Rules of Bursa Malaysia Securities Clearing

Clearing Participants must clear and settle all On-Market Transactions and Direct. Business Contracts through the Clearing House in…

The selling Clearing Participant must ensure that the Securities sold pursuant to a Novated Contract are available as Tradeable Balance in the relevant securities account of the selling Clearing Participant or its client by the time specified in the Exchange Rules. In order to fulfil its obligation to deliver the Securities to the Clearing House, the selling Clearing Participant irrevocably authorises the Clearing House to instruct the Central Depository to debit the Securities from the relevant securities account of the selling Clearing Participant or its client…Read more

Market Standards for Corporate Actions Processing

Corporate actions processing is deemed one of the most complex areas of post trading. Standardising these processes across all

European markets, and possibly beyond, aims at achieving a significant reduction of respective costs and operational risks. To

dismantle Giovannini Barrier 3, investments may be required in order to become compliant with the standards on corporate actions

processing. However, upon implementation of the standards, the European securities market and its users will benefit from cost

savings resulting from harmonising the processes cross border…Read more

Contents

Learning Objective

Introduction

Clearing

Delivery and Settlement

Other Matters

Summary

Self-Assessment

Learning Objective

At the end of this topic, you should be able to:

• Describe the role and functions of Bursa Malaysia Securities Clearing Sdn Bhd

• Explain the procedure and requirement for participantship of Bursa Malaysia Securities Clearing Sdn Bhd

• Explain the Fixed Delivery and Settlement System (FDSS) for contracts done on a ready basis

• Explain the FDSS for immediate basis contract

• Explain the Institutional Settlement Services (ISS)

• Describe the Central Depository System (CDS)

• Explain how the CDS applies to the payment of dividends, bonus issues and rights issue

• Explain buying in and when it is used

• Explain selling out and when it is used

• Explain netting.

Introduction

In the previous topic, we discussed the steps for trading on Bursa Malaysia Securities Berhad. In this topic, we look in detail at the fulfilment of these transactions, known as clearing, delivery and settlement.

Bursa Malaysia Securities Clearing Sdn Bhd provides clearing services for participants of Bursa Malaysia Securities Berhad. In providing these facilities, Bursa Malaysia Securities Clearing Sdn Bhd facilitates delivery and settlement among participants.

Previously, delivery referred to delivery of share scrip by a selling client and Participating Organisation and its receipt by a buying Participating Organisation and client. Under the Central Depository System (CDS), there is paperless delivery (in which there is no need for the delivery and receipt or even holding and moving of physical scrips). Delivery for shares within the CDS is carried out by computerised book entry.

Settlement refers to the completion of a transaction, so that in addition to delivery there will be payment by buying clients and stockbroking companies, and receipt by selling stockbroking companies and clients.

The time frames within which delivery and settlement must be undertaken are prescribed by Bursa Malaysia Securities Berhad’s Fixed Delivery and Settlement System (FDSS), which are contained in Chapter 9 of the Rules of Bursa Malaysia Securities Berhad. These time frames apply to all securities and delivery is by book entry. We will examine the Institutional Settlement Services (ISS) in which institutional investors can settle trades directly with Bursa Malaysia Securities Clearing Sdn Bhd.

We will also look at how the CDS works in relation to dividends, bonus issues and rights issues.

We will conclude this topic by looking at the action that can be taken when delivery or payment is not made within the FDSS time frames.

CLEARING

Clearing refers to the process of determining obligations and accounting for the exchange of money and securities, between market counterparties to a trade.

Settlement refers to the completion of a transaction, wherein securities and corresponding funds are “delivered” and credited to the appropriate accounts.

Bursa Malaysia Securities Clearing Sdn Bhd

Bursa Malaysia Securities Clearing Sdn Bhd is the organisation which provides clearing services for Participating Organisations of Bursa Malaysia Securities Berhad. All Participating Organisations of Bursa Malaysia Securities Clearing Sdn Bhd are clearing participants of Bursa Malaysia Securities Clearing Sdn Bhd.

Bursa Malaysia Securities Clearing Sdn Bhd provides clearing and settlement services for domestic contracts on all securities listed on the Official List of Bursa Malaysia Securities Berhad.

