CHAPTER 4

FEATURES OF THE PRIVATE RETIREMENT SCHEMES

Learning objectives

This chapter discusses the features and characteristics of PRS in detail as well as other main components of a PRS. This chapter also looks at the disclosure document and the various fees and charges of the PRS.

At the end of this chapter, you should be able to:

(a) describe the coverage of the PRS;

(b) list the tax incentives and account structure of the PRS;

(c) explain the default option and the parameters of the core funds;

(d) describe the circumstances for withdrawals from the PRS;

(e) explain the mechanism for switching between funds and the ability to transfer between PRS Providers (portability);

(f) explain the concept of vesting, vesting schedules and accrued benefits;

(g) explain forward pricing when selling and redemption occurs, and the impact of splitting and distribution of income on the net asset value (NAV) per unit of the fund;

(h) describe the various fees and charges and their impact on the funds under the Scheme;

(i) describe the various sections associated with the disclosure document, including the product highlight sheet, the key data section and the supplementary disclosure documents;

(j) explain the importance of the portfolio turnover ratio and the possible impact on returns; and

(k) recognise the legal consequences associated with false and misleading statements in the disclosure documents.

4.1 General

The PRS is defined as a capital market product and is a voluntary long-term investment scheme designed to help individuals accumulate savings for retirement. The SC will approve the PRS Providers, Scheme Trustee and PRS as well as license the PRS Distributors where applicable to ensure a minimum standard of conduct and the delivery of reasonable investment advice to the individual members of the Scheme.

A PRS consists of a range of funds which are called core funds and non-core funds. The PRS will also be invested in different types of asset classes which are briefly elaborated below.

Bonds

A bond is a debt investment where an investor loans money to an entity (corporate, supra-national or governmental) that borrows the funds for a defined period of time at a fixed interest rate. Bonds are used to finance a variety of projects and corporate activities. Bonds are also commonly referred to as fixed income securities as the coupon payment from these bonds are pre-determined and contractual. The level of a bond’s interest rate is determined by the credit quality of the issue and the duration of the bond. The lower the credit quality of the issuer, the higher the expected interest rate. As for the duration of the bond, the longer the maturity of a bond, the higher the expected interest rate of the bond.

Equities

The word signifies an ownership position or equity in a corporation. The equity holder only enjoys residual claim on the corporation after all prior claims have been settled (i.e. claims by debt holder etc.). In relation to PRS, equities refer to stocks and shares of companies that the fund under the Scheme invests in. The returns to the fund under the Scheme come in the form of dividends received, and capital appreciation of the stock.

Money market instruments

These are financial assets that have high liquidity and very short maturity (less than a year). Money market instruments consist of certificates of deposits (CDs), bankers’ acceptance, treasury bills, commercial papers and repurchase agreements (repos). The money market is used by participants as a means of borrowing and lending in the short term.

Collective investment schemes

A collective investment scheme is a way of investing together with other investors in order to benefit from the advantages of working as part of a group.

These advantages include the ability to hire professional investment managers, costs sharing and diversification. Collective investment schemes are defined under the PRS Guidelines and include, among others unit trust funds, real estate investment trusts, exchange-traded funds, wholesale funds and closed-end funds.

Derivatives

A derivative is a security whose price is dependent upon or derived from one or more underlying assets. The derivatives contract is between two or more parties whose value is determined by the fluctuations in the underlying asset. The common types of derivatives are futures contracts, forward contracts, options and swaps.

Derivatives can be used to hedge a risk. An example of this would be a Malaysian company hedging US$ receivables through a currency option because there is a belief that the US$ will weaken. Derivatives can also be used for speculation. Buying a Malaysian government bond futures contract to profit from an expected drop in interest rates is an example of speculative behaviour.

Real estate

Real estate is defined as land and anything permanent that is fixed on it, including buildings, fixtures and any items attached to the structure. Realestate can be grouped into three broad categories based on its use, namely residential, commercial and industrial. Examples of real estate would include houses, apartment blocks, undeveloped land, office buildings, retail complexes, condominium and factories.

Unlike other assets, real estate is most affected by local conditions of the immediate area where the property is located. With the exception of a global or national recession, real estate prices would be most influenced by local factors including the availability of jobs, crime rate, presence of good schools, local property taxes, proximity of shops and access from major roads.

(a) Coverage

(i) Eligibility

The PRS is open to both Malaysian and foreigners alike. The members

must be individuals who are 18 years of age and above. Employers

may also contribute to the Scheme as a benefit to their employee or

to encourage job loyalty by having a vesting schedule which stretches

out the vesting period for their contributions.

(ii) Contribution

Since the PRS is a voluntary scheme, there are neither required fixed

amounts nor fixed intervals for making contributions (although the

individual PRS Providers may set a minimum and maximum contribution

for each of the funds they offer). A lifetime private pension account

would be opened by the PPA upon the member completing the relevant

account opening form and/or fulfilling other requirements. At the time

of opening of the private pension account, potential members are not

required to make contributions to the Scheme. The PPA does not accept

monies/contributions from members. To make contributions, members

will have to indicate their investment direction to the PRS Provider. This can be done simultaneously when opening the private pension account

or at a later stage.

Where a member registers to open a private pension account and makes a contribution at the same time, PRS Providers are not required to wait until the private pension account is opened before subscribing units for funds under the Scheme as selected by the member.

Contributions can stop and also start up again after any lapse of time.

The member may also contribute to more than one Scheme although once again the PRS Provider may limit the numbers of funds that the member can join within a Scheme. PRS Providers set the minimum and maximum contribution amount that can be made by members.

