This examination is designed to test candidate’s knowledge and understanding of the financial issues relevant to the investment advisory and corporate finance services in the Malaysian capital market. It is one of the examinations to be passed by individuals who:

(a) Intend to apply for a Capital Markets Services Representative’s License (CMSRL) to carry on any of the following regulated activities:

(i) Advising on Corporate Finance;

(ii) Investment Advice; or

(b) Intend to be employees of registered persons who carry out the capital markets activities as stipulated in Items 2 and 3, Part 1 of Schedule 4 of the Capital Markets and Services Act 2007.

Candidates are advised to refer to the Licensing Handbook for detailed combination of examinations required for each regulated activity.

Candidates are expected to possess good knowledge and understanding of the subject matter provided in this study outline and specified reference. In addition, candidates are expected to have relatively strong capability in the application and analysis of information in this study outline and its reference. It is estimated that this module will require a minimum of 120 hours of study time. Candidates may need less or more depending on the education background and work experience.

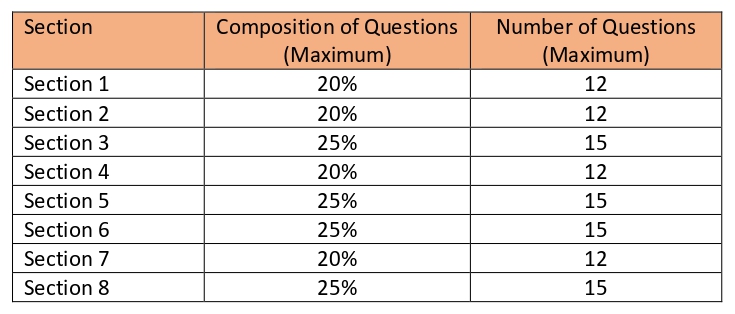

EXAMINATION SYLLABUS The syllabus for this examination is divided into 8 sections and the maximum composition of questions from each section is as follows:

Module 12 : Investment Management and Corporate Finance

No. of Questions: 60

Duration: 120 minutes

Pass Mark: 70%

SAMPLE QUESTIONS AND ANSWERS

Example 1:

A secondary market is a market trades in assets that have been issued in the primary markets. For a secondary market to function properly, efficient supporting institutional infrastructure such as market-based benchmarks, efficient clearing and settlement systems, credit rating agencies and central information systems are required. In order to be efficient, a secondary market needs to provide ___________.

A. a liquid market for the assets traded

B. a good price discovery function

C. a source for diversifying and transferring investment risk, and goodwill for firms.

D. All of the above

Example 2:

Some main types of money market instruments traded as government bonds in Malaysia other than Malaysia Treasury bills are ___________.

A. Malaysian Government Securities

B. Bank Negara Monetary Notes

C. Government Investment Issues

D. All of the above

Example 3:

Generally, the Islamic Capital Markets (ICM) in Malaysia is governed by several Acts and the significant ones are as follows ____________.

I Capital Markets and Services Act 2007

II Securities Commission Act 1993

III Banking and Financial Institutions Act 1989

IV Islamic Banking Act 1983;

A. I and II

B. I, II and III

C. II, III and IV

D. I, II, III and IV

Example 4

The SC has also introduced several guidelines, not just to interpret the legislation, subsidiary legislations and rules relevant to the Islamic Capital Market (ICM), but also to signal the policy decisions that participants in the ICM must follow, such as __________.

I Guidelines on the Offering of Islamic Securities 2004 (ISG),

II Guidelines on Islamic Fund management 2007,

III Guidelines for Islamic Real Estate Investment Trusts (REITs) 2008, and

IV Guidelines and Best Practices on Islamic Venture Capital 2008.

A. I and II

B. I, II and III

c. II, III and IV

D. I, II, III and IV

Example 5

Bursa Malaysia has established an Islamic Markets division dedicated to the development of Shariah-compliant capital capital market products and services as well as trading platforms such as an Islamic Exchange Traded Funds (IETFs). Among others, the Islamic Capital Markets (ICM) products and service available in Bursa Malaysia are as follows EXCEPT:

A. Bursa Suq Al-Sila

B. Shariah-compliant stocks

C. Sukuk

D. Real Estate Investment Trusts (REITs)

Note: The answer is D. REITs is not necessarily Islamic unless it is stated or specified or classified as an Islamic REITs.

