palm Oil Futures. This contract is still traded today. The KLCE had the infrastructure and capacity to allow for the trading of financial futures, however, setting up a subsidiary was necessary because trading in the financial futures fell under different jurisdictions.

Therefore, on 19 August 1992, the KLCE with the support of the management authorities, incorporated a wholly owned subsidiary called Kuala Lumpur Futures Market Sdn Bhd (KLFM), which was later renamed the Malaysia Monetary Exchange Bhd (MME) in mid-1995. On 7 May 1996, the Minister of Finance approved the establishment and operation of MME as a futures and options exchange company and the three-month KLIBOR futures contract was launched on 28 May 1996.

establishment and operation of MME as a futures and options exchange company and the three-month KLIBOR futures contract was launched on 28 May 1996.

On 9 November 1998, the KLCE was renamed the Commodity and Monetary Exchange of Malaysia (COMMEX) in preparation for the merger with the Malaysian Monetary Exchange. The merger took place on 7 December 1998. COMMEX provides the platform for the trading of CPO futures and KLIBOR futures. Trading is done on an open outcry system. The main participants of KLIBOR futures are financial institutions, as it serves as a means to hedge the interest rate risk of ringgit denominated fixed income instruments.

A visibility study by the International Monetary Fund for BNM in 1990 identified the need for some form of financial risk management tool in the face of increasing volatility in the financial markets. This study led to a series of regulatory infrastructure reforms to introduce financial derivatives. As a result of these reforms, Malaysia’s first financial derivatives exchange was established — the Kuala Lumpur Options and Financial Futures Exchange (KLOFFE). The first contract traded was the futures on the KLCI.

In its active pursuit to develop and improve competitiveness in the market, KLOFFE, in December 2000, introduced options on the KLCI. At the same time, measures were undertaken to attract active participants of foreign and local institutions. Continual efforts were also undertaken by the exchange to create public awareness on the uses and benefits of derivatives.

In line with the SC’s Capital Market Masterplan, KLOFFE and COMMEX merged on 11 June 2001 to form a new derivatives exchange called the Malaysia Derivatives Exchange Berhad (MDEX). In April 2004, MDEX was renamed Bursa Malaysia Derivatives Berhad.

Growth of Capital Market Products and Services in Malaysia

There has been significant development of other products and services in the capital market to support and supplement the underlying equity, bond and derivatives markets. The initial products and services composition of the capital market in Malaysia has gradually been altered to add new breadth to the overall market. Hence these ancillary instruments and services may not be completely new but rather are modified or expanded from their original features. Several key financial products and services that have evolved over the years are outlined below:

(1) Fund management industry

Fund managers consist of, among others, the EPF, unit trust management companies, asset management companies and insurance companies. The Malaysia’s fund management industry has come a long way. Since the establishment of the first unit trust fund back in 1959, numerous funds and services have been introduced over the years.

The unit trust funds in Malaysia can be categorized under government-sponsored funds and private funds. It has nevertheless maintained its upward trend in terms of the number of units in circulation and unit holders. The SC has revised the guidelines governing the unit trust industry in 2008 to enable benchmarking against international standards and enhancement of fund management while spurring the growth of the industry.

In an effort to further strengthen Malaysia’s position in the fund management and unit trust industry and to fund managers an additional option to establish their operation in the region, in June 2009, the Malaysian government announced that ownership in the wholesale segment of the fund management industry would be fully liberalized allowing qualified and leading fund management companies to established operations in Malaysia with 100% ownership. In addition, the foreign shareholding limits for the unit trust management companies would be raised to 70% from its previous level of 49%.

(2) Stockbroking industry

Stockbroking companies typically carry out a range of activities including trading and broking for Bursa Malaysia-listed instruments and other securities, offering investment advice and providing nominee/custodian services.

The SC aims to establish a consolidated, well-capitalised and more efficient stockbroking industry in Malaysia, as encapsulated under the Capital Market Masterplan (CMP). Consolidation would make the stockbroking industry better equipped to face the challenges of globalisation and liberalization. Some of the efforts directed at achieving this include, among other things, liberalizing foreign equity participation in domestic stockbroking companies in stages, starting in 2023 and introducing a new category of full-service intermediaries known as Universal Brokers (UBs). UBs would be allowed to undertake, in addition to the current activities of a stockbroking company, a full range of capital market services such as corporate finance activities, trading in derivatives, dealing in debt securities and trading in new capital market products that are introduced in the future by the SC or the exchange.