These are the major objectives of Bursa Malaysia Securities Clearing Sdn Bhd:

(a) To provide facilities for clearing contracts between clearing participants and for “delivering” or “receiving” stocks and securities or paying or receiving payment for participants in connection with securities transactions

(b) To provide clearing facilities between clearing participants and their clients.

The Rules of Bursa Malaysia Securities Clearing Sdn Bhd include rules in relation to:

Chapter 1 General Rules

Chapter 2 Clearing Participantship

(c) Trading Clearing Participant

(d) Non-trading Clearing Participant

(e) Inspection and Investigation

Chapter 3 Disciplinary Action

(f) Disciplinary Proceedings

(g) Expedited Proceedings Appeal

(h) Effect of Disciplinary Action

(i) Transitional Provisions

Chapter 4 Default Rules

(j) Novated Contracts

(k) Default Rules

Chapter 5 Clearing and Settlement

(l) Institutional Settlement Services

Chapter 6 Clearing Guaranteed Fund

Chapter 7 Bursa Malaysia Securities Borrowing & Lending (SBL) Transactions

Chapter 8 SBL Negotiated Transactions

Chapter 9 Islamic Securities Selling and Buying — Negotiated Transactions (ISSBNT)

In 1998, Bursa Malaysia Securities Berhad instituted new measures to further enhance transparency in the stock market. The relevant rules of Bursa Malaysia Securities Clearing Sdn Bhd and Bursa Malaysia Depository Sdn Bhd were amended to this effect.

The Exchange’s Rules are continually updated to enhance transparency in the stock market.

In order to use Bursa Malaysia Securities Clearing Sdn Bhd’s facilities, a company must first become a clearing participant by making an application and complying with the requirements of Chapter 2 of the Rules of Bursa Malaysia Securities Clearing Sdn Bhd.

Bursa Malaysia Securities Clearing Sdn Bhd provides clearing services for listed securities of Bursa Malaysia Securities Berhad, but a clearing participant may request Bursa Malaysia Securities Clearing Sdn Bhd to provide these services for direct business. In order for Bursa Malaysia Securities Clearing Sdn Bhd to perform its functions, delivery and settlement for the securities transactions must be effected within the specified timeframes (as shall be discussed in the following subtopics).

A default in delivery arises where a clearing participant is unable to fulfil its post-trade obligations to Bursa Malaysia Securities Clearing Sdn Bhd by the due date. See Rule 5.2(A)-(C) of the Rules of Bursa Malaysia Securities Clearing Sdn Bhd as to the action that can be taken by Bursa Malaysia Securities Clearing Sdn Bhd in order to effect delivery.

Each clearing participant must have an account for the purpose of financial settlement services. Monetary obligations of clearing participants are pooled and offset with each other, so that there is only one final net position for each clearing participant. A default in financial settlement arises if there are insufficient funds in this account. Read the default rules in Chapter 4 of the Rules of Bursa Malaysia Securities Clearing Sdn Bhd as to the actions that can be taken by Bursa Malaysia Securities Clearing Sdn Bhd if this situation arises.

Securities traded are prescribed by the stock exchange and are “delivered” and settled in accordance with the Rules of Bursa Malaysia Depository Sdn Bhd. A clearing fee is payable to Bursa Malaysia Securities Clearing Sdn Bhd by the clearing participants pursuant to Rule 1.4(b) of the Rules of Bursa Malaysia Securities Clearing Sdn Bhd.

As you read section 6.04 of this topic, please take note the role of Bursa Malaysia Securities Clearing Sdn Bhd.

Bursa Malaysia Securities Clearing Sdn Bhd (BMSC)

Bursa Malaysia Securities Clearing Sdn Bhd (BMSC) is an approved Clearing Houses under Capital Market Services Act (CMSA) and provide clearing & settlement services for the securities market. BMSC clears and settles equities transactions executed on Bursa Malaysia Securities Bhd.…Read more

DELIVERY AND SETTLEMENT

Delivery and settlement refers to what occurs after a trade has been executed on the market and the client has been issued a contract note. It refers to the fulfilment of the transactions entered into. As all securities are in the CDS system, there will be no actual physical delivery or receipt of scripts, but a debit or credit to his/her CDS account which will take place on the day specified in the FDSS.

