What Are Fundamentals?

Fundamentals include the basic qualitative and quantitative information that contributes to the financial or economic well-being of a company, security, or currency, and their subsequent financial valuation. Where qualitative information includes elements that cannot be directly measured, such as management experience, quantitative analysis (QA) uses mathematics and statistics to understand the asset and predict its movements…Read more

Understanding Fundamentals

In business and economics, fundamentals represent the primary characteristics and financial data necessary to determine the stability and health of an asset. This data can include macroeconomic, or large-scale factors, and microeconomic, or small-scale factors to set a value on securities or businesses…Read more

Macroeconomic and Microeconomic Fundamentals

Macroeconomic fundamentals are topics that affect an economy at large, including statistics regarding unemployment, supply and demand, growth, and inflation, as well as considerations for monetary or fiscal policy and international trade. These categories can be applied to the analysis of a large-scale economy as a whole or can be related to individual business activity to make changes based on macroeconomic influences. Large scale, macroeconomic fundamentals are also part of the top-down analysis of individual companies…Read more.

ECONOMIC FUNDAMENTALS

Overview

It is important for those in the financial market to understand the economic fundamentals. Important investment decisions will always be governed by what is happening in the economy, policy directors and anticipation of how the economy will change in the short and medium-term as policy changes.

In business and economics, fundamentals represent the primary characteristics and financial data necessary to determine the stability and health of an asset. This data can include macroeconomic, or large-scale factors, and microeconomic, or small-scale factors to set a value on securities or businesses.

Objectives

To provide the basic definition of economics,

Illustrate the interaction of the players and sectoralisation of the economy,

To provide understanding of the supply and demand concepts,

Discuss the importance of understanding economics for financial market participants, and

Examine several frequently-used basic economic concepts.

What is economics?

Economics is the study of low scarce resources are allocated among competing needs and the examination of the allocation of goods and services through the price mechanism and markets. Economics is concerned with the following:

(a) The production of goods and services i.e. the transformation of inputs into outputs by economic agents (individuals, firm and government) in order to meet some form of objectives such as profits and social goals.

(b) The consumption of goods and services, that is the act of using goods and services to satisfy wants.

There are two main branches of economics, namely macroeconomics and microeconomics.

Macroeconomics studies economic aggregates at the overall level, such as employment, prices, output and business cycles. It is also concerned with aggregate demand (total level of spending in the economy), aggregate supply (total output in the economy) and how government actions affect these aggregates.

Microeconomics studies individual units, e.g. households firm, and industries and the inter-relationship between these units in determining the pattern of production and the distribution of goods and services. It also examines how regulations and taxes affect the markets.

Key players in the economy

Economics is about combining and transforming limited resources into good and services. The key players in the production process can be categorised into three main sectors: private, public and international sectors. The private sector comprises the household, the firm and the financial institutions.

The household – households demand good and services and help determines what gets produced. Economic decisions of households on earning or saving their income and on activities of work or leisure are made with an objective of satisfying or maximizing their wants.

The firm – business enterprises engaged in the production and distribution and distribution of non-financial good and services play an important role in an economy. Such entities buy or hire factors of production, use them for the production of goods and services and sell the end-products with a new of making profits.

The financial institutions – these are involved in the provision of financial services. They act as intermediaries between the economic agents with surplus funds and those that require funds.

Financial market participants are generally concerned with economic factors such as:

– Interpreting the regular releases of economic data;

– Forecasting short to long-term trends for the investment decision-making;

– assessing the impact of policy changes and decisions; and

– managing risks versus returns in financial market

The public or government sector – is owned and operated by the government to provide goods and services, which cannot or will not be adequately provided by the private sector, such as national security services, roads, education, and healthcare.