(b) Default option

The default option is available to members who choose their PRS Provider but do not make a fund option. An example of this is when an employer makes a contribution to a member’s account but the employee does not specify the fund to be invested in, the amount would automatically be allocated using the default option which is based on the age of the member.

PRS Providers are to obtain satisfactory evidence of the member’s identity and age for all forms and documents received on behalf of the PPA, and have effective procedures for verifying the member and these must include—

(a) establishing the member’s full and true identity;

(b) verifying the identification given, where required; and

(c) establishing where appropriate, the clients’ financial position, investment experience, and investment objectives.

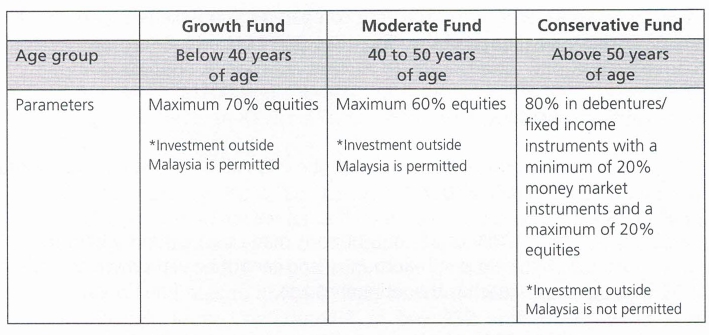

There are three core funds in the default options which must be offered under any PRS. The table below provides further details including the asset allocation of the core funds under the default option:

The age brackets are selected based on the life cycle approach to investing.

Those below the age of 40 still have a long time to accumulate savings for

retirement and can afford to be heavily invested in equities. Even if there are years of negative returns, the investor can sit out these negative returns and wait for a market recovery with time. The investors in the 40 to 50 age bracket will have to start considering that retirement is within one or two market cycles. The equities portion is reduced to a maximum of 60% and the portfolio becomes more balanced with more income producing assets.

When the investor reaches 50, retirement is imminent and the investor

cannot afford to sit out market cycles anymore given he is moving from

accumulation to decurnulation phase. The portfolio needs to consist of more income producing assets and very few risky assets (equities).

It is important to note that a member can actively select to contribute to the above three core funds which are the default options if they so choose.

The PRS Provider will have to notify the member one month in advance in writing that the member’s investment in the core funds will be switched according to the rules of the default option unless the member instructs otherwise. At this juncture, a member should also receive general investment advice and market outlook. This would facilitate decision making by the member as to whether he or she wishes to remain under the default option which would automatically change according to their age or choose a particular fund.

(c) Voluntary contributions

(i) Tax incentives

There is a tax relief of RM3,000 per annum for individuals if they choose

to contribute into a PRS. This relief is available for the next 10 years

from 2012 and can be used for contributions to more than one PRS.

Employers contributing for employees can claim a tax exemption above

the statutory rate of up to 19% of employees’ salary. All PRS are also

tax exempt from interest income received. This effectively increases the

returns of the Schemes compared to non-exempt funds and is another

advantage of the PRS.

(ii) Account structure

All contributions made to the PRS will be allocated and maintained in

two sub-accounts:

(a) 70% of all contributions made to any fund within the Scheme is

held in sub-account A and cannot be withdrawn until the member

reaches the retirement age.

(b) 30% of all contributions made to any fund within the Scheme is

held in sub-account B and can be withdrawn once a year upon

payment of a tax penalty.

Retirement age is defined under the PRS Guidelines as the age of 55

or the compulsory age of retirement from employment as specified

under any written law.

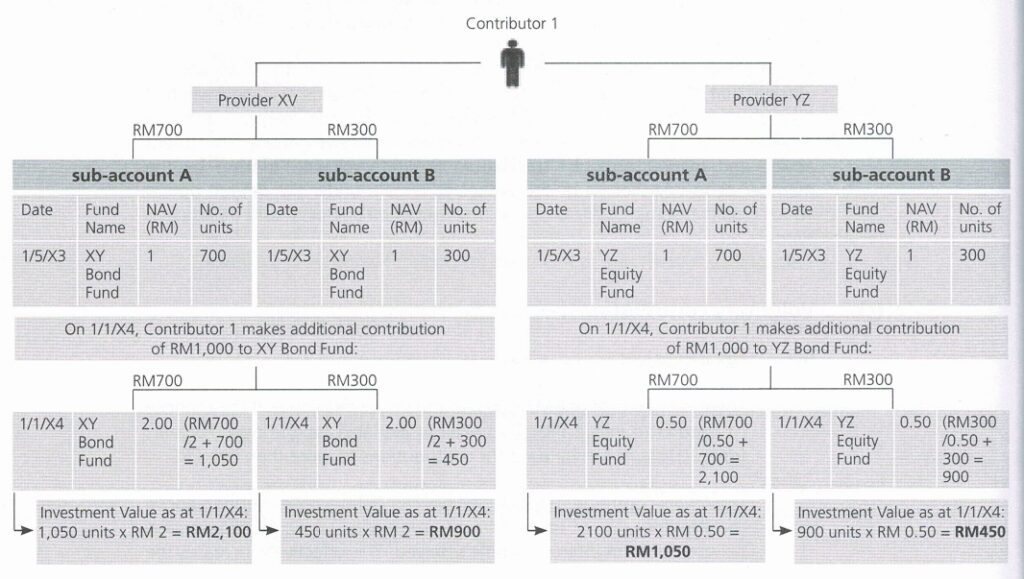

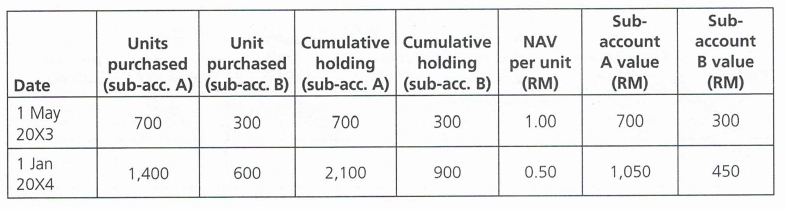

(iii) Example of contribution allocations

For illustration of the split into the two accounts, please see example of

the contribution allocation in the diagram below.

