Organisation Chart to Easily Visualize

Your Organization

When it comes to visualizing team structure, hierarchy or the reporting relationships nothing comes close to an organizational chart. It enables employees to find the right person to talk to and at a higher level helps to bottlenecks and growth needs of a company.

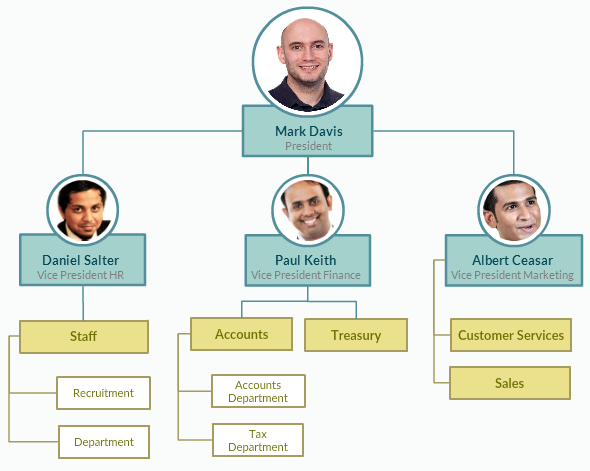

Example of the Company’s Organisation Chart.

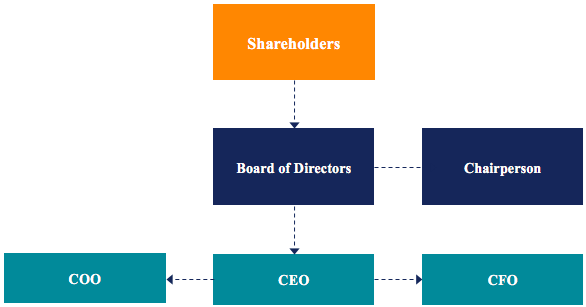

Corporate Governance

A typical organizational structure looks like this:

The CEO is the top operational decision-maker within an organization, but they report to the Board of Directors (BOD). All appointments to (or removals from) the BOD are voted on by shareholders of the company. Conceptually, this is what creates a Corporate Governance function within an organization. The BOD is a safeguard that provides a layer of protection for (and to generally look out for) the rights and interests of stakeholders. This ensures that the CEO – while a highly-coveted title – does not have complete dictatorial control over the entire firm. Driven in large part by the emergence of ESG (Environmental, Social & Governance), the nature of board oversight has evolved. While historically, their sole responsibility was looking out for shareholders (often called shareholder primacy), increasingly, boards are being expected to look out for all stakeholders more broadly, including consumers, employees, suppliers, and the general public.

Chief Executive Officer

A chief executive officer (CEO) is the highest-ranking executive in a company. Broadly speaking, a chief executive officer’sprimary responsibilities include making major corporate decisions, managing the overall operations and resources of a company, acting as the main point of communication between the board of directors and corporate operations. In many cases, the chief executive officer serves as the public face of the company.

Source: https://www.investopedia.com

A chief executive officer (CEO) is elected by the board and its shareholders. They report to the chair and the board, who are appointed by shareholders. A CEO’s role varies from one company to another depending on the company’s size, culture, and corporate structure. In large corporations, CEOs typically deal only with very high-level strategic decisions and those that direct the company’s overall growth. For example, CEOs may work on strategy, organization, and culture. Specifically, they may look at how capital is allocated across the firm, or how to build teams to succeed.

Remarks:

(a) The chief executive officer (CEO) is the highest-ranking person in a company.

(b) While every company differs, CEOs are often responsible for expanding the company, driving profitability, and in the case of public companies, improving share prices. CEOs manage the overall operations of a company.

(c) Across many companies, CEOs are elected by the board of directors.

(d) CEOs of the 350 largest companies in America earn on average $24 million, or 351 times more than an average employee.

(e) Studies suggest that 45% of company performance is influenced by the CEO, while others show that they affect 15% of the variance in profitability.

The Chief Executive Officer is referred to someone who provides leadership for all aspects of the company’s operations with an emphasis on long-term goals, growth, profit, and return on investment. He/She is also responsible to manage and direct the company toward its primary goals and objectives. Oversees employment decisions at the executive level of the company. Leads a team of executives to consider major decisions including acquisitions, mergers, joint ventures, or large-scale expansion. In smaller companies, CEOs often are more hands-on and involved with day-to-day functions. One study from Harvard Business review analyzed how CEOs spend their time. They found that 72% of CEOs’ time was spent in meetings versus 28% alone. Moreover, 25% was spent on relationships, 25% on business unit review and functional reviews, 21% on strategy, and 16% on culture and organization. Some food for thought: the study showed that just 1% of time was spent on crisis management and 3% was allocated to customer relations. Not only that, CEOs can set the tone, vision, and sometimes the culture of their organizations.

Supervisory Responsibilities:

(a) Oversees the ongoing operations of all divisions in the company.

(b) Manages and directs the company toward its primary goals and objectives.

(c) Oversees employment decisions at the executive level of the company.

(d) Leads a team of executives to consider major decisions including acquisitions, mergers, joint ventures, or large-scale expansion.

(e) Promotes communication and cooperation among divisions to create a spirit of unity in the organization.

Duties/Responsibilities:

(a) Works with the board of directors and other executives to establish short-term objectives and long-range goals, and related plans and policies.

(b) Presents regular reports on the status of the company’s operations to the board of directors and to company staff.