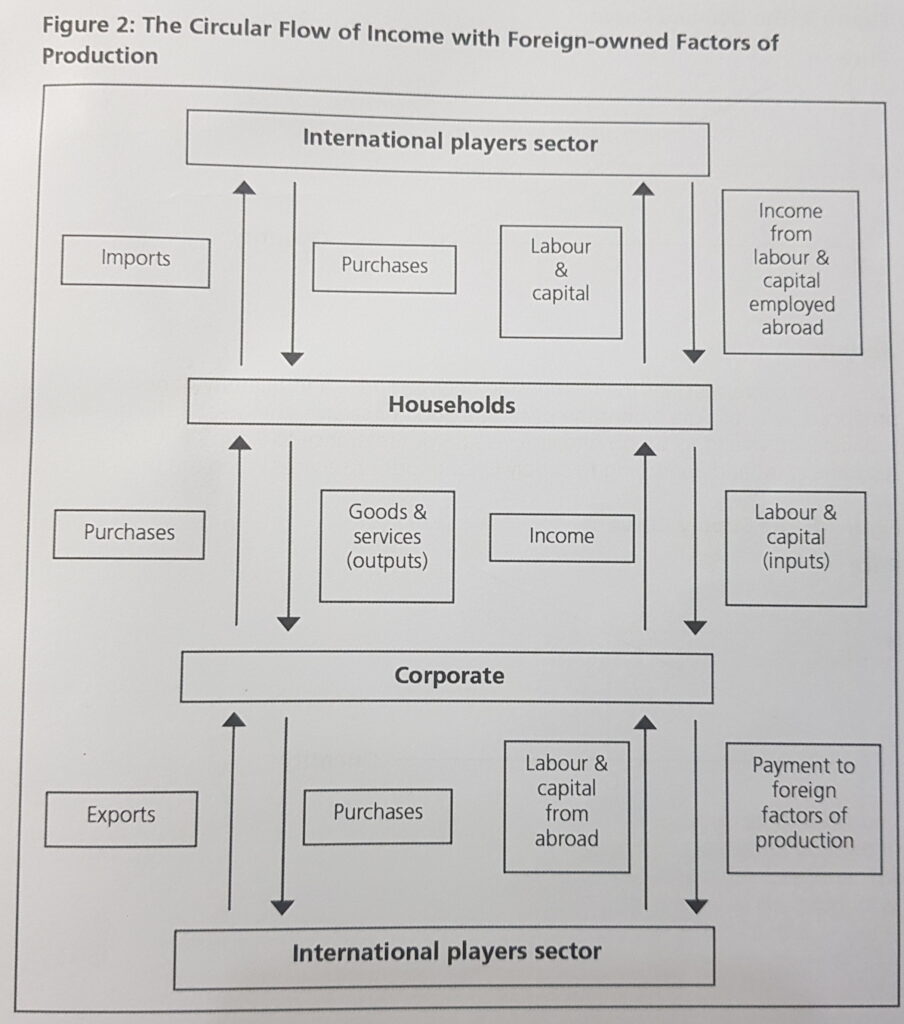

The private and public sectors are key domestic players within a country but the rest of the world affects what a country produces or consumes. The international sectors comprise national trade among different countries involving foreign transactions in the provision of goods and services, imports and exports and the inflow and outflow of capital from the country.

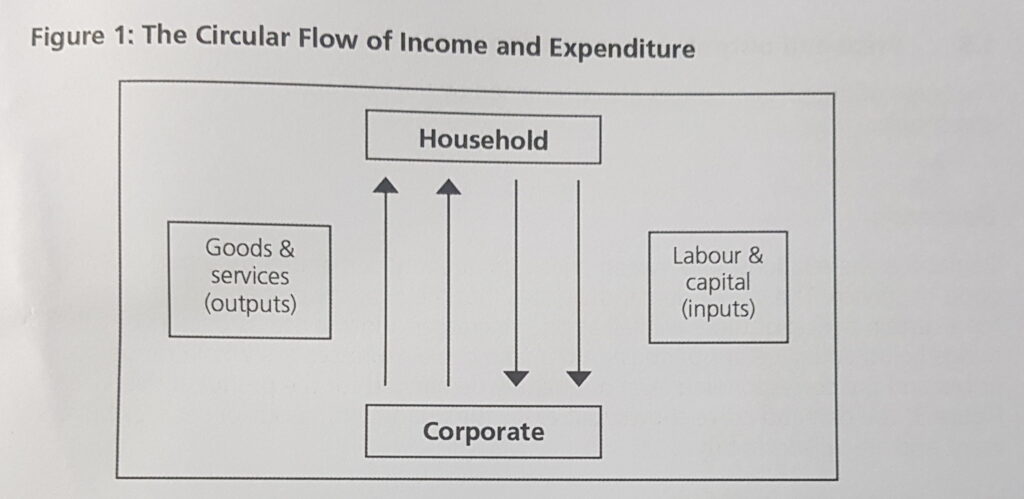

The circular flow of income and expenditure

Each player has an important role to play in the flow of inputs, money, goods and services in the economy. The setting in which these roles interact is called the “circular flow”, where resources (or factors of production) flow from households to firms and where goods and services flow from firms to households. The following chart illustrates the circular flow.

