In this topic, it provides an overview of the strategic management process and helps readers to understand its significance and linkage to investment and corporate finance.

Contents

Introduction

Overview of Strategic Management

Linking Corporate Finance with Strategic Management

Shareholder Value

Conclusion

Introduction

Strategic management is the process of setting goals, procedures, and objectives in order to make a company or organization more competitive. Typically, strategic management looks at effectively deploying staff and resources to achieve these goals. Often, strategic management includes strategy evaluation, internal organization analysis, and strategy execution throughout the company.

The theory of corporate finance helps organisations make two major financial decisions. The first is the investment decision, which relates to decisions about the type of assets an organisation should invest in and the amount to be invested. the second is on how to raise the funds required for the investment.

The ultimate determinant for choosing the particular financial decision should be its impact on shareholder value. Herein lies the symbiotic relationships between corporate fiinance and strategic management (for commercial organisations anyway) is to enhance shareholder value.

A sound knowledge of strategic management is important for investment advisers because the strategy adopted by an organisation will have an impact on its value. Moreover, understanding the strategy of an organisation will give the investmenht adviser an insight as to whether the investment and financing decisions made are for the good of the organisation.

Objectives

(a) Provide an overview of the strategic management process

(b) Describe the inter-relationship between corporate finance, investment and strategic management, and

(c) Explain the concept of shareholders value and its determinants

Overview of Strategic Management

Strategic Management Process

Strategic management is the ongoing planning, monitoring, analysis and assessment of all necessities an organization needs to meet its goals and objectives. Changes in business environments will require organizations to constantly assess their strategies for success. The strategic management process helps organizations take stock of their present situation, chalk out strategies, deploy them and analyze the effectiveness of the implemented management strategies. Strategic management strategies consist of five basic strategies and can differ in implementation depending on the surrounding environment. Strategic management applies both to on-premise and mobile platforms.

Strategic management is also defined as the process of making and implementing major decisions inviolving the whole organisation, to enhance the performance of the organisation. Most significant business events of companies reported in the newspapers or business publications involve strategic management, for example acquisitions or disposals of businesses, launching of new products, restructuring, etc.

Given that these decisions will impact the performance of the company, the importance of strategic management cannot be under-emphasised.

While the process in Figure 1 is illustrated in a linear form, with each component being undertaken one after another in sequence, in practice, they are often interlinked as a dynamic interaction among the components in a strategic management process. Particularly, in a rapidly changing environment, organisations may act first and then evaluate the efficacy of the approach. The approaches that work eventually converge into viable patterns that are used as strategies.

For example, referring to Figure 1, strategy implementation and formulation may overlap with strategic analysis, which is an on-going activity.

Mission and vision

A mission statement is a statement of the role, or purpose of the organisation. It sets the scope and boundaries of the organisation and communicates the broad ground rules in conducting the organisation’s business to those involved in strategic decisions.

A mission statement may include the following:

(a) values of the organisation,

(b) products and services of the organisation,

(c) markets within which the organisation will trade and access,

(d) technology to be adopted by the organisation; and

(e) attitude of the organisation towards growth and financing.

A mission statement should set an organisation apart from others and arouse a strong sense of corporate identity and business purpose. Consider the mission statement of McDonald’s Corporation below:

“To offer the fast food customer, food prepared in the same high-quality manner world-wide, tasty and reasonably priced, delivered in a consistent, low-key décor and friendly atmosphere”

On the other hand, the vision statement below, gives the long-term direction of the organisation. It expresses what the organisation intends to be or can be in the future. The vision statement integrates a shared understanding of the nature and target of the organisation and uses the understanding to motivates the organisation to work towards its purpose.

The vision statement of McDonald’s corporation:

“To be the world’s best quick service restaurant experience. Being the best means providing outstanding quality, service, cleanliness and value, so that we maker every customer in every restaurant smile.”

Strategic analysis is an assessment of the strategic position of the company. It helps form a view of the key influence on the present and future condition of the organisation. Here, the infamous SWOT (strengths, weakness, opportunities, threats) analysis is usually adopted as the basis for strategic analysis.