(c) Oversees the organization’s financial structure, ensuring adequate and sound funding for the mission and goals of the company.

(d) Reviews the financial results of all operations, comparing them with the company’s objectives and taking appropriate measures to correct unsatisfactory performance and results.

(e) Ensures the company’s compliance with all applicable laws, rules, regulations, and standards.

(e) Negotiates with other companies regarding actions such as mergers, acquisitions, or joint ventures.

(f) Serves as the company’s representative to the board of directors, shareholders, employees, customers, the government, and the public.

(g) Performs other related duties to benefit the mission of the organization.

Required Skills/Abilities:

(a) Excellent managerial and financial skills and the ability to take leadership over any business operations area.

(b) Superlative communication skills, particularly the ability to communicate as a leader.

(c) Thorough understanding of management and financial practices in all areas and phases of business operations.

Education and Experience:

(a) Extensive professional experience in leadership roles.

(b) Education may vary; an advanced degree in business administration, finance, or law is preferred, but not required.

Physical Requirements:

(a) Prolonged periods sitting at a desk and working on a computer.

(b) Must be able to lift up to 15 pounds at times.

(c) Must be able to navigate various departments of the organization’s physical premises.

Salary guides:

Salary range/Kuala Lumpur: RM 11,750 toRM 14,250.

Reference: www.jobstreet.com.my/career-advice

Chief Operating Officer

The chief operating officer (COO) is a senior executive tasked with overseeing the day-to-day administrative and operational functions of a business. The COO typically reports directly to the chief executive officer (CEO) and is considered to be second in the chain of command. In some corporations, the COO is known by other terms, such as “executive vice president of operations,” “chief operations officer,” or “operations director.”

Source: https://www.investopedia.com/

A chief operating officer (COO) is the corporate executive who oversees ongoing business operations within the company. The COO reports to the chief executive officer (CEO) and is usually second-in-command within the company. He/She is a senior executive tasked with overseeing the day-to-day administrative and operational functions of a business. The COO typically reports directly to the chief executive officer (CEO) and is considered to be second in the chain of command. In some corporations, the COO is known by other terms, such as “executive vice president of operations,” “chief operations officer,” or “operations director.”

Remarks:

(a) The chief operating officer (COO) is a senior executive tasked with overseeing the day-to-day administrative and operational functions of a business.

(b) The COO typically reports directly to the chief executive officer (CEO) and is considered to be second in the chain of command.

(c) Depending on the CEO’s preference, the COO often handles a company’s internal affairs, while the CEO functions as the public face of the company, and thereby handles all outward-facing communication.

(d) Skills required to be a COO include strong analytical, managerial, communication, and leadership skills.

(e) There are generally seven different types of COOs that are best suited for different situations and different companies.

Understanding a Chief Operating Officer (COO)

The COO mainly focuses on executing the company’s business plan, according to the established business model, while the CEO is more concerned with long-term goals and the broader company outlook. In other words, the CEO devises plans, while the COO implements them.

For instance, when a company experiences a drop in market share, the CEO might call for increased quality control, in order to fortify its reputation among customers. In this case, the COO might carry out the CEO’s mandate by instructing the human resources department to hire more quality control personnel. The COO may also initiate the rollout of new product lines, and may likewise be responsible for production, research and development, and marketing.

The Role of a Chief Operating Officer (COO)

Depending on the CEO’s preference, the COO often handles a company’s internal affairs, while the CEO functions as the public face of the company, and thereby handles all outward-facing communication. Instead of having one or two skill sets, most successful COOs have multifaceted talents, enabling them to adapt to different tasks and solve a range of issues.

In many cases, a COO is specifically chosen to complement the skill sets of the sitting CEO. In an entrepreneurial situation, the COO often has more practical experience than the founding CEO, who may have come up with an excellent concept, but lacks the start-up know-how to launch a company and manage its early stages of development.

Consequently, COOs often design operations strategies, communicate policies to employees, and help human resources (HR) build out core teams.

Types of Chief Operating Officers (COOs)

Every company is different and in a different stage of growth. A new company will have very different needs than a company that has been around for 100 years and has a large market share of its industry. Depending on the company, its needs, the stage of its cycle, and the characteristics of the specific company, it will require a specific type of COO to help it realize its goals.

There are generally seven (7) types of COOs:

(a) The executor, who oversees the implementation of company strategies that are created by senior management and has the responsibility of “delivering results on a day-to-day, quarter-to-quarter basis”.

(b) The change agent, who spearheads new initiatives (This COO is brought on to “lead a specific strategic imperative, such as a turnaround, a major organizational change, or a planned rapid expansion.”).

(c) The mentor, who is hired to counsel younger or newer company team members, mainly young CEOs.

(d) An “MVP” COO who is promoted internally to ensure that they don’t defect to a rival company.

(e) The COO, who is brought in to complement the CEO (This is a person who has the opposite characteristics and abilities as the CEO.)

(f) The partner COO, who is brought in as another version of the CEO.

(g) The heir apparent, who becomes the COO to learn from the CEO, in

order to ultimately assume the CEO position.

Qualifications for a Chief Operating Officer (COO)

A COO typically has extensive experience within the field in which a given company operates. COOs often work for at least 15 years, climbing the corporate ladder. This slow build helps prepare COOs for their roles, by letting them cultivate extensive experience in the practices, policies, and procedures of their chosen field.

