This topic is intended as a brief introduction by way of providing an overview of the stock markets. We will examine the stock exchange which provides the market for trading securities, and the particular characteristics of the Malaysian stock Market, as well as look at the players who invest in the stock market.

1.01 Learning Objectives

At the end of the topic, you should be able to:

a. Define “securities” within the context of the financial markets and as defined in the Capital Markets and Services Act 2007 (CMSA)

b. Describe the role of a stock exchange

c. Describe the different exchanges in Malaysia

d. Explain how the stock market functions, both as a fund-raising and an investment medium

e. Distinguish between the primary and secondary market

f. Explain the use of stock market indices

g. Explain the role of the Islamic capital market and its stock screening criteria

h. Explain the role of Participating Organisations in the market

i. Describe some of the roles of Participating Organisations

j. Distinguish between two different types of dealer’s representatives

k. Describe how different types of investors, including sophisticated investors, use the stock market

l. Describe LEAP and other alternative markets

m. Describe the developments and impact of technology on securities trading.

SECURITIES

What are Securities?

Within the context of financial markets, “securities” is a general term used and applied to instruments such as stocks, shares, debentures, notes, bills, bonds, etc. Securities are typically the documents that are evidence of ownership or debt. A shareholding is evidence of ownership whereas a debenture or bond is evidence of debt. Securities are exchangeable or saleable in the market place.

“Securities” is the term used to describe any “interest-bearing or dividend-paying” paper traded in financial markets.

The Capital Markets and Services Act 2007 (CMSA), s.2 defines “securities” as:

(a) Debentures, stocks or bonds issued or proposed to be issued by any government.

(b) Shares in or debentures of, a body corporate or an unincorporated body.

(c) Units in a unit trust scheme or prescribed investments.

aid includes any right, option or interest in respect thereof.

What is a Stock Market?

A stock market consists of the trading of stocks and related securities on all exchanges, including the over-the-counter market.

The stock market is the central market place for the raising of equity funds by corporations and governments. It provides a market place where company and government securities may be bought and sold. It brings together enterprises, which intend to raise money through the issue of new securities to individuals or organisations that seek to invest their savings or surplus funds.

In doing so, the stock market offers investors liquidity, i.e. the ability to convert their investments cash at short notice, thereby encouraging the flow of savings into productive ventures.

What is a Stock Exchange?

A stock exchange is an organisation which provides the market place or facility for the buying and selling of securities under strict rules, regulations and guidelines.

Finance and Investing

A stock exchange must develop to meet two basic and complementary needs: a business need for raising funds (i.e. the primary market) and an individual’s or company’s desire to invest savings efficiently (i.e. the secondary market).

The primary market allows a company or other types of entities to raise initial capital. This is usually done by a company issuing a prospectus through an underwriting stockbroking company. The purchasers of the shares become the initial owners. They can remain shareholders of that company or sell their shares on the secondary market.

The primary market embraces issues of debentures, preference shares and notes, as well as the equity securities of listed companies, and is used by governments and companies, both public and private. By issuing securities such as shares, which offer the prospect of dividends and capital gains, businesses can attract funds. Similarly, by issuing debentures, which offer interest, businesses can attract the funds of those who prefer a “less risky” investment.

Hence, the stock market channels funds into productive areas of the economy and this speeds economic growth and raises living standards.

(b) The secondary – market is the central market place provided by the stock exchange where people can buy and sell securities that have been previously issued to the market. It is an auction system and the price of the share is determined by supply and demand.

In a free enterprise system, funds are directed to areas that investors consider to have the most profitable opportunities and these judgments are, in turn, reflected in the level of activity in the secondary market where transactions in existing securities are effected. So shares of companies which prospects are judged to be good will be in demand and may command relatively high prices. On the other hand, shares of companies with relatively poor and mediocre prospects, sell at relatively low prices in the market.

Duties of a Stock Exchange

In Malaysia, the duties of a stock exchange are set out in s.11 of the CMSA and include the following:

(a) To ensure, in so far as may be reasonably practicable, an orderly and fair market in the securities that are traded through its facilities.

In performing the above duty, the stock exchange shall:

(i) Act in the public interest having particular regard to the need for the protection of investors

(ii) Ensure that where any interests that are required to be served under any law relating to corporations’ conflicts with the interest of the public, the latter shall prevail.

(b) To immediately notify the Securities Commission Malaysia (SC) if it becomes aware of:

(i) Any matter which adversely affects, or is likely to adversely affect, the ability of any relevant person to meet his/her obligations in respect of his/her business dealing in securities and derivatives, including the ability of any relevant person to comply with the minimum financial requirement as may be prescribed under the CMSA.

