This topic is designed as a reference on the rules and regulations governing advisory services in the Malaysian capital market. Examination candidates should review the notes for the Module 19 (SIDC – Advisory services) and complete the self-assessment questions and answers in the topics.

Objectives

Learners are expected to have good knowledge, understanding and ability to apply in the following areas:

• The principles of contract law and relevant issues

• The laws which are relevant to the advisory services in the Malaysian capital market

• The system and procedures of licensing of persons who carry on the investment advisory business in Malaysia

• The features and prohibitions of investment advisory activities

• The regulations governing the issue and offer of equity securities, listing of corporations and quotations of securities on the Main Market of Bursa Malaysia Securities Berhad (Bursa Securities) (Main Market) and proposals which result in a significant change in the business direction or policy of corporations listed on the Main Market under the Securities Commission Malaysia’s Equity Guidelines

• The regulations setting out who can act as principal advisers for the submission of corporate proposals and the competency standards required

• The regulations governing the conduct of due diligence for corporate proposals by issuers, advisers and experts

• The activities and current trends connected to money laundering and terrorism financing and the Malaysian regulatory approach towards them

• The characteristics and regulations governing take-overs in Malaysia

• The regulations governing valuations of property assets in conjunction with corporate proposals for submission to the Securities Commission Malaysia or for inclusion in prospectuses and circulars

• The regulations governing the issuance and registration of prospectuses

• The regulations governing the issue, subscription, purchase, invitation to subscribe or purchase corporate bonds or sukuk to retail investors

• The regulations that must be observed for the purposes of exclusively making available unlisted capital market products to sophisticated investors in Malaysia or persons outside Malaysia

• The regulations governing the issuers of structured warrants

• The regulations governing listing of securities under the Bursa Securities Main Market Listing Requirements, Bursa Malaysia Securities Berhad ACE Market Listing Requirements and Bursa Malaysia Securities Berhad LEAP Market Listing Requirement.

Question 1

CNC Investment Bank has been appointed as the Principal Advisor and Lead Manager for the upcoming initial public offering (IPO) of shares of TCB International Berhad. MIH Services Berhad will be the issuing house for the shares to be offered. The shares of TCB International Berhad will be listed on Main Market of Bursa Malaysia Securities Berhad. Which of the following is the offeror of TCB International Berhad for the IPO?

A. CNC Investment Bank.

B. MIH Services Berhad.

C. The public who wish to subscribe for the shares.

D. TCB International Berhad.

Answer: C

Question 2

On May 1, 20X5, Ultra Sdn Bhd (Ultra) mailed a written offer to Caltech Corporation Bhd (Caltech) for the sale of an office building. The offer included an express term that it would expire on June 30, 20X5 if the acceptance was not delivered into the hands of the offeror by the expiration date. On June 30, 20X5 at 8:00 a.m., Caltech sent a written acceptance to Ultra via Caltech’s personal messenger. However, the messenger was not able to deliver the acceptance until July 1, 20X5. On July 2, 20X5, Ultra contacted Caltech, informing him that the acceptance had been delivered one day late. As a result, Ultra refused to honour the acceptance. Which of the following is the most correct statement?

A. There is no contract between Ultra and Caltech. However, if Caltech would have mailed the acceptance on June 30, 20X5, a contract would have been created.

B. There is a contract between Ultra and Caltech. The moment that Caltech gave the acceptance to the messenger, a contract was formed because acceptances are valid immediately upon dispatch.

C. There is a contract between Ultra and Caltech. The fact that the acceptance arrived only one day late is of no significance.

D. There is no contract between Ultra and Caltech.

Answer: D

Question 3

A financial advisory firm, Moneyplus Advisers contracts with one of its clients that the professional fees for providing advice on disposal of an asset will be RM480,000 plus a success fee of RM100,000 which will not be declared thereby avoiding tax. However, upon successful completion of the asset disposal, the client refused to pay Moneyplus Advisers the success fee. Moneyplus Advisers are now contemplating legal action against the client to recover the success fee, can they succeed?

A. Yes, Moneyplus Advisers have completed the work as agreed.

B. Yes, provide the contract is in writing.

C. No, the contract is void for illegality.

D. No, the contract is void for mistake.

Answer: C

Question 4

The directors of ABC Corporation were advised by TMA Investment Bank (TIB) on the disposal of a subsidiary of ABC Corporation. After the disposal, it was later found that TIB failed to conduct appropriate due diligence on the subsidiary and the valuation of the subsidiary. The subsidiary was grossly undervalued and was disposed at a price way below its fair value. The valuation as conducted by a professional firm appointed by the Board of Directors of ABC Corporation and accepted by TIB. The shareholders of ABC Corporation are planning to take legal action against TIB. Which of the following statements is CORRECT?