The SWOT analysis involves determining the organisation’s strengths and weaknesses, and assessing the opportunities and threats from the external environment that might influence them. By bringing together the strengths, weaknesses, opportunities and threats faced the organisation, a strategic niche can be developed and exploited by the organisation. The objective of the SWOT analysis is to allow an organisation to leverage its strengths, minimise its weaknesses, seize opportunities and counteract threats.

The SWOT analysis process is briefly discussed below:

Analysis of internal strengths and weaknesses

An effective internal analysis provides information about specific assets, skills work practices of an organisation and an understanding of how a company can compete given its resources.

In general, if these resources are exceptional in the way they enhance the value of the organisation, they become the core competence of the organisation and provide a source of competitive advantage.

The major components of internal analysis include the examination of the strengths and weaknesses of the organisation’s financial position, human resources, marketing activities and operations.

Analysis of external opportunities and threats

This involves a through evaluation of the environment in which the organisation operates. The factors analysed include:

(a) Political environment

Examines the regulations and controls imposed by the authorities such as trade and labour policies, taxation policies and environmental protection laws.

(b) Economic factors

How economic factors are affecting demand, supply, growth, competition and profitability of the industry.

(c) Social environment

Examines social trends such as the migration of skilled labour, emerge of alternative labour markets and lifestyle.

(d) Technological factors

How the industry is and will be affected technological advancement, particularly by recent and potential innovations.

The external analysis should help develop an understanding of the:

(i) opportunities which the company can capitalise on; and

(ii) threats which have to be overcomed or circumvented

Once the organisation is able to identify is strengths, weaknesses and the opportunities and threats confronting them, the next step would be to:

(i) match strengths with opportunities (i.e. identify the organisation’s strengths that can be employed to exploit opportunities);

(ii) match strengths with threats (i.e identify the organisation’s strengths that can be employed to counteract external threats);

(iii) match weaknesses with opportunities (i.e. identify the organisation’s weaknesses that constrain its ability to exploit opportunities); and

(iv) match weaknesses with threats (i.e. identify the organisation’s weaknesses that are susceptible to external threats).

The matches which are perceived to be greatest importance to the organisation are used as the base for developing appropriate strategies. Most organisations give top priority to strategies that involve the matching of strengths with opportunities followed by strategies that involve the matching of weaknesses with threats. The key is to select a strategy that best meets the needs of the business.

Strategic formulation

Strategic analysis provides the basis for the formulation of strategies. Most textbooks on strategic management generally distinguish two different levels of strategy, namely corporate-level strategy and business-level strategy.

Corporate-level strategy

If an organisation is involved in several types of businesses, it will need to have a corporate level strategy. Corporate-level strategy addresses rthe type of businesses in which the company should invest its resources. Hence, it is more concerned with the allocation of the company’s resources among various businesses so that the overall value of the portfolio is enhanced. If the existing portfolio cannot generate the expected level of shareholder value, the corporate strategy may be targeted towards changing the business mix through merges and acquisitions, divestitures, strategic alliance or changing the allocation of capital among the organisation’s businesses.

Generally, these corporate level strategy alternatives fall under one of four major groups:

(i) stability strategy;

(ii) growth strategy

(iii) retrenchment strategy, and

(iv) combination strategy

These strategies are discussed below;

(a) A stability strategy is adopted when the organisation has no intention of changing its business direction. Many small businesses adopt this strategy. The owners are content to maintain what they have no interest to diversify into other areas.

(b) Growth strategy – Organisations can potentially achieve growth through one of the following:

(i) Concentration – A concentration strategy focusses on a single business competing in a single industry. Organisations adopt the concentration strategy to expand into a particular industry when prospects of the industry are good or when the company has a narrow range of competencies.

(ii) Vertical integration – Vertical integration refers to the expansion of the organisation into its supply or distribution channels. The strategy is adopted to eliminate uncertainties and reduce costs associated with the organisation’s suppliers or distributors.

(iii) Concentric diversification – Concentric diversification involves moving into additional businesses through acquiring or merging with other organisations whose principal activities are similar or related to the organisation’s core business. For example, a pharmaceutical company could acquire or merge with companies manufacturing diapers or feminine hygiene products as part of its growth strategy.