3. Islamic capital market

The Islamic finance industry in Malaysia distinguishes itself as one of the proven platforms for conducting Islamic finance activities across the globe. The vibrancy and dynamism of Malaysia’s Islamic financial system is reflected by its continued product innovation, a large and diverse pool of Islamic finance talent, diversity of financial institutions from across the world, a wide range of innovative Islamic financial products, a comprehensive Islamic financial infrastructure as well as adoption of global regulatory, legal and Shariah best practices.

Malaysia has also the distinction of being the world’s first country to have a full-fledged Islamic financial system operating in parallel to the conventional banking system. It has placed strong emphasis on human capital development in Islamic finance to ensure the availability of capable and adapt talents.

Malaysia’s Islamic finance journey

Malaysia’s chronology in Islamic finance began in the 1960’s with the establishment of the Pilgrims Fund.this was followed by various initiatives throughout the decades. Notably in the 1980’s, Malaysia enacted the Islamic Banking Act 1983 and the Takaful Act 1984 respectively. This Paved the way for the creation of Malaysia’s first Islamic bank and first takaful company and thereafter the development of more Islamic financial institutions and the growth of industry as a whole.

On the Islamic Capital Market (ICM) side, notable developments and accomplishments include the establishment of the first Islamic equity trust fund in 1995 and the establishment of a full-fledged Islamic stockbroking company, BIMB Securities in 1994.

Today, Malaysia possesses, one of the world’s most advanced Islamic financial markets and is a leader in Islamic finance system where assets are estimated to be worth around US$1 trillion globally, 5 times greater than in 2003.

The Islamic Financial System is divided into Islamic banking, takaful and the ICM. The sub-components of the ICM are Islamic equity, sukuk, Islamic funds, unit trusts, Islamic real estate investment trusts (REITS), Islamic structured products, Islamic venture capital, Islamic derivatives, Islamic exchange traded funds (iETF), Shariah indices and Islamic stockbroking. There are various stakeholders or participants who play different roles in the ICM, including investment and commercial bankers, investors, issuers, fund managers, stockbrokers and takaful operators.

In the ICM, transactions and activities are harmonized with the conscience of Muslims and consistent with the principles of Islamic law or Shariah. In this context, the ICM is free from elements of usury (riba), gambling (maisir) and ambiguity (gharar), which Islam prohibits. Through ICM, capital seekers such as the government, corporations and individuals have access to a larger pool of capital than what is available if they were to rely exclusively or bank borrowings.

In developing the capital market, the SC had identified the development of the ICM as one of its main agendas, which was later incorporated into the SC’s Capital Market Masterplans.

ICM Regulatory framework

As the ICM runs parallel to the conventional capital market, the regulatory frameworks of the capital market are applicable to the ICM, expert in a few circumstances where specific laws, regulations and guidelines are provided exclusively for the operation of the ICM.

All matters, pertaining to the conventional and the Islamic markets come under the jurisdiction of the Ministry Finance. The governing authorities of the ICM are the SC, BNM, Labuan Offshore Financial Services Authority (Labuan FSA) and Bursa Malaysia.

The Malaysian government also encourages the private sector to actively participate in the ICM. The organisations and working groups that develop various self-regulatory guidelines to streamline the industry’s best practices for adaptation by market players, to ensure a high standard of professionalism and effective investor protection.

ICM Regulatory requirements

Generally, the ICM in Malaysia is governed by several Acts and the significant ones are as follows:

– Capital Markets and Services Act 2007

– Securities Commission Act 1993

– Banking and Financial Institutions Act 1989

– Islamic Banking Act 1983; and

– Companies Act 1965.

The SC has also introduced several guidelines, not just to interpret the legislation, subsidiary legislations and rules relevant to the ICM, but also to signal the policy decisions that participants in the ICM must follow, such as:

– Guidelines on the Offering of Islamic Securities 2004 (ISG),

– Guidelines on Islamic Fund management 2007,

– Guidelines for Islamic Real Estate Investment Trusts (REITs) 2008, and

– Guidelines and Best Practices on Islamic Venture Capital 2008.

