Contents

Learning Objectives

Introduction

Primary Issues of Ordinary Issues

Post-listing Requirements

Securities Issues in the Secondary Market

Debt Securities and Derivatives Products

Structured Products

Bursa Malaysia Securities Berhad Main Market Listing Requirements

Bursa Malaysia Securities Berhad ACE Market Listing Requirements

Bursa Malaysia Securities Berhad LEAP Market Listing Requirements

Summary

Self-Assessment

Learning Objectives

At the end of this topic, you should be able to:

State advantages and disadvantages of listing on the stock market

Identify the criteria for listing and floating on Bursa Malaysia Securities Berhad.

Identify the role of the SC in the primary issue of securities on Bursa Malaysia Securities Berhad.

Summarise the main features of the Equity Guidelines

Summarise the requirements for listing on the Main Market, ACE Market and LEAP Market of Bursa Malaysia Securities Berhad.

Describe the role of the adviser in the issues of securities

Summarise the main features of the Prospectus Guidelines.

Describe briefly the Corporate Disclosure Policy adopted by the SC and Bursa Malaysia Securities Berhad.

Describe briefly the continuing listing requirements of a publicly listed company.

List and describe the various techniques a company may adopt to raise additional equity funds.

Describe the different types of debt securities traded on Bursa Malaysia Securities Berhad.

Describe some hybrid products traded on Bursa Malaysia Securities Berhad

Summarise the main features of Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework.

Introduction

We begin this topic by describing how companies join the official list of Bursa Malaysia Securities Berhad and raise funds on the stock market. This topic also includes a brief explanation of the Securities Commission Malaysia (SC)’s Equity Guidelines and the Listing Requirements of Bursa Malaysia Securities Berhad that are designed to protect investors and to ensure an orderly capital market.

Once a company has been listed on Bursa Malaysia Securities Berhad and is thereby raising initial capital, it may raise additional capital from the market. There are various avenues available to a listed company, including the issue of additional ordinary shares via various equity raising techniques, which will also be discussed. We will also take a brief look at the Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework offered to sophisticated investors in Malaysia or abroad.

PRIMARY ISSUES OF ORDINARY ISSUES

Advantages and Disadvantages of Flotation

There are several reasons why companies may wish to “go public”, i.e. to float their securities, yet there are also drawbacks. Public company status and listing is not always the most appropriate (or feasible) means of raising capital. Each company deciding to go public must weigh where the balance of advantage lies and decide whether the compromises involved are worthwhile.

Advantages

Access to equity capital

The principal advantage of a public flotation is access to additional equity capital. Funds raised from the initial issue of securities are available to launch or expand operations, increase working capital or reduce borrowings. The establishment of a market for the company’s securities and a broader shareholder base generally enhances its capacity for further equity capital raisings in order to satisfy its funding requirements without increasing its debt funding.

Secondary market for shares

The facility to resell shares on the secondary market is an attractive feature to shareholders who know they can readily sell their shares at a price determined by the market. The value of a listed company’s shares tends to be enhanced by their liquidity and marketability, whereas the valuation and disposal of unlisted shares are more difficult.

Heightened corporate image

A further advantage of public company listing is the improved corporate image that results from the prestige and public exposure of listing on the stock exchange. This can be important for companies, particularly consumer sales-orientated companies, as it will ultimately help stimulate growth in the company and attract new business. In addition, a public-listed company is generally regarded as having a higher standing than a private company and is in a better position to expand overseas as it enjoys more recognition because of greater publicity of its activities.

Attract key employees

A listed company may be in a better position to attract and retain key personnel and other staff by offering shares or options as part of their remuneration package. For many previously family-owned companies, this may assist in recruiting a professional middle management structure, which may be currently missing or inadequate.

Disadvantages

Dilution of control

Dilution of control of existing owners is an obvious disadvantage flowing from flotation. Depending on the extent of the dilution, there is the possibility of an increased risk of take-over.

Increased responsibility of directors

Directors of a public company assume additional responsibilities and are legally obliged to act in the best interest of all shareholders. The company is no longer the private vehicle of the original owners and all transactions between the two must be on an arm’s length basis.

Disclosure requirements

An important consequence of listing is the greater demand for disclosure of information and its wider distribution. Disclosure requirements for public companies have increased in recent years and this trend will no doubt continue. Some companies fear that disclosing financial information may place them at a competitive disadvantage. However, the available evidence shows that such fears are generally ill-founded.

Costs

There are explicit costs associated with a flotation, both in terms of time and money. These include the initial costs of conversion to a public limited company, the cost of issuing a prospectus, underwriting fees and brokerage, professional advisory fees, accounting and legal fees, listing fees, share registry costs and other continuing expenses, such as the increased cost of producing annual reports. In addition, executives need to allocate time to shareholder relations and meetings with investment analysts.

Insider trading legislation

The insider trading provisions of the securities legislation have significant implications for directors and principal officers connected with the company who may wish to deal in the company’s securities. Directors and principal officers of the company will normally be privy to price-sensitive information. Thus, to avoid possible legal action for dealing in the shares of the company based on such privileged information, there are restrictions on the occasions that the directors and principal officers can trade in shares of the company.

Less control over the company’s direction

Certain transactions to be carried out by the company may be subject to a vote of shareholders. In particular, if the controlling shareholders are interested in the transaction, they may not be able to vote to ensure that the proposed transaction is implemented. The controlling shareholder will be unable to vote in respect of his/her shares and the outcome will be dependent on the vote of other shareholders.

Listing and Flotation on Bursa Malaysia Securities Berhad

Flotation or an initial public offering usually involves the issue of securities to the public at large that are subsequently listed on the stock exchanges for the first time. This is known as an issue in the “primary market”.

It is the official listing and quotation of securities for trading by the public on the stock exchange known as the “secondary market”, which completes the process of flotation.

As indicated earlier in this guide, the securities of an established company are usually listed on the Main Market of Bursa Malaysia Securities Berhad. As an alternative, Bursa Malaysia Securities Berhad offers the sponsor-driven ACE Market which allows all companies regardless of size and economic sectors to raise capital.

All companies seeking listing on the Main Market of Bursa Malaysia Securities Berhad will require the SC’s approval, under s.212 of the Capital Markets and Services Act 2007 (CMSA). In addition, a prospectus issued in conjunction with the listing, must be registered with the SC. For ACE Market listing applications, the SC’s approval under s.212 is not required. However, the IPO prospectus is subject to the SC’s review.

To float the securities of a company on Bursa Malaysia Securities Berhad, the company must meet the various requirements of the SC as set out in its Equity Guidelines and must comply with the Listing Requirements of Bursa Malaysia Securities Berhad.

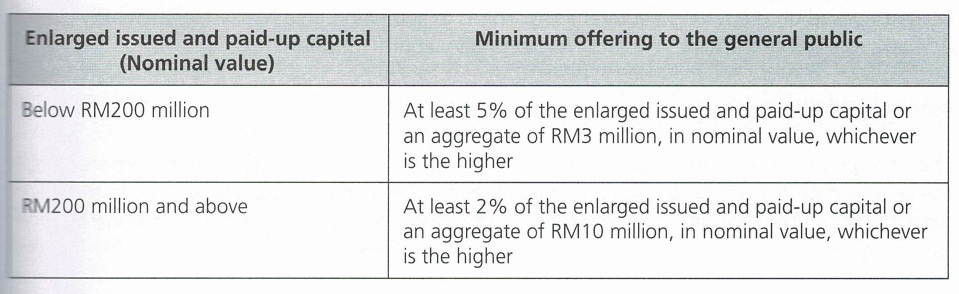

As a general rule, as part of its listing scheme, the company is required to undertake an offering of securities to the general public so that at least a certain percentage of the issued and paid-up capital will be in the hands of the public. This is designed to ensure that there will be sufficient shares available in the market to form a satisfactory basis for trading.