(iv) Conglomerate diversification – Conglomerate diversification strategy refers to an expansion into unrelated businesses. The diversification strategy is usually adopted to mitigate risks arising from market fluctuation in one industry.

(c) Retrenchment strategy – Retrenchment strategy involves scaling down the size or diversity of an organisation’s operations. This strategy is normally adopted as part of a cost cutting strategy arising from a slowdown in the affected industry. The strategic actions may include reducing the number of branches, closing down certain operations and trimming product lines.

( d) Combination strategy – Finally, organisations may consider a simultaneous pursuit of two or more of the aforesaid strategies. This is practical when there exist internal or external factors which directly affect the organisation in more than one way.

Boston Consulting Group matrix

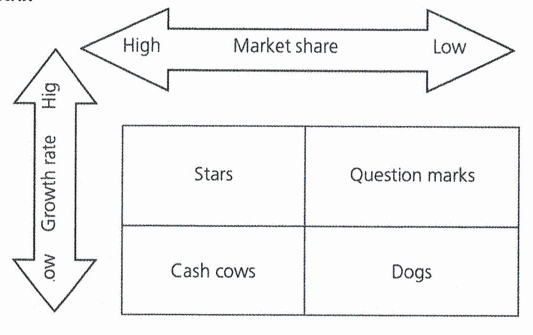

One of the most popular approaches used to determine corporate strategy is the Boston Consulting Group (BLC) matrix.

The BCG matrix is a strategy tool that is used to guide resource allocation decisions on the basis of market share and growth potential of strategic business units.

As depicted above, businesses can be categorised under four groups.

(i) Star (High growth, high market share) – Businesses in this category are typically fast growing and hold a dominant share in the market but might or might not produce a positive cash flow, depending on the amount of additional investment required in the business.

(ii) Cash cows (Low growth, high market shares) – Businesses in this category generates lots of cash but prospects for future growth are limited and therefore require little investment. Revenues generated in excess of investment needs can be used to fund other businesses.

(iii) Question marks (High growth, low market share) – Businesses in this category neither produce much cash nor require any further significant infusion of resources and there is little future in keeping them.

(iv) Dogs (low growth, low market share) – Business in this category neither produce much cash nor require any further significant infusion of resources and there is little future in keeping them.

The BCG matrix assumes the existence of a cumulative experience curve. In other words, doing the same things many times leads to finding more efficient methods of production. What this means is that as a business increases the volume of production, the unit cost of the product will decrease. Accordingly, businesses with the largest market share should have the lowest costs.

What then are the strategic implications of the BCG matrix?

Research by BCG showed that organisations that sacrifice short-run profits to increase market share are likely to yield the highest long-run profits. Accordingly, management should milk “cash cows” as much as they can, limiting any investments in them to the minimal maintenance level.

ventually, the excess cash generated from “cash cows”. The strategy in relation to “question marks” is harder to determine. Due to the risky nature of these businesses coupled with the substantial investments required to transform them into “stars”, management should limit the number of these ventures.

Finally, “dogs” should be divested given their low growth and weak competitive position. Cash from the disposal of “dog” can be used to invest in “question marks” to turn them into “stars”.

Limitations of the BCG matrix

Despite being helpful for portfolio planning, the BCG matrix has several limitations which affect its practical application.

(i) There is a wide range of other variables to consider, other than the market share and industry growth rate, that have an effect on profitability.

(ii) Even though the basic BCG matrix can be technically developed to incorporate more sophistication such as increasing the dimensions and extending the number of boxes to, say, 10 cells on each axis, that would make it far more difficult to plot and to interpret each business position. When it becomes too complicated, the BCG matrix loses its clarity, and

(iii) The matrix, while helpful for identifying where the business strands relative to its competitors, does not help a business develop strategies to improve its competitiveness.

Business-level strategy

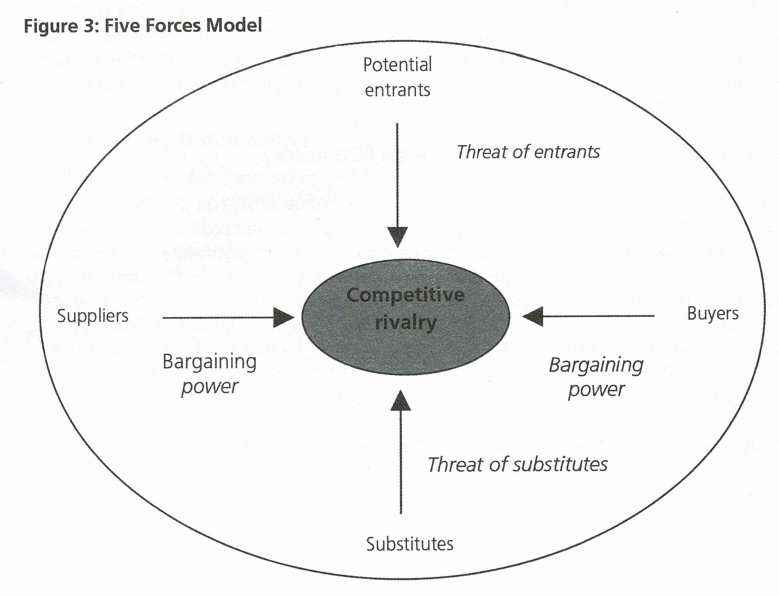

Just as the SWOT analysis is useful in assessing the broader environment, the “Five forces model” developed by Micheal E. Porter helps gain insights into the forces at work in the industry, or the immediate environment. Figure 3 below presents the “Five forces model”.

The nature and extent of competition relevant to an organisation are determined by the structure of the competitive forces of the industry. The interconnected forces are made up of the following:

(i) Threat of new entrants to the market – New firms will be attracted to enter a profitable industry. New entrants would imply increased capacity and higher supply of the industry’s products. It becomes and higher supply of the industry’s products. It becomes a threat if the increased is not matched by a corresponding rise in demand for the products. Hence, the law of demand and supply states that if supply for a product outstrips its demand, market forces will cause prices to fall and thus, profits fall.

However, penetration into the industry may not be easy as there are barriers to entry, e.g. economies of scale, patents, tariffs, branding etc.

(ii) Threat of substitutes – Substitute are goods that are able to satisfy the needs of buyers in a similar way or, better than the existing products in the industry. These needs can be related to functions, status etc. as long as there are substitute goods that can provide similar or higher satisfaction relative to the existing ones in the industry, buyers will be tempted to switch to the substitutes. This will eventually drives down prices and profits of the products which are already in the industry.

(iii) Bargaining power of the organisation’s buyers – some situations that increase the power of buyers are: (a) when buyers are few and they purchase in large quantities; (b) when buyers’ purchases represent a sizeable percentage of the industry’s total sales; (c) when the industry comprises many small sellers; and (d) when the item is standard by nature i.e. can be obtained from different suppliers. Under any one of the situations above, buyers can bargain away potential profits from the organisation in the industry. As a result, sellers would undercut each other in order to secure sales. Again, prices will fall, and so will profits

(iv) Bargaining power of the organisation’s supplies – Suppliers are producers of resources such as raw materials, power, skilled, labour, components and other inputs to the industry. Suppliers’ power is likely to be high when: (a) the suppliers’ input is, in one way or the other, important to the buyers; (b) the industry is dominated by a few large suppliers: and (iii) the suppliers’ products are so unique that they become too difficult or costly to obtain from elsewhere.

When suppliers have the advantage of any of the above situations, they can dictate high prices on their supply of goods. High prices would imply high costs for the industry, leading to a squeeze on its profits.

(v) The intensity of competition among industry players – It is important that organisations recognise the extent of direct rivalry between themselves and their competitors. Common conditions that will increase competitiveness are where new entrants are likely, substitutes are readily available and buyers or suppliers exercise control. Rivalry results in either value being passed on to buyers in the form of lower prices or a rise in the costs of competing such as new product development, increased advertisement and promotion expenses etc.

Hence, where the five forces are strong, industry profitability would be expected to be low and conversely, weak competitive forces would be bring about higher prices and above-average industry profitability. The attractiveness of the industry would have an impact on the position of the organisation.

The five forces analysis is a means of identifying the forces which affect the level of competition in an industry, it serves as a way of examining the competitive environment of an organisation at the business level. The forces analysis is particularly useful for the development of strategy for the business units. The business-level strategy is discussed below.

Strategy at the business level seeks to determine how each business unit should compete in its market place. Each business unit can be defined as a self-contained organisation that serves a particular market with a specific range of products. Hence, for an organisation with multiple business units, each business will have its own strategy for competing in its respective market.

Essentially, business-level strategy is driven by product-market issues. It seeks to answer questions such as: What products or services are customers looking to buy? How can customers needs be best satisfied? How competitive is the business in its pricing, service and offerings vis-à-vis its competitors in the industry?

There are basically three generic strategies which organisations can adopt. These generic competitive strategies are briefly discussed below.

(a) Cost leadership strategy – A cost leadership strategy is a strategy whereby the organisation sets out to be the lowest cost producer in its industry. An organisation can achieve cost advantage through, for instance, economies of scale, proprietary technology and proper logistics for its operations and activities. The low-cost leader must be able to offer products and services that are perceived to be comparable to those of its competitors and are acceptable to buyers.

(b) Differentiation strategy – In a differentiation strategy, the organisation chooses attributes that are district from its competitors. In other words, it seeks to be unique and different in ways that are valued by customers. Differentiation can be based on the product, service, delivery method, marketing approach, unusual positive brand image etc.

(c) Focus strategy – A focus strategy seeks establish a competitive advantage in narrow segment in a market. The organisation selects a segment in the market and tailors its strategy to suit that particular segment to the exclusion of others. These segments can be based on product variety, type of end buyer, distribution channel or geographical location of buyers. The focus strategy has two variants, namely cost focus and differentiation focus. A cost focus strategy refers to the strategy that meets the target segment’s needs with a cost advantage while a differentiation focus strategy is a strategy designed to meet the target segment’s needs ion ways better than that of its broadly targeted competitors.

Strategy implementation

Once strategies are established, it is essential that they are implemented effectively and efficiently. To ensure that strategies are properly implemented, the organisation must first consider the overall organisation structure, technology, human resources, culture and management style, and then see if these factors can support the strategy. How strategies are implemented and whether they successful would depend on the joint effort of the top management team, employees and the rest of the organisation.

Evaluation

The strategic management process is only complete when the organisation’s progress and performance are evaluated. for this purpose, strategy evaluation and monitoring tools such as performance indicators and information systems may be used. Should any disparity arise between the strategy being implemented and the results being monitored, the organisation will have to take corrective measures to adjust or rectify the deviation.

Linking Corporate Finance With Strategic Management

Corporate finance can be briefly described as the part of corporate strategy which deals with key financial objectives and decisions. Corporate finance concerns decisions on which investments to make and how best to raise the required funds. These decisions cannot be considered in isolation. They are dictated by the overall strategy of the organisation.

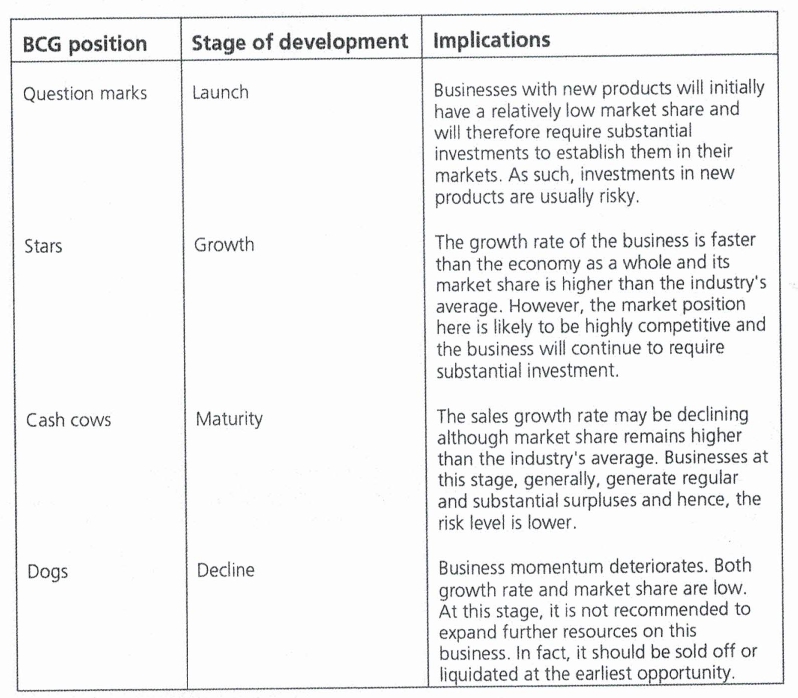

Let us expand the BCG matrix and incorporate the product life cycle concept to obtain how corporate finance activities should be tailored to take into account the organisation’s overall corporate strategy. For example, the corporate finance strategy of an organisation seeking high growth through acquisitions or development of new products will be different from one seeking to consolidate or maintain its performance.

Let us examine the relationship between the BCG matrix position, the stages of development of a business and their implications:

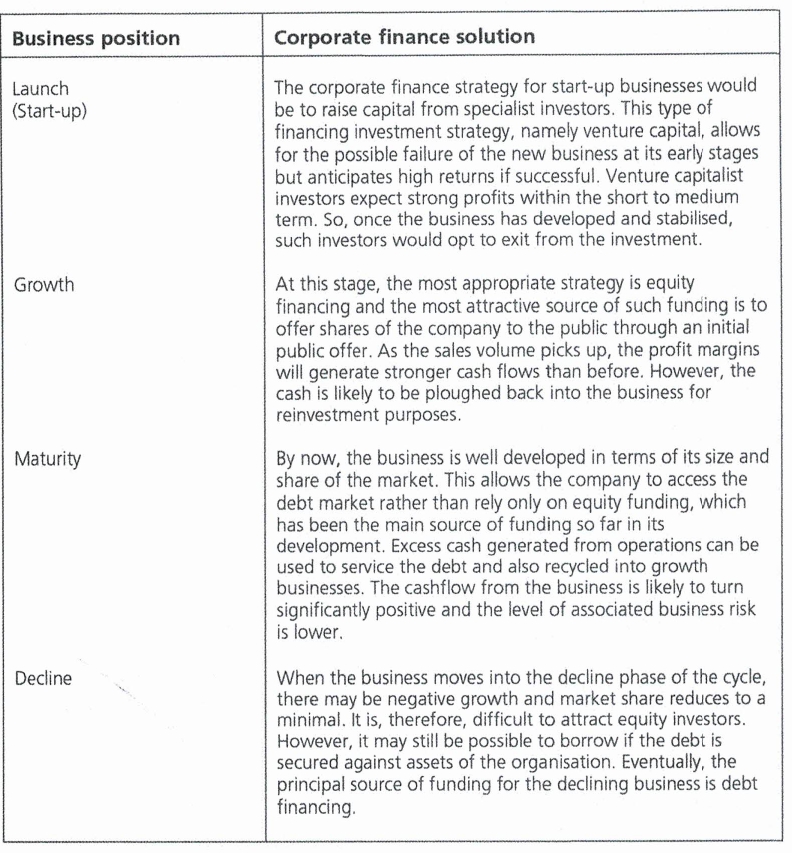

Given that the characteristics of business at different stages of development are different, the corporate finance strategy to apply will also have to be tailored to suit the profile of the business.

