Monetary policy is the use of economic tools by a country’s central bank or other government agency, to control critical economic factors such as money supply, inflation, employment, and economic growth. Monetary policy does not include such political mechanisms as fiscal policy, which is often administered by unrelated government representatives and includes tax policy, infrastructure spending, military operations, etc. Monetary policy must consider the effects of fiscal policy to meet its goals, but the directors of fiscal policy may not need to consider the objectives of monetary policy when making decisions.

Central banks use monetary policy to manage economic fluctuations and achieve price stability, which means that inflation is low and stable. Central banks in many advanced economies set explicit inflation targets. Many developing countries also are moving to inflation targeting…

What Is Monetary Policy?

Monetary policy is a set of tools used by a nation’s central bank to control the overall money supply and promote economic growth and employ strategies such as revising interest rates and changing bank reserve requirements. In the United States, the Federal Reserve Bank implements monetary policy through a dual mandate to achieve maximum employment while keeping inflation in check…Read more

Overview

Monetary policy is the macroeconomic policy laid down by the central bank. It involves management of money supply and interest rate and is the demand side economic policy used by the government of a country to achieve macroeconomic objectives like inflation, consumption, growth and liquidity.

Monetary policy refers to the setting of money and credit conditions to achieve a desired goal for price inflation and to assist in the promotion of sustainable economic prosperity. As such, it is concerned with the behaviour of supply, interest rates and general financial conditions. Monetary policy is an integral part of economic policy.

While monetary policy could be undertaken by a government ministry, the importance of the financial conditions of a country in the maintenance of economic prosperity in the long-term makes it imperative that monetary policies are set by an organisation with strong links to the financial markets and one that is seen to be independent and objective. For this reason, monetary policy in developed countries is undertaken by central banks.

Objectives

– Examine the current stance of monetary and fiscal policy in Malaysia.

– describe the functions of Bank Negara Malaysia.

– Illustrate how Bank Negara Malaysia implements its monetary policy decisions, and

– Discuss the objectives of Bank Negara Malaysia’s money market operations

Monetary policy

Monetary policy is an integral of economic policy and refers to the set of policies undertaken by the central bank that affects variables (such as money supply and interest rates). The aim of monetary policy is to maintain price stability and achieve sustained economic growth.

The objectives of monetary policy

(i) Short-term objectives

– To accommodate the short-term liquidity needs of the financial system,

-To provide lender of last resort facilities to the financial system; and

– To ensure stability in the money and foreign exchange markets.

(ii) Medium-term objectives

– To maintain a sound and efficient financial system;

– To ensure economic stability, price stability and full employment;

– To ensure the balance of payments equilibrium, and

– To promote export competitiveness

(ii) Long term objectives

– To ensure a long-term upward trend in economic growth;

– To promote long-term financial development; and

– To ensure equitable income distribution among various income groups.

The implementation of the monetary policy is taken by central banks. A central bank is a financial institution with links to the government, but with a degree of autonomy in decision-making. The autonomy of the central bank could range from minimal to largely independent. In some countries, monetary policy is undertaken by monetary authorities with central bank functions. For example, in Singapore (and for that matter, Hong Kong), the Monetary Authority is not a central bank but it functions as a de factor bank, in Malaysia, the setting and implementing of monetary policy are undertaken by Bank Negara Malaysia (BNM), which was set up under the Central Bank of Malaysia Ordinance 1958.

Monetary policy transmission

Monetary instruments are the tools though which the central bank tries to influence the monetary base, money multiplier, bank assets and interest rates.

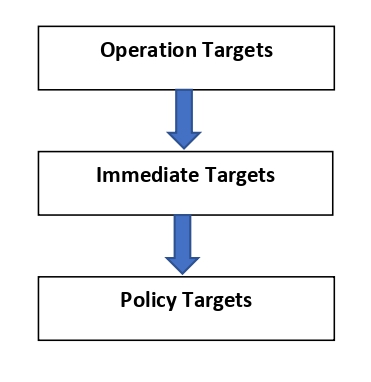

Operating targets are the variables which the central bank tries to influence directly to achieve certain desired levels. The attainment of the operating targets will enable the central bank to achieve its intermediate targets on money supply, bank credit and long-run interest rates. The attainment of these intermediate targets will, in turn, enable the central bank to achieve the policy targets such as inflation, full employment, balance of payments equilibrium, income distribution, economic development and growth.

In an ideal situation, the operating targets should have a close and stable relationship with the intermediate targets, which in turn will have a significant influence on the policy targets. The policy targets are the main objectives that a government will try to achieve and they are the quantitative measurement of the social well-being of the population.

