What Is Economic Analysis?

Economic analysis refers to evaluating costs and benefits to check the viability of a project, investment opportunity, event, or any other matter. In other words, it involves identifying, evaluating, and comparing costs and benefits. In addition, there are many other significant concepts involved.

Economic Analysis

Standard economic analysis of choice behavior, such as the expected utility theory, begins with the assumption that decision makers assign a numerical score to each available option according to the subjective desirability of its outcome, commonly referred to as utility function…Read more

What Is an Investment Strategy?

An investment strategy is a systematic approach to making investment decisions based on principles, guidelines, and rules.

It involves selecting a portfolio of investments expected to meet the investor’s financial goals while considering their risk tolerance, time horizon, and investment objectives.

A good investment strategy considers various factors, such as economic trends, market conditions, and the investor’s financial situation.

It may involve diversifying the portfolio across different asset classes such as stocks, bonds, and real estate and using various investment vehicles such as mutual funds, exchange-traded funds (ETFs), or individual securities…Read more

Economic Analysis and Investment Strategy

Overview

Economic analysis essentially entails the evaluation of costs and benefits. It starts by ranking projects based on economic viability to aid better allocation of resources. It aims at analyzing the welfare impact of a project.

Investment analysis is a broad term for many different methods of evaluating investments, industry sectors, and economic trends. It can include charting past returns to predict future performance, selecting the type of investment that best suits an investor’s needs, or evaluating individual securities such as stocks and bonds to determine their risks, yield potential, or price movements.

An investment strategy is a systematic approach to making investment decisions based on principles, guidelines, and rules. It involves selecting a portfolio of investments expected to meet the investor’s financial goals while considering their risk tolerance, time horizon, and investment objectives.

The term investment strategy refers to a set of principles designed to help an individual investor achieve their financial and investment goals. This plan is what guides an investor’s decisions based on goals, risk tolerance, and future needs for capital.1 They can vary from conservative (where they follow a low-risk strategy where the focus is on wealth protection) while others are highly aggressive (seeking rapid growth by focusing on capital appreciation).

In this part, we shall apply economic issues discussed earlier in the context of financial markets. We will describe the key influences that drive financial markets and how economic analysis can be applied to financial markets and investment strategy.

Objectives

(a) Provide an understanding of economic cycles.

(b) Discuss the usage of the cyclical indicator approach of describing the stage of the economic cycle that an economy is in;

(c) Illustrate the economic cycle as it applies to the Malaysian economy; and

(d) Discuss the business outlook indicators.

Economic cycles and investment strategy

Economic cycles

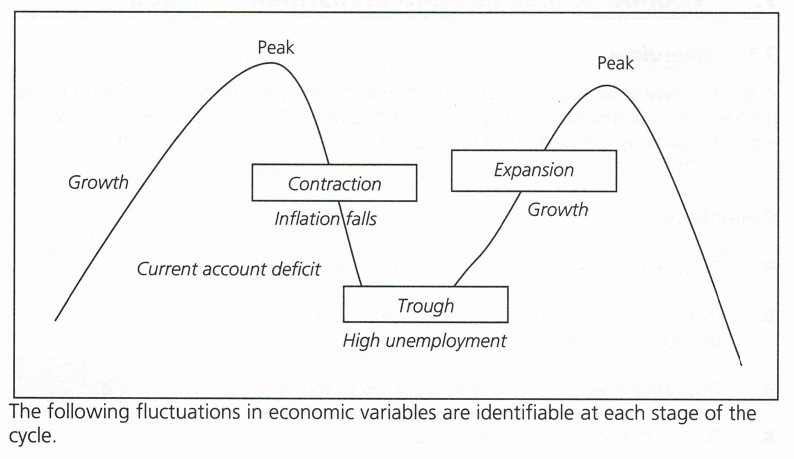

An economic cycle is a fluctuation found in the aggregate economic activity of an economy. A cycle generally consists of an expansion (which usually occurs at about the same time in many economies), followed by a recession, contraction and revival (which will merge into the expansion phase of the next cycle). This sequence of the stages in an economic cycle occurs repeatedly (recurrent) in a random manner. In terms of duration, an economic cycle can last from 1 year to 10 or 12 years. A cycle is not divisible into shorter cycles.