Price and outputs determination in market

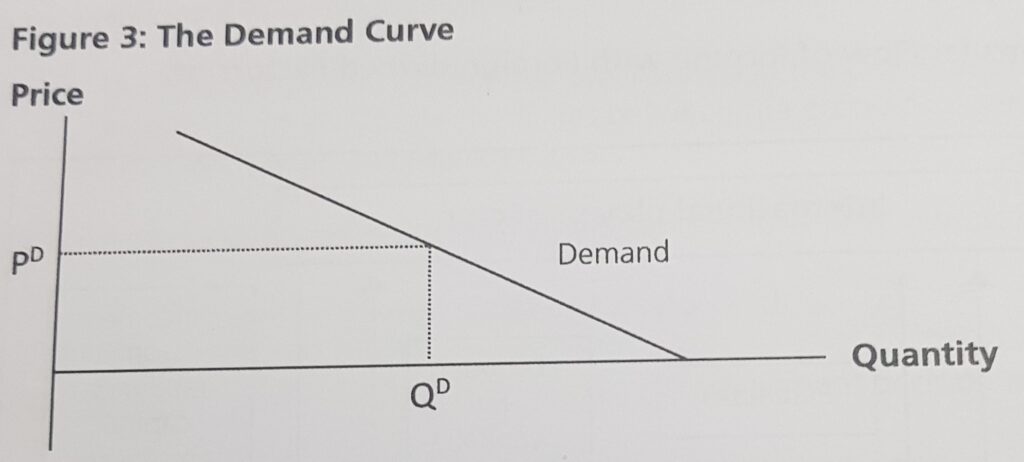

The levels of outputs and prices are determined by the interaction between demand and supply.

Demand

Demand is the relationship between price and quantity demanded for a particular good or service. The law of demand dictates that the quantity demanded for a good for a certain period of time, will fail as price increases and will rise as price falls, other things being equal (ceteris paribus). A demand curves expresses the whole range of prices and the corresponding level of of quantity demanded for the product or service. in figure 3, the demand curve shows that at PO, the quantity of goods or services buyers want and are willing to buy is QD.

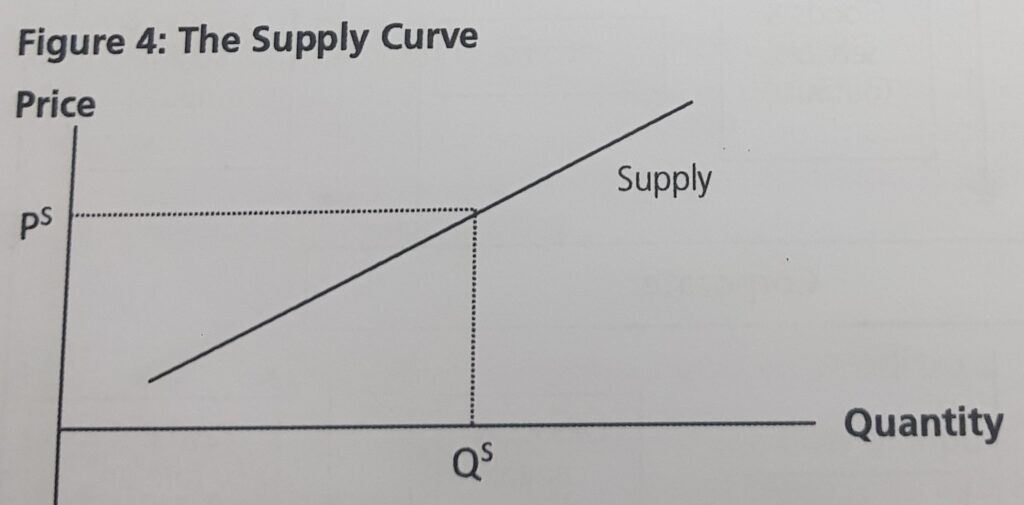

Supply

The supply curve specifies the relationship between price and quantity of goods produced by firms. The higher the price of a good or services, the greater the quantity suppliers are willing to supply and vice versa. With reference to Figure 4 below, suppliers want and willing to supply QS of goods or services when the price is at PS

