Economics & Finance

Investment Management And Corporate Finance

Sample Assessment Questions:

Guideline to Register for Non HRDC Members:

SC's MODULES DESCRIPTION AND MODULE COMBINATION FOR REGULATED ACTIVITIES

The Securities Industry Development Corporation (SIDC) offers multiple choice question examinations for individuals wishing to undertake one or more regulated activities under the Capital Markets and Services Act 2007.

The SC administers the following acts: (a) Securities Commission Act 1993; (b) Capital Markets and Services Act 2007; and (c) Securities Industry (Central Depositories) Act 1991.

SC's LICENSED AND REGISTERED PERSONS

BNM's APPROVED FINANCIAL ADVISERS

BNM's Money Services Business / Legislation And Guidelines

List of Approved Islamic Financial Advisers

Malaysia Capital Market

Overview of the Malaysian Stock Market – Regulation of the Securities Industry – Business Structures – Capital Raising on the Primary Market – Trading on Secondary Market – Clearing, Delivery, Settlement and Corporate Actions – The Law of Contract – Relationship Between Stockbroking Company and Client – Negligent Misstatement – Licensing – Securities Offences – Take-Overs And Mergers.

Economy/Finance &

Stock Market

Overview of the Malaysian

Stock Market

Malaysian Equities / Stock Market And Securities Law

Overview of the Malaysian Stock Market – Regulation of the Securities Industry – Business Structures – Capital Raising on the Primary Market – Trading on Secondary Market – Clearing, Delivery, Settlement and Corporate Actions – The Law of Contract – Relationship Between Stockbroking Company and Client – Negligent Misstatement – Licensing – Securities Offences – Take-Overs And Mergers.

Economy/Fund Management

Funds Management (Regulation) In Malaysia

Funds Management (Regulation) In Malaysia

Malaysia has a well-established fund management industry that caters to institutional investors as well as qualified retail investors. According to the Securities Commission Malaysia (SC), assets under management (AUM) typically originate from unit trust funds, corporate bodies, the Employees Provident Fund (EPF) and wholesale funds.

Fund Management Industry In Malaysia – Law and Organisations Regulating the Fund Management Industry – The Law of Contract – Negligent Misstatement – Relationship Between Fund Management Company and Client – Securities Offences – Conduct of a Fund Management Company’s Business – Compliance – Topical issues in Fund Management Regulation.

Economy/Fund Management

Asset And Funds Management

An action for negligent misstatement arises where Party A has carelessly made a statement to Party B, where the relationship between the parties is such that Party A owes Party B a duty of care. A negligent misstatement claim is brought at common law in tort.

The relationship between a fund management company and its client is complex and requires careful analysis. Further, the potential for dispute between the parties is significant given the nature of the investment services provided. In the event of a dispute involving loss, the amount may be large...

In this topic we examine several practical aspects relating to the conduct of a fund management company’s business. We start by looking at the Investment Management Agreement which describes the contractual arrangement between a fund management company and its client...

Ethical and responsible investing is not a foreign concept. Globally, investors are showing interest in investments that cover a whole range of ethical options, from investing in businesses which cause the least environmental damage to those that safeguard human rights, or promote corporate governance and shareholder advocacy…Read more...

Corporate governance is a generic term covering issues associated with business management practices and the structure of a company’s board of directors. The Cadbury Committee defined it as the system by which companies are directed and controlled’...

Asset And Funds Management

Overviews/Objectives – Fund Management Industry In Malaysia – The Investment Setting – Life-cycle Investing And Investment Structure – Asset Allocation – Modern Portfolio Theory (MPT) – Managing An Equity Portfolio – Managing A Fixed Income Portfolio – Derivatives In Portfolio Management – Managing Alternative Investments – Managing International Investments – Understanding Islamic Investments – Portfolio Risk Management – Portfolio Measurement And Presentation of Returns – Investment Psychology.

Fundamentals of Compliance

Overview and Glossary/Abbreviations – Fundamentals of Compliance – Roles and Responsibilities – Compliance Officers – Establishing and Monitoring Compliance – Risk Management – Costs benefits of Compliance and Case Studies – Structural Framework and Principles of Capital Market Regulation – Guidelines for Compliance

Legal Consideration And Code of Conducts

A prudent person who carries on the business of investment advice and/or advising on corporate finance should be aware of the relevant laws and principles regulating his conduct and actions, in particular: (a) Contract law, (b) Tort, and (3) Securities law.