To enhance the performance of the overall activities in the conventional and Islamic capital markets and to promote best practices in market conduct, the SC issued the Malaysian Code of Corporate Governance in 2000 revised (2007), which provides guidance tp ICM players on the standards of corporate governance, best practices and disclosure.

Shariah Advisory Council of the SC

The ICM Department of the SC carries out research activities and functions as the secretariat to the Islamic Instrument Study Group (IISG). The latter succeeded in exploring the foundation for developing an ICM in Malaysia. Thus, the SC viewed that it was important for the IISG to expand its roles; consequently, it was upraded to a more formal body called the Shariah Advisory Council (SCA) on 16 May 1996. Its establishment was endorsed by the Minister of Finance and it was given the mandate to ensure the SC on ICM issues.

The SAC represents the acme of all Shariah matters in the ICM. As a primary catalyst in the research and development of innovative ICM products and services, the SAC acts as a reference centre for Shariah issues in the ICM. Both the SC and the SAC have been the pioneering efforts towards creating a more organized and efficient ICM.

Under the amended Capital Markets and Services Act 2007 (CMSA), His Majesty the Yang di-Pertuan Agong may, on the advice of the Minister of Finance after consultation with the SC, appoint persons as members of the SAC who are qualified in:

(a) Fiqh muamalah

(b) Islamic jurisprudence

(c) Islamic finance

(d) any other relevant discipline

The SAC has been empowered to make rulings on any Shariah matter relating to ICM business or transactions referred to it by any court, arbitrator, industry participant or other parties.

The SAC has been instrumental in the development of innovative Islamic products and services and has played a key role in transforming a niche growth sector into a core component of the Malaysian capital market. The recent amendments to the CMSA reflect the SAC’s significance and will further promote the development of the ICM in Malaysia and enhance it position as an international centre for Islamic finance.

Before ICM products and services are introduced to the market, they undergo a through process of research and deliberations to ensure their permissibility from the perspective of Shariah. The SAC adopts two significant approaches for this process:

(i) conducting research or studying the validity of conventional instruments from the Shariah point of view, where the focus is on the mechanism and the usage of the instruments to ensure that they comply with Shariah principles; and

(ii) formulating and developing new financial instruments based on Shariah principles.

The Quran and Sunnah are the primary sources of research used by the SAC. In addition, the SAC also uses secondary sources and Islamic jurisprudence manhaj, such as jimak, qiyas, maslahah, istishan, istishab, sadd zari’ah, ‘urf, maqasis Syariah, siyasah syaryyah, tawil, istiqra’, talfiq and others which have already been applied in Islamic jurisprudence.

Bursa Malaysia

Bursa Malaysia has established an Islamic Markets division dedicated to the development of Shariah-compliant capital capital market products and services as well as trading platforms. Among others, the ICM products and service available in Bursa Malaysia are as follows:

– Bursa Suq Al-Sila

– Shariah-compliant stocks

– Sukuk

– Islamic Real Estate Investment Trusts (REITs), and

– Islamic Exchange Traded Funds (IETFs)

In addition to the issuance pf Ringgit-denoted sukuk, the current issuance framework allows for issuers to issue non-Ringgit-denominated sukuk in Malaysia. Governing laws of Malaysia, England or United States may be used for bond documentation for both Ringgit and non-Ringgit-denominated sukuk. In addition, both resident and non-resident issuers are free to utilize proceeds from the issuance onshore and offshore.

Shariah screening

In principle, Islamic equities are categorized by the absence of interest-based transactions, doubtful transactions and unlawful stock of companies which deal in non-Shariah activities or items. The SAC has laid down general requirements for all listed stocks classified as Shariah-compliant. Screening for Shariah compliant stocks is made at the central level by the SAC, where a list of Shariah-Compliant Securities is published every ay and November to accommodate the companies’ different financial periods.

The screening criteria are mainly based on the activities or sources of income of the companies. There are no screening on debt or liability, which implies that screening processes require income statements rather than balance sheets of the companies. individual funds or investment companies do not perform their own Shariah screening.