Equilibrium position

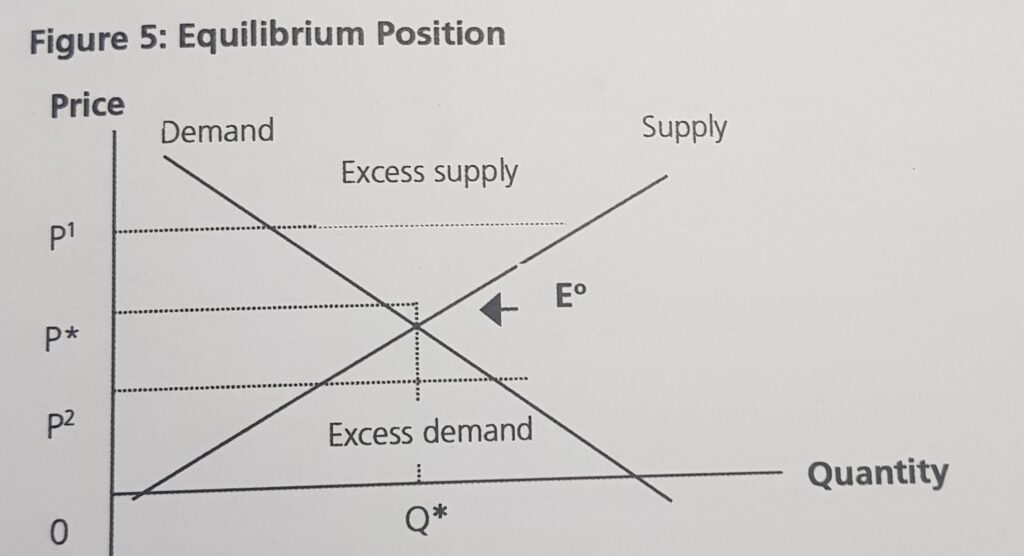

Equilibrium is a situation where the demand for and supply of a good or service are exactly balanced and there is no inherent tendency to more away from that position. An equilibrium point is the point where the supply and demand curves cross. Also called the market clearing position. At the equilibrium price of P*, the quantity that would be traded in a market equilibrium is Q*.

If the price is increase to P1, there will be excess supply, which is characterised by the built-up of unsold stocks. This will place pressure on suppliers to lower their price in order to increase demand for the stocks. On the other hand, at P2 the price is too low resulting in excess demand. As a result of excess demand, prices will be pushed up. Equilibrium between supply and demand is achieved at P* (the equilibrium).

Basic economic concepts

Economic concepts refer to the collection of basic ideas that explain various occurrences in the economy, like the actions and choices of economic agents. Therefore, a basic understanding of the concepts is important in studying and analyzing the decisions and behavior of economic agents. For example, it includes the producers’ and consumers’ decisions on producing and buying.

What are the 3 basic economic concepts?

The three basic concepts are supply & demand, scarcity, and opportunity cost. When supply and demand meet, the quantity demanded is equal to the quantity supplied, and we can say that the market is in equilibrium. Scarcity indicates a shortage of resources. Finally, opportunity cost is the benefit missed due to not selecting a particular alternative. The explanation details of the basic economic concepts are as discuss below:

Flows and stocks

A flow is an economic magnitude measured as a rate per unit of time. For example, production of Proton cars per week, the consumption of fish per year and the total output of an economy per quarter.

A stock is the magnitude measured at a point of time. For example, the total holdings of Malaysian Government Securities (MGS) by banks as at the end of 2010 and the total reserves held by Bank Negara Malaysia as at 15 August 2010.

Opportunity costs and money price

Opportunity cost is a ratio which measures how much of one type of goods must be foregone in order to produce more of another type of goods. For instance, in order to produce another bottle of soda, two video tapes may be required to be foregone. The opportunity cost of producing a product generally increases as more of the product is produced because not all productive resources are equally well suited for the producers of a product or service.