For instance, if monetary growth has a close relationship with the inflation rate, in order to control inflation, the central bank would try to reduce the monetary base, i.e. an operating target, to a certain desired level. Given a stable money multiplier, money supply, i.e. an intermediate target, is subsequently reduced to a desired level, which exerts a dampening effect on inflationary pressure.

Monetary indicators are variables which summarise and cause the impact of past monetary policies on various macroeconomic variables. Note that the variables that serve as operating targets and immediate targets may also act as monetary indicators.

The impact of monetary policy

The effectiveness of monetary policy depends on the strength and reliability of the relationship among the instruments over which the relationship is known as “the transmission mechanism”. This mechanism has an indirect influence over most financial mechanism”. This mechanism has an indirect influence over most financial variables. The central bank has direct administrative control over only one interest rate, which is the three-month intervention rate but has no direct control over cash, bank deposits and other liquid assets.

The yield curve-term structure of interest rates

Adjustment to short-term interest rates (usually overnight or three-month intervention rate) by central banks have an impact on interest rates covering the entire term structure of interest rates of the yield curve. The yield curve acts as a market mover because changes in the yield curve will indicate a rise or fall of rates in the future – i.e. an indication of whether the central bank is tightening or loosing the money supply (which will affect the contraction and expansion of the economy).

In general, these are three types of yield curves – normal, inverted or flat. A yield curve is normal when short-term rates are lower than-term rates. When a normal yield curve exists, investors who are willing to tie up their money for a longer period of time (and thus subject their investments to a higher risk) are rewarded with a higher yield than those with longer maturities. An inverted, or negative, curve exists when securities with shorter maturities have higher yield than those with longer maturities. An inverted yield curve occurs when the central bank is trying to keep money tight. A flat yield curve indicates a change between a positive and inverted curve. A flat yield curve could occur when the central bank is in the process of tightening or loosening money. For example, if the previous yield curve was normal, the central bank is tightening money; if it was inverted, the central bank is loosening money.

A change in interest rates would have the following effects:

– Alter disposal income

For example, lower interest rates could cause banks to lower their home/business loan rates, resulting in lower loan repayments for borrowers. The rise in income after interest is paid affects the spending patterns of household and business. This channel of funds is called the cash flow effect.

– Change the attractiveness of purchasing services (holidays, entertainment and restaurants) or acquiring physical assets (cars, television and stereos) compared with acquiring financial assets (bonds or bank deposits). The return on services/physical assets will not change, unlike the return on financial assets.

– Cause a tightening of credit criteria by financial intermediaries

If interest rates rise, banks will respond to higher interest rates by rationing credit to ensure that their average default rates remain low.

– Cause changes in wealth

When interest rates rise, bond price will fall resulting in lower net worth for bondholders. Equity prices will fall as well. As a result, the wealth of investors will fall causing them to be less inclined to spend on goods and services.

– Alter expectation

When interest rates are raised, businesses, consumers and wage earners may rightly conclude that the authorities want to curb excess demand and that the economy is about to slow down. Business may curb price increases to maintain demand for their products, wage earners may curb wage demands to ensure that they are not laid off. Both these actions will tend to limit increases in price levels. Consumers may postpone spending decisions in the belief that economic conditions are likely to deteriorate while businesses may defer capital spending employment of more staff.

Importance of capacity constraints

The extent to which relative changes in the prices of financial and physical assets ultimately affect real output and the general level of prices also depend on the level of output relative to the economy’s potential. If the economy is operating close to full capacity, an easing in monetary policy aimed at increasing aggregate expenditure will generally result in higher inflation, rather than extra output.

Indicators of policy

Uncertainties abound in judging how discretionary shifts in policy instruments may feed through to ultimate policy objectives. Central banks look at a variety of indicators to determine if the setting of policy is appropriate to achieve its goals.

In general, no single indicator has a sufficiently reliable relationship with the ultimate objective to act as role indicator of the effectiveness of adjustments to policy. Different central banks will use different indicators to direct them in their monetary policy.

Three broad categories of indicators are used.

– indicators that are close to the ultimate policy goal such as indicators of price movements and output. In Malaysia, the forms of price indicators such as the consumer price index (CPI), asset prices and measures of GDP are the most obvious too loose. Strong GDP growth above the capacity growth may also suggest that monetary policy needs to be tightened. Trends in wage growth have traditionally provided dues to possible future inflation because wages are a major cost of production.