The Shariah screening methodology developed by the SAC involves qualitative and quantitative parameters. The qualitative parameters involve the screening of the businesses that are prohibited or disapproved by Shariah, where core activities of the companies should be compatible with Shariah principles.

Under the resolutions of the SAC, it is necessary to draw up specific benchmarks to ensure that prohibited elements are minimal and related to those excused by the Shariah in order to determine the status of a mixed company as a Shariah-approved company/securities. This implies that the presence of prohibited elements does not affect the permissible part which is larger and more important.

The SAC has taken a different approach in screening the activities of listed companies as compared to their Middle Eastern counterparts. While financial gearing is not tested, the SAC is focuses on primarily activities of the companies. Thus companies with more liquid than liquid assets can be classified under the criterion.

For quantitative screening methodology, the SAC deals with the issues of mixed contributions from both permissible and non-permissible activities in determining the revenue ad profit of a company which have passed the qualitative test.

In order to establish the minimum acceptable level of mixed contributions from non-permitted activities, the SAC has established four benchmarks, which are based on juristic reasoning. to qualify, the companies should not breach any of the following benchmarks:

(i) The benchmarks for acceptable revenues or profits generated by clearly prohibited activities, such as conventional bank (riba), gambling (maysir), liqour and pork, is a maximum of 5%.

(ii) A benchmark of 10% is imposed on revenues or profits from activities involving prohibited elements that effect most people and are difficult to avoid such as interest income derived from fixed deposits placed in conventional financial institutions or tobacco-related activities.

(iii) As for companies with mixed contributions of revenues and profits such as rental income derived from premises that operate non-Shariah compliant activities, including gambling, selling liquor and pork, the SAC’s benchmark is 20%.

(iv) The highest benchmark of 25% is for companies with activities that are generally permissible under Shariah and also maslahah (in public interest). However, there are certain elements that could affect the Shariah status of these activities, such as hotel and resort operations or share trading, which are deemed non-permissible according to the Shariah.

Shariah principles and concepts

The following Shariah principles and concepts are employed in developing ICM products or instruments:

(i) Murabahah – refers to the sales and purchase transaction for the financing of an asset or project whereby the costs and profits margin (mark-up) are made known and agreed by all parties involved. The settlement for the purchase can be either on a deferred lump sum basis or on an instalment basis and is specified in the agreement.

(ii) Bai’bitaman ajil – is a murabahah-based transaction that refers to a deferred (instalment) sale and purchase transaction for the financing of an asset with a pre-agreed payment period. The sale price includes a profit selling price.

(iii) Bai’al-inah – is a sale and buy-back contract where the financier sells a product to the buyer at an agreed price to be paid later. The financier then immediately buys back the asset at a cash price lower than the defferred selling price.

(iv) Ijarah – is a manfaah (unsufruct) type of agreement whereby the lessor (owner) leases out an asset or equipment to its client at an agreed rental fee and predetermined lease period upon the aqad (contract). The ownerships of the leased equipment remains in the hands of the lessor.

(v) Musharakah – refers to a partnership between two parties or more to finance a business project whereby all parties contribute capital either in the form of cash or in kind for the purpose of financing the business project. any profit derived from the project will be distributed based on a pre-agreed profit sharing ratio, but losses will be shared on the basis of capital participation.

(vi) Istisna’ – is a purchase order contract of asset whereby a buyer places an order to purchase an asset for delivery in the future. The parties of the contract are free to determine the price and the settlement can be arranged or delayed based on the schedule of the work completed.

(vii) Mudharabah/Muqaradhah – is an agreement between two parties to finance a business a business venture. The parties are rabb-al-mal (the investor who solely provides the capital) and mudharib (the enterprenuer who manage the project). Profits derived from the project/investment will be distributed based on a pre-agreed ratio while any losses will be borne by the investor up to the amount of capital contributed.

Sukuk

Sukuk are the Islamic alternative to bonds. As bond represent debt capital with a fixed interest return and principal guarantee, they violate the Islamic rule of earning money from riba. More accurately sukuk are translated as Islamic investment certificates or even participation certificates which represent obligation of the issuer (the company or firm needing the funding, be it a corporate or a sovereign) to the sukuk holders.