The money price of a product is the ringgit amount that must be used to buy it, the relative price of a product is the ratio of its money price to the price of another product. A relative price of a product is the opportunity cost of buying it. Because the relative price of a product is the opportunity cost, the demand and supply for it depends on the relative price. Hence the demand and supply model determines relative prices, not money prices.

Uncertainty and risk

Uncertainty is a situation in which more than one event may occur but we don’t know which one. For example, when farmers plant their crops, they are uncertain about the weather during the growing season.

Risk is the uncertainty of achieving the expected returns or the probability that the realised outcome will be different from the expected outcome. People are, in general, risk averse and therefore would avoid unnecessary risk. If they have to assume more risk than they prefer, the rewards have to be large enough to compensate for the extra risk. Some people are willing to bear more risk than others, but almost everyone prefers less risk to more, other things being equal. We measure people’s attitude towards risk by using their utility of wealth curves. Risk aversion is a measure of attitudes towards risk. A person is risk averse when he prefers less risk, all other things being equal. A risk taker prefers more risk, all other things being equal.

Information, moral hazard and adverse selection

Information is valuable because it helps people make correct choices or decisions. Both moral hazard and adverse selection are the result of private information. Moral hazard occurs when, after an agreement has been reached, one of the parties to the agreement has the incentive to gain additional benefits at the expense of the other party. Adverse selection refers to people who accept certain contracts and have private information that allows them to benefit from the contract while harming the other party.

Both moral hazard and adverse selection represent some of the problems arising in loan and insurance markets.

Market prices and factor costs

Production is normally valued at market prices or comparable prices imputed to arrive at the market price. Valuation according to comparable market prices is not available for most services of the government. Valuation of government services is usually based on the costs incurred by the government.

Valuation at factor cost for businesses would give us the factor income earned, i.e. remuneration of employees plus the operating surplus or the rental surplus. These are corporate profits or proprietors’ income, rental and interest. In order to arrive at the market value of the production, we must add to the factor income, indirect taxes (mostly sales taxes) net of subsidies. This is because indirect taxes and subsidies are transfer payments that do not add value to production. Conversely, to arrive at the factor cost, indirect taxes should be excluded but subsidies should be included.

Nominal and real concept

The various aggregates defined above such as gross domestic product (GDP) and gross national product (GNP) can be measured either in current prices (nominal) or in constant prices (real). Nominal valuation uses prices of goods or factors of production prevailing in the current period to value the current period’s output or expenditure. Real valuation uses prices of goods or factors that prevailed in earlier period, called the base period to value the current period’s output and expenditure. Changes in volume are measured by changes in real aggregates. A measure of the change in prices of newly produced goods and services from a base year can be obtained by dividing the nominal aggregate by the real aggregate.

For instance, to arrive at the implicit deflator of the GDP, divide the normal GDP by the real GDP. Real values are appropriate for measuring the level and change in economic activity. Since macroeconomics is concerned with both the scale of activities and prices (i.e. inflation), both nominal and real values are important.

What Is Gross Domestic Product (GDP)?

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health. Though GDP is typically calculated on an annual basis, it is sometimes calculated on a quarterly basis as well. In the U.S., for example, the government releases an annualized GDP estimate for each fiscal quarter and also for the calendar year. The individual data sets included in this report are given in real terms, so the data is adjusted for price changes and is, therefore, net of inflation…Read more

Economic ration analysis

Ratios, marginal propensities and elasticity are basic mathematical concepts used in economic analysis to explain the relationship between two variables. A ratio is the most wisely used statistical measure and measures the magnitude of the variable in the numerator in relation to the variable in the denominator in a given period. Marginal propensities measure the relationship between the change in one variable and the change in another. Elasticity is the ratio percentage change in two variables.

Considerations in the comparison and use of ratios

Ratios are used to study relationships between two or more variables. Certain generalisations can be made in choosing which of the two variables in a ratio that should be taken as the base of comparison or as the denominator. If the magnitude of a part relative to the corresponding total is to be determined, the total is generally taken as the base. For instance, in relating the value of output in manufacturing to the total value of output of the economy, the latter would be the denominator of the ratio.