We will now discuss the relevant steps and time frames.

Fixed Delivery and Settlement System

The Fixed Delivery and Settlement System (FDSS) was established by Bursa Malaysia Securities Berhad to facilitate clearing and settlement. Chapter 9 of the Rules of Bursa Malaysia Securities Berhad sets out the provisions in relation to delivery and settlement. The FDSS is summarised in Schedules 2 and 3 of the Rules of Bursa Malaysia Securities Berhad. In describing the FDSS, the starting point is the date of the contract known as “T”.

Each step that needs to be undertaken is then described in terms of having to be completed by a specified number of market days from this date. A market day is a day on which Bursa Malaysia Securities Berhad is open for trading. In general, there are five market days per week; however; this will not always be the case as Bursa Malaysia Securities Berhad will not be open on certain holidays.

Schedule 2 of the Rules of Bursa Malaysia Securities Berhad sets out the scheduled delivery and settlement times for on-market for contracts done on a ready basis, and Schedule 3 sets out the scheduled delivery and settlement times for direct business transactions.

Institutional Settlement Services

Bursa Malaysia Securities Berhad through Bursa Malaysia Securities Clearing Sdn Bhd launched the Institutional Settlement Services (ISS) on 15 July 1999 to facilitate the settlement of trades of institutional investors directly. Eligible institutions (see Chapter 2 Section B of the Rules of Bursa Malaysia Securities Clearing Sdn Bhd), such as locally incorporated custodian banks and financial institutions, can become non-trading clearing participants (NTCP) of Bursa Malaysia Securities Clearing Sdn Bhd, which will enable them to directly clear and settle securities transactions on the same day. The ISS runs parallel with the present T+2 rolling settlement system.

The ISS has the following salient features:

• The settlement of funds will be directly between Bursa Malaysia Securities Clearing Sdn Bhd and the ISS participants. This entails Bursa Malaysia Securities Clearing Sdn Bhd directly debiting/crediting the cash settlement amounts from/into the banks account of the relevant ISS participants by 2.00 pm on T+2.

• Settlement instructions among participants will be transmitted electronically. The generation of these instructions shall commence from 1+1 up until 3.00pm on T+2

• Shares delivery/receipt will entail crediting/debiting of corresponding CDS accounts maintained directly with NTCPs. The crediting/debiting of shares will be completed by 2.00 pm on T+2.

Central Depository System (CDS)

The Central Depository System (CDS) is a computerised system for the central handling of securities for the Malaysian stock market, operated by Bursa Malaysia Depository Sdn Bhd. Bursa Malaysia Depository Sdn Bhd is a subsidiary of Bursa Malaysia Berhad, and was incorporated to operate the CDS in Malaysia.

The CDS is regulated by the Securities Industry (Central Depositories) Act 1991 (SICDA) and the Rules of the Bursa Malaysia Depository Sdn Bhd. What follows is a summary of the CDS. In order to obtain more details, please read the Act and the Rules.

Under the CDS, delivery of shares is done through book entry, and there is no physical movement of scrips. This makes the delivery and clearing of shares more efficient and convenient. Instead of delivery and receipt of share certificates, a seller’s account is debited and a buyer’s account is credited with the relevant number of shares for each transaction.

All physical scrips of listed companies under the CDS are kept in the form of jumbo certificates registered in the name of Bursa Malaysia Depository Nominees Sdn Bhd. These jumbo certificates do not have any street value.

Since November 1998, all securities are deposited in the CDS and all new issues of securities by public-listed companies are made by way of crediting securities into the CDS accounts of securities holders. These new securities may arise from rights issues, bonus issues, private placements, special issues, conversion of debt securities/warrants, share swaps or any other corporate activities. However, exceptions do exist; see Rule 6.01A of the Rules of Bursa Malaysia Depository Sdn Bhd.