Fund Management / Private Retirement Scheme Industry

Malaysia has a well-established fund management industry that caters to institutional investors as well as qualified retail investors. According to the Securities Commission Malaysia (SC), assets under management (AUM) typically originate from unit trust funds, corporate bodies, the Employees Provident Fund (EPF) and wholesale funds...

Private Retirement Scheme Industry

This topic introduces the fund management industry in Malaysia. We will examine those participants in the fund management industry who provide investment management services. We will also consider the various structures or ‘funds used in the industry to pool moneys prior to investment. This will provide us with an insight into the clients of fund management companies. We then review some of the other important participants in the industry. Finally, we introduce the rationale for regulation of the fund management industry...

An action for negligent misstatement arises where Party A has carelessly made a statement to Party B, where the relationship between the parties is such that Party A owes Party B a duty of care. A negligent misstatement claim is brought at common law in tort.

In this topic we examine several practical aspects relating to the conduct of a fund management company’s business. We start by looking at the Investment Management Agreement which describes the contractual arrangement between a fund management company and its client...

Private Retirement Scheme

Overview and Glossary/Abbreviations – Introduction to the Private Retirement Schemes Industry – Regulatory Framework – The Private Retirement Scheme Provider – Features of The Private Retirement Schemes – Constitution of the Private Retirement Schemes – Private Retirement Schemes Investments – Private Retirement Scheme Distributor and Consultant.

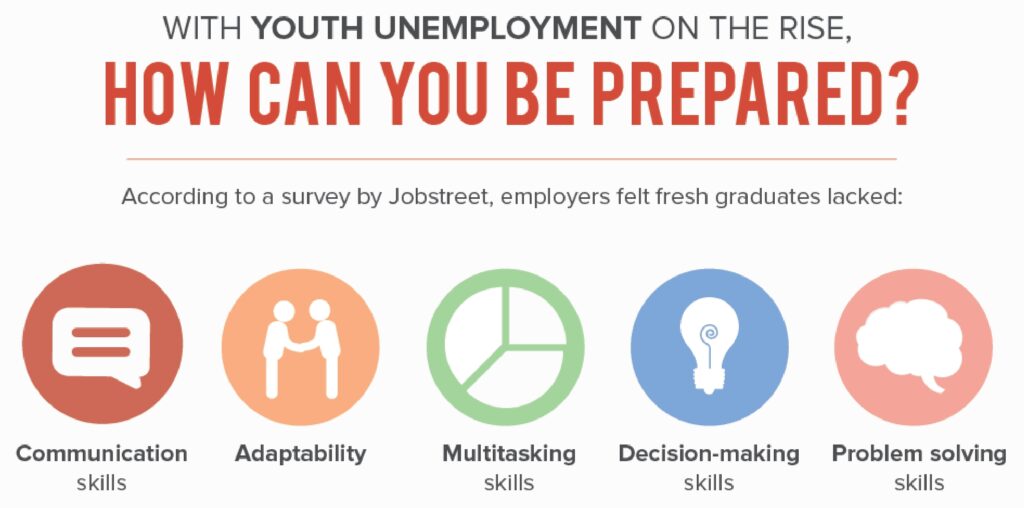

The faithful financial cultures and practices are the main components of our corporate missions. The moral values which are governed by Shariah perspectives are our practices.

We aim to help millions of people in the pursuit of financial freedom — helping the world become smarter, happier, and richer.