Also, because they’re traditionally responsible for directing multiple departments, COOs must be resourceful problem solvers and must possess strong leadership skills. Educationally, COOs typically at a minimum hold bachelor’s degrees, while often also holding Master’s in Business Administration (MBA) degrees and other certifications.

Examples of a Chief Operating Officer (COO)

Ray Lane (Oracle)

Oracle is a technology firm that began in 1977. It sells database software, cloud technology, management systems, and a variety of other products. Oracle had been performing well as a company but then hit a growth cap and couldn’t increase annual revenue past $1 billion for a period of time.

In 1992, Larry Ellison, then CEO and now executive chair and CTO, brought in Ray Lane to turn the company’s fortunes around. Lane joined as Senior Vice President and President of Oracle USA. He became COO in 1996.

When Lane came on board, he integrated packaged software and high-margin professional service. In this aspect, he was selling two products in one cycle, increasing revenues from one sale. And according to him, because the people providing the professional service were experts on the product, the company could charge a high price for it resulting in a high margin.

In 1992, Oracle had sales of $1.8 billion and profits of $61.5 million. In 1997, it had $5.7 billion in sales and profits of $821.5 million.

In 1999, Lane received a salary of $1 million and a $2.25 million bonus. He was also given 1.125 million in stock options, at the time valued between $11.8 million and $30 million.

What is a COO?

A chief operating officer (COO) is an executive member of a firm that is tasked with managing the day-to-day operations and administrative functions of the firm.

What is a COO in government?

COOs are not common in government, though some governors have COOs that serve the same function in a company: to manage the day-to-day operations of the governor’s office.

What is the difference between a CEO and COO?

A CEO is the top-most ranking person at a firm that is responsible for the long-term health and direction of the firm while a COO is the second-highest individual in the firm that reports to the CEO and is responsible for the day-to-day operations of the firm.

What does it take to be a COO?

COOs have a strong educational background combined with extensive work experience. A strong COO will have worked in a variety of positions, particularly in a specific organization, to understand all of the different parts of a business and how they work together. This allows them to pinpoint specific issues and gaps within the organization. Having experience managing people and teams is also imperative to be a COO. In addition, COOs should be great at communication, flexible, and strong leaders.

How much money does a COO make?

The salary of a COO will vary greatly depending on a variety of factors. These factors include the company they work for, their experience, and their contract. According to PayScale, as of March 1, 2022, the average COO salary is $144,996. The base salary ranges from $74,000 to $246,000. On top of that, COOs are paid bonuses and profit-sharing plans.

The Bottom Line

A COO is the CEO’s right-hand person and the second-highest in command at a firm. The COO is responsible for the day-to-day operations of a firm and for assisting the CEO in a variety of tasks. Not all firms require a COO; however, those that do often benefit from the specific skill set that a COO brings to a company, such as strong analytical, organizational, and communication skills.

Salary guides:

Salary range/Kuala Lumpur: RM 12,750 to RM 15,250.

Reference: www.jobstreet.com.my/career-advice

Financial/Finance Department

A Financial Advisor/Financial Consultant

A Financial Advisor, or Financial Consultant, is responsible for providing businesses and individuals with sound advice regarding their financial planning and investments. Their duties include meeting with clients to establish their needs and obtain financial statements, using financial statements and legislation to develop financial plans to maximize profitability or reduce debts and researching investment opportunities for clients. Financial advisors help the companies/clients understand their current financial situation and develop plans that help those people meet their short- and long-term financial goals. People work with financial advisors when they want to figure out how to pay for college, save for retirement, start investing, or have more capital available to meet regular expenses. It’s not unusual for financial advisors to see a lot of clients who are preparing for major life changes like marriage, divorce, job transitions, or the birth of a child (all of which can impact individual and household finances). Many financial advisors are licensed to buy and sell financial products—and in some cases, that may be their main gig. Sometimes bankers, insurance brokers, security analysts, and other financial professionals call themselves financial advisors when they don’t actually spend much time advising clients. Financial consultants are personal financial advisors that help people build wealth by designing comprehensive, long-term financial strategies. They look at personal finance the same way analysts look at large financial systems, and the work they do involves strategizing, designing action plans, and accountability. Some financial consultants offer financial planning services, but most are heavily involved in the buying and selling of investments and otherwise turning complicated financial concepts into actionable strategies. This can involve working closely with accountants, investment managers, and other professionals. They also spend a lot of time educating their clients. They may host seminars or events or share relevant news items with clients in a regularly published newsletter. Financial consultants tend to work with clients over the long term, developing and then maintaining relationships.

A financial/finance department is the unit of a business responsible for obtaining and handling any monies on behalf of the organization. The department controls the income and expenditure in addition to ensuring effective business running with minimum disruptions.

Source: https://www.indeed.com/career-advice

Besides the traditional roles of handling the payroll, income and expenses, finance department responsibilities also include economic analysis to improve key business strategies. A finance department has specific responsibilities to carry out daily. Its primary functions include:

1. Accounting – Daily account record keeping is a finance department function that entails reconciling a company’s financial registers to make suitable business decisions. Through bookkeeping and income statement preparations, the unit supports the management in filing requisite financial data that’s useful in managing funds.