The minimum public offering size through a balloting process is as follows’:

As part of the new listing framework, the SC and Bursa Malaysia introduced the listing of Special Purpose Acquisition Companies (SPACs), which are shell companies without operations formed specifically with the intention of merging with or acquiring operating companies or businesses using the proceeds of the floatation. SPACs are also allowed to list on the Main Market. The listing of SPACs on the Main Market is aimed to promote and facilitate private equity activities and encourage corporate mergers and acquisitions (see subtopic 1.3 for the requirements in the Equity Guidelines on SPACs).

Equity Guidelines and the Listing Requirements of Bursa Malaysia Securities Berhad

The Role of the Sc

The Equity Guidelines were formulated to ensure a fair and consistent application of policies. The requirements represent the minimum standards that have to be met by applicants embarking on proposals.

Para. 1.01 of the Equity Guidelines provides that the SC’s approval under s.212 of the CMSA will only be required for the following corporate proposals:

• Issues and offerings of equity securities

• Listing of corporations and quotations of securities on the Main Market of Bursa Malaysia Securities Berhad

• Proposals which result in a significant change in the business direction or policy of corporations listed on the Main Market.

The SC will vet and register prospectuses to ensure adequate and meaningful disclosures to investors; however, the approvals for the proposals will rest with Bursa Malaysia Securities Berhad’s based on the Listing Requirements. This is in line with Bursa Malaysia Securities Berhad’s role as the frontline regulator for secondary equity fund-raisings.

Equity Guidelines

The principles on which these guidelines are based embrace the interests of listed corporations, the provision of investor protection and maintenance of investor confidence, as well as the need to protect the reputation and integrity of the capital market. The principles include the following:

• Issuers must be suitable for listing and have minimum standards of quality, size, operations, and management experience and expertise.

• Issuers and their advisers must make timely disclosure of material information and ensure the accuracy and completeness of such information to enable investors to make an informed assessment of the issuer, the proposals and the securities being offered.

Issuers and their directors, officers and advisers must maintain the highest standards of corporate governance, integrity, accountability and responsibility.

• Directors of an issuer must act in the interests of shareholders as a whole, particularly where a related party has material interest in a transaction entered into by the issuer.

• All holders of securities must be treated fairly and equitably and must be consulted on matters of significance.

• Proposals undertaken by issuers must not undermine public interest.

Decisions on Proposals

In considering the applications on proposals for the offering and issue of securities by a public company, the SC may:

• Approve the proposal subject to such terms and conditions as it deems fit.

• Approve the proposal with revisions and subject to such items and conditions which it deems fit.

• Reject the proposal.

Where the approval of the SC is subject to conditions, the applicant and any other party involved in the proposal must take appropriate steps to ensure that the conditions are complied with. Public companies should also ensure that the requirements of other regulatory bodies where applicable, e.g. the Foreign Investment Committee, Ministry of International Trade and Industry and Bank Negara Malaysia, are observed.

The SC may revoke or revise an approval or impose further terms or conditions in relation to a proposal approved by it in such circumstances provided for under s.212 (7) of the CMSA.

Failure to Comply

Failure to comply with the Equity Guidelines is considered a breach and shall subject a person to the penalties set out under the CM5,42. Public companies, promoters and directors of public companies, as well as advisers, reporting accountants and experts must comply with the various guidelines applicable to them.

The following are among the measures that may be taken by the SC against persons who have been found to have breached the Equity Guidelines3:

• Direct the person in breach to comply with the guideline.

• Impose a penalty in proportion to the severity or gravity of the breach on the person in breach not exceeding RM1,000,000.

• Reprimand the person in breach.

• Direct to remedy the breach or to mitigate the effect of such breach, including making restitution.

• Refuse to accept or consider the submission from the person in breach.

What are the Listing Requirements of the Bursa Malaysia Securities Berhad?

To be admitted to the Official List of Bursa Malaysia Securities Berhad and to secure an official quotation of their securities on Bursa Malaysia Securities Berhad, companies must, in addition to compliance with the relevant provisions of the CMSA, Companies Act 2016 (CA), and Equity Guidelines, comply with the Listing Requirements of Bursa Malaysia Securities Berhad.

The Listing Requirements of Bursa Malaysia Securities Berhad set out the requirements which apply to applicants for listing, the manner in which any proposed marketing of securities is to be conducted and the continuing obligations of listed companies. The Listing Requirements of Bursa Malaysia Securities Berhad enable Bursa Malaysia Securities Berhad to facilitate the admission of only suitably qualified entities. Once listed, the Listing Requirements of Bursa Malaysia Securities Berhad provide the guidelines to ensure that the entities conduct themselves in a proper manner that will give due regard to investor protection and at the same time, enable them to achieve their corporate objectives.

The Listing Requirements of Bursa Malaysia Securities Berhad are based on the following general principles:

• All applicants will be of a certain quality and have a record of operations of adequate duration.

• Investors and the public will be kept fully informed by the listed issuers of all facts or information that might affect their interests.

• All holders of securities will be treated fairly and equitably.

• Directors, officers and advisers of listed issuers will maintain the highest standards of integrity, accountability, corporate governance and responsibility.

• Directors of listed issuers will act in the interests of the corporation as a whole, particularly where the public represents only a minority of the shareholders or where directors or major shareholders have material interests in transactions entered into by listed issuers.

Requirements for Initial Public Offerings of Securities with Listing and Quotation on Bursa Malaysia Securities Berhad

Main Market

The Equity Guidelines set out the requirements to be met by public companies intending to undertake offering of securities with listing and quotation on the Main Market of Bursa Malaysia Securities Berhad.

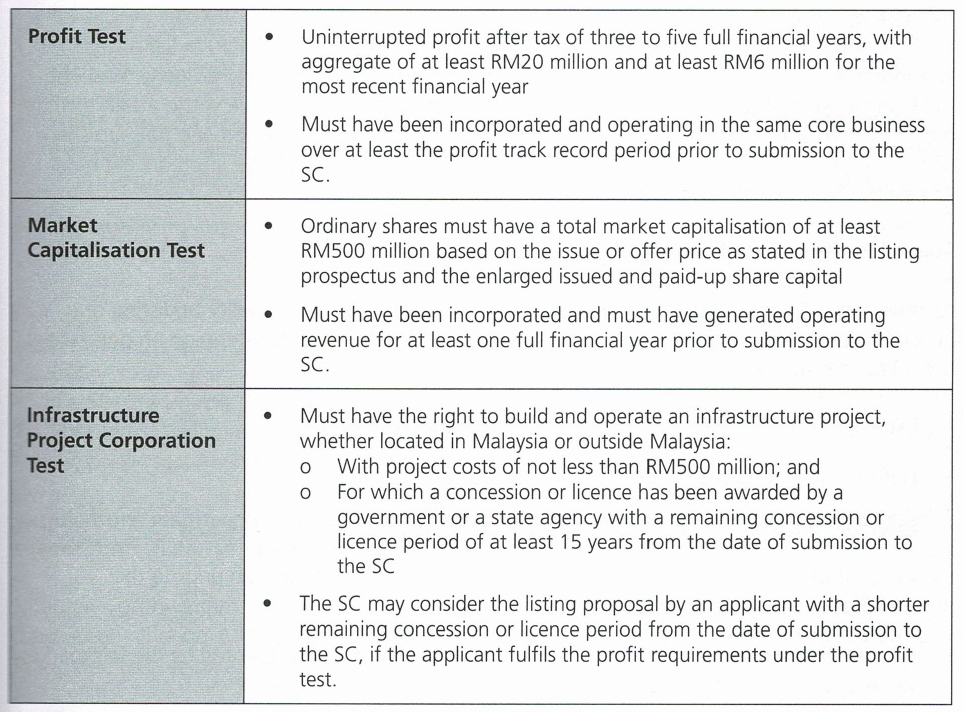

There are three alternative routes available for listing on the Main Market of Bursa Malaysia Securities Berhad and depending on the listing route taken, applicants must fulfil the following requirements stated in each route’:

Read paras. 5.03 to 5.28 of the Equity Guidelines to understand the additional requirements to be complied with by those corporations submitting applications for listing on the Main Market of Bursa Malaysia Securities Berhad.

Moratorium on Disposal of Shares Pursuant to an Initial Public Offering

There is a moratorium imposed on the disposal of shares by the promoters of all applicants (see para. 5.29 of the Equity Guidelines). This requirement is deemed necessary to ensure that the promoters, who invariably are in control to dictate the fortunes of the company, continue to manage the public company after listing.

For listing under the profit test or market capitalisation test, the promoters are not allowed to sell, transfer or assign their entire shareholdings in the applicant for a period of six months from the date of listing6.

For listing under the infrastructure project corporation test, the promoters are not allowed to sell, transfer or assign their entire shareholdings in the applicant for a period of six months from the date of listing’.

The moratorium will be lifted at the end of this period if the infrastructure has generated one full financial year of audited operating revenue. For companies which have yet to attain this, the promoters must retain their shareholdings amounting to 45% of the issued and paid-up share capital of the applicant. The moratorium on the 45% shareholding will be lifted once it has achieved a full financial year of audited operating revenue8.

Special Purpose Acquisition Company

As provided in Chapter 6 of the Equity Guidelines, in assessing the suitability for listing of a Special Purpose Acquisition Company (SPAC), the SC will take into consideration among others, the following factors:

• Experience and track record of the management team

• Nature and extent of the management team’s compensation

• Extent of the management team’s ownership in the SPAC

• Amount of time permitted for completion of the qualifying acquisition prior to the mandatory dissolution of the SPAC

• Percentage of amount held in the trust account that must be represented by the fair market value of the qualifying acquisition

• Percentage of proceeds from the initial public offering that is placed in the trust account.

The Equity Guidelines further provide the following requirements to be complied with:

• A SPAC must raise a minimum of RM150 million through its initial public offering.

• At least 90% of the gross proceeds raised from its initial public offering must be deposited in a trust account immediately upon receipt.

• A custodian must be appointed according to the eligibility requirements in Part D of the Equity Guidelines to safeguard the proceeds in the trust account

• A SPAC must demonstrate that the members of its management team have the experience, qualification and competence to achieve the SPAC’s business strategy.

The main requirements on qualifying acquisitions by SPACs are as follows:

• A SPAC must complete a qualifying acquisition within 36 months of its listing on Bursa Malaysia Securities Berhad.

• Public investors who vote against a qualifying acquisition must be entitled to receive, in exchange for their securities, a pro rata portion of the monies in the trust account, provided that the qualifying acquisition is approved and completed within the given timeframe14.

• The qualifying acquisition must account for at least 80% of the amounts then on deposit held in the trust account.

Part C of the Equity Guidelines also provides the guidelines relating to liquidation distribution upon failure to meet time frame for a qualifying acquisition and custodian arrangements.

• If a SPAC is unable to complete the business acquisition within the specified timeframe, the SPAC must be liquidated and the proceeds held in the trust account must be distributed to the public security holders on a pro rata basis.

Acquisitions resulting in a significant change in business direction or policy of a listed corporation (Reverse take-overs and back-door listings)

Chapter 7 of the Equity Guidelines sets out the requirements for proposals which would result in a significant change in the business direction or policy of a listed company including back door listing and reverse takeovers.

The SC will treat a listed company undertaking such proposals as if it were a new listing application and the proposals would have to comply with either the profit test or the infrastructure corporation test.

The moratorium rules will also apply under these circumstances.

Secondary listings and cross listings

A foreign company seeking a secondary listing on Bursa Malaysia Securities Berhad and a Malaysian incorporated company seeking cross listings on foreign stock markets are required to obtain the SC’s approval. In assessing secondary listing proposals, the SC would look to the standards in relation to corporate governance, shareholders and minority interest protection and regulation of take-over and merger of the jurisdiction in which the company is incorporated.

In the case of cross listings, the SC will have to be satisfied that the listing will benefit the company and that the foreign stock market where the cross listing is sought is a member of the World Federation of Exchanges and must be based in a jurisdiction that is subject to corporation laws and have standards at least equivalent to Malaysia, particularly in relation to corporate governance, shareholders and minority interest protection, disclosure standards and regulations of take-overs and mergers.

ACE Market

Under the new framework for listing, corporations that wish to list on the ACE Market are required to appoint sponsors to assess the quality and suitability of the applicant for listing.

The assessment would entail looking at:

• The prospects of the applicant’s business

• Its corporate governance record

• Past corporate conduct of board of directors and key management

• The nature and extent of conflict of interests or potential conflict of interests.

• Whether the applicant has sufficient systems, controls and resources to comply with the ACE Market listing requirements.

• Ensuring the admission of the applicant does not undermine public interest.

Sponsors continue to play an important role in the corporation after it is listed. A Sponsor is obligated to remain with the corporation for at least one full financial year after the applicant’s admission to the Official List. During this time the Sponsor is not allowed to resign and neither is the corporation allowed to terminate the services of the Sponsor.

Companies listing on the ACE Market must secure and maintain the services of a Sponsor for at least three full financial years from the date of its admission.

Transfer of Listing from the ACE Marketto the Main Market of Bursa Malaysia Securities Berhad (Chapter 8 of the Equity Guidelines)

A company which is listed on the ACE Market may seek a transfer of listing to the Main Market if it fulfils any one of the following requirements:

An aggregate after-tax profit of at least RM20 million and an after-tax profit for the most recent financial year of at least RM6 million; however, it is not required to comply with the “uninterrupted” profit requirement

Market capitalisation of at least RM500 million

Infrastructure project corporation test as per the Equity Guidelines.

The SC, in considering a transfer of listing proposal via the market capitalisation test, will take into account any past records of unusual market activities or other events which may have adversely affected the fair and orderly trading restrictions imposed by Bursa Malaysia Securities

Berhad for the past one year prior to submission to the SC.

The Adviser

Where a company plans to float its shares through a listing on Bursa Malaysia Securities Berhad or raise funds by issuing or offering securities, it must appoint a principal adviser to manage the flotation exercise, prepare and submit the corporate proposal, act as an underwriter for the securities offered as well as act as a placement agent (or joint placement agent) for any placement of securities.

Please read para. 2.02 of the Principal Adviser Guidelines to see the different categories of principal advisers and the types of corporate proposals they are permitted to submit.