A. The shareholders will fail as there is no contractual relationship between them and TIB.

B. The shareholders will succeed as TIB has breach its duty and the shareholders suffered loss.

C. The shareholder will succeed as TIB is acting as an agent for TIB and the shareholders.

D. The shareholders will fail as TIB owes no duty of care to the shareholders.

Answer: B

Question 5

Which of the following situations may consider as a negligent act by a bank when acting as a financial adviser?

I. A client bought a tanker for RM1.5 million, based on the Bank’s officer recommendation that it was fully functional, but the Bank officer knew it was not the case.

II. A client is solvent, and the Bank issued a statement to another bank stating that the client is a bankrupt.

III. A client bought a big-ticket asset based on the Bank’s officer recommendation, which was made without establishing whether or not the asset is suitable for the client.

IV. The Bank forcefully seizes the property of a client without a court order when the client failed to settle its debt with the bank.

A. I only

B. III only

C. I and III only

D. I, II and III only

Answer: B

Question 6

ABC Investment Bank is the Adviser for a corporate transaction undertaken by Company X. As a result of the ABC Investment Bank’s negligence in providing advice on the transaction, Company X incurred certain hardships and financial losses amounting to RM1,500,000. Company X filed and won a lawsuit against ABC Investment Bank. The court judgement required ABC Investment Bank to pay Company X RM1,500,000 for the loss incurred. The court also required ABC Investment Bank pay RM2,000,000 to Company X, to make an example of the Bank’s wrongful behaviour. What type of damages are ABC Investment Bank paying?

I. General damages

II. Special damages

III. Nominal damages

IV. Punitive damages

A. I and III only

B. I and IV only

C. II and III only

D. II and IV only

Answer: D

Question 7

In relation to offences under the Capital Markets and Services Act 2007, select the correct statements.

I. Securities Commission may revoke a Capital Market Services Licence if the holder fails to carry on the business in the regulated activities for a consecutive period of two months.

II. Securities Commission may commence a civil proceeding against an offending party at any time within twelve years from the later of the date the offence is committed or the date on which Securities Commission discovered the contravention.

III. Securities Commission has a right to civil proceeding even if the offending party has not been charged with an offence in respect of the contravention

IV. Securities Commission, upon instituting a civil proceeding against the offending party, loses its right against the same party under other laws.

A. I, II and III only

B. II and III only

C. II, III and IV only

D. I and III only.

Answer: B

Question 8

Su Lin is a licensed representative of Global Capital Sdn Bhd, a Capital Market Service Licence (CMSL) holder. Which of the following situations may cause Su Lin’s licence being revoked by the Securities Commission Malaysia?

I. She allows one of her unlicensed colleagues to represent her in carrying out permitted capital market activities.

II. She was previously a bankrupt.

III. Her previous employer has taken a civil proceeding against her for misappropriation of funds.

IV. The CMSL of Global Capital Sdn Bhd has been revoked by the Securities Commission.

A. I and IV only

B. II and III only

C. I, II and IV only

D. I, III and IV only

Answer: A

Question 9

What is the consequence if Zuraida who had applied for a capital market services representative licence while under the employment of Glonic Financials, a capital market services licence (CMSL) firm, and subsequently leaves the firm while the application is still pending?

A. Securities Commission will approve her application if she joins another CMSL firm that carry out similar regulated activity.

B. Up to the discretion of the Glonic Financials.

C. Securities Commission will give her 30 days to seek employment with another CMSL before revoking her application.

D. Securities Commission will not approve her application.

Answer: D

Question 10

Firm Z has its Capital Market Services Licence (CMSL) revoked by the Securities Commission for failing to comply the certain licensing requirements. However, the firm continues to provide investment advice to clients after the licence was revoked. Which of the following may be imposed on Firm Z by the Securities Commission?

I. A fine of not less than RM1,000,000 and a jail term of less than 10 years or both

II. A fine of not more than RM5,000,000 or a jail term of less than 10 years or both

III. Damages amounted to the loss suffered by clients, if any

IV. A fine of up to RM5,000 for every day after the licence has been revoked.

A. I and III only

B. I and IV only

C. II, III and IV only

D. II and IV only

Answer: D

Question 11

Pentop Advisory is a licence holder as provided under the Capital Markets & Services Act 2007 (CMSA). Which of the following are obligations of Pentop Advisory under the CMSA?