2. Examining financial statements and reporting – By analyzing a company’s financial statements, the finance department evaluates economic trends, identifies its future investment and cultivates long-term business plans. It uses and synthesizes financial analysis information to assist in business decision-making. Related: Financial Reports vs. Financial Statements: Key Differences

3. Preparing and forecasting budgets – The finance department plans and implements the company’s financial year budget. The department also conducts research and collects data that assists in the organization’s temporary and permanent financial forecast. The information is essential in planning and providing informed decisions critical to expansion, such as staff training and asset procurement.

4. Managing operations systems – The finance department plays a significant part in acquiring, updating and maintaining the latest operations systems to improve efficiency. A systems change may include automation of various functions or digitalization of some organization’s system.

Depending on a company’s activities and your skill set, you can work in any of the following finance department roles (job within the finance department):

Accountant – He/She prepares financial statements and documents monetary transactions and income statements. The accountant role has a seniority hierarchy, with the accounting manager being the topmost in the ranks.

Auditor – An auditor’s primary role is to evaluate the documents prepared by the rest of the teams and authenticate their accuracy. They identify all insufficiencies and mistakes for accountability.

Budget Analyst – He/She is skilled in preparing and maintaining a balanced budget throughout the year. They plan for the future financial responsibilities of the business.

Financial Controller – is referred to as comptroller, they oversee the activities performed by other finance roles, such as auditing and accounting. The finance controller audits and prepares financial reports on tax compliance and risk management, among other financial document.

Finance Administrator – He/She helps plan and verify business documents for completeness. They also manage cash flows, prepare budgets and present reports to management for advisory and accountability purposes.

Payroll officer – He/She prepares documentation related to employees’ salaries, taxation, commissions and any other benefit for timely and accurate payment.

A treasury Analyst – He/She analyzes the transaction and investment accounts to evaluate expenses and advise management on how they can best minimize costs.

Treasury Department

Treasury is a key finance function that is vital to the financial health and success of every business, large or small. Treasury involves the management of money and financial risks in a business. Its priority is to ensure the business has the money it needs to manage its day-to-day business obligations, while also helping develop its long term financial strategy and policies.

Where do treasury professionals work?

Treasury offers a diverse career in finance with lots of opportunities. You could be working anywhere around the world, and for any type of business, from large global organisations, not for profit and government departments, to start-ups and small and medium sized enterprises (SMEs).

The treasury function will vary depending on the size and nature of each business. Whatever business or type of organisation, treasury activities will always exist even if there is no treasurer or treasury department.

Large businesses

Large and multi-national businesses (such as FTSE 100 companies) are likely to have a team of treasury professionals across multiple regions and countries that operate as part of a wider finance division.

Small businesses

In small businesses sand start-ups, treasury will not be a standalone role/function. Instead staff in the finance team will carry out specific treasury activities as part of their day-to-day responsibilities. Senior management may also be familiar with some treasury activities, and will know when to seek out expert advice as it’s needed. For example, if the owner needs to raise more money to grow the business, he’ll need advice from a treasury professional.

What do treasury professionals do?

As a treasury professional you’re essentially a trusted advisor to the business on financial matters, always looking forward and planning how you can add value and drive success. The decisions you make will have a direct impact on performance and profits.

Your role is about managing the money and financial risks in a business. This involves making sure the business has the capital it needs to manage its day-to-day business obligations, while helping develop its long term financial strategy and policies. You’ll do this by focusing on how and where to put money – while managing any associated risks – to add value and drive business success.

Every business takes risks. It’s the treasury professional’s role to identify, assess and manage these risks so they support the business’s objectives. You’ll also help to identify and create new opportunities that could benefit the business.

Treasury in action – some examples:

(a) A business wants to expand its operations into a new region, which will generate significant revenue and create a competitive advantage. Your role is to assess the risk, weigh up the pros and cons and determine if this is a good move for the business. If it is, you’ll develop and implement a financial strategy that supports the business expansion.

(b) Economic factors such as interest rate rises, changes in regulations and volatile foreign exchange rates can have a serious impact on any business. Your role is to monitor and assess these market conditions, determine how these external factors could or will impact the business; and put strategies in place to mitigate any potential financial risks to the business.

What career opportunities are there for treasury professionals?

The treasury recruitment landscape is currently very positive. Over the last few years there has been a marked pick-up in recruitment at all levels including an increasing number of opportunities for graduates, with more organisations now looking to place talent at entry level direct from university.

You can expect to be well rewarded, highly valued for your expertise and gain real satisfaction from knowing what you do can make a real difference to the success of any business. Whether you want to work for large multi-national organisation, a charity, government agency or a start-up, treasury offers a diverse and lucrative career that can set you on the path to the most senior roles in business and finance and open up doors to international opportunities. Adding a recognised ACT qualification and membership to your CV can further enhance your employability by demonstrating your commitment to achieving and maintaining the highest professional standards. It can also give you a valuable edge in a competitive marketplace.

From entry level to board level, there are a huge variety of roles and job titles that include aspects of treasury. Some of these include:

(a) Treasury analysts, treasury dealers and treasury accountants

(b) Risk managers and cash managers

(c) Credit risk and financial analysts

(d) Group treasurers, head of treasury operations and tax directors

(e) Relationship managers and transaction services analysts

(f) Finance directors, financial controllers

(g) Managing directors, company secretaries

(h) Small business owners and entrepreneurs

(i) Non-executive directors

(j) Chief financial officers (CFOs) and Chief executive officers (CEOs)

How much do treasury professionals earn?