Investor Accounts

To trade securities, an investor must open a CDS account. An investor can open an account with a Participating Organisation of Bursa Malaysia Securities Berhad that has been appointed as an authorised depository agent (ADA). To do so, the investor must make an application to open an account, provide identification and pay a one-time account-opening fee. If an investor is a successful applicant under the public offer but does not stipulate his/her CDS account number on the public issue application form, a CDS account is automatically opened on the investor’s behalf with an ADA assigned by the share registrar. Thereafter, in order to trade on that account, the investor must formalise the account opening with the assigned ADA.

An individual investor may only open one account with an ADA, but may have an account with more than one ADA, whereas a corporate investor may open multiple accounts with one ADA.

The criteria which must be met in order for a person to open a CDS account are set out in Rule 25.02 of the Rules of Bursa Malaysia Depository Sdn Bhd. This rule also sets out the categories of persons who are eligible to open a CDS account.

These accounts contain quantities of shares for each security; however, this account is not to be confused with the investor’s cash accounts maintained by the Participating Organisation to record the investor’s indebtedness to a Participating Organisation or vice versa arising out of share transactions. Apart from showing trades, a CDS account will also show deposits, transfers, bonus and rights issues.

If the application meets all the requirements, an account number is allocated and the account may then be used for any CDS transaction.

Where there has been a transaction a monthly statement will be issued. If there are no transactions in a 6-month period, statements are issued every half yearly, in June and December. An investor can request additional statements for a nominal fee. An inquiry by investors as to their stock balances, however, can be made at any time. To close an account, an investor must submit an application for closing of account form to the ADA.

Rule 14.02 of the Rules of Bursa Malaysia Depository Sdn Bhd prescribes the persons that are able to apply to Bursa Malaysia Depository Sdn Bhd to be an Authorised Direct Member who may, upon appointment, be authorised to maintain such securities accounts as stated under Rule 33.01 (3) of the Rules of Bursa Malaysia Depository Sdn Bhd. Chapters 14, 15 and 16 of the Rules of Bursa Malaysia Depository Sdn Bhd apply to Authorised Direct Members.

The Depository may appoint any of the persons eligible under Rule 14.02 to be an Authorised Direct Member who may, upon appointment, be authorised to open, operate and maintain the following securities accounts as stated under Rule 33.01 (3):

• Principal accounts

• Nominee accounts for locally incorporated nominee companies which are wholly owned by such person (subject to Rule 33.09 (1A) of the Rules of Bursa Malaysia Depository Sdn Bhd).

Account Structure

Rule 25.02 of the Rules of Bursa Malaysia Depository Sdn Bhd sets out that the following persons shall be eligible to open a securities account with Bursa Malaysia Depository Sdn Bhd:

• An individual who has attained the age of 18 years as of the application date

• A corporation within the meaning of s.3 of the Companies Act 2016 (CA)

• A body corporate that is incorporated within Malaysia and is by notice published in the Gazette declared to be a public authority or instrumentality or agency of the Government of Malaysia or any State

• A society under any written law relating to cooperative societies

• A statutory bodies incorporated under an Act of Parliament

• A trustee or trust corporation duly constituted under any written law

• A society registered under the Societies Act 1966.

However, such persons are not eligible to open a securities account if they:

• Have been adjudicated bankrupt and remain undischarged at the time of application

• Are mentally disordered

• Are a partnership

• Are not a beneficial owner or not an authorised nominee of the deposited securities.

A securities account may only be operated through the ADA with whom the account is maintained or through any branch office of that ADA. An individual can only open and maintain one account with the same ADA. However, a corporate body is allowed to open more than one account with any authorised depository agent (refer to Rule 26.03 of the Rules of Bursa Malaysia Depository Sdn Bhd).

Under s.25 (4) of the SICDA, a securities account must be in the name of the beneficial owner of the deposited securities or in the name of an authorised nominee. The person opening the account must make a declaration that he is the beneficial owner or an authorised nominee as the case may be (s.25 (5) of the SICDA).