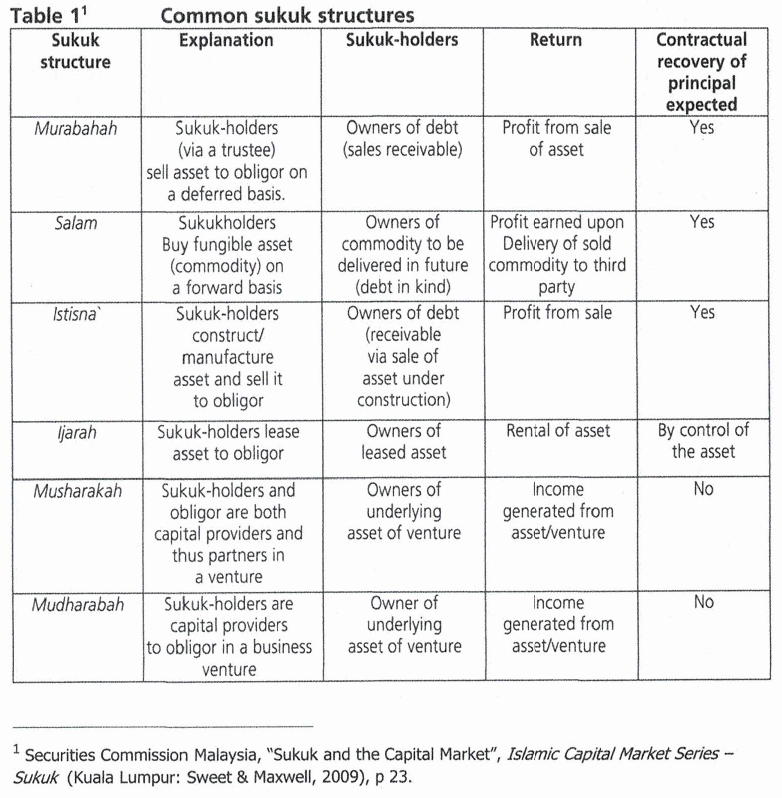

In Malaysia, the SC regulates the issuers of sukuk via the framework provided under the Guidelines on the Offering of Islamic Securities 2004 while the SAC regulates the Shariah component. The underlying relationship between the issuer and sukuk-holders could be based either on a sale transaction (murabahah, salam, or istisna’), a lease transaction (ijarah) or equity and agency relationships (musharakah, mudharabah amd wakalah). Sale and lease transactions are naturally certain in their payment characteristics, whereas the equity and agency structures are naturally uncertain. Many sukuk transactions have been executed by combining different forms of transaction in order to craft a sukuk which have fixed income characteristics similar to traditional bonds. The salient features of common sukuk structures are summarised in the table below:

IOSCO

The SC was also given a mandate by the Executive Committee of the international Organisation of Securities Commission (IOSCO) to lead Islamic Capital Market Task Force (ICMTF). The mandate was given during the IOSCO Annual Conference and meetings held in Istanbul. IOSCO’s main task is assessing the state of play and development potential of Islamic financial products and activities, determining any specific and/or general regulatory gaps in the area, and, enhancing the level of knowledge of IOSCO member jurisdictions in financial products and activities based on Islamic principles offered across the globe.

IOSCO is the world’s most important international cooperative forum for regulatory agencies and it members regulate more than 90% of the world’s securities markets. As the leading international policy forum for securities regulators, IOSCO plays a key role in setting the international standards for securities regulation, identifying issues affecting global markets and making recommendations in meeting those challenges.

Regulatory Framework of the Malaysian Capital Market

This section highlights the relevant rules and regulations of the securities markets and some of the changes that have taken place in the regulatory environment over the years.

Securities Commission Malaysia

– Supervising exchanges, clearing houses and central depositories.

– Registering authority for prospectuses of corporations other than unlisted recreational clubs.

– Approving authority for corporate bond issues.

– Regulating all matters to securities and futures contract.

_ Regulating the take-over and mergers of companies.

_ Regulating all matters relating to unit trust schemes.