Salaries vary depending on the size, location and nature of the business. The role and your level of experience will also influence how much you are paid. Professional qualifications can also make a real difference in terms of earnings potential, eligibility for promotion and the speed at which you progress. Recruiters Brewer Morris and Hays are seeing increased demand for ACT qualifications which they say make candidates more marketable. Broadly speaking, salaries for graduate and assistant level roles will start from £25,000 per year. In senior roles such as group treasurer you can earn from £100,000 per year. Bonuses and benefits packages may also be provided. Broad salary expectations based on recruiter Hays 2015 salary survey for key treasury roles at different levels of seniority within FTSE 100/250 companies and Small and Medium Size Enterprises (SMEs) across London and the UK can be seen on the ACT Competency Framework overview by job level.

Chief Financial Officer

A Chief Financial Officer (CFO) is a senior executive responsible for managing the financial actions of their company. They are often in charge of tracking cash flow, analyzing strengths/weaknesses in the company’s finances and overseeing all aspects of its financial success.

https://www.investopedia.com

The term chief financial officer (CFO) refers to a senior executive responsible for managing the financial actions of a company. The CFO’s duties include tracking cash flow and financial planning as well as analyzing the company’s financial strengths and weaknesses and proposing corrective actions. The role of a CFO is similar to a treasurer or controller because they are responsible for managing the finance and accounting divisions and for ensuring that the company’s financial reports are accurate and completed in a timely manner.

Remarks:

A chief financial officer is a top-level executive.

(a) The CFO is a financial controller who handles everything relating to cash flow, financial planning, and taxation issues.

(b) A CFO is often the highest financial position and the third-highest position in a company, playing a vital role in the company’s strategic initiatives.

(c) Financial reports completed under a CFO must adhere to financial standards.

(d) People interested in becoming a CFO must have an academic and professional background in finances, economics, and/or analysis.

How Chief Financial Officers (CFOs) Work?

The chief financial officer is a member of the C-suite, a term used to describe the most important executives in a company. Alongside the CFO, these roles include the chief executive officer (CEO), the chief operating officer (COO), and the chief information officer (CIO).

Becoming a CFO requires a certain degree of experience in the industry. The majority of people who end up in this position have advanced degrees and certifications, such as a graduate degree in finance or economics, and the Chartered Financial Analyst (CFA) designation. It also helps to have a background in accounting, investment banking, or analysis.

The CFO reports to the CEO but remains one of the key personnel in any company. In the financial industry, it is a high-ranking position, and in other industries, it is usually the third-highest position in a company.

People in this role have significant input in the company’s investments, capital structure, and how the company manages its income and expenses. This corporate officer may assist the CEO with forecasting, cost-benefit analysis, and obtaining funding for various initiatives.

The CFO also works with other senior managers and is a vital participant in a company’s overall success, especially when it comes to the long run. For instance, when the marketing department wants to launch a new campaign, the CFO may help to ensure the campaign is feasible or give input on the funds available for the campaign. A CFO can become a CEO, COO, or they can assume the role of company president.

What Does a CFO Do?

The CFO’s role is twofold: Oversee the organization’s financial activities, including being responsible for the finance and accounting professionals who perform operational functions, and serve in a strategic advisory role for the CEO and C-suite peers. Brainyard’s Winter 2021 Survey shows how finance and business leaders rank success factors and how those priorities have changed over time. Meeting revenue and earnings goals and keeping cash flow stable are clearly in the CFO’s purview. Finance chiefs also advise department heads across the organization, assisting them in both maximizing revenues, if they serve in a revenue-generating capacity, and controlling expenses without sacrificing customer or employee satisfaction or the company’s reputation. The CFO helps select skilled staff for the finance team and works with departments to allocate budget for human capital management. CFOs put complex data — current, past and predicted financial results — in perspective and help the CEO make sound financial decisions: Should we introduce this new product or service? Can we afford to on-shore our supply chain? What are the tax implications of our employees working from anywhere?

Special Considerations: The CFO must report accurate information because many decisions are based on the data they provide. The CFO is responsible for managing the financial activities of a company and adhering to generally accepted accounting principles (GAAP) adopted by the Securities and Exchange Commission (SEC) and other regulatory entities. CFOs must also adhere to regulations such as the Sarbanes-Oxley Act that include provisions such as fraud prevention and disclosing financial information.

Local, state, and federal governments hire CFOs to oversee taxation issues. Typically, the CFO is the liaison between local residents and elected officials on accounting and other spending matters. The CFO sets financial policy and is responsible for managing government funds.

The Benefits of Being a CFO: The CFO role has emerged from focusing on compliance and quality control to business planning and process changes, and they are a strategic partner to the CEO. The CFO plays a vital role in influencing company strategy.

The United States is an international financial hub and global economic growth increases employment growth in the U.S. financial industry. Companies continue to increase profits leading to a demand for CFOs. The Bureau of Labor Statistics (BLS) predicts the job outlook for financial managers to grow 15% between 2019 and 2029. The average annual salary for a financial manager was $134,180 in 2020.

Is a CFO an Accountant? Generally, no, a CFO is not the same as an accountant. Accountants handle bookkeeping tasks and tax filings. Meanwhile, a CFO focuses on the company’s financial future, creating forecasts.

What Is the Average Salary of a CFO? The average salary of a CFO, according to PayScale, is roughly $140,000.

What Is the Highest CFO Salary? The highest-paid CFO for fiscal year 2020 was Comcast’s Michael J. Cavanagh, whose salary was $2.39 million.