I. To notify the Securities Commission on any change of address, business name or any other information deemed relevant.

II. To seek approval of the Securities Commission when recruiting licensed representatives from other licensee firms.

III. To notify the Securities Commission on ceasing to carry on the business.

IV. To notify the Securities Commission where a representative of the company ceases to be an employee the company.

A. I and III only

B. II and IV only

C. I, III and IV only

D. All of the above

Answer: C

Question 12

Sandy Joe is a capital market services representative licence holder (CMSRL). Which of the following is an example of Sandy Joe abusing information available to him?

A. When he provides a superficial market analysis.

B. When he falsifies client transactions.

C. When he disseminates client’s information.

D. When he manipulates share price of clients.

Answer: C

Question 13

There is a fiduciary relationship between a holder of a Capital Markets Services Licence (CMSL) who carries on the business of advising on corporate finance and a client. This means that the CMSL holder:

A. cannot charge a fee to clients.

B. must act in client’s best interest.

C. must disclose the identity of its client.

D. cannot make use of its position to benefit itself.

Answer: D

Question 14

”Money illegally obtained is integrated into the legitimate economic and financial system and is assimilated with all other assets in the system”

Pursuant to Guidelines on Prevention of Money Laundering and Terrorism Financing for Capital Market Intermediaries, the above process of money laundering is BEST referred to as:

A. integration.

B. layering.

C. leveraging.

D. placement.

Answer: A

Question 15

15. Syarikat Ionetolis was established some eight years ago. Its principal activities are production and marketing of industrial products. The company has been generating consistently after-tax profits of between RM4,000,000 and RM5,000,000 annually. The company paid-up capital consists of two hundred million shares which are currently valued at RM2.70 each. The company is now seeking a listing on the Main Market of Bursa Malaysia. To qualify for the listing, which one of the following tests should the company use?

A. Profit Test.

B. Market Capitalisation Test.

C. Both Profit Test and Market Capitalisation Test.

D. None of the above.

Answer: B

Question 16

Binaan Juta Berhad is currently undertaking a twenty-year concession dam-building project worth RM1.1 billion awarded by the5. Syarikat Ionetolis was established some eight years ago. Its princi South African government. In the financial year just ended, the company recorded a net profit of RM8.5 million. So far, after four years, the company has completed first stage of the project, recorded a profit after tax of RM48 million as well as having a positive operating cash flow. Given its success in the project, it is estimated that the company worth more than RM1 billion now. If the company was to seek a listing on the Main Market of Bursa Malaysia Securities, which of the following routes can the company takes?

A. Infrastructure Project Company test only.

B. Infrastructure Project Company and Market Capitalisation tests only.

C. Infrastructure Project Company and Profit tests only.

D. Infrastructure Project Company, Market Capitalisation and Profit tests.

Answer: D

Question 17

Syarikat Muda Bhd is a subsidiary company of Already Listed Bhd, a company currently listed on the Main Market of Bursa Securities. Syarikat Muda Bhd, a property construction company, is now seeking listing on the exchange on its own. Which of the following situations may frustrate the listing exercise of Syarikat Muda Bhd?

A. Syarikat Muda Bhd, in the last three financial years, on average, contributed 65% of the total revenue of Already Listed Bhd’s group.

B. The business of Syarikat Muda Bhd hardly gives rise to intra-group competition or conflict-of-interest situations.

C. The business of Already Listed Bhd which is the provision of financial-related services.

D. Except for two directors who are non-executive, all directors of Syarikat Muda Bhd is not involved in the management of Already Listed Bhd.

Answer: A

Question 18

18. Xsra Bhd is listing its shares on the Main Market of Bursa Malaysia. Upon listing, the company issued and paid up capital increases from 150,000,000 to 220,000,000 share ordinary shares. The shares will be listed at RM1.25 each. How many shares must be offered to the general public?

A. At least 3,000,000 shares

B. At least 4,400,000 shares

C. At least 7,500,000 shares

D. At least 11,000,000 shares

Answer: B

Question 19

Johnson Products Bhd (JPB) is making a restricted offer for subscription which is undertaken as part of a listing scheme. Which of the following party is NOT eligible to participate in the scheme?