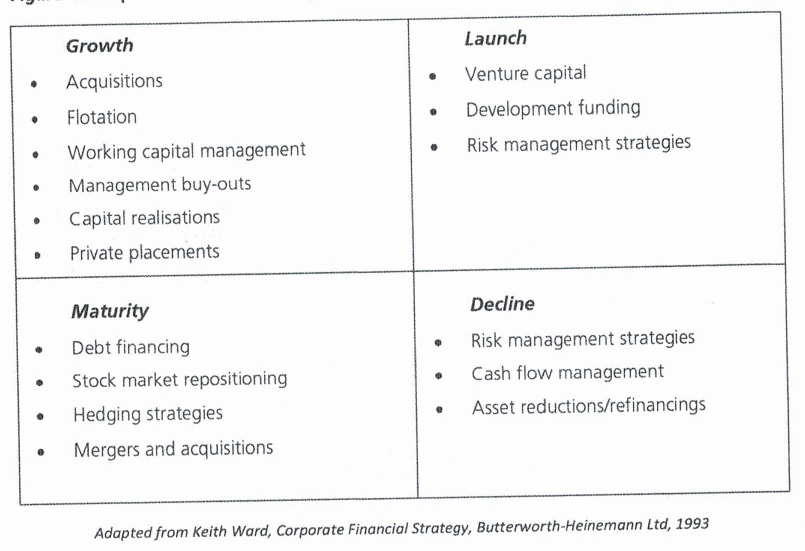

From the above, we are able to understand that as companies transit from one stage to the next, there is normally a need for some fundamental changes to their financial strategies. The diagram below highlights the possible corporate finance strategies that are at play at each stage of the life cycle.

Shareholder Value

We mentioned earlier that the ultimate objective of corporate strategy for a commercial organisation is to create shareholder value. The ultimate test of corporate strategy and the only reliable measure is whether it creates economic value for shareholders.

Corporate value id the total economic value of the organisation made up of the value of its debts and its equity.

CORPORATE VALUE = DEBT + EQUITY

The value of the equity portion represents shareholder value. Accordingly, rearranging the above equation:

SHARE VALUE = CORPORATE VALUE + DEBT

Using a discounted cashflow approach to valuation, corporate value in turn comprises the following:

(i) the present value of cash flow from operation during the forecast period;

(ii) “residual value” or the present value of the business beyond the forecast period; and

(iii) the current value of marketable securities and other assets that are not essential to the business operations and can be converted to cash:

In summary;

CORPORATE VALUE =

PRESENT VALUE OF CASH FLOW FROM OPERATIONS DURING THE FORCAST PERIOD + RESIDUAL VALUE + VALUE OF MARKETABLE SECURITIES AND OTHER INVESTMENTS

The valuation of each of the above components of corporate value will be discussed in the topics that follow. The point to make here is that to create shareholder value, appropriate strategies must be adopted. In other words, strategies drive shareholder value. Corporate strategy, however must be coupled with the appropriate corporate finance solutions in order to deliver the expected shareholder value results.

Hence, it is imperative for corporate finance advisers to realise that understanding the organisation’s corporate financial solution. Similarly, investment advisers need to recognise that corporate strategy on its own can have a major impact on the organisation. It affects the way investors view the organisation’s performance and thus, the readiness of investors to invest in the business of the organisation.

Conclusion

Strategic management in essence is about making and implementing decisions which affect the whole organisation. The decisions made will determine the function of the entire organisation and its performance. the strategic management process would typically encompass the establishment of a mission, strategic analysis, strategic formulation, strategic implementation and evaluation of the strategy implemented.

One of the most common approaches adopted by organisation to gauge their strategic position is the SWOT analysis, from which viable strategic options are determined. The internal and external assessments of SWOT analysis help the organisation to formulate appropriate strategies to achieve its objectives. Corporate strategies are generally categorised under four major groups, namely a stability strategy, a growth strategy, a retrenchment strategy and a combination strategy.

The objective of corporate strategy for commercial organisations is to create shareholder value. Whether or not the organisation is successful in creating shareholder value will depend on the corporate strategy it adopts. The strategy will in turn influence the organisation in their corporate financial decisions, i.e. the type of investments to make and how to finance them. In addition, strategic management is important to invest advisers because the validity of the strategy will influence the attractiveness of the organisation as an investment.

What is a Business Level Strategy?