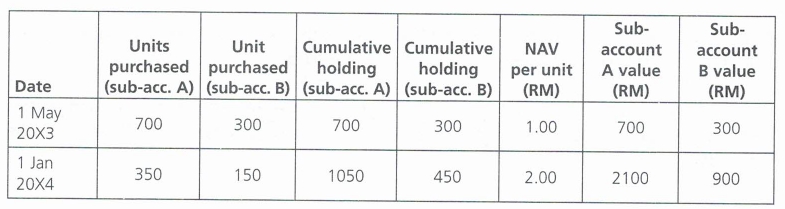

Say Contributor 1 initially contributes RM1,000 into Provider XY on 1 May 20X3. The RM1,000 contribution will be split as usual 70/30 into sub-account A and sub-account B respectively with sub-account A receiving RM700 and sub-account B receiving RM300. These will be used to purchase XY Bond Fund with an NAV of RM1 on that particular day.

On 1 January 20X4, Contributor 1 makes another contribution of RM1,000 into Provider XY and continues to choose the XY Bond Fund. As usual, the RM1,000 contribution is split 70/30 into sub-account A and sub-account B respectively. On 1 January 20X4, the NAV of XY Bond Fund rises to M2.00. Thus the contribution on 1 January 20X4 will only allow Contributor 1 to buy 350 units of XY Bond Fund (RM700/NAV of RM2) for sub-account A and 150 units of XY Bond Fund for sub-account B. In total, on 1 January 20X4, Contributor 1 will have 1,050 units in sub-account A worth RM2,100 and 450 units in sub-account B worth RM900.

Investments in XY Bond Fund

Investments value in XY Bond Fund

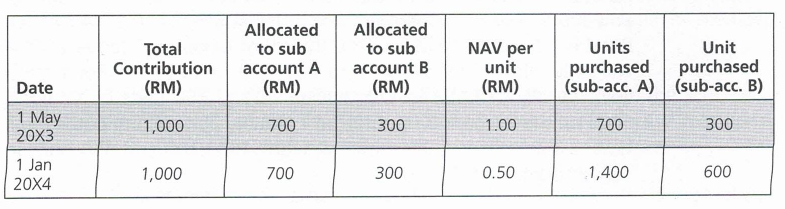

On 1 May 20X3, Contributor 1 also decides to participate in Provider YZ

by buying the YZ Equity Fund. He contributes RM1,000 which once again is split 70/30 into sub-account A and sub-account B respectively. With the NAV of YZ Equity Fund at RM1 on that day, Contributor 1 can buy 700 units for sub-account A and 300 units for sub-account B.

On 1 January 20X4, Contributor 1 makes another contribution of RM1,000 into Provider YZ and continues to choose the YZ Equity Fund. As usual, the RM1,000 contribution is split 70/30 into sub-account A and sub-account B respectively. On 1 January 20X4, the NAV of YZ

Equity Fund drops to RM0.50. Thus the contribution on 1 January 20X4

will allow Contributor 1 to buy 1400 units of YZ Equity Fund (RM700/

NAV of RM0.50) for sub-account A and 600 units of YZ Equity Fund for

sub-account B. In total, on 1 January 20X4, Contributor 1 will have

2100 units in sub-account A worth RM1,050 and 900 units in sub-

account B worth RM450.

Investment in YZ Equity Fund

Investment value in YZ Equity Fund

Note the following:

All new contributions to whichever PRS Provider and funds within the schemes must always be split 70/30 into sub-account A and sub-account B respectively.

All withdrawals from sub-account B except those occurring at retirement are classified as pre-retirement withdrawals and are subjected to a tax penalty collected by the PRS Provider on the withdrawal amount.

(d) Vesting

(i) Accrued benefits

“Accrued benefits” is defined as the amount of a member’s beneficial

interest in a PRS. In the context of PRS, accrued benefits are the

amounts accumulated in both sub-account A and B. Subject to certain

circumstances such as where contributions are subject to a vesting schedule, all contributions into the PRS are vested immediately and fully belong to the member.

The accrued benefits of a member are protected from judgement debt

and cannot be the subject of a charge, lien, pledge or assignment

under section 139ZA of the CMSA. Section 139Y(2) of the CMSA also

adds that income or profits derived from the investment of accrued

benefits of a member of an approved PRS, after taking into account any

loss arising from any such investment, shall also vest in the member as

accrued benefits as soon as they are received by either the PRS Provider

or the Scheme Trustee, whichever is earlier.

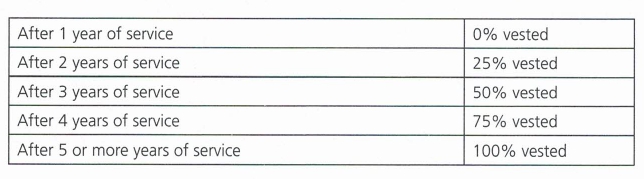

(ii) Vesting schedules

Employers may make the contributions to the PRS subject to a vesting

schedule to promote employee loyalty. The PRS Providers are to ensure

that such benefits are not transferred to another PRS Provider or

withdrawn by the employee until they are fully vested.

The vesting schedule is an optional feature of the PRS and is subject to

the schedule that determines the entitlement of an employee’s accrued

benefits based on terms of service.