(ii) Any irregularity, breach of any provision of the securities law or the rules of the exchange or approved clearing house, or any other matter, which, in the opinion of the exchange, indicates or may indicate, that the financial standing or financial integrity of any relevant person or of the chief executive or directors of the relevant person is in question or may reasonably be affected.

(c) To take appropriate action as may be provided for under its rules for the purpose of monitoring or securing compliance with such rules.

(d) To at all times have sufficient financial, human and other resources to ensure the provision of:

(i) An orderly and fair market in relation to securities or derivatives that are traded through its facilities

(ii) Adequate and properly equipped premises for the conduct of its business

(iii) Competent personnel for the conduct of its business

(iv) Automated systems with adequate capacity, and security arrangements facilities to respond to emergencies.

Stock Exchanges in Malaysia

Stock exchanges in Malaysia comprise Bursa Malaysia Securities Berhad, the securities exchange, and Bursa Malaysia Derivatives Berhad, the futures and options exchange.

Bursa Malaysia Securities Berhad will be described and discussed in further detail in subtopic.

Bursa Malaysia Derivatives Berhad

In Malaysia, Bursa Malaysia Derivatives Berhad (BMDB), formerly known as Malaysia Derivatives Exchange Berhad (MDEX) is the sole exchange offering both futures and exchange-traded options.

Like all derivatives exchanges, the basic functions of Bursa Malaysia Derivatives Berhad are as follows:

(a) To provide facilities whereby buyers and sellers can meet to trade contracts

(b) To ensure open and competitive trading

(c) To set and enforce rules for operating in the derivatives market

(d) To collect and disseminate market and price information.

Historically, the derivatives industry commenced in 1980 with the establishment of the Kuala Lumpur Commodity Exchange (KLCE). The initial futures contract traded on KLCE was the crude palm oil futures contract (FCPO). This contract is still traded today. The KLCE had the infrastructure and capacity to allow for the trading of financial futures; however, setting up a subsidiary was necessary because trading in the financial futures fell under different jurisdictions.

Therefore, on 19 August 1992, the KLCE, with the support of the government authorities, incorporated a wholly owned subsidiary called the Kuala Lumpur Futures Market Sdn Bhd (KLFM), which was later renamed the Malaysian Monetary Exchange (MME) in mid-1995. On 7 May 1996, the Minister of Finance approved the establishment and operation of MME as a futures and options xchange company and the 3-month KLIBOR Futures was launched on 28 May 1996.

On 9 November 1998, the KLCE was renamed the Commodity and Monetary Exchange of Malaysia (COMMEX) in preparation for a merger with the MME. The merger took place on 7 December 1998.

The Kuala Lumpur Options and Financial Futures Exchange (KLOFFE), Malaysia’s first financial derivatives exchange, was established on 11 December 1995. KLOFFE was licensed as a futures and options exchange. Stock index futures and stock index options were first traded on 15 December 1995 and 1 December 2000 respectively.

In line with the first Capital Market Masterplan (CMP1) of the SC, KLOFFE and COMMEX merged on 11 June 2001 and formed a new derivatives exchange called the Malaysia Derivatives Exchange Berhad (MDEX). Consequential to the demutualisation of the KLSE in 2004, MDEX was renamed the Bursa Malaysia Derivatives Berhad (BMDB).

On 17 September 2009, Bursa Malaysia Berhad entered into a strategic partnership with the Chicago Mercantile Exchange (C ME) with the view of improving accessibility to its derivatives offerings globally. The partnership covered licensing of the settlement prices of the FCPO to position Malaysia as the global price benchmark for the commodity as well as global distribution of Bursa Malaysia’s products through C ME’s Globex electronic trading platform.

Prior to September 2019, CME held 25% of the equity stake in BMDB, while the remaining 75% interest was held by Bursa Malaysia Berhad. However, in September 2019, Bursa Malaysia Berhad announced that the company was acquiring the remaining 25% equity in BMDB from CME Group Strategic Investments LLC for RM162.47 million and an additional sum, following the exercise of a put option under an agreement signed in 2009.

THE MALAYSIAN STOCK MARKET

What is the Malaysian Stock Market?

The Malaysian stock exchange is called Bursa Malaysia Securities Berhad. It governs the conduct of its participants in securities dealings, and is responsible for the surveillance of the market place, as well as for the enforcement of its listing requirements, which spell out the criteria for listing, disclosure requirements and standards to be maintained by listed companies.

Bursa Malaysia Securities Berhad

Bursa Malaysia Securities Berhad has 951 listed companies as of March 2020 (please refer to

http://www.bursamalaysia.com/market/listed-companies/initial-public-offerings/listing-statistics/) offering a wide range of investment choices to local and global investors. Companies are either listed on the Main Market, ACE Market or LEAP Market.