How Do You Become a CFO? Generally speaking, the CFO position is reserved for very experienced professionals with established track records in their field. CFOs are generally equipped with advanced educational designations, such as a Master of Finance or Chartered Financial Analyst (CFA) designation. Many CFOs have professional backgrounds in fields such as accounting, investment banking, or financial analysis. For financial professionals, the CFO is among the most prestigious and highly-paid positions available in a firm.

Are a CEO and a CFO the Same Thing? No, a CEO and a CFO are not the same thing. However, CFOs are required to work closely with the other senior executives of a company, such as the CEO. These executives are sometimes referred to as the C-Suite of the company, representing the company’s highest level of decision-making. Although the CFO is typically subordinate to the CEO in the corporate hierarchy, CFOs will generally be the foremost decision-maker on all matters within the Finance department of their firm.

The Bottom Line: The CFO is the top ranking executive related to managing a company’s finances. This includes managing all aspects of financial and cash flow planning, as well as analyzing its financial position. A CFO is comparable to a treasurer or controller. However, unlike a controller or accountant, a CFO is responsible for financial planning, while the other two are in charge of bookkeeping and the company’s financial statements.

CFO Responsibilities

Liquidity

Liquidity refers to an organization’s ability to pay off its short-term liabilities — those that will come due in less than a year — with readily accessible, or liquid, funds. Liquidity is usually expressed as a ratio or a percentage of what the company owes against what it owns.

CFOs are concerned with ensuring that customer payments are made in full and on time and controlling expenses so that enough cash is on hand to meet financial obligations.

Return on investment (ROI)

Part of a CFO’s strategic focus is on ensuring a strong return on investment (ROI) for their organizations. ROI is a measure of the likelihood of receiving a return on dollars invested and the precise amount of that return. As a ratio, it looks at the gain or loss of an investment as a percentage of the cost.

Because ROI is a relatively basic KPI that does not account for all variables — net present value, for example — CFOs add context to evaluate whether a project will deliver sufficiently robust ROI to be worth the investment.

Forecasting

Importantly, CFOs don’t only report what is — a significant part of their value to an organization is their ability to accurately predict likely future outcomes. That includes financial forecasting and modeling based not only on the company’s past performance but on internal and external factors that may affect revenue and expenses. The CFO is tasked with making sense of the various departmental level forecasts to create profit projections for the CEO and shareholders.

Internal factors include sales trends, labor and HR-related costs, the price of raw materials and more, while external data inputs could include opportunity cost for capital, shifts in market demand, emerging competitors and advances in technology.

To monitor the external environment, CFOs may rely on government data, analyst firms and business and general media, supplemented with insights gleaned through trade and association memberships and the input of board members, lenders and others.

Reporting

Financial reports including balance sheets and P&L and cash flow statements help both internal leaders and external stakeholders understand the financial state of the business, and it’s up to the CFO to attest that these statements are accurate and complete in accordance with generally accepted accounting principles (GAAP).

Although private companies are required to file financial reports with the SEC only if they have $10 million or more in assets and 500 or more shareholders, many businesses create these statements anyway so they’re available should the company seek a bank loan or venture capital or equity funding.

Members of the CFO’s Team

The key duties of the CFO position vary depending on the size of the organization, its industry and whether it’s a public or private company but generally fall into three broad functional areas: controller, treasury and strategy and forecasting. Organizations may have professionals overseeing some or all of these roles and reporting to the CFO.

Controller: Controllers run day-to-day accounting and financial operations and often hold a CPA or MBA. They are responsible for creating reports that provide insights into a company’s financial standing, including accounts receivable, accounts payable, inventory and payroll.

Treasury: The treasurer is responsible for the company’s liquidity, debt and assets. That includes any investments the company may have, whether physical assets, such as buildings and equipment, or financial investments.

Strategy & forecasting:

Strategy and forecasting involves using available data and reports, both internal and external, to advise on areas including product development, market expansion, human capital management, M&A and capital investments. It’s also where structured planning and forecasting exercises, like scenario planning and FP&A, fall. Controllers, treasurers and FP&A analysts are invaluable members of the team, but in all these areas, the buck stops at the CFO’s desk.

Salary guides:

Salary range/Kuala Lumpur: RM 11,750 to RM 14,250.

Reference: www.jobstreet.com.my/career-advice

Human Resources (HR) Department

Human Resource (HR) Advisor/Consultant

The role of a human resource advisor includes a wide range of responsibilities. These responsibilities can vary based on an individual’s specific job, company, or industry.Here are some general human resource advisor responsibilities: (a) Provide professional HR advice on issues regarding compensation for proposal planning, (b) Intake, recommendation of performance management including attendance or behavior ww, pip’s, shared commitment options, mutuals, coaching, difficult conversations, feedback. Assesses risk identifies enterprise wide trends supports difficult conversations, understanding feedback/performance management, difficulty with managers, and (c) Monitor workforce for developing or actual employee trends, issues. Human resources consultants ensure that an organization’s human capital serves the best interests of the company. By creating and developing a human resources model specific to the organizations that hire them, human resources consultants work to ensure that the company is effectively using its personnel to achieve its stated goals, while also ensuring the workforce is operating at a high level of productivity and efficiency.

Human resources managers are an important part of the work culture of an organization. They’re in control of the creation and development of programs that improve the performance of employees and the output they produce. Also, they’re in charge of strategizing with the executive management team on goals and provide status updates when necessary.