For the purposes of employers who make contributions into PRS on behalf of their employees, the manner in which the accrued benefits will be accounted for and vested in a member may be in accordance with the vesting schedule of the respective employer.

Example:

Employer XYZ has a graded vesting schedule where they vest the

employer’s contributions on the following anniversaries of the

employee’s employment:

(e) Members withdrawal from PRS

(i) Pre-retirement withdrawal

Members are allowed to withdraw from sub-account B (30% of their

contributions) for their pre-retirement needs for any reason but any pre-

retirement withdrawals are subject to a tax penalty. The first withdrawal

can only be made one year after the initial contribution.

Upon receipt of the withdrawal request, the PRS Provider must first

obtain authorisation from the PPA before instructing the Scheme Trustee

to facilitate the withdrawal by cancelling the units. The PRS Provider

is tasked to collect the tax penalty on behalf of the Inland Revenue

Board and must deduct the penalty sum before crediting the member’s

account. The tax penalty for pre-retirement withdrawal is a flat 8%

penalty. The amount is to be deducted by the PRS Provider from the

amount withdrawn from sub-account B as pre-retirement withdrawal

by the member.

The member can only obtain information on consolidated holdings

or total amount in sub-account B from the PPA whereas specific

information on pre-retirement withdrawal amounts of a particular PRS

Provider can be obtained from the relevant PRS Provider.

(ii) Post-retirement withdrawal

Upon reaching retirement age, a member can withdraw from the PRS

account (both sub-account A and B) without incurring any tax penalty.

The withdrawal can be in the form of a lump sum or on a periodic basis

at the request of the member. Alternately, the member can choose to

retain their savings in the PRS for continuous investment under their

current schemes.

Under the first phase, to withdraw, the member would have to fill in

a form that is available at their PRS Provider. When the application is

submitted to the PRS Provider, the PRS Provider in turn will make the

onward submission to the PPA with the relevant supporting documents

to ensure that the member is withdrawing according to permitted rules,

such as for the first time that year. Over time, withdrawal requests

which cover multiple PRS Providers will be facilitated by the PPA.

(iii) Permanent departure from Malaysia

Members can also withdraw from the PRS if they leave Malaysia

permanently through emigration. For foreigners, it would be upon

cancellation of the relevant documentation such as work permit or

permanent residency.

(f) Switching between funds within the Scheme

Switching between funds within the Scheme is allowed. The funds in a PRS are at the sole disposal of the member who may make switches to accommodate asset allocation decisions or due to changes in market outlook. For example, a member may switch from a bond fund to a money market fund when he feels that interest rates have a good chance of moving higher or to move out of an emerging market equity fund if there is political turmoil in that country.

The PRS Providers are encouraged to charge low or no switching fee for fund switching within the same PRS. The PRS Provider has the right to prescribe the circumstances and to limit the number of times in a year that the member can switch their choice of funds within a PRS.

It is important to note that the member can switch between core funds as well as well as non-core funds. The funds in the PRS are at the member’s disposal and if he feels that a fund is suitable at the present time, he is given the flexibility to switch to that fund.

(g) Transfer between PRS Providers (portability)

One of the distinct advantages of the PRS is the ability of members to transfer between different PRS Providers. This portability feature allows the member to choose the PRS Provider which is ideal to the member’s unique circumstances and demands.

Once per annum, at the request of the member, the PRS Providers must allow the transfer of all the accrued benefits of any amount from any fund under the Scheme to another PRS of another PRS Provider. The first transfer of accrued benefits can only be requested by a member one year after the initial contribution to any fund under the Scheme.

Transfer of accrued benefits can be initiated by the member. Requests for

transfers can be made directly by contacting the transferee PRS Provider or in time through the PPA. All requests for transfers must obtain prior approval from the PPA before the transferor PRS Provider can issue instruction to the Scheme Trustee to cancel the units.

All requests for transfer between PRS Providers must—

(i) involve a transfer of one or more funds from one PRS Provider’s scheme to another PRS Provider; or

(ii) consolidate all monies of all funds in every Scheme to one Scheme if a person has contributed to more than one Scheme.

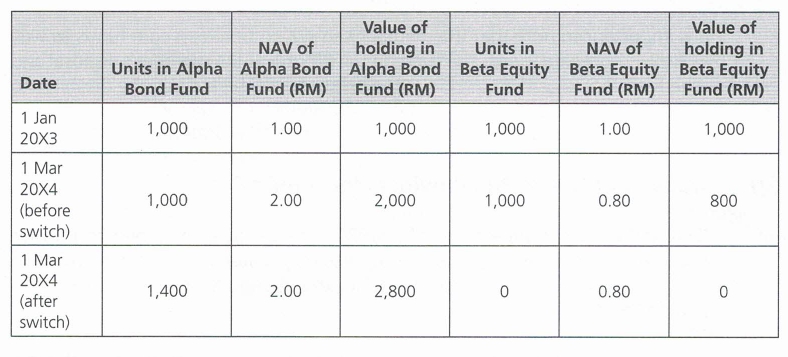

Example:

On 1 Jan 20X3, Ishak invests RM1,000 in PRS Alpha and buys 1,000 units of

Alpha Bond Fund with an NAV of RM1.00. On that same date, he also invests

RM1,000 into PRS Beta and buys 1,000 units of Beta Equity Fund with an NAV of RM1.00.

On 1 March 20X4, lshak decides to transfer his holdings from PRS Beta to

PRS Alpha. The NAV of the respective funds are RM2.00 for the Alpha Bond

Fund and RM0.80 for the Beta Equity Fund. PRS Beta will sell lshak’s 1,000

unit holdings in Beta Equity Fund for RM800 (1,000 x RM0.80) and buy 400 units of Alpha Bond Fund for RM800. For illustration purposes, we assume that there is no fee charged for this transaction. On 1 March 20X4, lshak will have 1,400 units of Alpha Bond Fund at NAV of RM2.00 and a total investment value of RM2,800.