The rate of return of an investment is determined by its expected future cash flows as well as the aggregate economic environment. For example, share prices are supposed to consistently turn before the economy does because stock investment decisions are based on future expectations.

Stages of an economic cycle

There are generally four stages to an economic cycle, namely:

(a) peak to contraction;

(b) contraction to tough;

(c) trough to expansion; and

(d) expansion to peak.

(e) Peak to contraction: growth falls, industrial production falls, capacity utilisation falls, labour productivity declines (as production falls while employments laps),

(f) Contraction to trough: inflation falls, retail sales declines, unemployment rises, balance of payments deficit falls (as imports decline), consumer sentiment decreases.

(g) Trough to expansion: inflation falls resulting in consumer real income increasing, interest rates fall, housing activity starts to increase, consumer sentiment improves, consumer demand increases (e.g. car sales, consumer credit, retail sales).

(h) Expansion to peak: growth broadens to include manufacturing, resulting in industrial production increasing, capacity utilisation increasing. Inflation bottoms and starts to increase, production is at minimum, the labour market is tight, wage demands increase. However, expectations that drive boom conditions cannot last and the cycle will repeat itself again.

Cyclical indicators approach

These indicators reflect the cyclical turning points in the economy.

Leading indicators

Normally, the cyclical turning points in leading indicators would occur before those in aggregate economic activity. As a rule of thumb, leading indicators (e.g. job consumer sentiment) lead the economic cycle by about 6 months. Leading indicators are given more credence than lagging indicators in determining policy implications, through some lagging indicators remain important (such as the labour market releases).

Coincident indicators

The cyclical turning points in coincident indicators would occur at about the same time as those of the aggregate economic activity.

Lagging indicators

The cyclical turning points in the lagging indicators generally would have occurred after those in the aggregate economic activities. Lagging indicators (such as the unemployment rate and employment growth) trail economic cycle by about 6 months.

Using the cyclical indicators approach for the Malaysian economy.

The cyclical indicators described above can be used to describe the Malaysian economic cycle.

The Department of Statistics has begun work to construct these indicators based on the approach used by the National Bureau of Economic Research, United States. Composite indices are constructed using the Moore-Shiskin method developed by Dr. Geoffrey Moore, who has long been recognised as one of the world’s leading authorities on research on the behaviour and measurement of business cycles.

In Malaysia, the construction of the leading, coincident and lagging indicators was based on the following time series.

Leading indicators

(a) Real money supply, M1

(b) Bursa Malaysia Industrial Index

(c) Real total trade: eight major trading partners

(d) CPI for services, growth rate (inverted)

(e) Industrial material price index, growth rate

(f) Ratio of price to unit labour cost, manufacturing

(g) Number of housing permits, approved

(h) Number of new companies registered

Coincident indicators

(a) Index of industrial production

(b) Real gross imports

(c) Real salaries and wages, manufacturing

(d) Total employment, manufacturing

(e) Real sales, manufacturing

(f) Real contributions, EPF

Lagging indicators

(a) Seven-day call money, rates

(b) Real excess lending to private sector

(c) Investment projects approved, number

(d) Number of defaulters, EPF (inverted)

Exercise:

1. Which of the following is NOT a stage in an economic cycle?

A. Peak to contraction

B. Contraction to trough

C. Trough to peak

D. Trough to expansion

2. There are generally several stages to an economic cycle and which is the following answer is TRUE about the stages of an economic cycle?

I. peak to contraction

II. contraction to tough

III. trough to expansion

IV. expansion to peak.

A. I and II only

B. II and III only

C. I, II and IV only

D. All of the above.

3. Which of the following is NOT an indicator followed by financial markets?

A. Inflation

B. Interest rates

C. Retail sales

D. Rice consumption

4. Which of the following is an indicator for the lagging index?

A. Index of industrial production

B. Salaries and wages

C. Number of new vehicles registered

D. GNP

Useful links:

Investment Strategy: Ways to Invest and Factors to Consider

Understanding Investments – Theories and Strategies

Investment Analysis Explained

Economic Analysis – European Central Bank