Details of the syllabus are as below:

Section 1

Exercises:

1. In order to induce producers to supply more of a commodity, a higher commodity price must be paid because producers usually face:

A. decreasing production costs

B. economies of scale

C. increasing production costs

D. specialisation and division of labour in production

2. Which of the following is NOT part of the government sector to the economy?

A. Federal government

B. State government

C. Firms

D. Municipal government

Section 2

TOPIC 5: RISKS AND RETURNS

1. Present Value and Opportunity Cost of Capital

2. Capital Budgeting

3. Measurement of Risk

4. Measurement of Investment Returns

Exercises

1. Which one of the following statements is FALSE in relation to the computation of returns:

A. Portfolio return = ∑[(Weight of asset in portfolio) X (return on asset)]

B. Total returns = Net cash flows + Capital gains

C. Nominal returns = Real returns + Inflation rate

D. Coefficient of variation = returns per unit of risk

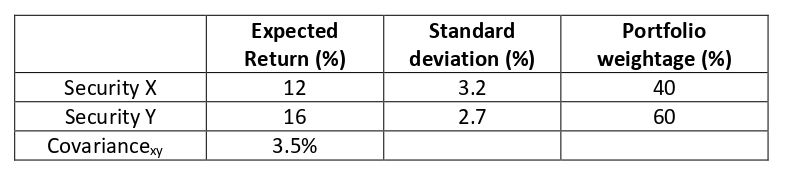

Question 2 to 5 will be based on the following information:

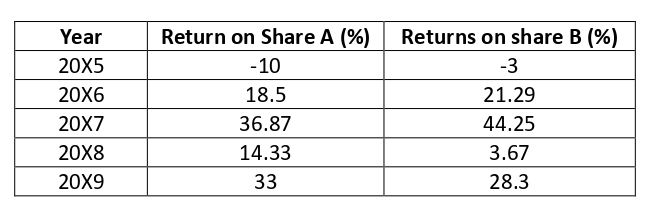

An investor bought two shares (share A and B) from the main board of Bursa Malaysia in 20X5. At the end of 20X9, the following information is available on these shares:

2. What is the realised average return on share B for the period 20X5 to 20X9?

A. 17.8%

B. 18.7%

C. 18.9%

D. 19.8%

3. What is the standard deviation of returns on share B?

A. 15.63%

B. 17.02%

C. 30.22%

D. 38.05%

4. What is the realised return of portfolio AB, if equal amounts are invested in each share?

A. 18.72%

B. 18.90%

C. 19.08%

D. 19.71%

5. What is the standard deviation of portfolio AB, if equal amounts are invested in each share, given the correlation of returns of A and B is 0.92?

A. 12.33%

B. 13.56%

C. 16.46%

D. 18.54%

Section 3

TOPIC 6: PORTFOLIO THEORY

1. Risk Aversion and Utility

2. Markowitz Portfolio Theory

3. Capital Asset Pricing Model

4. Arbitrage Pricing Theory

Section 4

TOPIC 7: PORTFOLIO MANAGEMENT

1. Market Efficiency

2. Security Analysis

3. An Introduction to Portfolio Management

4. Evaluation of Investment Performance

Exercises

1. ___________ decomposes the performance results in order to determine the source of over-performance or under-performance of the portfolio manager.

A. Performance appraisal

B. Performance attribution analysis

C. Sensitivity analysis

D. Market analysis

Note:

Portfolio performance evaluation is an essential aspect of the investment process that allows investors and portfolio managers to assess the effectiveness of their investment strategies.

The main goal of performance evaluation is to determine whether the chosen investment strategy is achieving the desired risk and return objectives.

2. allocation of a portfolio’s fund according to the classes of asset is called:

A. performance measurement

B. performance evaluation

c. asset allocation

D. performance attribution.

3. The dollar-weighted rate of return measures;

A. the opportunity cost of forgoing consumption, given no inflation.

B. the risk-adjusted rate of return of a portfolio

C. the discount rate that equates all cash flows to or from the portfolio, including the ending market value, with the beginning market value of the portfolio.

D. the compounded rate of growth of the initial portfolio market value during the evaluation period.

4. _________ is a measure of market risk.