Ishak’s holdings

The PRS Providers can only charge actual and reasonable expenses incurred in connection with the transfers to another PRS Provider.

(h) Unclaimed monies and death of members

The PRS Provider will need to maintain the account of the member even if it becomes dormant (no monies received or movement between funds after a certain period). Where the account is dormant for 12 months subsequent to the member’s 80th birthday, the Scheme Trustee may pay any unclaimed accrued benefit held by the Scheme Trustee to the registrar of unclaimed monies, in accordance with the provisions of the Unclaimed Monies Act 1965. Por to paying the unclaimed accrued benefits to the registrar of unclaimed monies, the Scheme Trustee must obtain approval of the PPA.

Members can make a nomination and designate a beneficiary who can receive the accrued benefits in the event of the death of the member depending on what is allowed by the particular PRS Provider. The benefits may be paid also to the member’s personal representative such as the executor or administrator upon the making of an application for withdrawal to the relevant PRS Provider or to the PPA (as the case may be) and providing valid court orders such as the probate or letter of administration.

4.2 The Scheme Trustee

(a) Approval from the SC

The Scheme Trustee must be approved by the SC under section 139ZC of the CMSA. Each Scheme is required to have one Scheme Trustee.

(b) Eligibility to be a Scheme Trustee

To be eligible, a Scheme Trustee must—

(a) be a trust company under the Trust Company Act 1949 or incorporated

pursuant to the Public Trust Corporation Act 1995;

(b) be registered with the SC;

(c) have a minimum paid-up capital of RM500,000 and a minimum shareholders’ funds of RM1 million (or such amount as may be specified

by the SC);

(d) obtain professional indemnity insurance coverage of at least RM5

million in the first year of its registration by the SC and increase its

professional indemnity insurance coverage to at least RM10 million

in the second year of its registration by the SC, and maintain such

coverage thereafter; and

(e) be independent from the PRS Provider.

(c) Duties and functions

(i) Holds assets in trust for the members of the PRS

The main function of the Scheme Trustee is to take custody and control

of all securities, derivatives, property and assets of a PRS and hold it in trust for the members in accordance with the deed, relevant securities

laws and any guidelines issued by the SC. In that regard, the Scheme

Trustee must exercise the degree of care and diligence that a reasonable

man would exercise if he were in the Scheme Trustee’s position (the

“reasonable man” test) to safeguard the best interest of the members

as a whole.

(ii) Dealing in units

The Scheme Trustee, on receiving instructions from the PRS Provider,

creates and cancels units of a fund within the PRS, hence facilitating

the dealing in units of a fund. The Scheme Trustee may refuse to create,

cancel or suspend dealing in units if it is not in the best interest of

members or if it would result in a breach of the deed, securities laws

(including the PRS Regulations) or the PRS Guidelines.

(iii) Accounts and audit

A Scheme Trustee must ensure that the financial statements of the fund

are audited annually by an auditor independent of the PRS Provider and

the Scheme Trustee and registered with the Audit Oversight Board. The

Scheme Trustee may also remove an auditor and appoint another in

its place if it deems it necessary. Members may by way of an ordinary

resolution request the trustees to replace an auditor.

(iv) Reports to members

A Scheme Trustee must prepare a report to the members to be included in the fund’s report on whether the distribution of returns for the fund is relevant and reflects the fund’s investment objective.

This report must also state the Scheme Trustee’s opinion on whether

the PRS Provider has operated and managed the fund in accordance with—

(a) the limitations imposed on the investment powers of the PRS

Provider under the trust deed, the PRS Guidelines, CMSA and other applicable laws;

(b) the valuation is carried out in accordance with the trust deed and

any regulatory requirements; and

(c) the creation and cancellation of the units are carried out in accordance with the trust deed and other regulatory

requirements.

If the Scheme Trustee is of the opinion that the PRS Provider has not

done so, then the Scheme Trustee must disclose these shortcomings which may impact the decision of members or potential members to invest in the fund. The Scheme Trustee needs to disclose the steps taken to address the shortcomings and/or to prevent future occurrences.

(v) Oversight function

The Scheme Trustee’s main concern is to ensure that the Scheme and the funds under the Scheme are operated and managed in accordance with—

(a) the deed;

(b) the disclosure document;

(c) the PRS Guidelines;

(d) securities laws, including the PRS Regulations; and

(e) acceptable and efficacious business practices within the PRS

industry. As such, it is essential that the Scheme Trustee maintains policies and procedures that actively monitor the operations and management of the PRS Provider. This is done through regular compliance review of the investment limits and processes adopted by the PRS Provider. The Scheme Trustee is required to report on any breaches of procedures. An independent auditor must be appointed by the Scheme Trustee to

carry out the annual audits of the financial statements to lend credibility to the whole oversight function.

4.3 Fees, charges and expenses

(a) General

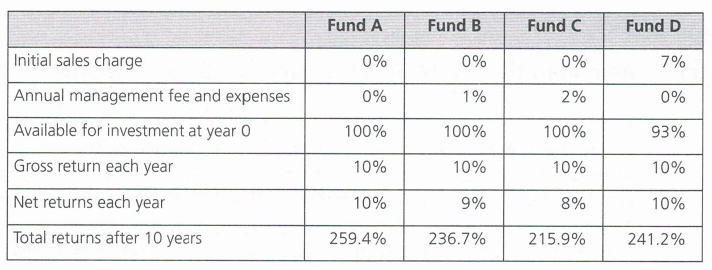

This section deals with the fees and charges that affect the PRS member. It is important for the member to understand that higher fees and charges will inevitably detract from long-term fund performance as less of the invested monies actually become available for investment and high expenses reduce the annual performance of the fund as a direct consequence.