The primary business level strategy definition is the strategic planning and implementation processes incorporated by successful businesses in their niche market. Your choice of business-level strategy is configured to gain a competitive advantage, improve customer satisfaction, and maintain above-average returns. Most organizations that operate one business often combine their business-level strategy with the corporate-level system to devise a single level of the process…Read more

Self-assessments

1. Analysis of external opportunities and threats involves a through evaluation of the environment in which the organisation operates. The factors analysed should include:

I. Political environment – Examines the regulations and controls imposed by the authorities such as trade and labour policies, taxation policies and environmental protection laws.

II. Economic factors -How economic factors are affecting demand, supply, growth, competition and profitability of the industry.

III. Social environment – Examines social trends such as the migration of skilled labour, emerge of alternative labour markets and lifestyle.

IV. Technological factors – How the industry is and will be affected technological advancement, particularly by recent and potential innovations.

A. I and II only

B. II and III only

C. II, III and IV only

D. All of the above

2. In strategic management processes, the organisation external SWOT analysis should help develop an understanding of the following (a) opportunities which the company can capitalise on and (b) threats which have to be overcomed or circumvented. Once the organisation is able to identify is strengths, weaknesses and the opportunities and threats confronting them, the next step would be to:

I. match strengths with opportunities such as identify the organisation’s strengths that can be employed to exploit opportunities.

II. match strengths with threats such as identify the organisation’s strengths that can be employed to counteract external threats.

III. match weaknesses with opportunities such identify the organisation’s weaknesses that constrain its ability to exploit opportunities); and

IV. match weaknesses with threats such as identify the organisation’s weaknesses that are susceptible to external threats.

A. I and II only

B. II and III only

C. II, III and IV only

D. All of the above

3. In strategic management processes, generally there are several corporate strategy alternative which fall under four major groups such as stability strategy, growth strategy, retrenchment strategy and combination strategy. In growth strategy processes, organisations can potentially achieve growth through one of the following:

I. Concentration

II. Vertical integration

III. Concentric diversification

IV. Conglomerate diversification

A. I and II only

B. II and III only

C. II, III and IV only

D. All of the above

4. Despite being helpful for portfolio planning, the BCG matrix has several limitations which affect its practical application. Which of the following statements is TRUE about the limitation of the BCG Matrix?

I. There is a wide range of other variables to consider, other than the market share and industry growth rate, that have an effect on profitability.

II Even though the basic BCG matrix can be technically developed to incorporate more sophistication such as increasing the dimensions and extending the number of boxes to, say, 10 cells on each axis, that would make it far more difficult to plot and to interpret each business position. When it becomes too complicated, the BCG matrix loses its clarity, and

III. The matrix, while helpful for identifying where the business strands relative to its competitors, does not help a business develop strategies to improve its competitiveness.

A. I only

B. I and II only

C. II and III only

D. I, II and III

5. Boston Consulting Group matrix (BCG) is one of the most popular approaches used to determine corporate strategy. The BCG matrix is a strategy tool that is used to guide resource allocation decisions on the basis of market share and growth potential of strategic business units. Which category of business group is incorrect in term of definition:

A. Star – Low growth but high market value

B. Cash cow – Low growth but high market share

C. Question marks – High growth but low market share

D. Dogs – Low growth and low market share]

6. In Business-level strategy, the “Five forces model” developed by Micheal E. Porter helps gain insights into the forces at work in the industry, or the immediate environment. The nature and extent of competition relevant to an organisation are determined by the structure of the competitive forces of the industry. Threat of new entrants to the market is one of the forces. The other interconnected forces are made up of the following EXCEPT:

I. Threat of substitutes

II. Bargaining power of the organisation’s buyers

III. Bargaining power of the organisation’s supplies

IV. The intensity of competition among industry players

A. I and II

B. II and III

C. II, III and IV

D. None of the above

7. In business leval strategy, there are basically several generic competitive strategies which organisations can adopt:

I. Cost leadership strategy

II. Differentiation strategy

III. Focus strategy

A. I and II only

B. II and III Only

C. I and III only

D. I, II and III

Related/Useful links

What Is Strategic Management?

Strategic Management – A Brief Overview

Strategic Management – Summary

More Resources

Aggregate Supply and Demand

Market Positioning

Network Effect

Substitute Products

See all management & strategy resources