_ Licensing and supervising all licensed persons.

_ Encouraging self-regulation, and

– Ensuring proper conduct of market institutions and licensed persons.

Bank Negara Malaysia (BNM)

The Central Bank of Malaysia is the Malaysian central bank. Established on 26 January 1959 as the Central Bank of Malaya, its main purpose is to issue currency, act as banker and adviser to the government of Malaysia and regulate the country’s financial institutions, credit system and monetary policy. The bank is mandated to promote monetary stability and financial stability conducive to the sustainable growth of the Malaysian economy. The roles of BNM are simplified as follows:

– Implements, control and supervise mechanisms in the banking system of Malaysia.

– Ensures the orderly growth and expansion of the banking and financial infrastructures in Malaysia.

– Regulates and supervises financial institutions who fall under the category of ‘registered person’ under the Capital Markets and Services 2007, and

– Implements control and supervisory mechanisms for the banking system of Malaysia.

Companies Commission of Malaysia (CCM)

– Overseas substantial shareholding reporting requirements.

– Enforcement of offences under the Companies Act 1965 which relate to the securities industry, and

– Lodgement of prospectuses, except for the lodgement of unit trust prospectuses, which resides with the SC.

Ministry of International Trade And Industry (MITI)

– Recognition of Bumiputra interests for compliance with the National Development Policy.

– Provision of regulatory approvals for issuance of securities by companies regulated by MITI, such as manufacturing companies.

As can be seen above, capital market exercises may require the approval of more than one authority.

The regulatory provisions for the market are made through legislation such as the Capital Market services Act 2007, Securities Commission Act 1993, Companies Act 1965, the listing requirements of the Bursa Malaysia Securities Berhad and the various guidelines issued by the SC.

The Companies Act 1965 governs companies operating in Malaysia. It sets out the various disclosure requirement relating to the form and content of the statutory accounts as well as the responsibilities of the directors in the preparation of a company’s financial statements for filing purposes.

The securities Industry (Central Depositories) Act 1991 was enacted to establish and maintain a central depository system. An important requirement laid down in the Security Industry (Central Depository) Act 1991 is set out in subsection 25(4), which states that every securities account opened with the central depository shall be in the name of the beneficial owner of the deposited securities or in the name of an authorised nominee.

The Capital Markets and Services Act 2007 (CMSA) came into force on 28 September 2007, marking another major milestone in the SC’s continued measures to strengthen the capital market regulatory framework, improve business efficacy and further enhance investor protection by:

– enhancing the SC’s power to take civil action and administrative actions.

– allowing the SC to recover three times the amount of losses through civil action for a wider range of market misconduct, including market manipulation.

– Requiring application monies of sophisticated investors investors to be held on trust in fund-raising exercises.

– enhancing the standards of trustee for debenture holders; and

– extending investor protection provisions to clients of financial institutions.

The CMSA increases the efficiency of the fund-raising process in that the SC’s approval on corporate proposals such as share splits or share consolidations and entitlements in respect of warrants, options or rights are no longer required. This act basically consolidates the Securities Industry Act 1983, Futures Industry Act 1993 and Part IV of the Securities Commission Act 1993 which deals with fund raising activities.

Bursa Malaysia is responsible for the surveillance of the market place and the enforcement of the listing requirements which spell out the listing prerequisites and continuing disclosure obligations to be maintained by the public-listed companies. Bursa Malaysia continually reviews and revamps listing requirements with nan objective to enhance corporate governance, corporate transparency and efficiency in capital market activities, strengthen investor investor protection and promote confidence.

BNM regulates the activities of financial institutions through the Banking and Financial Institutions Act 1989 (BAFIA), which was enacted to provide laws for the licensing and regulating of institutions carrying out banking, financing, merchant banking and discount house activities. It is BNM’s overall responsibility to monitor the extent of public and private debt as pat of its policy measures to manage liquidity and contain inflation within the economy.

In the aftermath of the financial crisis in 1997, further efforts were made to build up the Malaysian securities industry. One of the key regulatory reforms is the transition of the industry to a disclosure-based regime (DBR) in 2003. The shift from merit-based regulation to DBR, with emphasis on disclosure, due diligence and corporate governance, is necessary efficiency and transparency in the capital market.