The example below illustrates the point. Assume that all the four funds return 10% gross (before fees and expenses) each year for the next 10 years.

Fund A outperforms Fund B and Fund C merely because the higher fees of Fund B and Fund C results in lesser assets accumulated each year for the member and a smaller compounding factor.

Fund A outperforms Fund D because the initial sales charge of 7% in Fund D means that only 93% of that fund’s initial investment is invested for the member. This results in 7% reduction in total return over time.

It is imperative that the member understands the various fees, charges and

expenses involved in order to make an informed decision on whether to

participate in a PRS. It is also important for the member to note that fees charged to the fund can also be in the form of trustee’s fees, fees paid to the PPA and other fees which will impact the fund returns.

In addition, the dealing charge must be clearly permitted by the deed and

expressed as a fixed amount or a fixed percentage of the price of a unit or amount invested.

The PRS Provider can change the dealing charge but only after notifying the trustee and the SC of the change and issuing a supplementary disclosure document provided the change is within the range stipulated in the deed. Thirty days must elapse after the supplementary disclosure document is issued before the new dealing charge can take effect. Any increase in the maximum amount or maximum rate stated in the deed can only be made pursuant to a special resolution passed at a meeting of members of the Scheme or the fund within the Scheme, as the case may be.

In the interest of fairness, discounts and rebates in any form are prohibited and the PRS Provider, its sales agents and distributors must clearly inform members and contributors of the actual rate of charges payable.

(c) Remuneration of the PRS Provider and Scheme Trustee

Both the PRS Provider and Scheme Trustee can only be remunerated by way of an annual management and annual trustee fee charged to the fund. The fees must be accrued daily and calculated based on the NAV of the fund (as most PRS Provider and Scheme Trustee’s fees are based on a percentage of fund size).

These fees must be permitted by the deed and clearly disclosed in the disclosure document and are expected to be reasonable with regard to the roles, duties and responsibility of the respective parties.

The management fee percentage may only be raised by way of a supplementary deed with the members of the fund passing a special resolution to approve the increase.

The PRS Provider is allowed to collect fees on behalf of the PPA as agents. These fees are not remuneration for the PRS Provider and should not be confused with the annual management fee.

(d) Expenses of the fund

Except for fees payable to the PPA, only expenses (or part thereof) directly related and necessary in operating the Scheme and managing a fund may be paid out of the fund. These would include the following:

(a) Commission or fees paid to brokers or dealers;

(b) Custodial charges or fees paid to sub-custodians (where applicable);

(c) Tax and other governmental and local authority charges;

(d) Audit fee and related expenses by the auditor appointed by the PRS;

(e) Valuation fees and related expenses by independent valuers for the

benefit of the fund;

(f) Costs incurred in the modification of the deed (other than those that

benefit the PRS Provider or Scheme Trustee); and

(g) Costs incurred in any meeting of members (other than those that

benefit the PRS Provider and Scheme Trustees).

The onus is on the Scheme Trustee to ensure that all expenses charged to the fund are legitimate and that the quantum of expenses charged is reasonable with reference to standard commercial rates. The Scheme Trustee itself may be reimbursed for expenses incurred in the course of exercising its duties as a trustee.

(e) Review of fees and charges

The SC has the power to review the fees and charges. Where it finds that the expenses and fees are inconsistent with the objectives of the Scheme or prejudicial to the interests of the members, it may require such expenses and fees to correspond with the services provided.

4.4 Dealing, valuation and pricing

(a) Fund units

Fund units are created and cancelled by the Scheme Trustee upon the advice of the PRS Provider because of new requests by members or potential members of a PRS to buy or to redeem units. Apart from the initial offer of the fund where the initial price is fixed during the offer period (a period not exceeding 21 days), all dealings in the fund must be at the NAV per unit of the fund at the next valuation point (usually the next business day) after the request for the sale or repurchase of units by the PRS Provider. This is known as forward pricing and it is imperative that the member understands the rationale behind this pricing.

(b) Forward pricing

It is best to explain forward pricing with an example.

Say the published NAV per unit of Fund A (an equity fund) on 20 March 20X2

was RM1.00. Assume that overnight, there was equity market turbulence

and the major overseas markets plunged. Member XYZ wants to switch to

another fund, hence redeems his one unit in Fund A and submits the request

on 21 March. Forward pricing means that Member XYZ would only receive

his redemption at the price of the NAV per unit on 21 March (the next

valuation point) which turned out to be RM0.98. Allowing Member XYZ to

redeem at RM1.00 per unit would disadvantage the rest of the members

because Member XYZ would gain RM0.02 per unit at the expense of the

rest of the members.

Conversely, say the overseas markets experienced a huge rally and Member

QRS wants to buy the fund and submitted his request on 21 March to buy one

unit. The NAV on 21 March turned out to be RM1.03. Member QRS could only

buy the fund at RM1.03 per unit (the forward price). Allowing Member QRS to buy the fund at historical NAV of RM1.00 per unit (on 20 March 20X2) would be allowing Member QRS to profit at the expense of the other members.

In another example:

Provider A’s PRS Fund Pricing

Date – NAV

23 January 20X4 – RM1.00

24 January 20X4 – RM1.20

Provider A’s valuation point is at 4pm every business day. For Member ABC who submits a request to invest in the PRS fund on 23 January 20X4 at 12pm, the valuation points for his investment would be NAV for 23 January 20X4 which would only be published the following day.