Source: https://www.indeed.com/

A human resources department is focused on the recruiting and retention of employees within a company. HR typically finds, hires (and fires), and trains employees. It oversees employee relations. It manages benefit programs. It’s the place an employee goes with questions about their position at the company, to address concerns, and to air grievances.

Human resources (HR) is the division of a business that is charged with finding, screening, recruiting, and training job applicants. It also administers employee-benefit programs. HR plays a key role in helping companies deal with a fast-changing business environment and a greater demand for quality employees in the 21st century.

An HR department is an essential component of any business, regardless of an organization’s size. It is tasked with maximizing employee productivity and protecting the company from any issues that may arise within the workforce.

HR responsibilities include compensation and benefits, recruitment, firing, and keeping up to date with any laws that may affect the company and its employees.

Key HR Activities

Research conducted by The Conference Board, a member-driven economic think tank, found six key, people-related activities that HR must effectively do to add value to a company. They are:

(a) Managing and using people effectively

(b) Tying performance appraisal and compensation to competencies

(c) Developing competencies that enhance individual and organizational performance.

(d) Increasing the innovation, creativity, and flexibility necessary to enhance competitiveness

(e) Applying new approaches to work process design, succession planning, career development, and inter-organizational mobility.

(f) Managing the implementation and integration of technology through improved staffing, training, and communication with employees.

There are numerous, important human resources functions carried out by an HR Department. Five well-known types of these responsibilities could include:

(a) Recruiting, hiring, and onboarding new employees

(b) Handling employee compensation and benefits

(c) Offering employee job/career development

(d) Addressing work-related issues of individual employees

(e) Developing policies that affect a working environment company-wide

Human Resources (HR) Manager

Human resource managers plan, direct and coordinate the administrative functions of an organization. They oversee recruiting, interviewing and hiring of new staff as well as training for current staff. Human resource managers play an important role in strategic planning and serve as a liaison between administrative staff and employees.

HR Manager Daily Tasks

(a) Coordinate and supervise the work of the human resource staffs.

(b) Meet with other department heads to collect information about their staffing and training needs.

(c) Plan and oversee employee benefit programs.

(d) Mediate disputes between employees and direct disciplinary procedures.

(e) Supervise recruitment, interviews, selections, hiring and training.

Generally, human resource managers are on the frontlines of building the staff needed to help an organization succeed. This includes working with administrative staff to maximize the value of the employees and to ensure that everyone is working as productively and efficiently as possible. Human resource managers usually direct the administrative functions of the human resource departments in larger organizations. In the largest corporations, there are specialty human resource managers who work in different areas of HR like compensation and benefits, training and recruitment.

HR Career Growth: Employment for human resource managers is projected by the Bureau of Labor Statistics to grow about 9 percent by 2024. This is faster than the average for all occupations in the United States. Human resource managers are needed to help organizations and companies evolve to meet the different work styles and ethics of the newer generation. Human resource managers are needed to make sure their companies adhere to changing and complex employment laws.

HR Manager Salary Potential: The median annual salary of a human resource manager is $104,440. HR managers who work in the management of companies and enterprises have the highest earning potential at $118,320. HR managers in the professional, scientific and technical services industry and manufacturing industry can make $117,640 and $100,710 respectively.

Human Resources Manager Degrees: Typically, a human resource manager needs at least a bachelor’s degree in order to acquire entry-level employment. However, some companies require a graduate degree like a Master of Science in Human Resource Management. Graduates with a master’s degree in human resource management are better prepared to advance in their careers because they are equipped with relevant skills including ethics, training and development, managing culture and morale and organizational strategy.

HR Consulting Services – Q&A

What Does HR Consultancy Do?

HR consultants offer professional HR consultation services and even sometimes handle the complete process of roles like recruitment, Business research, organization Management, workplace management, Capital Management, and many more.

Is HR Consulting Services Cost Effective?

Hiring a full-time HR to take over the complete company process can be very costly and time-consuming because you have to hire an experienced HR for handling the complete HR workload for your organization. Else it will affect your company’s structure and may result in errors and unwanted fines. But an HR consultant will take care of the complete process at a very affordable rate.

Why Do Companies Hire HR Consultants?

Hiring an HR consultant can effectively improve your company’s growth and gives you more time on handling the work which matters most. And also, companies have to keep updated with the latest federal and state laws related to workforce engagement, outsourcing to an HR consultant can be very useful.

Salary guides

HR Director.

A HR Director oversees the HR personnel of an organization. They direct and oversee the implementation of HR policies such as change management, employee benefits and personnel development. They set the overall HR direction and are responsible for the HR strategies in an organization.

Salary: RM 8,750 – 11,250.

Reference: www.jobstreet.com.my/career-advice

HR Manager.

A HR Manager oversees all the processes and practices involved in human resources. They develop and maintain the HR procedures, practices and strategies of an organization in order to nurture a healthy work environment. They also serve as a bridge between an organization’s management and its employees.

Salary range/Kuala Lumpur: RM 5,750 – 8,250

Reference: www.jobstreet.com.my/career-advice

HR Executive.

A HR Executive handles the daily operation in human resources. They deal with HR matters such as recruitment, employee benefits and payroll. They liaise with respective departments on various HR matters such as recruitment and disciplinary issues. They also play a role in the training and development of personnel in an organization.

Salary range/Kuala Lumpur: RM 2,900 – 3,800.

Reference: www.jobstreet.com.my/career-advice

Admin Executive.