As for underwriting arrangements, para. S.25 of the Equity Guidelines provides that an applicant and its advisers have the flexibility to decide whether underwriting arrangements are necessary, depending on the funding needs of the issuers. In the event there is an underwriting arrangement, the principal adviser must be part of the syndicate of underwriters.

Para. S.19 of the Equity Guidelines provides that the principal adviser must act as the placement agent (or joint placement agent, where applicable) for any placement of securities under an initial public offering.

In addition to the principal adviser, an applicant company relies on other advisers, including public accounting and law firms to provide professional advice. These advisers have a professional responsibility to satisfy themselves and based on all available information, ensure that the application is suitable for the specific proposal being submitted for the consideration of the SC. The advisers should exercise due diligence expected of them in preparing the application.

Under s. 215 of the CMSA, a person (which includes a financial adviser or an expert) who is found guilty of submitting to the SC any statement or information that is false or misleading or from which there is a material omission, or engages in conduct that is misleading or deceptive shall be liable to a fine not exceeding RM3 million or to imprisonment for a term not exceeding 10 years or both.

Preparing the Prospectus

A prospectus is a legal document by which a company offers to sell its securities to the public. Such documents include a notice, circular and advertisement. Apart from this, the CMSA lists out other documents under the purview of the CMSA that perform the function of a prospectus, including the abridged prospectus for renounceable rights issue (s.237), shelf prospectus, supplementary shelf prospectus, short form prospectus and profile statement (s.240), and preliminary prospectuses (s.241 (6)).

As prospectuses provide the primary source of information which potential investors rely on in assessing the merits of a company, great care must be taken to ensure that all relevant information is included and the contents do not contain any false or misleading statements or material omissions.

The provisions of Division 3 of Part VI of the CMSA govern the issue and registration of the prospectus. The basic provision under s.232 of the CMSA states that no issue, offer for subscription or purchase, invitation to subscribe for or purchase any securities, or in the case of an initial listing, application for the quotation of securities on a stock market of a stock exchange can be made unless a prospectus in relation to the securities mentioned above has been registered with the Sc. In addition to this, the prospectus must also comply with the requirement stated under Division 3 of Part VI of the CMSA. See also the Prospectus Guidelines issued by the Sc.

Content

The content of the prospectus must comply with the provisions set out in s.235 and s.236 of the CMSA as well as the Prospectus Guidelines. As a general disclosure test, issuers are required to include such information, as investors and their professional advisers will reasonably require and reasonably expect to find it in the prospectus for the purpose of making an informed investment decision.

Registration

The registration of the prospectus with the Sc must be submitted together with the relevant documents as set out in s.233 of the CMSA as well as the Prospectus Guidelines.

The SC may refuse to register a prospectus as provided under s.233 of the CMSA.

In accordance with s.234 of the CMSA, an issuer must lodge a copy of the prospectus to be registered with the SC and a copy of the form of application accompanying such prospectus with the Companies Commission of Malaysia (CCM). As for the prospectus in relation to unit trusts or prescribed investment schemes, a copy of the prospectus and the form of application must be lodged with the SC. Both of these actions must be done before the date of issue of the prospectus.

Liability

Failure to comply with the requirements of the CMSA may give rise to criminal liability, civil liability or both. A misstatement in the prospectus may lead to a criminal liability under s. 246 of the CMSA. Any person who contravenes s.246 shall be guilty of an offence and shall upon conviction be punished with a fine not exceeding RM3 million or imprisonment for a term not exceeding 10 years or both.

In addition to this, the CMSA may also impose civil liability on certain prohibited actions. This includes the situation where any person acts in a manner that is misleading or deceptive or likely to be misleading or deceive as provided under s.249 of the CMSA. S.357 of the CMSA provides that a civil proceeding may be initiated against any person who acts in breach of the CMSA.

In addition to criminal liability, the CMSA also provides for civil remedies in s.248. In addition to this, s.358 of the CMSA provides that the SC may institute civil actions on behalf of a person who suffers loss or damage, if it is in the public interest to do so.

Another civil remedy available under the CMSA is the power of the SC to issue a stop order in accordance with s.245.

Restriction on Advertising

The CMSA under S.241 prohibits the publishing of any notice that offers or issues invitations to subscribe for or purchase securities. Included within s.241 are notices that refer, directly or indirectly, to a prospectus, an offer or intended offer, invitation or intended invitation or another notice that refers to a prospectus.

Summary of Prospectus Guidelines

The SC is the sole regulatory authority for approving and registering prospectuses. The Prospectus Guidelines is issued by the SC under s.377 of the CMSA for the purpose of providing the additional disclosure requirements to be disclosed in a prospectus pursuant to s.235 (1)(f) of the CMSA, and information to be disclosed in an abridged prospectus pursuant to s.237 (2) of the CMSA.

The Prospectus Guidelines set out specific guidance for issuers and principal advisers on the SC’s expectations in complying with the requirements so that the key and comparative information provided in a prospectus must be presented in a manner that is clear and concise, in order to be easily understood by the investors to enable them to assess and make an informed investment decision.

Any action or conduct which deviates from the Guidelines must be referred to the SC and “relief” may be granted by the SC if the variation is not contrary to the intended purpose of the relevant requirements of these Guidelines or there are mitigating factors which justify the variation.

The Prospectus Guidelines are divided into the following parts:

• Part I — sets out the general requirements governing information to be disclosed in the prospectus.

• Part II — sets out the minimum contents of a prospectus.

• Part III — sets out the registration process of a prospectus.

• Part IV — sets out other matters related to a prospectus.

Under Part II of the Prospectus Guidelines, comprehensive guidance on specific requirements for the contents of prospectus for each of the financial instruments is given as below:

• Division 1 Equity

• Division 1A ASEAN Equity Disclosure Standards

• Division 2 Corporate Bonds and Sukuk

• Division 2A ASEAN Debt Securities Disclosure Standards

• Division 3 Structured Warrants

• Division 4 Business Trust

• Division 5 Abridged Prospectus

• Division 6 Supplementary or Replacement Prospectus

Below is an example outline of the contents of a typical equity prospectus.

Contents of an equity prospectus

Cover page and Inside cover/first page

The cover page for an equity prospectus must include the information, such as name of the corporation, place of incorporation, registration number, date of the prospectus and essential statements as stated in the guidelines. This is followed by the first page of the prospectus, which states the responsibility statements, statements of disclaimers and other statements as listed in the guidelines, indicative timetable of the critical dates including the opening and closing dates of the offering, date of the balloting of share applications, date for allotment of shares and listing date. It should also provide the corporate directory, including the details of directors and all parties involved in preparing the corporate proposal.

In the case where the corporation has appointed a person to provide financial advice in relation to the corporate proposal, the salient terms of engagement and scope of work of such person must be disclosed in the prospectus.

Prospectus Summary

After the introductory information, a Prospectus Summary of not exceeding 10 pages will provide a concise overview of the corporation and highlights of significant matters disclosed in the prospectus, among others, the principal details of the offering, the business model, competitive position of the corporation, business strategies and risk factors involved in the business, the directors and key senior management in the corporation, promoters and substantial shareholders, use of proceeds, financial and operational information and dividend policy. Guidance provided in the Guidelines encourages the use of diagrams and illustrations for better presentation, and appropriate cross-references to the details provided in specific sections of the prospectus should be made.