A. Beta – Beta (β) is a measure of the volatility—or systematic risk—of a security or portfolio compared to the market as a whole (usually the S&P 500). Stocks with betas higher than 1.0 can be interpreted as more volatile than the S&P 500. Beta is used in the capital asset pricing model (CAPM), which describes the relationship between systematic risk and expected return for assets (usually stocks). CAPM is widely used as a method for pricing risky securities and for generating estimates of the expected returns of assets, considering both the risk of those assets and the cost of capital.

B. Standard deviation – Standard deviation is a statistical measurement of how far a variable, such as an investment’s return, moves above or below its average (mean) return. An investment with high volatility is considered riskier than an investment with low volatility; the higher the standard deviation, the higher the risk. A traditional bell curve is a good way to visualize the concept of an investment’s returns over an extended period of time.

c. Alpha – Alpha (α) is a term used in investing to describe an investment strategy’s ability to beat the market, or its “edge.” Alpha is thus also often referred to as “excess return” or the “abnormal rate of return” in relation to a benchmark, when adjusted for risk. Alpha is often used in conjunction with beta (the Greek letter β), which measures the broad market’s overall volatility or risk, known as systematic market risk.

D. Gamma

5. An index that measures the excess return of a portfolio relative to the portfolio’s total risk using standard deviation is known as:

A. information ratio

B. Jensen Index

C. Treynor Index

D. Sharpe Index

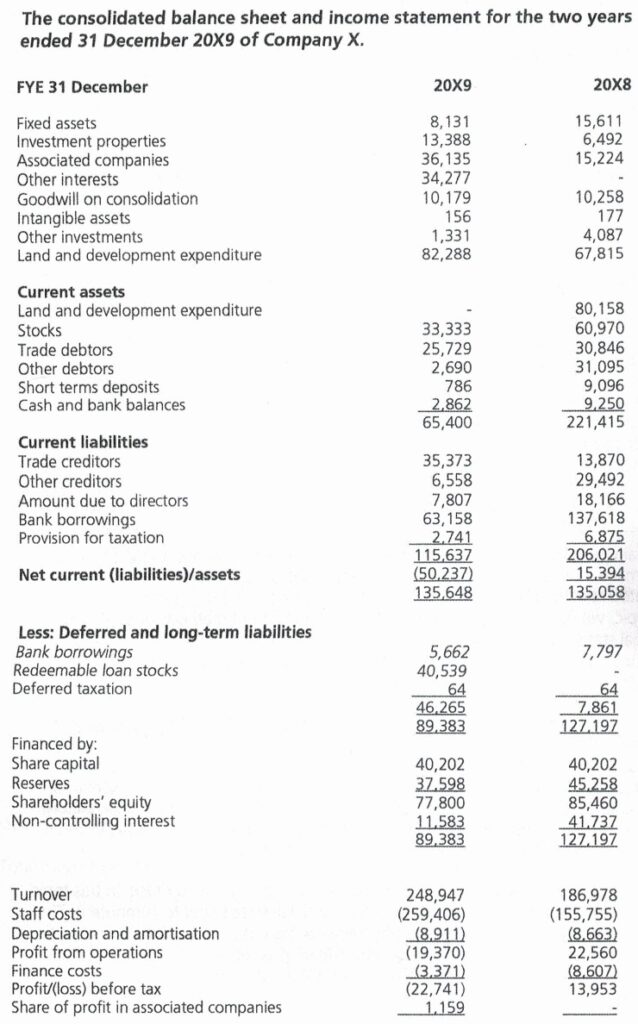

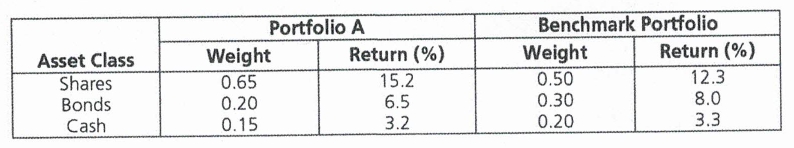

Question 6 to 9 are based on the following information:

6. The expected rate of return of portfolio A is:

A. 11.42%

B. 11.66%

C. 12.01%

D. 12.62%

7. What is the rate of return of the benchmark portfolio?

A. 8.88%

B. 9.21%

C. 9.32%

D. 10.53%

8. What is the selection effect portfolio A?

A. -1.45%

B. 1.55%

C. 1.57%

D. 1.63%

9. The allocation effect a portfolio A is:

A. -0.93%

B. -0.65%

C. 0.88%

D. 0.93%

Question 10 to 12 are based on the following table:

10. The HENSEN ALPHA for portfolio Z is:

A. 2.20

B. 3.09

C. 3.34

D. 5.26

Note:

Alpha = R(i) – (R(f) + B x (R(m) – R(f)))

where:

R(i) = the realized return of the portfolio or investment

R(m) = the realized return of the appropriate market index

R(f) = the risk-free rate of return for the time period

B = the beta of the portfolio of investment with respect to the chosen market index

11. The TREYNOR INDEX for portfolio W is:

A. 6.6

B. 7.8

C. 8.6

D. 10.0

Note:

Treynor Ratio = (PR – PFR)/PB = (16 – 8)/0.8 = 10

where:

PR= Portfolio return

RFR= Risk free rate and

PB= Portfolio beta

12. which portfolio ranks the best under the Sharpe Index?

A. W

B. X

C. Y

D. Z

Section 5

TOPIC 9: DEBT FINANCING

1. Key Categories of Debt Financing services

2. Valuation of Bonds

3. Price Volatility

4. Convertible Bonds

Exercises:

1. ABC Ltd has a constant overdraft balance of RM100,000 up to 15 March 20X9. Subsequently, the company drew down an additional RM50,000 and the overdraft remains unchanged up to 1 April 20X9. At 7.5% per annum, what would be the interest accrued for the month of March in ABC Ltd’s account?

A. RM 318.49

B. RM 801.37

C. RM 832.19

D. RM 955.48

2. _________ is the periodic interest payment paid to the bondholder before and at the maturity of the bond.

A. Coupon payment

B. Yield

C. Nominal value

D. Capital gains

3. All things constant, the price and yield on a bond are:

A. not related

B. inversely related

C. positively related

D. constant

4. The number of shares for which each convertible bond can be exchanged is called:

A. conversion price

B. conversion ratio

C. conversion premium

D. market value

5. Which of the following statements is CORRECT about ZERO-COUPON BONDS?

A. Zero-coupon bonds provide periodic payments

B. Zero-coupon bonds are sold at a higher price relative to straight bonds.

C. Holders of zero-coupon bonds do not enjoy any capital gains as the price of the bond increase as it approaches maturity.

D. The price of a zero-coupon bond is the present value of the nominal value of maturity.

Use the following information to answer questions 6 and 7.

Consider two bonds, Bond A and B, with a nominal value of RM1,000 and a coupon rate of 6% per year. Both bonds have similar risk characteristics and differ only in their term to maturity. Bond A is term to maturity is 5 years while Bond B’s term to maturity is 10 years. The current yield is 6%.

6. If the yields increase by 2% points, the percentage price change of Bond A is:

A. -13.42%

B. -7.97%

C. 7.97%

D. 13.42%

7. If yields by 2% points, the percentage price change of Bond B is:

A. -13.33%

B. -7.99%

C. 7.99%

D. 13.33%

8. The duration of a bond is a function of the bond’s:

I time to maturity

II coupon rate

III yield

IV price of the bond

A. I and II

B. I and III only

C. I, II and III only

D. All of the above

9. The convexity of bonds is more important when interest rates are:

A. low

B. high

C. expected to change very little

D. less than the coupon rate on the bond

10. The number of shares for which each convertible bond can be exchanged is called:

A. yield to maturity

B. term to maturity

C. modified duration

D. convexity

11. A modified duration of a 8% coupon bond paying interest semi-annually with a duration of 4.5 years and a yield of 10% is:

A. 4.09

B. 4.25

C. 4.29

D. 4.35

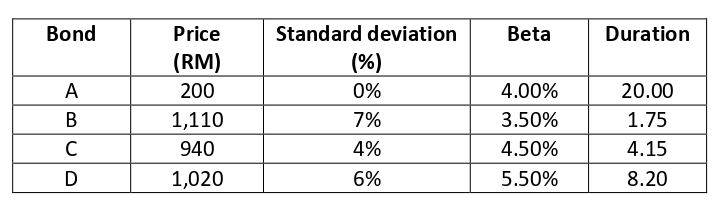

Use the following information to answer questions 12 and 13