– Financial variables involved in the transmission process, such as interest rates, exchange rates and asset prices. If long-term interest rates or exchange rates were to fail, the authorities would usually expect growth to be stimulated. Higher assert prices, for example for shares and real estate may increase that financial conditions are too expansionary and that this will inevitably spill over onto increase spending on goods and services and, in time, push up the prices of those goods and services (too much money chasing too few goods).

-Indicators of financial conditions in volume terms. These include indicators such as is the volumes of money and credit. This category does not receive the same emphasis now as they dis in the late 1970s and early 1980s, when monetary targeting was the main basis for monetary policy decisions.

Different, countries have placed different emphasis on the three categories of indicators. This reflects shifts in views and ideals about the transmission mechanism and the role and potency of monetary policy over the years.

In Malaysia, BNM monitors a broad range of real, monetary and financial indicators to gauge the inflationary pressure and economic activities in formulating the monetary policy. In order to evaluate the impact of past monetary policy decision, BNM will also monitor stock and how of liquidity in the financial system.

Monetary Policy in Malaysia and the role of Bank Negara Malaysia

The history of monetary policy in Malaysia has been a progression from a monetary targeting approach to an interest rate targeting approach until the mid-1990s. Thereafter, a more market-based approach was implemented. Malaysia uses both direct controls are not developed to the same level of sophistication as those of the industrialised countries.

Direct controls

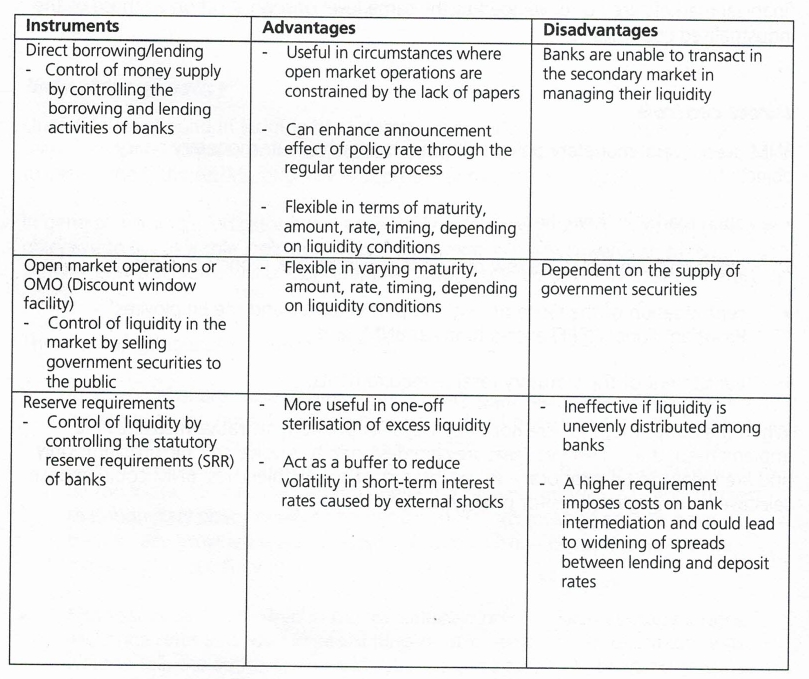

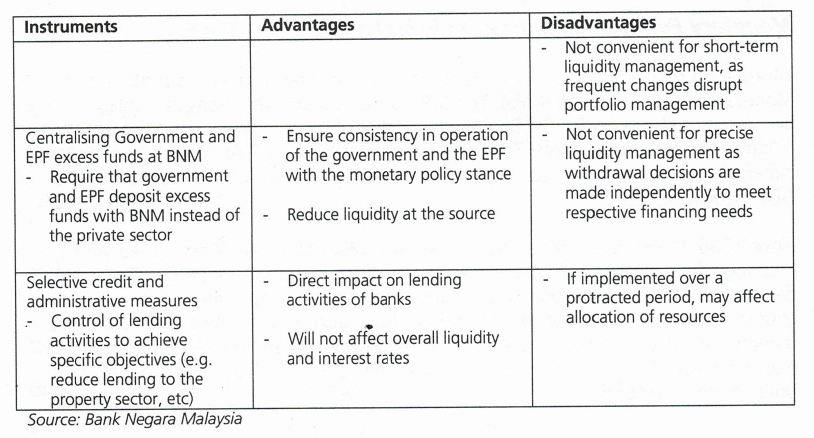

BNM uses several monetary policy instruments to achieve its monetary policy objectives:

– open market intervention;

– direct intervention to borrow or lend in the interbank money market;

– centralisation of the Government’s surplus balances and the Employees’ Provident Fund’s (EPF); and

– adjustment of the statutory reserve requirements.