Where the person opening the account is an authorised nominee, he/she can only hold deposited securities from one beneficial owner in respect of each securities account. He/she must, in accordance with the Rules of Bursa Malaysia Depository Sdn Bhd, provide to Bursa Malaysia Depository Sdn Bhd the name and other particulars of the beneficial owner. See s.25A of the SICDA.

Contravention of s.25 or 25A is an offence liable to a fine of up to RM3 million or imprisonment up to 10 years or both.

Deposit of Securities

Deposits in the CDS relate to the immobilisation of scrips, their registration into Bursa Malaysia Depository Nominees Sdn Bhd’s name and safe keeping. The SICDA was amended by the Securities Industry (Central Depositories)(Amendment)(No.2) Act 1998 to require full immobilisation of securities within the CDS. Therefore, investors no longer hold shares in the form of scrips but have a CDS account whether they intend to trade in securities or not.

Trading

Under the CDS, trade settlement is accounted for at the investor level, as opposed to the stockbroking company level. The FDSS applies, with delivery by book entry. CDS accounts show the quantities of shares and not values.

For ready basis contracts, a buyer of securities will have his/her CDS account credited on T+2. However, if a seller of a security does not have sufficient securities in his/her account to settle the sale, then buying-in can be instituted see Rule 9.05 and Schedule 2 of the Rules of Bursa Malaysia Securities Berhad. If a buyer of securities does not pay the stockbroking company by the due date for a purchase of securities, then selling-out can be instituted — see Rule 9.12 and Schedule 2 of the Rules of Bursa Malaysia Securities Berhad.

Transfer of Securities

Generally, CDS account holders are prohibited from transfer shares to other accounts within the system unless as provided under Rule 29.01 and 29.02 of the Rules of Bursa Malaysia Depository Sdn Bhd.

Read Chapter 29 of the Rules of Bursa Malaysia Depository Sdn Bhd and note, in particular, Rule 29.05 on the implied terms in an agreement for the transfer of securities, the ability to make objections to a transfer and the action Bursa Malaysia Depository Sdn Bhd may take upon investigation of an objection and Bursa Malaysia Depository Sdn Bhd’s disclaimer of liability.

Withdrawal of Securities

Withdrawal of securities is generally prohibited. Circumstances in which withdrawal is permitted include the facilitation of share buy-back, conversion of debt securities, the process of company restructuring and rectification of errors. Chapter 7 of the Rules of Bursa Malaysia Depository Sdn Bhd governs the withdrawal of securities.

CORPORATE ACTIONS

When a listed company announces a corporate action, such as payment of dividends, issues of rights or bonus shares, the shareholders entitled to them are those who are registered in the company’s register of members on the entitlement date.