A. Encik Basir, a shareholder of Johnson Group Berhad, a listed entity and the holding company of JPB.

B. Mr. Tan, a friend of the managing director of JPB and a non-executive director of So Fine Sdn Bhd, a major supplier of JPB which has contributed significantly to the success of JPB.

C. Encik Shanmugum, a senior partner of Shan & Associates, a long-time major customer of JPB.

D. Puan Normah, an employee at one of JPB’s subsidiaries.

Answer: B

Question 20

Unicorn Trading Bhd (UTB) will be undertaking an initial public offering (IPO) on Bursa Malaysia Securities Berhad’s Main Market next month. The exercise will involve a public issue of 31,250,000 new shares, representing 20% of its enlarged share capital, as well as an offer for sale of 12,500,000 existing shares. If these shares are to be made available to eligible directors, employees, and persons who have contributed to the success of UTB Group, the maximum number of shares to be offered to them will be:

A. 4,375,000 shares.

B. 7,812,500 shares.

C. 10,937,500 shares

D. 15,625,000 shares

Answer: C

Question 21

Under its initial public offering of ordinary shares, Konsortium Negara Berhad is offering securities to some related parties. What is the minimum price of the shares to be offered to such related parties?

A. 10 sen

B. 50

C. At the discretion of Konsortium Negara

D. Not less than the issue price to the public.

Answer: D

Question 22

After successfully complied with the profit track record requirements of the Equity Guidelines, JYJ Corporation Berhad (JYJ) was successfully listed on the Main Market of Bursa Malaysia Securities on 30 August 20X2. Mr. Joe Yang, the controlling shareholders of JYJ, holds, holds in aggregate 65% of the issued share capital of the company upon its listing on Bursa Malaysia Securities. The issued share capital of JYJ consists of 250,000,000 ordinary shares. Which of the following statements is CORRECT?

A. Mr. Joe Yang can dispose up to 50,000,000 ordinary shares within the first 12 months of 30 August 20X2.

B. Mr. Joe Yang is free to dispose his shareholdings after 28 February 20X3.

C. Mr. Joe Yang is only allowed to dispose his shareholdings if JYJ achieved a full year after-tax profit after the listing exercise.

D. Mr. Joe Yang is free to dispose his shareholdings any time after the listing exercise as long as JYJ is generating operating revenue.

Answer: B

Question 23

Strong Infra Limited is a foreign-based infrastructure project company listed on the Main Market of Bursa Malaysia. Almost all of the company’s projects are located outside Malaysia. Which of the following statements regarding resident directors of the company is correct?

I. The company must have at least two resident directors.

II. At least one of the resident directors must be a member of the company’s audit committee.

III. Majority of its directors must be a Malaysian resident or citizen.

IV. All executive directors must be a Malaysian resident.

A. I and II only

B. II and III only

C. II, III and IV only

D. III and IV only

Answer: A

Question 24

Which of the following is applicable in determining whether the operations of a listed company are Malaysian-based or foreign-based?

I. Sales revenue of the company

II. After-tax profit of the company

III. Net asset of the company

IV. Infrastructure projects undertaken by the company

A. I and II only

B. I, II and III only

C. II and IV only

D. III and IV only

Answer: C

Question 25

Techno Trading is a special purpose acquisition company (SPAC). It is seeking a listing on Bursa Malaysia Securities Berhad (BMSB). The requirements for the listing include:

I. Offer to list the its shares on Bursa Malaysia Securities Berhad’s Main Market only.

II. Appoints a Sponsor to ensure compliance with the listing requirements.

III. Raise at least RM100 million from the listing exercise.

IV. Meeting at least the minimum profit or market capitalisation levels set by the Securities Commission.

A. I and III only

B. I and IV only

C. II and III only

D. III and IV only

Answer: A

Question 26

Kiara Advances Berhad is seeking to transfer its listing status from the ACE Market to the Main Market of Bursa Securities. Which of the following requirements are relevant to the company?

I. The market capitalisation of the company after the transfer must be at least RM500 million.

II. The average market capitalisation of the ordinary shares for the one year period ending on the last business day of the calendar month immediately preceding the date of submission of the application to transfer the listing status, is at least RM500 million.

III. The company must have uninterrupted after–tax profit for 3 to 5 years, prior to the submission of application to transfer the listing status, of at least RM20 million in aggregate.