Economic and Financial Development in Malaysia

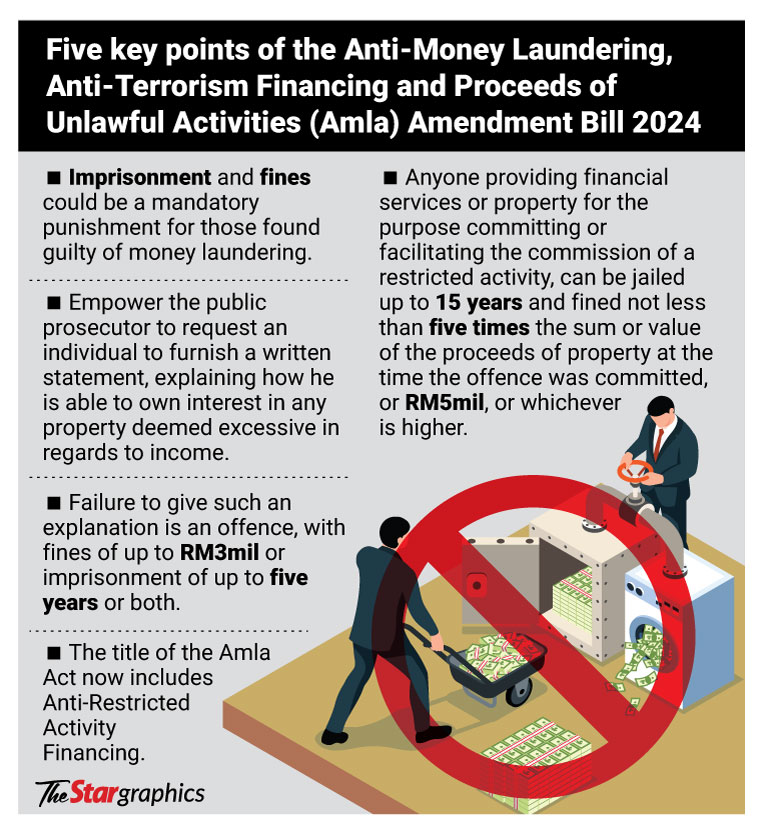

Money laundering

Money laundering is the illegal process of converting money earned from illegal activities into “clean” money – that is, money that can be freely used in legitimate business operations and does not have to be concealed from the authorities.

Money laundering operations deal with trillions of dollars worldwide each year; therefore, money laundering activities exert a substantial impact on major national economies.

Some banks have been complicit in aiding money laundering operations.

Money Laundering

How do criminals launder money?

What is anti-money laundering and countering financing of terrorism (AML/CFT)?

Case Study #1

Case Study #2

The importance of countering terrorism financing (CTF)?

Targeted Financial Sanctions (TFS) regime for TF

A person commits money laundering when the person engages directly or indirectly, in a transaction that involves proceeds of any serious offence or instrumentalities of an offence. This includes receiving, possessing, transferring, converting, carrying, disposing of or using these proceeds.

Money laundering itself is a criminal offence under the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA).

Wikipedia.org

corporatefinanceinstitute.com

www.unodc.org

Money Laundering & Terrorism Financing

Money Laundering & Terrorism Financing

By: Central Bank of Malaysia

Note: No person shall structure, or direct, assist or participate in structuring, any transaction in domestic or foreign currency, to evade reporting requirement.

How do criminals launder money?

Commonly, there are three stages of the money laundering process:

Placement, Layering and Integration.

(a) Placement - Illicit funds are separated from their illegal source. This typically happens when illegal funds are placed into a reporting institution.

(b) Layering - Creating multiple layers of transactions to distance or disguise the illegal funds from their illegal sources. This is to obscure or make it difficult to trace the origin of the illegal funds. This may involve multiple transfers between accounts, hiding funds in shell companies or trusts or transferring funds into multiple assets.

(c)

Integration -

Final stage where the laundered proceeds are successfully integrated into the economy appearing as legitimate funds. This may include purchases of properties or high value goods, and investment into business ventures.

Note: Money launderers tend to seek out reporting institutions with weak anti-money laundering controls to ‘clean’ the illegitimate funds through theses multiple stages, since there is less risk of detection.

A Biden-Trump rematch is now all but inevitable on November 5 and polls are pointing to a tight race. With Donald Trump threatening to raise tariffs, his team talking about scrapping the Inflation Reduction Act, and the presumptive Republican nominee taking credit for the equities rally, investors need to understand what the outcome of this election could mean for the US, for the global economy, and for markets.

BNM says falling ringgit doesn’t reflect economy’s prospects. It’s tumble has been influenced by ‘external factors’.

BNM Governor: Malaysia Not In Crisis Despite Falling Ringgit

Finance & Development

A Quarterly Publication of the International Monetary Fund...