What Is an Economic Indicator?

An economic indicator is a piece of economic data, usually of macroeconomic scale, that is used by analysts to interpret current or future investment possibilities. These indicators also help to judge the overall health of an economy. While there are many different economic indicators, specific pieces of data released by the government and non-profit organizations have become widely followed. Such indicators include but aren’t limited to the Consumer Price Index (CPI), gross domestic product (GDP), or unemployment figures…Read more

Overview

Now that we have an organisation of how the economy works, it is essential to examine how to use the economic data and indicators. In this part, we will examine how different economic data and indicators can be interpreted to provide a better understanding of the economy. We will also examine other to provide a meaningful picture of the economy. In addition, we will look at how economic indicators relate to investment decisions in the financial markets.

Objectives

(a) Provide an understanding of economic indicators

(b) Examine the coverage, significance and reliability of economic indicators; and

(c) illustrate how economic indicators affect financial markets.

The plethora of economic indicators

Types of economic indicators

Economic indicators help provide a reading on the economy’s pulse. Some characteristic of economic indicators are:

(a) Multidimensional (production, prices, interest rates, and employment)

(b) Varied in timing (daily, weekly, monthly and annually)

(c) Sourced from various places; and

(d) Reported by different agencies.

Economic indicator should be combined with information and knowledge on the business cycle or the economic fundamentals (e.g. aggregate supply and demand) framework to be meaningful and useful for financial market participants. Without a framework, we cannot sensibility analyse new information.

Separating the noise from the relevant economic indicators

1. The primary qualities that economic indicators should posses are those of relevance and reliability. Economic indicators should also have:

(a) predictive value: should have some ability in making decisions.

(b) feedback value: provide a basis for consumptions, such as actual

versus forecasts.

(c) timeliness: must be available at a time when decisions are to be made.

(d) verifiability: replicate information by using defined procedures;

(e) neutrality: freedom from bias; and

(f) representational faithfulness: must represent what it purports to represent.

2. Expectation of financial markets: the critical judgement to be made when analysing market behaviour is what are the market’s expectations and why. In financial market language, this is called knowing what has been “discounted” by the market. Major events that are widely anticipated may have absolutely no impact on prices at the time they occur.

3. Revisors of official statistics: in many instances the quality of reported statistics is very poor. Many figures which are closely watched represent aggregates of a number of spending components, each of which is subject to error. Small revisions in one of the components can lead to major changes in the net result, a factor seasoned traders are very familiar with.

4. Challenges: a growing proportion of trade and investment reflects internal decisional made by multinational corporations.

(a) Globalisation: a growing proportion of trade and investment reflects internal decisions made by multinational corporations.

(b) Invisibility: conventional statistics were originally devised for tracking the production of physical goods. A growing slice output consists not only of material things but also of the production of ideas, such as education and finance.

(c) Technology: new goods, shorter product cycles and rapid quality improvements make it harder to measure changes in output and prices over time.

Fundamental analysis, business cycle and financial markets

The fundamental analysis of markets is closely tied to the supply and demand for money. The money supply, in turn, affects the level of interest rates, bond prices and the current markets. Because so many factors influence the supply and demand for money, the reaction of financial markets is somewhat complex.

In general, three major sources of information are important for financial market participants:

(a) Key economic reports issued by the various government agencies and private organisations;

(b) The central bank/monetary authority; and

(c) Ministry of Finance

Major financial markets will focus on different types of key economic indicators. Fixed income markets are concerned with the reports that address the place of economic growth and inflation. The foreign exchange markets also look at these figures, as well as at foreign trade balances.

The share market is affected by economic growth to the extent that it affects earnings. But share prices are also dependent on specific company and industry fundamentals. In addition, changes in interest rates will affect the stock market to the extent that interest rate shifts may cause investors to be more or less attacked to equity relative to bonds.

Prior to the release of an economic report, many of the news agencies will survey the major dealers and other published forecasts. These surveys are an excellent barometer of the financial market participants’ expectations and are built into market prices prior to the report’s release date. But the forecasts are not always accurate. Once the actual figures are released, share prices will adjust quickly to effect new information.

How does the business cycle affect financial markets?

Business activities historically go through waves of expansion followed by waves of contraction. At one stage of the cycle of production, employment and profits rise, which is then followed by another phase when profits, prices and output fall resulting in rising unemployment. Then the entire cycle repeats itself.

In general, during the expansion phase, demand production, income and wealth will experience growth. House and factories are constructed and investments in machinery and equipment take place. House prices, share prices and other assets grow in value. But then comes the inevitable contraction and the forces that had previously caused growth in wealth to go into reverse. Demand, production and income will fall. The amount of house-building and investment in factories are drastically reduced. Assets fall in value as house prices and share prices fall.

The response of financial markets to different stages of the business cycle will depend on whether it is the bond, equity or foreign exchange markets. In general:

(a) Bond market: too much economic activity is bad news as it may force interest rates to go to up. Too little economic activity is good news, as it could result in falling interest rates.

(b) Equity market: economic activity is good news, as long as there is no rise in interest rates. Economic activity increases the likelihood of higher earnings which can be translated into higher dividends. As economic slowdown would have the opposite effect.

(c) Foreign exchange market: if interest rate rise, this is normally good news for the currency as it increases the returns from holding the currency. However, if there are domestic reasons to prevent rising interest rates, such as high unemployment and at the same time there is bad news on the inflation side, then this will be bad news for the currency market. Falling interest rates will normally cause the currency to weaken.

The impact of economic news on financial markets

To illustrate the impact of economic news on financial markets, assume that the unemployment report showed a lower unemployment rate than expected. This would signal stronger business conditions, more consumer income and increased spending – all signs that the economy is heating up. This news would tend to drive interest rates up. Prices and yields move inversely in fixed income markets. Therefore, an increase in interest rates would mean a decrease in bond prices.

At different points in time, the market will tend to favour and follow certain reports over others. For example, if the current concern is centred on inflation, then the CPI and PPI reports will take on more significance.

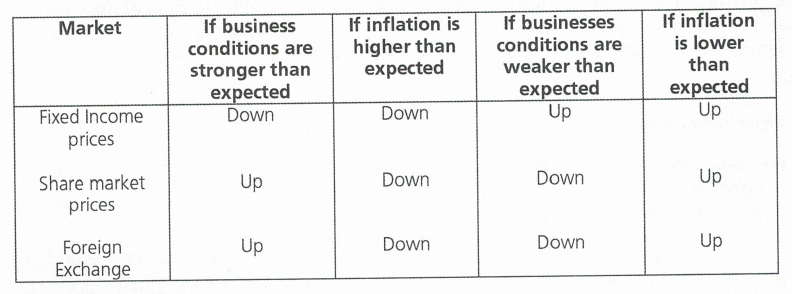

Table 5: Business Condition, inflation and Financial Markets

Economic indicators and financial markets

In trying to assess the significant of economic indicators on financial markets, it is important to understand that each economic indicator provides a piece of information about some aspect of nominal gross product (GNP).

Analysts are concerned about nominal GNP because there is a relationship between nominal GNP and monetary growth. This relationship comes about because as nominal GNP increases there is an increased demand for transactional balances, that is, as income grows we need more cash to spend. Therefore, the growth of the money supply and nominal GNP are related. What is important is that there is an identifiable relationship between the growth rates of nominal GNP and the various monetary aggregates. If something causes nominal GNP to grow more quickly, then it will translate into more rapid growth of money supply. If money supply growth picks up, the central bank will tighten monetary policy by raising interest rates.

As interest rates increase, the price of fixed income securities declines. Nominal GNP comprises real GNP and the GNP deflator, which is proxied by the inflation rate. Lower real GNP growth and lower inflation imply slower nominal GNP growth, which could cause the central bank to ease monetary policy. A central bank easing of the monetary policy would bring about lower interest rates and higher share prices. Fixed income markets thrive when the economy collapses and moves into recession and they suffer when the economy is doing well.

Having stressed the importance of determining how an economic indicator affects nominal GN, it is important to remember that it is not the absolute change in an indicator that is important, but how it compares to market expectations.

Why do market participants look at economic data? Investors must be forward looking and economic data help them forecast. If there is new information on the economy, whether it is demand, profit potential or prices, among other factors, then the underlying value of financial and real investments may shift, changing values, profit projections and plans.

There are a number of time horizons relevant to how market watches evaluate economic data use them for forecasting. The evaluation of various longer-run fundamentals often begins with examining short-run relationships among economic variables. Analysts use economic data to forecast other economic series by observing various behavioural links. One type of economic activity appears to have an impact on another type of economic activity and often with a lag. Some examples of these links are:

(a) Consumer-income and expenditure – An income-expenditure flow analysis of the consumer sector is straight forward. Income is the main driver behind consumer spending (although other factors such as changes in employment and wealth, changes in interest rates and changes in prices play a role as well). Consumer income is dependent on the product of the number of workers, the average number of hours worked and the average wage. An increase in any of these variables will lead to an increase in personal income and in turn personal consumption.

(b) Manufacturing and inventory cycle – The income and expenditure flow plays a more complex role in the manufacturing sector, via the inventory cycle. Changes in consumer spending affect actual and desired inventory levels. When the desired inventory levels differ from actual levels, manufacturers, wholesalers and retailers will make the necessary adjustments to bring the two together. These, in turn will affect consumer income and spending. Essentially , the consumer plays a key role in the inventory cycle.

(c) Construction sector linkages – Just as there are inventory cycle effect in manufacturing, there are similar linkages in the construction sector. An unexpected increase in housing sales will lead to a drop in the supply of houses for sale. If housing stocks decline below desired levels, then builders will take out housing permits, initiate housing below desired levels, then builders will take out housing permits, initiate housing starts and work towards completing houses by making construction outlays.

(d) Price sector linkages – To some degree there are linkages in prices in various sectors of the economy through cost pass-throughs. The cost of crude materials may be passed through to costs for intermediate goods, for producer-determined prices for finished goods and finally on to the consumer. The relationship between the PPI for finished goods and the CPI should be measured using the CPI for goods only. In addition, the length of gross-through from the PPI for finished goods to the CPI is rather short, with most of the impact taking place within the current and following months.

When analysing the components of GNP, we must investigate which regularly published data will best indicate the likely future trend of the economy and their likely impact on financial markets. Economic data are analysed using the following classification system, in order that a consistent analytical framework is adopted.

Nominal GNP = Consumer expenditure + Housing Investment + Business investment + Inventory changes + Government expenditure + Net exports.

(e) Nominal GNP – These reports on quarterly GNP are published by BNM on a 3-month lag. Look at the annualised growth in real expenditure on different sectors and demand components. Financial market behaviour to this economic indicator is restrained as it is usually expected news, with many of the key components having already been published. Financial markets will react to unexpected news.

(f) Consumer price index (CPI) – The CPI is a measure of the prices of a fixed basket of consumer goods and is an indicator for the inflation rate. The CPI is published monthly in a press release from the Department of Statistics in then middle of the month, with a 1-month lag. Publication of the data is usually in the first week of the following month. Financial markets generally await the CPI because it drives much of the activity in the market place. The fixed interest rates will rise and stocks will fall and the value of the ringgit will rise. This is because the rise in interest rates is due to price increases, not economic expansion.