For Member XYZ who submits a request to invest in the PRS fund on 23 January 20X4 at 5pm, the NAV per unit for his investment will be RM1.20.

From the above example, it becomes clear that the forward pricing will depend on the timing of the next valuation point.

For investment requests submitted after the valuation point or time, it will be based on the NAV of the next business day. It is important to note that the PRS Providers have differing valuation points.

(c) Valuation

A fair and accurate valuation of all the assets and liabilities of the fund must be conducted at each valuation point to determine the NAV per unit of the fund.

The valuation process must be consistently applied and the valuation process must be verifiable and objective. Once valuation is determined, the Scheme Trustee would have to be immediately notified. The NAV of a fund needs to be published daily on the website of the PRS Provider and the PPA.

The valuation point must be at least once every business day although in some circumstances with limited repurchased arrangement or investments in illiquid assets (like real estate), the daily valuation requirement does not apply. In those cases, the valuation points must be clearly disclosed in the disclosure documents and must be at least one a month.

(d) Distribution, splits and NAV

(i) Impact of splitting on NAV

Splitting the units reduces the NAV per unit but it has no overall effect

on the total value of the holdings of a member as the reduction in NAV

is compensated by a higher number of units.

Example:

As of 2 April 20X2, Member ABC held one unit of Fund XYZ with an NAV of per unit of RM2.10. A 2-for-1 split was declared on that same date. After the split of the units, Member ABC held two units of Fund XYZ but with an NAV per unit of RM1.05.

(ii) Distributions impact on NAV

Distributions (in terms of dividends) will reduce the NAV per unit

because part of the NAV is returned to the member in the form of a

cash payment. In the case of the PRS where units must be given in lieu

of cash payment, the NAV of the fund will still be reduced because

there will be more units created from the same pool of funds. Income

distribution in the form of units is akin to unit splitting as above.

Example:

As of 1 March 20X2, Member QQQ owned 800 units of Fund MNO with an NAV per unit of RM2.00. A dividend of RM0.40 per unit was declared and paid on the same date in the form of fund units.

Immediately after the payment of the dividend, Member QQQ would

hold 1000 units of Fund MNO with a lower NAV per unit of RM1.60.

Even though the NAV per unit had been reduced with the distribution,

Member QQQ was not made worse off as he still had the same amount

of wealth as before.

If the PRS Provider chooses not to distribute income or declare a

dividend, the unit price of the fund will increase with the growth of

the NAV. At all times, the NAV of a fund should reflect all the available

income accrued to it.

4.5 Disclosure document

(a) General

The purpose of a disclosure document is to enable members to make an informed investment decision in contributing to a PRS by providing relevant and accurate information that is material to understanding the management and operation of the respective funds within the Scheme.

Potential members will be given a copy (either a hard or soft copy) of the disclosure document when they request for subscription to a Scheme. These members must be advised to read and understand the disclosure document before making the decision to participate in the scheme.

The contents of a disclosure document must include:

(i) The cover page with the name of the Scheme and date;

(k) The inside cover of the document with the responsibility statements

and statement of disclaimer;

(iii) The table of contents which lists all the sections and subsections of the disclosure document;

(iv) The section on definitions and the corporate directory;

(v) The key data/information summary highlighting the salient features of

the funds under the PRS;

(vi) Information regarding the risk factors of investing in the fund;

(vii) The PRS details;

(viii) The details of the funds under the Scheme including the investment objectives;

(ix) The fees, charges and expenses which are the costs of investing in the fund;

(x) Transaction information including information on valuation points and

procedures on purchasing and redeeming units;

(xi) A section on the PRS Provider with corporate information and

information on the investment committee, the audit committee, the

Shariah adviser and the panel of advisers where applicable;

(xii) A section on the Scheme Trustee;

(xiii) Salient terms of the deed;

(xiv) Related-party transactions and areas of potential conflict of interest;

(xv) Taxation of the fund;

(xvi) Statement of consent from relevant parties including among others,

auditors, valuers, solicitors and other experts;

(xvii) A statement stating that all relevant documents are available for

inspection at the registered office of the PRS Provider; and

(xviii) Specific requirement for the various different types of funds.

(b) Product highlight sheet

A product highlight sheet is a summary of the disclosure document and

therefore cannot contain information that is not included in the disclosure document. It must highlight information to potential members in a clear and concise manner using easily understood language and where necessary, it can have diagrams, charts and tables for illustrative purposes. The product highlight sheet must contain a warning in bold advising members not to invest in the PRS based on the product highlight sheet alone as it is merely a summary of salient information. The members should instead read the product highlight sheet together with the disclosure document for all the available information.

The product highlight sheet, whether in hard or soft copy, must be presented to the potential member at the initial engagement or at the point the individual shows interest in the PRS. The product highlight sheet must include:

(i) Scheme information

(a) Name of Scheme;

(b) General information on the Scheme;

(c) Brief description of the operations of the Scheme;

(d) The number of funds within the Scheme, the name of each fund

and the type of each fund.

(ii) Fund information

(a) Name, the category and type of fund;

(b) Initial offer period and initial price;

(c) Investment objectives of the fund;

(d) Description of the policies and investment strategies including

asset allocation strategies to be used to meet the investment

objectives;

(e) Performance benchmark;

(f) Description of principal risk of investing in the fund;

(g) Where multiple classes of units are issued, a comparison table

highlighting the different features of each class.

(iii) Fees and charges

All fees and charges should be tabulated and clearly explained

(iv)Taxation of the fund The taxation of the fund must be briefly examined as well as the tax liability of the member if so affected.

(v) Risk factors

Key risks relating to the fund must be highlighted including the risk of

significant losses if these occur.