Admin Executives usually serve as a point of contact for business administration and office matters. They handle the requests and inquiries involving the office and general business operation. Besides general business administration, they may handle tasks related to sales support, procurement and human resources.

Salary range/Kuala Lumpur: RM 2,800 to RM 3,800.

Reference: www.jobstreet.com.my/career-advice

Key Highlights

Chief Executive Officer (CEO)

(a) The CEO is the highest-ranking employee within any organization; they report to the Board of Directors.

(b) Core responsibilities include setting and executing the organization’s strategy, allocating capital, and building and overseeing the executive team.

(c) CEOs must possess strong communication skills, great leadership acumen, and unrivaled passion for the organization and its people.

(d) CEOs also sometimes serve as the Chair of the Board of Directors, but this can pose a potential conflict of interest.

Chief Operating Officer

(a) The chief operating officer (COO) is a senior executive tasked with overseeing the day-to-day administrative and operational functions of a business.

(b) The COO typically reports directly to the chief executive officer (CEO) and is considered to be second in the chain of command.

(c) Depending on the CEO’s preference, the COO often handles a company’s internal affairs, while the CEO functions as the public face of the company, and thereby handles all outward-facing communication.

(d) Skills required to be a COO include strong analytical, managerial, communication, and leadership skills.

(e) There are generally seven different types of COOs that are best suited for different situations and different companies.

Chief Financial Officer

(a) What informs the need for a CFO is less company size than a desire for a strategic adviser with deep financial expertise.

(b) CFOs are captains of a team that covers both accounting and finance and consists of senior leaders, such as controllers and VPs of finance, and operational staff — accountants, bookkeepers, tax specialists, data analysts.

(c) Serving as a CFO requires a background in accounting or finance and an advanced business degree, generally including an MBA. But it also takes plenty of soft skills.

Public Relations Officer

A Public Relations Officer responds to requests for information from media outlets. They aim to maintain the positive image of an organization or client. Developing PR strategies and campaigns. Preparing press releases, keynote speeches and promotional material. Building positive relationships with stakeholders, media and the public

Job brief

We are looking for a Public Relations (PR) Officer to organize and oversee PR activities and ensure effective communication with stakeholders, media and the public.

As a PR Officer, you should be an organized and cool-tempered professional who is able to handle a crisis. We expect you to have a creative mind and excellent communication skills. If you are also confident in your public speaking and project management abilities, we’d like to meet you.

Your goal will be to cultivate a positive company image.

Responsibilities

Develop PR campaigns and media relations strategies

Collaborate with internal teams (e.g. marketing) and maintain open communication with senior management

Edit and update promotional material and publications (brochures, videos, social media posts etc.)

Prepare and distribute press releases

Organize PR events (e.g. open days, press conferences) and serve as the company’s spokesperson

Seek opportunities for partnerships, sponsorships and advertising

Address inquiries from the media and other parties

Track media coverage and follow industry trends

Prepare and submit PR reports

Manage PR issues

Requirements and skills

Proven experience as a Public Relations Officer or similar PR role

Experience managing media relations (online, broadcast and print)

Background in researching, writing and editing publications

Proficient in MS Office and social media

Familiarity with project management software and video/photo editing is a plus

Strong communication ability (oral and written)

Excellent organizational skills

Ability to work well under pressure

Creativity and problem-solving aptitude

BSc/BA in Public Relations, Journalism, Communications or a related field

Frequently asked questions

What does a Public Relations Officer do?

A Public Relations Officer has a positive public opinion of an organization and increased brand knowledge as their first concern. They access and monitor their client’s online presence to prepare the right message to convey. They can also coach clients on the importance of self-image and how to communicate with the media. A Public Relations Officer aims to positively handle and communicate information internally and externally.

What are the duties and responsibilities of a Public Relations Officer?

A Public Relations Officer responds to requests for information from media outlets. They aim to maintain the positive image of an organization or client. To that end, they can write marketing materials like newsletters, social media posts, and press releases. Writing speeches can also be an important responsibility of a Public Relations Officer. In addition, they spearhead press conferences, exhibitions, and tours/visits and are usually the point of contact for external and internal communication.

What makes a good Public Relations Officer?

A great Public Relations Officer has stellar communication skills. Whether written or vocal, they should efficiently convey information with clarity. They work closely with their client or organization to anticipate needs and tackle problems. They should also have key contacts in various media outlets to ensure a streamlined communication process.

Who does a Public Relations Officer work with?

A Public Relations Officer works closely with others in the Communications field to develop effective marketing strategies to boost brand awareness and positively mold the public opinion of a client or company. A Public Relations Officer often reports to a Public Relations Director who monitors their performance and sets overall PR goal objectives.

Salary guides:

Salary range/Kuala Lumpur: RM 3,100 to RM 4,100.

Reference: www.jobstreet.com.my/career-advice

Related articles

EPF/KWSP – Wages Liable for EPF Contribution

IRBM/LHDN – Employer Responsibilities

SOCSO/PERKESO – Employer And Employee Eligibility

Useful Links

Business etiquette

Employee Etiquette – Codes of Conduct necessary for an Individual at Work

Basic Workplace Etiquette Rules You Must Follow

Workplace Etiquette Tips Every Professional Should Know

What is Business Meeting?

How To Run A Business Meeting (With Best Practices)

How to Run a More Effective Meeting

General meeting rules and procedures for limited companies