The Guidelines require that detailed disclosures in the following areas are to be made in the prospectus, namely:

o Details of the shares being issued or offered.

o Detailed information on the corporation’s promoters, direct and indirect substantial shareholders, directors, key senior management and key technical personnel risk factors that would have material adverse effect on the corporation’s business operations, financial position and results, and shareholders’ investments in the corporation.

o Related party transactions during the historical financial period disclosed in the prospectus.

o Any conflict of interest of a director or substantial shareholders who has a direct or indirect interest in other entities involved in similar trade as the corporation or is a customer or supplier of the corporation.

o Financial information prepared in accordance with the approved accounting standard.

o Reports by the reporting accountants in respect of the audited financial reports for the period under review.

o Any expert’s reports will have to be signed and dated, with disclosure on the expert’s professional experience.

o Additional information on the provisions of the corporation’s constituent document.

o Documents available for inspection for a period of at least six months from the date of issue of the prospectus at the registered office of the corporation.

o The procedures for application of shares.

o Specific requirements for an infrastructure project corporation / a special purpose acquisition company / a corporation with MOG exploration or extraction assets.

The last two divisions of Part II, namely Division 5 and 6 detail out the requirements for Abridged Prospectus and Supplementary or Replacement Prospectus. An Abridged Prospectus is issued When there is a rights issue offer for subscription or purchase whereas under s.238 (1) of the CMSA, a supplementary or replacement prospectus is required when the issuer becomes aware that:

o A matter has arisen and information on that matter is required to be disclosed in the prospectus if the matter had arisen when the prospectus was prepared.

O There has been a significant change affecting a matter disclosed in the prospectus.

O The prospectus contains a material statement or information that is false or misleading, or

O The prospectus contains a statement or information from which there is a material omission.

Part Ill of the Guidelines sets out the registration process of a prospectus for all divisions of Part II.

An application to register a prospectus must be in accordance with the submission requirements and procedures set out in Part Ill.

Example: Submission of prospectus under Division 1 & 1A (equity) for registration

• Stage 1 – The principal adviser must submit at least three copies of the prospectus in English, together with all required documents as stated in Part B under para. 1.08, for registration to the SC before 12:30 p.m.

• Stage 2 – Upon receiving the relevant authority’s approval for the corporate proposal, where applicable, the principal adviser must provide all documents required in Part C under para. 1.12, to the SC before 12:30 p.m. at least seven market days prior to the intended date of registration.

For registration of a supplementary prospectus, the supplementary prospectus must be submitted to the SC before 12:30 p.m. at least three market days prior to the intended date of registration (Part D, para. 1.13).

For registration of a replacement prospectus, the replacement prospectus must be submitted to the SC before 12:30 p.m. at least seven market days prior to the intended date of registration (Part D, para. 1.14)

Upon issuance of the prospectus, confirmation must be made to ensure that the printed prospectus is the same as the prospectus registered by the SC and the electronic prospectus complies with the requirements under Division 2 of Part IV of these Guidelines.

Part IV sets out other matters related to a prospectus.

• Division 1 — Plain Language Guide for Prospectus

The purpose of this division is to provide guidance on how to create a clear and concise prospectus using plain English so that investors are able to grasp the vital information and make informed investment decisions. A legalistic approach, long sentences and technical jargons are not encouraged.

• Division 2 — Electronic Prospectuses and Electronic Application Forms

The purpose of this division is to provide guidance for issuance, circulation or distribution of electronic prospectuses and electronic applications by the issuer and internet securities applications.

Completion of the Issue and Listing

A company intending to issue, circulate or distribute a prospectus pursuant to an issue/offer of securities must file a final copy of the prospectus with Bursa Malaysia Securities Berhad and must register the prospectus with the Companies Commission of Malaysia (CCM). A final draft of this prospectus must be submitted to the SC before its registration with the CCM.

After registration of the prospectus, it is issued together with the application form to subscribe for the securities being offered or issued. Applications have to be made together with payment for securities before the closing date for applications. Following the application closing date, shares will then be allotted. Allotment means the allocation of new securities to an applicant for a new issue.

If the issue is oversubscribed, a ballot is held to determine the successful applicants. If the issue is undersubscribed, the offering of securities must be terminated and all considerations received must be immediately returned to all subscribers. In the event that an underwriting arrangement is in place, appointed underwriters and sub-underwriter will be called upon to subscribe for the shortfall pro rata to their commitments.

The company then advises Bursa Malaysia Securities Berhad of the result of the issue (i.e. number of securities allotted which must be at least the amount to meet the minimum shareholding by public and small shareholders). Bursa Malaysia Securities Berhad grants quotation of the securities two market days after receipt of confirmation from Bursa Malaysia Depository Sdn Bhd that the securities accounts of the successful applicants have been duly credited.

The steps required for the ACE Market are similar to those of the Main Market. See Bursa Malaysia Securities Berhad ACE Market Listing Requirements.

Corporate Disclosure Policy

Companies listed on Main, ACE and LEAP Markets must comply with the Corporate Disclosure Policy adopted by the SC and Bursa Malaysia Securities Berhad. The guiding principle behind the Corporate Disclosure Policy is that the conduct of a fair and orderly market requires every listed company to make available to the public, information necessary for informed investing.

To achieve this, every listed company must take reasonable steps to ensure that all its investors enjoy equal access to such information.

Bursa Malaysia Securities Berhad has adopted the following specific policies concerning disclosure:

• Policy in immediate public disclosure of material information — A listed company is required to make immediate public disclosure of all material information about its affairs, except in exceptional circumstances (Chapter 9, Part J of the Listing Requirements of Bursa Malaysia Securities Berhad)

• Policy on thorough public dissemination — A listed company is required to release material information in a manner designed to achieve its widest possible public dissemination (Chapter 9, Part D of the Listing Requirements of Bursa Malaysia Securities Berhad)

• Policy on clarification, confirmation or denial of rumours and reports — Whenever a listed company becomes aware of a rumour or report, true or false, that contains information that is likely to have, or has had, an effect on the trading and price movement of the company’s securities, the company is required to clarify the rumours or reports publicly as promptly as possible (Chapter 9, Part E of the Listing Requirements of Bursa Malaysia Securities Berhad).

• Policy on response to unusual market action — Whenever unusual market action takes place in a listed company’s securities (in price movement, trading activity or both), the ompany is expected to make an inquiry to determine whether rumours or other conditions requiring corrective action exists and if so, to take whatever action is appropriate (Chapter 9, Part F of the Listing Requirements of Bursa Malaysia Securities Berhad).

• Policy on unwarranted promotional disclosure activity — A listed company must refrain from promotional disclosure activity which exceeds that which is necessary to enable the public to make informed investment decisions (Chapter 9, Part G of the Listing Requirements of Bursa Malaysia Securities Berhad)

• Policy on insider trading — Insiders should not trade on the basis of the material information, which is not known to the investing public (Chapter 9, Part H of the Listing Requirements of Bursa Malaysia Securities Berhad).

Detailed guidance on Bursa Malaysia Securities Berhad’s Corporate Disclosure Policy is set out in Chapter 9, Part B of the Listing Requirements of Bursa Malaysia Securities Berhad.

Continuing Disclosure Obligations

The continuing disclosure obligations are contained in Chapter 9 of the Listing Requirements of Bursa Malaysia Securities Berhad, which provides for the following:

• Examples of events which may require immediate disclosure by the listed issuer:

o The entry into a joint venture agreement or merger

o The acquisition or loss of a contract, franchise or distributorship rights

o The introduction of a new product or discovery

o A change in management

o The borrowing of funds

o The purchase or sale of an asset

o A change in capital investment plans

o Others (please see Chapter 9, Part C, para. 9.04 of the Listing Requirements of Bursa Malaysia Securities Berhad)

• Immediate announcements to the Bursa Malaysia Securities Berhad:

The following are the events that a listed issuer must immediately announce to the Exchange.

o Fixing of book’s closing date and its reason

o Declaration of dividend — the amount per share, the mode and others

o Any recommendation or decision that a divided will not be declared

o Any change in terms of a debt security or a convertible security

o Any re-organisation of the group structure of the listed issuer

o Any general meeting

o Any proposed change of name of the listed issuer

o A listed issuer must issue its annual report that includes annual audited financial statements together with the auditors’ and directors’ reports of the listed issuer to Bursa Malaysia Securities Berhad and shareholders within four months from the close of the financial year of the listed issuer.

o Any change in the financial year end of the listed issuer

o Others (please see Chapter 9, Part .1, para. 9.19 of the Listing Requirements of Bursa Malaysia Securities Berhad).

Securities Issues in the Secondary Market

Capital Raising Securities

Once a company has floated its securities and obtained a listing of its securities on Bursa Malaysia Securities Berhad, a broad range of alternative capital raising opportunities becomes available, whereby shareholders and the market place generally can be approached to support further issues of equity, hybrid equity or debt securities (Note: hybrid equity securities have characteristics of both debt and equity; examples are preference shares and convertibles notes).

A company listed on Bursa Malaysia Securities Berhad may choose to offer further ordinary shares or it may decide to offer other types of securities including:

• Debt securities (including redeemable preference shares); and

• Warrants or other convertibles securities.

Modes of Issuing Securities

There is a variety of techniques that companies which are already listed can employ to issue further securities. Some of these issues raise equity capital to fund expansion or diversification of its business activities, whereas other securities issues (e.g. bonus issues) do not raise equity capital. Some of these modes of issuing securities are briefly discussed below.

• Public issues

• Rights issue

• Private placement

• Issues of shares for acquisition, take-overs, mergers

• Issue of convertible securities

• Issues of shares from conversion of warrants and convertibles

• Issue of shares from Employee Shares Option Schemes

• Bonus Issues

Public Issues – A public issue represents an issue of new shares for sale to the public at a price agreed upon by the issuer and its Principal Adviser (usually acting as the adviser and managing underwriter).

Rights Issue – A rights issue is the issue of new shares to existing shareholders for cash generally at an attractive price (usually at a discount to the current pre-announcement market price of a company’s quoted shares. As it might adversely affect existing shareholders’ relative equity participation levels, a rights issue is made to existing holders in proportion to their holdings).

A rights issue made by a public-listed company must be renounceable. This means that shareholders may either take up the new shares offered or if they do not wish to apply for the new shares, they may sell their rights in part or in whole to a third party on Bursa Malaysia Securities Berhad. All rights issues for which there are no irrevocable written undertakings from the shareholders to take up their full entitlement must be underwritten.

The company is expected to have a specified use for the proceeds of the rights issue. It is generally expected that the proceeds will be utilised for investments in viable projects, expansion of productive capacity or loan repayments.

Usually when a rights issue is announced, the term of the issue will also be specified. If it is a 1:2 rights issue, then the existing shareholders will be eligible to buy one share for every two shares they already own. If he/she owns 2,000 shares, then he/she is eligible to buy 1,000 new shares. If he/she buys those 1, 000 shares, then he/she is said to have exercised the right.

Private Placement – This represents an issue of securities that are not offered to the general public but are placed in the hands of party/parties that are independent and not under the control or influence of any of the issuer’s directors or substantial shareholders. The securities issued should be priced based on weighted average market price of the shares for the past five days before placement.

Issue of Shares for Acquisitions, Take-overs, Mergers – When a company A acquires assets of, takes over, or merges with another company B, company A will often issue new shares in the exchange for the assets or the share capital of company B. Issuing shares in exchange for assets or the capital of another company is often a cheaper and quicker way of expanding operations than issuing new capital for cash and then setting up the infrastructure to extend operations. A problem arising from this, however, is that the holdings of existing shareholders may be diluted. As such, a public-listed company is expected to negotiate for the highest possible value for its shares issued as consideration, after taking into account the current market price of its shares.

Issue of Convertible Securities – An issue of warrants or convertible securities may be made either by way of rights or otherwise. For an issue of structured warrants where settlement is by way of physical delivery and the underlying financial instruments is shares or an exchange traded fund listed on Bursa Malaysia Securities Berhad, the aggregated outstanding collateralised and non- collateralised structured warrants issued at any one time must not exceed 20% of the share capital of the underlying corporation or the exchange traded fund size (Chapters 5 and 6 of the Listing Requirements of Bursa Malaysia Securities Berhad contain requirements as to the procedures for listing and other relevant requirements).

Issue of Shares from Conversion of Warrants and Convertibles – This is an additional issue of shares to holders of other classes of securities (such as warrants and convertible securities) upon exercise or conversion of securities held. When they are issued, warrants are usually bundled together with debt securities (particularly bonds). A warrant holder is entitled to buy a proportionate amount of shares of the issuing company within a specified period at a predetermined price. Convertible securities, on the other hand, are a form of deferred equity. The issuing company is able to raise funds at the point of its issue whereas the holder of the convertible loans is entitled to convert them into shares of the company within a specified period at a predetermined price.

Warrants and convertible securities are generally issued by public-listed companies embarking on projects with a long gestation period. The issue is made so that the point when the warrants or convertible securities expire, and results in the issue of further company shares, is likely to coincide with the time when the potential earnings of the projects are starting to be attained. The additional shares issued will, therefore, be supported by the higher earnings attained by the company.

Issue of Shares from Employee Shares Option Scheme – Some companies have share option schemes for their employees to, among other reasons, encourage loyalty to the company. This provides the employee with the option to subscribe for a certain number of shares in the company within a specified period (subject to a maximum of 10 years) at a predetermined exercise price (Chapter 6 of the Listing Requirements of Bursa Malaysia Securities Berhad).

Bonus Issues – A bonus issue is also referred to as a “scrip issue” or “capitalisation issue”. It merely represents an adjustment to the accounts of a company. No additional funds are raised.

In the course of its normal activities, a company’s reserves may increase as a result of retaining part of its earnings or the company may revalue its fixed assets resulting in a surplus, which will increase its reserves. Thus, the value of the company’s assets may substantially exceed the value of its issued capital, with the balance forming part of the various reserves. The company may then decide to convert part of these reserves into issued capital. The new shares will be issued and distributed without payment to existing shareholders in proportion to their existing holdings.

So, for example, if accompany announces a 2:1 bonus issue, for every one share existing shareholders own they will receive two new bonus shares.

A benefit may flow to the existing shareholder who receives a bonus issue. If the amount of cash dividend per share remains the same, or increases, the shareholder receiving the bonus issue will also receive an increase in the amount of future cash dividends.

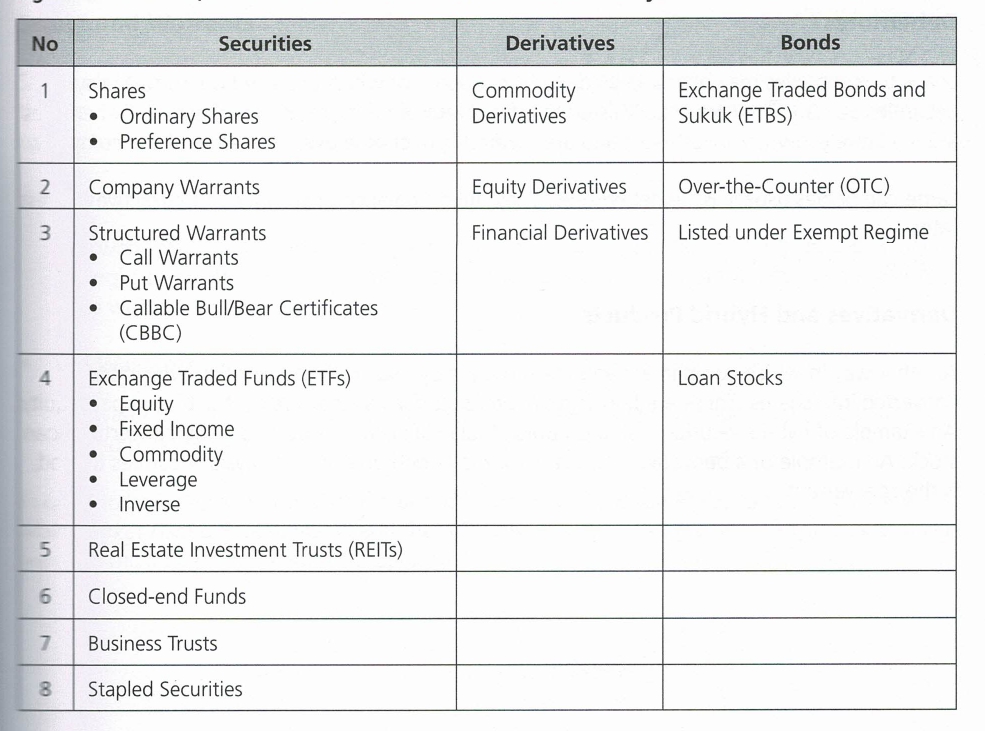

Debt Securities and Derivative Products – As mentioned earlier, a wide variety of equity securities are traded on Bursa Malaysia Securities Berhad. These include securities issued by companies to raise equity capital, derivative products and trusts. Equity securities were discussed in the previous topic.

In addition to equity securities, debt or loan securities and derivative products are also traded on the stock market.

Figure 1: Securities, Derivatives and Bonds Traded on Bursa Malaysia Securities Berhad

Also called loan securities, debt securities listed on Bursa Malaysia Securities Berhad have a fixed interest rate and a specific maturity date. Hence, everything is fixed except the market value, which fluctuates in accordance with the general level of interest rates in the economy.

In Malaysia, policy makers recognise the need for a more balanced mix of debt and equity as a means to mobilise domestic savings to fund large investments, particularly in the infrastructure sector.

There are two main types of debt securities traded on the market: bonds (through which governments and companies raise money) and debentures (through which companies raise money).

Bonds

With bonds, the borrower usually guarantees the amount borrowed will be repaid on a specific date and a fixed rate of interest will be paid at regular intervals for the period of the loan. Bonds (and loans stocks) are sometimes referred to as fixed interest or fixed income securities. Bonds are a form of long-term debt issued by the government and companies.

Debentures

Loans to companies may be made by debentures, some of which are listed on Bursa Malaysia Securities Berhad. They are usually listed at a fixed rate of interest for a fixed period. Debentures are a relatively low-risk investment and are secured by a charge over the assets of the company.

Large companies usually issue debentures. They offer a balance of security and attractive interest rates.

Derivatives and Hybrid Products

Another way in which companies can raise money is by issuing debt securities, which can be converted into shares. These are known as hybrid securities as they are part debt and part equity.

An example of hybrid securities listed on Bursa Malaysia Securities Berhad is the convertible loan stock. An example of a derivative product, which is traded on Bursa Malaysia Securities Berhad, is the call warrant.

Convertible Loan Stocks

Loan stocks are securities issued by a company for a loan made by investors. In the event of the company’s liquidation, unsecured loan stocks rank with other unsecured creditors. Convertible loan stocks can be converted into ordinary shares on prearranged terms within a limited period. A convertible loan stock enables the company to obtain fixed interest financing at a relatively low interest rate while making it attractive to buyers by the offer of equity participation at a later date. Some loan stocks have subscription rights (also known as warrants) which give the holders the right to subscribe for ordinary shares, at a given price at a specified date in the future. This right to convert is something known as a “call option”. In order to exercise this right, the owner of the convertible loan stock must surrender or give up the loan stock.

Company Warrants

Company warrants are issued by the company and give the holders the right, but not the obligation, to subscribe for new ordinary shares at a specified price during a specified period. The company usually attaches them to an issue of loan stocks. Warrants have a maturity date (up to a maximum of 10 years) after which they expire worthless, unless the holder exercises the right to subscribe for the new shares before the maturity date.

Structured Warrants

Structured warrants are issued by third parties, based on existing shares, so they do not, therefore, increase the issued capital or dilute the earnings of the company. There are two types structured warrants which are explained as below:

Call Warrants – Call warrants (as opposed to a put warrant) is like a call option because it gives the owner the right to buy the underlying share of the company that issued the warrant at a specified price within a limited period of time.

Put Warrants – Put warrants gives holder the right to sell the underlying share at a specified price within a limited period of time.

In order to be listed on Bursa Malaysia Securities Berhad, the Bursa Malaysia Securities Berhad Main Market Listing Requirements and the ACE Market Listing Requirements for the issue of call warrants must be complied with (Chapter 6).|

Structured Products

In Malaysia, the SC’s Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework (the LOLA Guidelines) sets out the definition of structured products as any investment product that falls within the definition of “securities” under the Capital Markets and Services Act 2007 (CMSA).

The products are generally issued by financial institutions and are securities which fall under the category of debentures. Structured products derive its value by reference to the price or value of an underlying reference. The underlying reference as set out in the LOLA Guidelines includes amongst others, equities, indices, commodities, currencies and credit. There are also hybrid investments that combine into a single “structure” a traditional security with one or more asset classes as its underlying references.

Structured products investments are bilateral whereby the counterparties comprise the issuer and the investor. Investments in structured products usually involve the upfront investment of a principal sum, payment of interest at pre-determined intervals at pre-determined rates during the life of the structured products and at maturity and the repayment of the principal sum at maturity. These payments would depend on the performance of the underlying references and the agreed terms for the investment. It can be created with fixed term maturity with the principal being fully or partially protected. The investors could also stand to lose their entire investment, including the principal, depending on the terms of the structured products and the performance of the underlying references.

Summary of Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework

These Guidelines issued by the SC pursuant to s.377 of the CMSA, set out the requirements that must be observed for the purposes of exclusively making available unlisted capital market products to sophisticated investors in Malaysia or abroad. For the purpose of these Guidelines, unlisted capital market products shall not include shares and real estate investment trusts.

The SC may, upon application, grant an exemption from or a variation to the requirements of these Guidelines if the SC is satisfied that such variation is not contrary to the intended purpose of the relevant provision in these Guidelines; or there are mitigating factors which justify the said exemption or variation.

The Lodge and Launch framework seeks to promote process efficiency, shorten time to market and provide certainty to product offering. Under the Lodge and Launch framework, unlisted capital market products will not require the SC’s approval, authorisation or recognition under s.212 of the CMSA.

“Lodge” refers to the submission of information and documents as may be specified by the Sc. Such information and documents must be true, complete and accurate.

“Launch” refers to making available; offering for subscription or purchase of; or issuing of an invitation to subscribe for or purchase, an unlisted capital market product and includes any issuance, publication or release of any information, notice or advertisement in respect of any of the act specified above.

Responsible Party

Responsible Party means any person who is accountable or responsible, whether solely or jointly with other persons in the lifecycle of an unlisted capital market product. A Responsible Party must carry out its roles and responsibilities with integrity, due care, knowledge, skill and diligence. It must declare any conflict of interest and have in place policies and processes to closely monitor and manage them in the best interest of the investors.

Lodgement Party means the Responsible Party who is required to lodge the relevant information and documents with the SC. The Lodgement Party must identify all other Responsible Parties accountable or responsible in the lifecycle of an unlisted capital market product. In the event a Responsible Party ceases to be accountable or responsible for a product, the Lodgement Party must identify a new Responsible Party to undertake such role and responsibility. A Responsible Party who is aware of any change in information or document lodged with the SC or provided to investors must immediately notify the Lodgement Party to enable it to make the necessary revision.

Structured Products

These Guidelines sets out the specific requirements that must be complied with in relation to unlisted structured products under the Lodge and Launch framework.

Unlisted structured products include floating rate negotiable instruments of deposit (NIDs) and Islamic negotiable instruments of deposit (INIDs) with tenure of more than five years. Other examples of structured products falling under these Guidelines are equity linked notes, bond linked notes, index linked notes, currency linked notes, interest rate linked notes, commodity (contracts) linked notes and credit linked notes.

The Eligible Issuers for structured products include a qualified bank; a qualified dealer; a locally incorporated special purpose vehicle (SPV) sponsored by a qualified bank or qualified dealer; and Cagamas Bhd. (Cagamas) and locally incorporated SPV sponsored by Cagamas, provided that the underlying reference of the structured product is restricted to assets originated in the domestic banking sector. The sponsors for the SPV must provide an undertaking to investors on the performance of the administrative and operational obligations of the SPV.

A qualified bank and qualified dealer may issue a structured product of its foreign-related corporation, provided that such foreign-related corporation is duly licensed in its home jurisdiction as the equivalent of a qualified bank or qualified dealer; or an SPV which is sponsored by the foreign parent company or foreign-related corporation of that qualified bank or qualified dealer.

In order to quality as an Eligible Issuer, an SPV must be a resident in Malaysia, with independent and professional directors or trustees; and sufficiently ‘bankruptcy remote’. It must maintain proper accounts and records to enable a complete and accurate view of its financial status and compliance with all regulatory reporting requirements in respect of the issuance of structured products. It must only issue structured products that are fully collateralised against assets or securities or guaranteed by a qualified bank.

For Islamic structured products, the Eligible Issuer must appoint a Shariah adviser and comply with the relevant Shariah principles and concepts.

(For further information, please refer to Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework, Part 2 on Structured Products)

Bursa Malaysia Securities Berhad Main Market Listing Requirements

The purpose of the Bursa Malaysia Securities Berhad Main Market Listing Requirements is to set out the requirements that must be complied with by all parties, including all applicants, listed issuers, management companies, trustees, trustee-managers, their directors, officers, advisers or other persons to whom these Requirements are directed. Failure to comply with any of these Requirements will amount to a breach in respect of which actions may be taken or penalties may be imposed or both.

As long as the listed issuer or its securities remain listed on the Official List, it must comply with the Requirements and give effect to any decision made, conditions imposed, and instruction or directive issued, by the Exchange, within the time stipulated by the Exchange even during periods when the listed issuer’s securities are suspended from trading.

In order to apply for listing, the listing application must be submitted through a Principal Advisor and all relevant admission procedures and requirements as prescribed by the Exchange must be complied with.

For further information on the Bursa Malaysia Securities Berhad Main Market Listing Requirements, please refer to the Bursa Malaysia website at http://wwwbursamalaysia.com/markettregulation/rules/listing-requirements/main-market/listing-requirements/

Bursa Malaysia Securities Berhad LEAP Market Listing Requirements

The objective of the Bursa Malaysia Securities Berhad LEAP Market Listing Requirements is to set out the general requirements of the Exchange which apply to all applicants, listed corporations, their directors, advisers or any other person to whom these Requirements are directed. Failure to comply with any of the requirements will amount to a breach in respect of which actions may be taken or penalties may be imposed, or both.

The LEAP Market is a market designed to accommodate corporations to which a higher investment risk may be attached. It is a qualified market which is meant mainly for sophisticated investors only. Investors must be fully aware of the greater risk profile and other characteristics of the LEAP Market and invest with due and careful consideration.

An applicant which is seeking admission to the LEAP Market must submit its listing application through an Approved Adviser, who must assess the suitability of the said applicant. The submission of an initial listing application to the Exchange must comply with the SC’s Guidelines on Due Diligence Conduct for Corporate Proposals. Where a listed corporation undertakes a corporate proposal which will result in a significant change in the business direction or policy of a listed corporation, the Exchange will treat such listed corporation as if it were a new applicant seeking admission to the LEAP Market.

An applicant must have a clearly identifiable core business. It is not suitable for listing if it is a subsidiary or holding company of a corporation currently listed on the Main Market or ACE Market of the Exchange and its listing will result in the existing listed corporation within the group ceasing to have a separate autonomous business of its own and not be capable of sustaining its listing in the future; or it is an investment holding corporation with no business operations within its group; or it is an incubator, including a technology incubator which may apply for admission to the Main Market only.

Summary

We began this topic by considering capital raising on the primary market. We looked at if advantage and disadvantages of listing, the Equity Guidelines and Listing Requirements of Bursa Malaysia Securities Berhad for Main Market, ACE Market and LEAP Market, and the listing process, as well as the role of advisers, the prospectus (both its content and liability for that content) and the completion of the issue and listing.

We then considered the company’s post-listing requirements, which included the corporate disclosure policy and continuing obligations. A company with a good history of profit, share price performance and a committed body of shareholders is likely to find its shares in demand on the market. It may then be able to approach its shareholders and the market place to raise additional capital on the market. We also discussed the variety of avenues through which companies can raise additional equity capital and we considered debt funding and some hubrid (with characteristics of both debt and equity) products. Finally, we took a brief look at the unlisted structured product offerings and the Lodge and Launch framework, which enables process of bringing these products to the market in an efficient and timely manner.

Self-Assessment

1. A ________ is a legal document by which a company offers to sell its securities to the public and the document includes a notice, circular and advertisement.

A. Prospectus

B. Share Certificate

C. Product Highlight Sheets

D. Memorandum and Articles of Association

2. Identify whether the statements in relation to the requirement of the SC’s approval for companies seeking to be listed on the ACE and Main Markets are TRUE or FALSE.

a. For ACE Market listing applications, the SC’s approval is not required. TRUE / FALSE

b. All companies seeking listing on the Main Market of Bursa Malaysia Securities Berhad will require the SC’s approval. TRUE / FALSE

3. The information that is required to be included in a prospectus by the CMSA includes the following:

1. Assets and liabilities of the issuer

2. The merits of investing in the securities

3. The risk involved in investing in the securities

4. Financial position, profit and losses and prospects of the issuer

5. The persons likely to consider acquiring such securities

6. The nature of the securities, the business of the issuer of the securities and the unit trust scheme or prescribed investment scheme

Answer: All of the above