As an effort for continued improvement, further actions were taken by the SC, such as amending the Companies Act 1965 to address gaps in related-party transactions, penalties for contravention by directors as well as private enforcement capacity of investors and disclosure, amending the listing requirements for stricter disclosure by listed companies, implementing measures to expand the role of the audit committee in line with international best practices; and transforming GLC;s into high-performing entities and upgrading of GLC boards.

Conclusion

We have briefly learned an overview of the investment environment in Malaysia. Over the years, the market has developed progressively and consistently with strong economic growth of the country. Much of the progress is attributable to the efforts of the government and the general market participants. The capital market composition can be broadly classified under asset classes, activities, participants and the regulatory framework.

We have also learned a general picture of the market institutions in the Malaysian capital market and how they are essential to the overall financial and economic development of the country. The current forces of globalization, degregulation in the financial sector and the development of information and communication technology are some of the potential factors leading to the intense competition faced by the capital market of emerging economies. In an environment of increasing liberalization and globalization, Malaysia is constantly assessing and reviewing significant capital market developments and regulatory issues. We have looked at the introduction of new products and services in the various markets segment in Malaysia, in particular the investment management industry, the stockbroking industry and Islamic capital market. Regulations are also continually revised and updated to suit the changing structure and condition of the financial sector and the capital market.

The Capital Market Masterplan 2 (CMP2), the SC’s strategic blueprint for the development of the Malaysian capital market over the next 10 years launched in April 2011. Themed Growth with Governance and leveraging on the sound foundation built during the first Capital Market Masterplan, CMP2 will tackle the challenges for Malaysia’s capital market in expanding its role in invigorating national economic growth while addressing concerns about the efficacy of markets in the aftermath of the global financial crisis. The details of the CMP2 are available at the SC’s website – www.sc.com.my.

SELF-ASSESSTMENT QUESTIONS

1. The following are the functions of a stock market, EXCEPT:

(a) liquidity – means how quickly you can get your hands on your cash. In simpler terms, liquidity is to get your money whenever you need it. Description: Liquidity might be your emergency savings account or the cash lying with you that you can access in case of any unforeseen happening or any financial setback.

(b) goodwill – is an intangible asset that is associated with the purchase of one company by another. It represents the value that can give the acquiring company a competitive advantage.

(c) diversification – is a strategy that mixes a wide variety of investments within a portfolio in an attempt to reduce portfolio risk.

(d) HEDGING – is a strategy that seeks to limit risk exposures in financial assets. is therefore a trade that is made with the purpose of reducing the risk of adverse price movements in another asset. Normally, a hedge consists of taking the opposite position in a related security or in a derivative security based on the asset to be hedged.

2. Which of the following is an interest rate futures contract:

(a) CPO Futures

(b) SIF Futures

(c) KLIBOR Futures – means, in respect of Malaysian Ringgit and for any specified period, the interest rate benchmark known as the Kuala Lumpur inter-bank offered rate.

(d) KLCI Futures

3. The price discovery function of a well functioning secondary market relates to:

A. alternative source of financing

B. diversification

C. transfer of risk at a cost

D. LIQUIDITY – Liquidity refers to the efficiency or ease with which an asset or security can be converted into ready cash without affecting its market price. The most liquid asset of all is cash itself.

Consequently, the availability of cash to make such conversions is the biggest influence on whether a market can move efficiently. The more liquid an asset is, the easier and more efficient it is to turn it back into cash. Less liquid assets take more time and may have a higher cost.

4. The Securities Commission (SC) is responsible for the administration and enforcement of the following acts, EXCEPT:

A. Securities Commission Act 1993.

B. Capital Market and Security Act 2007.

C. Companies Act 1965– The Companies Act 1965, is a Malaysian law which relates to companies.

D. Securities Industry (Central Depositories) Act 1991

5. All the following are the areas covered by the Capital Market and Services Act 2007 (CMSA), EXCEPT:

A. enhancing the standards of trustee for debenture holders

B. enhancing the SC’s power to take civil action and administrative actions.

C. private enforcement capacity of investors and disclosure.

D. extending investor protection provisions to clients of financial institutions.