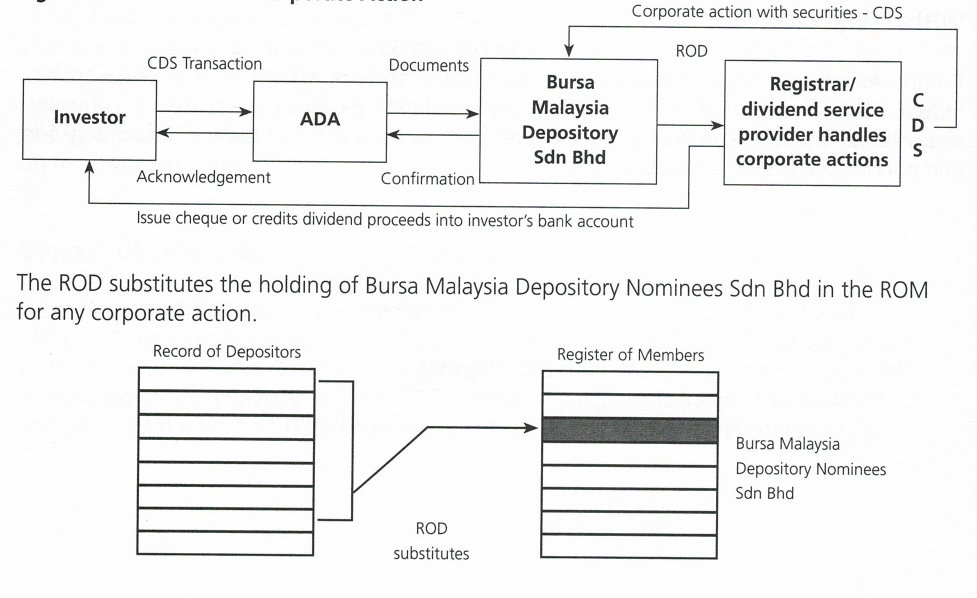

The registered shareholder is Bursa Malaysia Depository Nominees Sdn Bhd as all shares in that security which were originally deposited by investors are registered in its name. However, Bursa Malaysia Depository Nominees Sdn Bhd is a bare trustee and the beneficial owners are the depositors. Although the securities are held in the name of Bursa Malaysia Depository Nominee Sdn Bhd, the person whose name appears in the Record of Depositors (ROD) has all rights, benefits, powers and privileges elating to the securities and also is subject to all liabilities, duties and obligations in respect of or relating to those securities. Neither Bursa Malaysia Depository Sdn Bhd nor Bursa Malaysia Depository Nominees Sdn Bhd has these rights or obligations. Burs2

Malaysia Depository Sdn Bhd will produce a ROD as at the lodgement date, and forward it to the Registrar.

The ROD contains a listing of all CDS account holders together with the number of shares to their credit, as at the lodgement date. This should be equal to the total number of shares registered in the name of Bursa Malaysia Depository Nominees Sdn Bhd, in the company’s Register of Members (ROM).

A flow chart describing the corporate action procedures appears below.

Figure 1: Flow Chart for Corporate Action

Read ss.20, 21, 33 and 35 of the SICDA, which set out the provisions in relation to deposited securities.

Dividends

Under the CDS, a listed company that announces a dividend will request from Bursa Malaysia Depository Sdn Bhd a ROD as of a specified date. Upon receipt of the ROD, the company’s share registrar will calculate the dividend payable and send out the cheques directly to the investors.

Bonus Issues

When a company declares a bonus issue, a ROD as at the lodgement date will be produced by Bursa Malaysia Depository Sdn Bhd and then given to the Registrar. The Registrar will calculate the entitlement due for each account and will advise Bursa Malaysia Depository Sdn Bhd on the number of bonus shares to be credited to each of the account holders in the ROD. Bursa Malaysia Depository Sdn Bhd will credit these accounts accordingly.

Rights Issues

When a company declares a rights issue, a ROD is also produced. Based on this ROD, the Registrar will also generate the provisional allotment letters (PALs) and send them directly to the investors. The investors may renounce their shares.

The Registrar will advise Bursa Malaysia Depository Sdn Bhd of the number of shares to be credited to the subscribing shareholders. The accounts of these shareholders will be credited as advised.

OTHER MATTERS

Non-delivery and Buying-in Rule 9.05 of the Rules of Bursa Malaysia Securities Berhad sets out that where a Participating Organisation, having sold securities in board lots, fails by the Scheduled Delivery Time to make available in the relevant securities account the securities in board lots as tradeable balance the Bursa Malaysia Securities Berhad shall upon being advised by the clearing house of the failed contract, automatically buy-in against the defaulting Participating Organisation concerned without notice, on the market day specified in Schedule 2 of the Rules of Bursa Malaysia Securities Berhad.

Buying-in is conducted every market day at 8.30am-12.30pm and 2.00pm-5.00pm.

If incomplete, the buying-in will be continued on the following market day. Read Rule 9.06 of the Rules of Bursa Malaysia Securities Berhad for the buying-in procedures. Defaulting Participating Organisations are prohibited from charging brokerage for the buying-in against the seller in a failed contract. The defaulting Participating Organisation must pay a levy of 1% of the buying-in contract value to Bursa Malaysia Securities Berhad, which can be recovered from the seller in the failed contract.

Non-payment and Selling out

Rule 19.09 of the Rules of Bursa Malaysia Securities Berhad provides that in relation to FOSS contracts, Participating Organisations shall, close off the purchase positions of their respective Defaulting Clients who fail to pay for their purchases by the Scheduled Settlement Time and shall institute a selling-out on the market day prescribed in Schedule 2 on any such securities for which the Defaulting Clients have not made full payment by the Scheduled Settlement Time.