(vi) Other information

(a) Avenues of advice for prospective members if applicable;

(b) Information on how the member can keep abreast of developments

(c) The customer service provided by the PRS Provider;

(d) The following statement must be disclosed (in bold)

“This is a Private Retirement Scheme”

“There are fees and charges involved and investors are

advised to consider them before investing in the fund”

“Unit prices and distribution payable, if any, may go down

as well as up”

“This product highlight sheet is part of the disclosure

document and must be read in conjunction with the

disclosure document.”

Where a fund proposes to invest substantially in derivatives (that

is more than 30%), a warning statement (to appear in bold) must

appear to warn of the likelihood of high volatility in the NAV of

the fund due to these derivatives; and

(e) Any other material information considered necessary by the PRS

Provider.

(c) Key data section/information summary

A key data/information summary section in the disclosure document highlights salient features of the fund and where necessary, includes cross-references to pages in the disclosure document which gives full details on the respective matters. It is important for PRS Consultants to draw the members’ attention to this section as it discloses the charges and fees incurred in the investing of the units of the fund.

The summary section should include the following information:

(i) Scheme information

(a) Name and general information of the Scheme;

(b) Brief description of the operations of the Scheme; and

(c) The number of funds within the Scheme and the name of each

fund and type of fund.

(ii) Fund information

(a) Name, category and type of fund;

(b) Initial offer period and its initial price;

(c) Investment objectives of the fund;

(d) A description of the policies and investment strategies including

asset allocation strategies to be used to meet the investment

objectives;

(e) A description of principal risk of investing in the fund; and

(f) Where multiple classes of units are issued, a comparison table

highlighting the different features of each class.

(iii) Fees and charges

(a) Disclosure of the charges directly incurred by members when

purchasing or redeeming units of a fund;

(b) Clear indication clearly in the disclosure document on whether the

charges are negotiable; and

(c) To disclose fees indirectly incurred by members when investing in

the fund.

(iv) Other information

(a) A list of current deed and any supplementary deeds and their

corresponding dates;

(b) Any key data that the PRS Provider considers necessary, material

and important to be included in this section; and

(c) For a scheme that is already in operation, this warning statement

must be included:

“Past performance of the fund is not an indication of its

future performance.”

(d) Portfolio turnover ratio

Portfolio turnover ratio (PTR) is an indication of how frequently the assets within a fund are bought and sold by the managers over a measurement period (usually a 12-month period).

The PRT can be calculated as follows:

(1/2 x (total investment purchases + total investment sales) / (Average fund size for the year calculated on a daily basis)

The PTR measurement should be considered by an investor before deciding to

invest in the fund because a fund with a higher PTR will incur higher transaction costs than a fund with a lower PTR. Unless the fund with the higher PTR can justify superior stock selection and switching, a less active trading posture may generate higher fund returns.

(e) PRS member’s rights and liabilities

The potential member, when contemplating whether to invest in a Scheme, will have the right to expect that relevant information be given to him to enable him to make a sound decision.

On initial contact with the PRS Consultant, the potential member should be given the product highlight sheet which is a summary of the salient points about the PRS as well as the funds that are being offered. The potential member must be told not to make the investment decision solely on the information obtained from the product highlight sheet but to read the disclosure document in full.

The exception to this is when the member chooses to exercise his right not to select any specific funds and to rely on the default option of the PRS. This is usually more prevalent in cases involving employer contribution on behalf of their employees.

The disclosure document which usually contains the account application form is to be given to the member when he wants further information and is ready to commit to investing in the PRS and the funds within. The potential member should be advised to read the disclosure document in its entirety and to seek legal and investment advice if there are any doubts in their minds.

Finally, the potential member has a right to expect the PRS Consultant to be well qualified to provide investment advice and information about the funds and PRS in general. The PRS Distributor and Consultant will be registered with the FIMM as well as licensed by the SC where applicable. In this manner, potential member will be reassured that there is minimum standard of care and professionalism that can be expected from such licensed representatives.

(f) False and misleading statement

Section 92A of the CMSA stipulates that a PRS Provider which breaches any rules in relation to false or misleading statements will have committed an offence.

PRACTICE QUESTIONS

Question 1

Which of these statements are CORRECT with regard to contributions to the Private Retirement Schemes (PRS)?

I. Employers can contribute on behalf of employees

II. The PRS Providers set the minimum contribution amount

III. Members can contribute to only one PRS

IV. Members can stop contributions any time

A. I and IV only

B. I, II and IV only

C. I, II and (III only

D. II, III and IV only

[Answer: B]

The next two questions are based on the scenario below:

Employer ABC contributes to a Private Retirement Scheme on behalf of an employee, Yasmin, subject to a vesting schedule. Yasmin, who is 30 years old, does not contribute to the PRS on her own.

As of 1 March 20X2, the vested amount is RM10,000. The penalty imposed on

members for early withdrawal from sub-account B is 8%.

Question 2

As at 1 March 20X2, what is the available amount in Yasmin’s sub-account A?

A. RM3,000

B. RM7,000

C. RM9,700

D. RM10,000

Question 3

If on 1 March 20X2, Yasmin decides to do a pre-retirement withdrawal from sub-account B and withdraw all the available balance. What is the net amount due to Yasmin?

A. RM2,760

B. RM3,000

C. RM9,200

D. RM10,000

[Answer: A]

Question 4

Which of these are examples of expenses that are ALLOWED and paid out from the Private Retirement Scheme?

I. Custodian fees

II. Valuation fees

III. Commission paid to brokers

IV. Expenses to call a members’ meeting to increase annual management fees

A. I and II only

B. II and IV only

C. I, II and III only

D. II, III and IV only

[Answer: C]