When the above methods are not effective, selective administrative measures are implemented; these selective measures are designed to resolve specific problems only and are mean to be temporary. In the interest of social objectives, BNM could impose selective lending guidelines for sectors.

The market-based solution

The lack of infrastructure in Malaysia’s financial system in 1990s for a market-based solution has led to its ineffectiveness. In response, the monetary authorities decided to switch from direct controls to indirect response, the monetary authorities decided to switch from direct controls to indirect controls. BNM started three-pronged approached to facilitate this transition:

Enhancing transparency through effective communication and wide dissemination of information

Since 1998, BNM enhanced its signalling mechanism by announcing daily liquidity forecasts and its daily tender operations. Furthermore, BNM’s 3-month intervention rate was announced to mark any changes in the direction of the monetary policy.

– Moves taken to improve trading, payment and settlement system

This was done to improve the handling of large volumes of securities as well as the settlement lag, thereby enabling greater volume of transaction to be handled. Measures taken were the implementation of scripless trading and real-time gross settlement system.

– Acceleration of both regulatory and prudential reforms

Measures taken included the implementation of liquidity management of banking institutions through the introduction of a new liquidity framework. Bank soundness was also enhanced in line with international standards.

Table 2: Monetary Policy Instruments

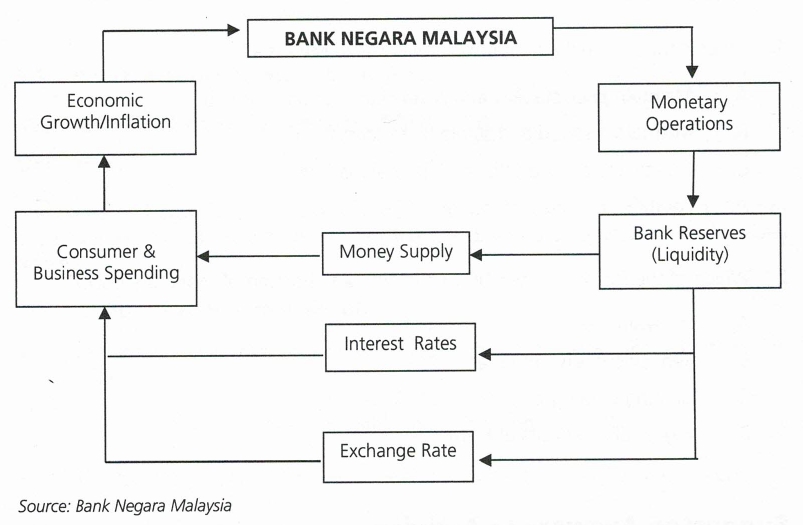

Figure 6: How Bank Negara Malaysia’s Monetary Policy Affects the Economy and Inflation

In April 2004, BNM introduced a new interest rate framework which represented a change in the system of implementing monetary policy and promoting a more efficient pricing by the banking institutions. The new framework was designed to enhance the effectiveness of monetary policy by facilitating the transmission of changes in the policy rate to the other market rates and ultimately, to key macroeconomic objectives. Following the implementation of this interest rate framework, the Overnight Policy Rate (OPR) is now the indicator of the BNM’s monetary policy stance.

Monetary policy Communication in Malaysia

Information on monetary policy in Malaysia is primarily being released through the Monetary Policy Statement (MPS). The MPS not only states the monetary policy decision, but also provides the Bank’s assessment of the performance of the country, inflation and the policy issues. The first MPS was issued on 27 August 2003 and was initially released only on a quarterly basis to coincide with the announcement of the GDP growth figures.

Since 20005, the MPS has been issued after each Monetary Policy Committee (MPC) meeting. The availability of regular and timely information on monetary policy decisions is part of BNM’s ongoing initiative to enhance greater understanding on the country’s economic and financial condition. BNM also releases the schedule of MPC meeting in advance. The transparency of the procedures and the clarity of monetary policy decisions help facilitate orderly market adjustments following the monetary policy announcements.

Exercise:

1. What is the principal aim of monetary policy in Malaysia?

A. Maintain price stability and stabilising economic growth

B. Maintain a sound and stable financial system

C. Create a deep and efficient financial markets

D. Equitable income distribution

2. Which of the following does NOT constitute a toughening of monetary policy?

A. Increasing SRR

B. Reducing intervention rate

C. Limiting credit growth to only 5% annually.

D. Higher EPF deposits at BNM