IV. The company must have at least RM6.0 million profit after tax for the most recent financial year.

A. II and IV only

B. I, II and IV only

C. II, III and IV only

D. All of the above.

Answer: A

Question 27

Which of the following statements regarding an initial public offering (IPO) by a company to list its securities on the Main Market of Bursa Malaysia Securities Berhad is CORRECT?

A. The IPO must be underwritten.

B. All companies listed on the Main Market must be incorporated in Malaysia.

C. Moratorium may be placed on executive directors who are substantial shareholders of the company.

D. Shareholders of the company’s holding company are not eligible to participate in restricted offer of the securities.

Answer: C

Question 28

Recently, Kreatif Manufacturing Corporation was successfully listed on the Main Market of Bursa Malaysia Securities Berhad. Which of the following information relating to the listing exercise are required to be submitted to the Securities Commission?

I. A confirmation of all terms and conditions relating to the listing have been complied with.

II. The date of the listing.

III. The management accounts of the company immediately after the listing.

IV. The price at which securities were issued during the listing.

A. I and II only

B. I, II and III only

C. I, II and IV only

D. II, III and IV only

Answer: C

Question 29

The Malaysia Code on Take-overs and Mergers (The Code) and Rules on Takeovers, Mergers and Compulsory Acquisitions (The Code Rules) governs the takeover of companies listed on Bursa Malaysia Securities Berhad. Which of the following statements relating to the Code and Code Rules is CORRECT?

I. A person is deemed to have control of a company if that person appoints the majority of the members of Board of Directors of the company

II. A person gains control of a company if that person acquired more than 30% of its voting shares

III. A voluntary offer can only be made person who has control over the company

IV. A mandatory offer is triggered if a person has gain control of a company.

A. I and II only

B. I and IV only

C. II and III only

D. II and IV only

Answer: B

Question 30

BellyCorp Berhad has announced and served a takeover notice to Jualan Berhad on Monday 3 September 20X1. As a result, BellyCorp Berhad is required under the Malaysian Code of Take-Overs and Mergers to forward offer documents to the shareholders of Jualan Berhad. When must BeLlyCorp Berhad forward the offer documents to Securities Commission for clearance?

A. Within 24 hours of serving the takeover notice.

B. Within 48 hours of making the announcement and serving the takeover notice.

C. Note later than Monday, 10 September 20X1.

D. Not later than Friday, 7 September 20X1.

Answer: D

Question 31

Johan Berhad is making an offer for the entire voting shares in Exin Bhd. After having issued an offer documents for the purpose, Johan Berhad discovered that there is a material omission in the offer document. Which of the following parties must Johan Bhd immediately disclose the material omission to?

I. To Johan Bhd’s shareholders by way of circular

II. To the public by way of press notice

III. To the Securities Commission

IV. To Bursa Malaysia Securities Berhad

A. I, II and III only

B. II and III only

C. II, III and IV only

D. All of the above

Answer: C

Question 32

Which of the following is prohibited, under the Malaysian Code of Takeovers and Mergers, during the offer period of a takeover deal?

I. Appointment of directors onto the Board of Directors of the target company by the offeror

II. Resignation of directors of the offeree before the 1st closing date of the offer or the acceptance condition is met, whichever is later

III. Disposal of the target company’s shares by the offeror

IV. Disclosure of significant events to Bursa Malaysia Securities by the offeror

A. I and III only

B. I, II and III only

C. II and III only

D. II, III and IV only

Answer: B

Question 33

Which of the following information can be found on the inside cover/first page of prospectus issued by a company seeking to be listed on the Main Market of Bursa Malaysia Securities?

I. Indicative timetable for the listing exercise.

II. Name and address of the company.

III. Name and address of the Principal Adviser.

IV. Proposed utilisation of proceeds to be raised from the listing.

A. I and II only

B. I and III only

C. II, III and IV only

D. III and IV only

Answer: B

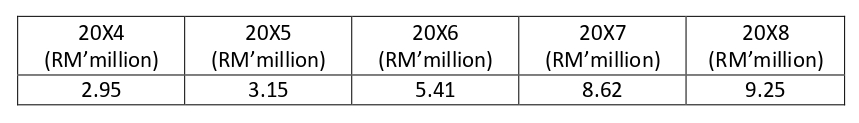

Question 34

BBM Corporation Berhad (“BBM”) is making an application to the Securities Commission Malaysia to list its shares on the Main Market of Bursa Malaysia Securities (“BMSB”). The after-tax profit of BBM in the years prior to the application was as follow: