What Is Financial Statement Analysis?

Financial statement analysis is the process of analyzing a company’s financial statements for decision-making purposes. External stakeholders use it to understand the overall health of an organization and to evaluate financial performance and business value. Internal constituents use it as a monitoring tool for managing the finances.

Financial analysis is also referred to the process of examining a company’s performance in the context of its industry and economic environment in order to arrive at a decision or recommendation. Often, the decisions and recommendations addressed by financial analysts pertain to providing capital to companies—specifically, whether to invest in the company’s debt or equity securities and at what price. An investor in debt securities is concerned about the company’s ability to pay interest and to repay the principal lent. An investor in equity securities is an owner with a residual interest in the company and is concerned about the company’s ability to pay dividends and the likelihood that its share price will increase.

Overall, a central focus of financial analysis is evaluating the company’s ability to earn a return on its capital that is at least equal to the cost of that capital, to profitably grow its operations, and to generate enough cash to meet obligations and pursue opportunities.

How to Analyze Financial Statements

The financial statements of a company record important financial data on every aspect of a business’s activities. As such, they can be evaluated on the basis of past, current, and projected performance.

In general, financial statements are centered around generally accepted accounting principles (GAAP) in the United States. These principles require a company to create and maintain three main financial statements: the balance sheet, the income statement, and the cash flow statement. Public companies have stricter standards for financial statement reporting. Public companies must follow GAAP, which requires accrual accounting. Private companies have greater flexibility in their financial statement preparation and have the option to use either accrual or cash accounting.

Several techniques are commonly used as part of financial statement analysis. Three of the most important techniques are horizontal analysis, vertical analysis, and ratio analysis. Horizontal analysis compares data horizontally, by analyzing values of line items across two or more years. Vertical analysis looks at the vertical effects that line items have on other parts of the business and the business’s proportions. Ratio analysis uses important ratio metrics to calculate statistical relationships.

What Is Financial Performance?

Financial performance is a subjective measure of how well a firm can use assets from its primary mode of business and generate revenues. The term is also used as a general measure of a firm’s overall financial health over a given period.

Analysts and investors use financial performance to compare similar firms across the same industry or to compare industries or sectors in aggregate.

What Is a Financial Performance Analysis?

Financial analysis refers to the process of studying and assessing a company’s financial statements—a collection of data and figures organized according to recognized accounting principles. The aim is to understand the company’s business model, the profitability (or loss) of its operations, and how it’s spending, investing, and generally using its money—summarizing the company by the numbers, so to speak.

A financial performance analysis examines the company at a specific period in time—usually, the most recent fiscal quarter or year. The balance sheet, the income statement, and the cash flow statement are three of the most significant financial statements used in performance analysis.

Financial performance analysis can focus on different areas. Types of analysis can include a specific examination of a firm:

- Working capital: the difference between a company’s current assets, such as cash, accounts receivable (customers’ unpaid bills), and inventories of raw materials and finished goods, and its current liabilities

- Financial structure: the mix of debt and equity that a company uses to finance its operations

- Activity analysis: the factors involved in the cost and pricing of goods and services

- Profitability analysis: how much money the business clears, after expenses and taxes

Summary

The main purpose of financial statement analysis and performance analysis is to help users make a more informed investment decisions. Financial ratios should be evaluated relative to a predetermined benchmark for the analysis to be meaningful. In this topic, we have introduced and illustrated four different methods of analysing financial statements namely, horizontal analysis, common-size statement analysis, cash flow analysis and financial ratio analysis. We have also discussed five different aspects of a company that can be evaluated via financial ratios.

These five aspects are liquidity, operating performance, growth, financial risk and market performance. However, the analysist should not limit his analysis to the number of financial ratios we have discussed. there are potentially a very large number of financial ratios through which almost every possible relationship can be examined. Ratio analysis, while easy to use, may provide an incomplete and inaccurate picture due to their shortcomings. Nevertheless, these traditional methods are still useful if interpreted while bearing potential shortcomings in mind.

Measuring and assessing managerial performance is a very difficult task. in this topic we have also introduced the concept of EVA and illustrated how to compute it. The EVA method has increased in popularity because it is not heavily reliant on market movements and it quantifies the real value after accounting for the cost of capital applied. MVA is the value of capital employed plus the present value of all future EVA.