(g) Trade balance – Monthly data on trade balance are published by the Department of Statistics in the second week of the month with a 2-month lag. Focus is on the seasonally adjusted trade numbers. A single month’s trade figures are not a reliable guide to the underlying trend, so take a 3-month moving average at the very least. If the 3-month comparison suggest a change of trend, check to see whether the 6- and 9-month moving averages fit in with the picture. A surplus in the trade deficit is good news for the ringgit, if the ringgit is not pegged. Bond investors are worried whether the trade surplus indicates a faster rate of GDP growth. A faster rate of GDP growth will worry bond investors about the possibility of higher interest rate. The stock market response is that a vtrade surplus indicates faster GDP growth, which is good for earnings and will be positive for the stock market.

(h) Index of industrial production – Monthly data on the trade balance are published by the Department of Statistic in the first week of the month with a 2-month lag. The index of industrial production figures is a set of index numbers which measures the physical output of Malaysian factories, mines and electric utilities. The index is broken down by type of industry (manufacturing, mining or electricity). Focus is on the seasonally adjusted trade numbers. A rise signals economic growth whereas a decline in production indicates contraction. This fixed income participants view a rise in industrial production as a warning of inflationary pressure. This means a possible increase in interest rates, which is bad news for fixed income markets. Participants in the equity and foreign exchange market favour gains in industrial production since they portend economic growth and therefore corporate earnings. Foreign exchange participants look towards higher economic growth as precursors of higher interest rates.

(i) Monetary aggregates – Monthly data on monetary aggregates are published by BNM in the first week of the month with a 2-month lag. These aggregates are important to financial market participants as they indicate the liquidity situation of the economy. Fixed income participants are worried about excessively strong growth in monetary aggregates as it might signal a tightening of monetary policy in the future. Equity market participants prefer strong monetary growth to provide liquidity to stock prices.

(j) Bank Negara Statement of Asset and Liabilities – Published on a fortnight basis by BNM, it provides market participants with an indicator of the level of foreign exchange reserves held by the central bank. This is the best indicator of the overall balance of payments position of the country. Equity market participants look at the increase of reserves as a forward indicator of monetary aggregates and the liquidity situation of the industry.

Exercise:

1. What does “expectation” mean in financial market?

A. Prices are discounted by the market

B. The market adjusts to present set of prices

C. Market participants are certain of future prices

D. Market participants do not know what to expect

Note: The market expectations theory melds into the theory of efficient markets, which asserts that all market pricing already “knows” all of the commercial data that are known. The theory is that market efficiency causes existing market prices to reflect all relevant information at all times…

2. What are the current challenges to official statistics?

A. Globalisation, invisibility and technology

B. All market participants have access to statistics through the internet

C. Leakage of information to market participants before they are released.

D. Coping with the amount of changes

3. What is the impact on the share market and foreign exchange prices when business conditions are stronger than expected?

A. Up

B. Down

C. No relationship

D. No impact

4. If inflation is higher than expected, the prices of fixed income and share market prices will go:

A. Up

B. Down

C. Sideways

D. No relationship

Note: What is inflation? Real more…

5. It is not much the absolute change in an indicator that financial market participants should be concerned about, but:

A. who collects and publishes the information

B. how it compares to market expectations

C. the explanation released by the government agency

D. what the percentage change is

6. The is an identifiable relationship between the economy (nominal GDP) and financial markets via the:

A. trade balance

B. industrial production index

C. money supply

D. auto sales

7. If money supply picks up, the central bank will tighten monetary policy by:

A. reducing exports

B. reducing government spending

C. increasing foreign investments

D. increasing interest rates

8. An easing in monetary policy by the central bank will bring about:

A. lower interest rates and higher share prices

B. lower interest rates and lower share prices

C. higher interest rates and lower share prices

D. no impact on financial markets.

9. The response of financial markets to different stages of the business cycle will depend on:

A. Bond markets

B. Equity markets

C. Foreign exchange market

D. All of the above

10. Economic indicators help provide a reading on the economy’s pulse. Some characteristic of economic indicators are:

A. Multidimensional (production, prices, interest rates, and employment)

B. Varied in timing (daily, weekly, monthly and annually)

C. Sourced from various places; and Reported by different agencies.

D. All of the above