If the relative change from an earlier period to a later period is to be determined, the earlier period is generally used as the denominator. For example, in calculating the percentage change in money supply from the end of 2002 to the end of 20X3, the money supply at the end of 20X2 would be taken as the base.

In order to minimise the scope for misinterpretation, the following factors about ratios should be kept in mind:

– Both variables in the numerator and the denominator will affect a ratio. Hence, the characteristics of both variables should be included in the interpretation of a ratio.

– Any one ratio reveals only a partial picture in most analytical situations. Because most problems in economic analysis are complex, one should be very sceptical of any attempt to answer such problems from the analysis of a single ratio.

– Any one ratio relates only two variables and consequently will provide only a part of the total picture. This will result in a partial equilibrium analysis.

For ratios to be meaningful, they should compare either to some predetermined benchmark or to other ratios. Comparisons between ratios are necessary, but they will be meaningless unless the basic data relates to comparable activities. For example, one may not be able to compare the national savings ratio between two countries if one country uses GNP as its base while the other uses GDP.

Elasticity

Elasticity is defined as the percentage change in one variable associated with a given percentage change in another variable. Normally, the absolute value is taken. When the value is one, the elasticity is considered as unitary. When it is larger than one, it is considered as elastic and when it is less than one, it is inelastic. For example, the income elasticity of imports is defined as the percentage change in imports divided by the percentage change in GDP.

Exercises:

1. In order to induce producers to supply more of a commodity, a higher commodity price must be paid because producers usually face:

A. decreasing production costs

B. economies of scale

C. increasing production costs

D. specialisation and division of labour in production

2. Which of the following is NOT part of the government sector to the economy?

A. Federal government

B. State government

C. Firms

D. Municipal government

Read More:

THE REAL ECONOMY

Overview

The real economy refers to all real or non-financial elements of an economy. An economy can be solely described using just real variables. A barter economy is an example of an economy with no financial elements. All goods and services are purely represented in real terms. A barter economy does not require the presence of an underlying monetary system…Read more

The Public Sector

Overview

Public sectors include the public goods and governmental services such as the military, law enforcement, infrastructure, public transit, public education, along with health care and those working for the government itself, such as elected officials.

In Malaysia, the public sector plays a crucial role in its contribution to the GDP and provides a roadmap towards economic development, industrialization, financial planning and performance…Read more

Monetary Policy

Overview

Monetary policy is the use of economic tools by a country’s central bank or other government agency, to control critical economic factors such as money supply, inflation, employment, and economic growth. Monetary policy does not include such political mechanisms as fiscal policy, which is often administered by unrelated government representatives and includes tax policy, infrastructure spending, military operations, etc. Monetary policy must consider the effects of fiscal policy to meet its goals, but the directors of fiscal policy may not need to consider the objectives of monetary policy when making decisions…Read more

The International Sector

Overview

The Malaysian economy is a small but open economy. It is expected to grow between 4 and 5 percent next year, 2024 to RM1.64 trillion after reading an estimated RM1.57 trillion in 2023. Growth will be broad-based, led by sustained domestic consumption and driven by sustained domestic consumption and improved export activities. Malaysia spending bill in 2024 will be whopping RM393.8 billion, 77%t of which will go to paying for emoluments and subsidies among others, under opening expenditure. The subsidy bill is expected to hit RM52.77 billion, despite a planned move towards targeted subsidies…Read more

International Economic

Overview

Being a small and open economy, developments in the international economic arena and general market forces will have an influence on the direction of the Malaysian economy. International markets are further linked through advancement in globalisation, improvement in telecommunications and resources allocation flows around the world…Read more

Economic Analysis And Investment Strategy

Overview

Economic analysis essentially entails the evaluation of costs and benefits. It starts by ranking projects based on economic viability to aid better allocation of resources. It aims at analyzing the welfare impact of a project…Read more

Economic Indicators – Usefulness And Practicality For Market Participants

Overview

Economic analysis essentially entails the evaluation of costs and Now that we have an organisation of how the economy works, it is essential to examine how to use the economic data and indicators. In this part, we will examine how different economic data and indicators can be interpreted to provide a better understanding of the economy. We will also examine other to provide a meaningful picture of the economy. In addition, we will look at how economic indicators relate to investment decisions in the financial markets…Read more