Self-Assessment / Activities

1. The main objective of financial analysis is to evaluate the past, current and future financial performance of a company, in order to determine the comparative measures of risk and return for the purpose of making investment or credit decisions. These decisions require financial estimates of the future. The company financial reports provide the necessary information, including financial statement, financial notes and other supplementary information, that an analyst must understand to have a good basis for estimating the future performance of the company. There are several general areas of financial analysis that would provide information on a company’s performance EXCEPT:

I. profitability – the ability of the company to provide a reasonable level of return on investment

II. liquidity – the ability of the company to meet its obligations as they fall due

III. financial stability – the ability of the company to meet its debt servicing obligations.

A. I and II only

B. II and II only

D. None of the above

D. All of the above

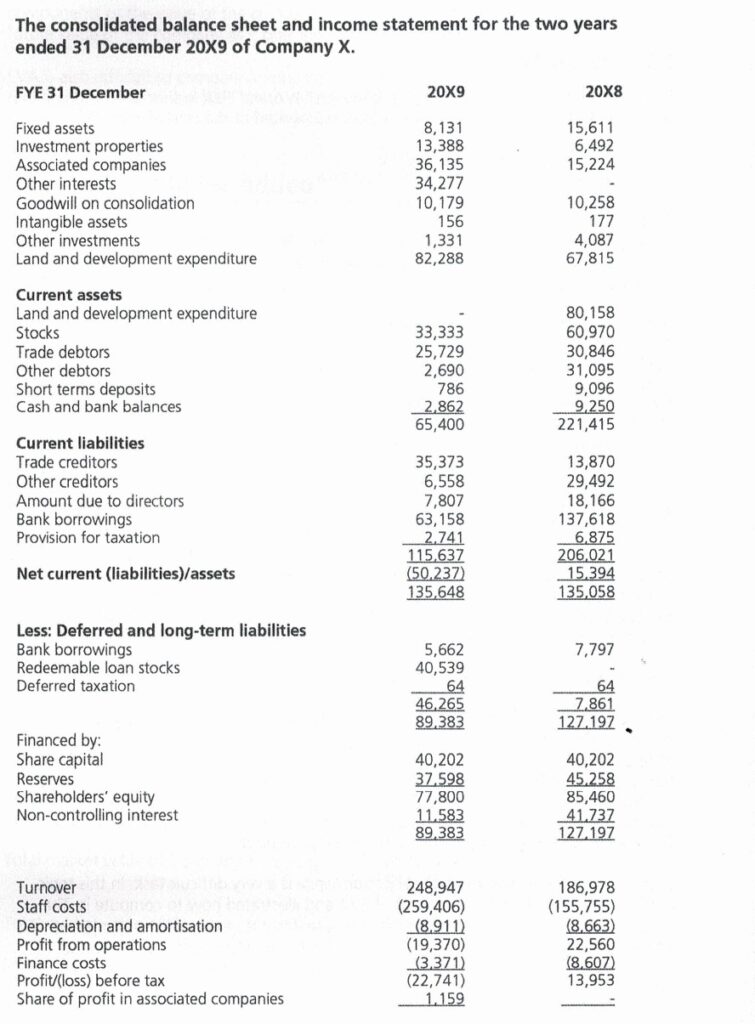

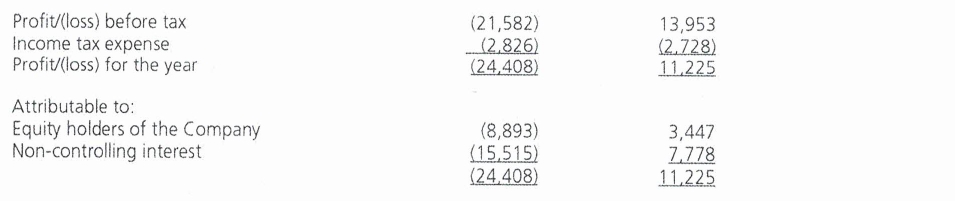

Question 2 t0 6 are based on the following information:

2. The current ratio for Company X in 20X8 was:

A. 0.09

B. 0.36

C. 0.57

D. 1.07

3. The average collection period for Company X in the year 20X9 was:

A. 8.8 days

B. 9.7 days

C. 38 days

D. 41 days

4. The equity turnover for Company X in the year 20X9 was:

A. 1.66

B. 2.67

C. 3.05

D. 3.20

5. The net profit margin of Company X in year 20X8 was:

A. 5.2%

B. 6.0%

C. 7.4%

D. 8.7%

6. The return on shareholders’ equity for the year 20X9 was:

A. -10.9%

B. -11.4%

C. -25.6%

D. -29.9%

7. Which one of the following statements is TRUE in relation to financial statement analysis?

A. Financial ratio analysis is useful as it allows companies operating in different countries with different accounting treatments to be directly comparable.

B. For a cash flow analysis, a company in the start-up phase will usually have a very low cash balance due to their high expenditure needs.

C. A horizontal analysis refers to a direct comparison of the financial statements of two or more companies at one period of time.

D. An analysis of financial statements is meaningful whether it is done in isolation in comparison to some pre-determined benchmark.