Events of Default

Note that Bursa Malaysia Securities Clearing Sdn Bhd also has the power to undertake certain action if a clearing participant is unable to meet its obligations for unsettled market contracts.

Where such a default in payment occurs, Bursa Malaysia Securities Clearing Sdn Bhd can undertake the actions described in Chapters 4 and 5 of the Rules of Bursa Malaysia Securities Clearing Sdn Bhd, including liquidating market contracts or selling securities.

Netting

Rule 5.3(e) of the Rules of Bursa Malaysia Securities Clearing Sdn Bhd prescribes that all amounts:

• Payable by Participating Organisations to the Bursa Malaysia Securities Clearing Sdn Bhd

• Receivable by Participating Organisations from the Bursa Malaysia Securities Clearing Sdn Bhd

on every market day shall be netted in accordance with the Rules of Bursa Malaysia Securities Clearing Sdn Bhd.

Rule 5.3 of the Rules of Bursa Malaysia Securities Clearing Sdn Bhd further provides that the financial settlement of securities shall be on a “net basis”. “Net basis” is defined as a process whereby monetary obligations of clearing participants are pooled and off-set with each other, resulting in one final position for each clearing participant.

Rule A5.9 (d) of the Rules of Bursa Malaysia Securities Clearing Sdn Bhd sets out that the money payment obligations of any clearing participant with respect to its ISS Transactions which have settled may be netted by the clearing house, and payment of such net payment amount by or to the clearing house by a clearing participant shall be effected in accordance with Rule A5.9 (b).

By way of example, if three of four investors of a stockbroking company sell 1,000, 2,000, 3,000 shares of a security and the fourth investor buys 10,000 shares of the same security, then under the CDS there will be a debiting of 1,000, 2,000, 3,000 shares from the respective accounts of the selling investors and crediting of 10,000 shares into the account of the buyer. Under Bursa Malaysia Securities Clearing Sdn Bhd, there will be a net buy of 4,000 shares for the stockbroking company, without going into detail at individual investor level.

Summary

We began this topic by discussing the role of Bursa Malaysia Securities Clearing Sdn Bhd in facilitating clearing of transactions.

We then looked in detail at the Fixed Delivery and Settlement System (FDSS) and the time frames for delivery and settlement. We also examined the Institutional Settlement Services (ISS) and continued our discussion by examining the Central Depository System (CDS) and how it works.

We then looked at dividends, bonus issues and rights issues under the CDS.

We concluded this topic by looking at buying-in, selling-out and netting under both Bursa Malaysia Securities Clearing Sdn Bhd and the CDS.

Self-Assessment

Refer to the diagram below to answer question 1.

1. Amir bought 2 board lots of SS shares on 26 July 20X9 on a ready basis contract. Assuming that Friday, 27 July 20X9 and Monday, 30 July are public holidays, what is the EARLIEST date for the selling-out of the SS shares to be instituted?

A. 31 July 20X9 at 2.00 pm

B. 1 August 20X9 at 10.00 am

C. 1 August 20X9 at 2.00 pm

D. 2 August 20X9 at 10.00 am

2 . The following persons shall be eligible to open a securities account with Bursa Malaysia Depository Sdn Bhd EXCEPT:

a. A partnership

b. A statutory bodies incorporated under an Act of Parliament

c. A trustee or trust corporation duly constituted under any written law

d. A corporation within the meaning of s.3 of the Companies Act 2016 (CA)

e. An individual who has attained the age of 18 years as of the

application date

f. A body corporate that is incorporated within Malaysia and is by notice published in the Gazette declared to be a public authority or instrumentality or agency of the Government of Malaysia or any State

3. Robert has submitted his application to open a securities account with an authorised depository agent on Monday, 9 June 20X9. Assuming there is no public holiday for that month, by which date should the authorised depository agent complete the process of the opening of Robert’s securities account?

A. Monday, 9 June 20X9

B. Tuesday, 10 June 20X9

C. Wednesday, 11 June 20X0

D. Thursday, 12 June 20X9