Main Market

On 8 May 2009, the SC and Bursa Malaysia Securities Berhad launched a new framework for listings and equity fund-raisings, which entailed the merging of the Main Board and Second Board into a single board known as “the Main Market” on 3 August 2009.

The new framework introduced a board structure comprised of different markets that were streamlined and clearly demarcated between established and emerging companies to raise capital for different investor risk appetites.

In the previous structure, the Main Board comprised large cap companies and the Second Board comprised medium cap companies. The Main Market comprising the merged Main and Second Board is intended as the primary market for established companies with clear listing requirements. As of March 2020, there were 790 companies listed on the Main Market (please refer to https://www.bursamalaysia.com).

ACE Market

As part of the new board structure, the ACE Market replaced the Malaysian Exchange of Securities and Dealing and Automated Quotation Berhad (MESDAQ) with effect from 3 August 2009. Whilst MESDAQ was confined to high growth or technology firms, the ACE Market is intended to be the alternative market that is sponsor-driven and allows access to companies of all sizes and from all economic sectors, particularly to facilitate early access to capital raising for emerging companies. As of March 2020, there were 130 companies listed on the ACE Market (please refer to https://www.bursamalaysia.com).

LEAP Market

The LEAP Market is an alternative market offered by Bursa Malaysia in 2017 which aims to provide small- and medium-sized enterprises (SMEs) and other companies with greater fund raising access and visibility via the capital market. As of March 2020, there were 31 companies listed in this market (please refer to https://www.bursamalaysia.com).

As prescribed under the CMSA, it is accessible only to sophisticated investors. The LEAP Market provides an efficient and transparent capital formation and price discovery mechanism compared to private markets, thereby allowing sophisticated investors to have greater opportunities to participate in the growth of SMEs.

Types of Securities on Bursa Malaysia Securities Berhad

There are many different types of securities traded on Bursa Malaysia Securities Berhad. They are:

(a) Ordinary shares/stocks — Shares in a company which give holders the rights of ownership of the company, such as the right to share in the profits of the company by way of dividend, as well as the ight to vote in general meetings and to elect and dismiss directors. Generally, ordinary shares onstitute the bulk of a company’s capital. Ordinary shareholders have no special rights over other shareholders and shall rank lowest in priority after all other liabilities of a company, in the event of liquidation.

(b) Preference shares — Shares of a different class from ordinary shares which give holders a referential position over ordinary shareholders in respect of the payment of dividends (normally of a fixed amount) and may be preferred as regards the distribution of assets, in the event of liquidation. Generally, preference shares do not carry any voting rights except in cases where it may be made contingent upon failure to pay dividends on preference shares for a certain period of time.

(c) Debentures — Securities which is evidence of indebtedness’ of a corporation for monies borrowed. Fixed interest securities bearing a maturity date and a specified rate of interest.

The assets of the borrowing company are charged against the debenture issue; details of the charge are included in a debenture deed drawn up to protect the debenture holder. In essence, debentures are long-term loans to companies secured on certain fixed or floating assets of a company.

(d) Loan stock/notes — Securities issued by a company for a loan made by investors. Loan stocks may be secured, unsecured, convertible or non-convertible, but are often unsecured.

(e) Bonds — Documents recording a loan specifying the date of its maturity and the rate of interest to be paid at each specified period. It is a common name for fixed interest securities of more than one year in term.

(f) Warrants — Give holders a right, but not an obligation, to subscribe for a specified number of new ordinary shares at a specified price during a specified period. The company issues the warrants, which are usually attached to an issue of loan stock.

(g) Call warrants — Give holders a right, but not an obligation, to buy a fixed number of shares at the specified price within a limited period. Call warrants are issued by parties other than the issuer of the underlying assets based on existing shares.

(h) Exchange Traded Fund (ETF) — A collective investment vehicle which is an index-based fund that allows investors to buy or sell exposures to an index through a single financial instrument. ETFs are shares of a portfolio and not an individual company. Similar to equity securities, ETFs are traded on Bursa Securities through stockbrokers.

(i) Real estate investment trust (REIT) units – Units in a listed trust fund, which invests in real estate.

The list of all securities, which have been admitted for quotation in accordance with the Listing Requirements of Bursa Malaysia Securities Berhad, is known as the Official List.

Indices

In general, indices for a stock exchange are calculations made on an index number basis to indicate the movements in the general level of prices of securities listed on the stock exchange. Indices are used as indicators of the performance of the stock market as a whole. A stock market index can be based on all the stocks listed on a stock exchange or on only a sample of stocks. Some indices are computed on the simple average closing price basis while others are derived using a weighted average method.

In Malaysia, the FTSE Bursa Malaysia Index Series is a comprehensive and complementary set of equities indices designed and developed to measure the performance of the major capital and industry segments of the Malaysian and regional capital markets.

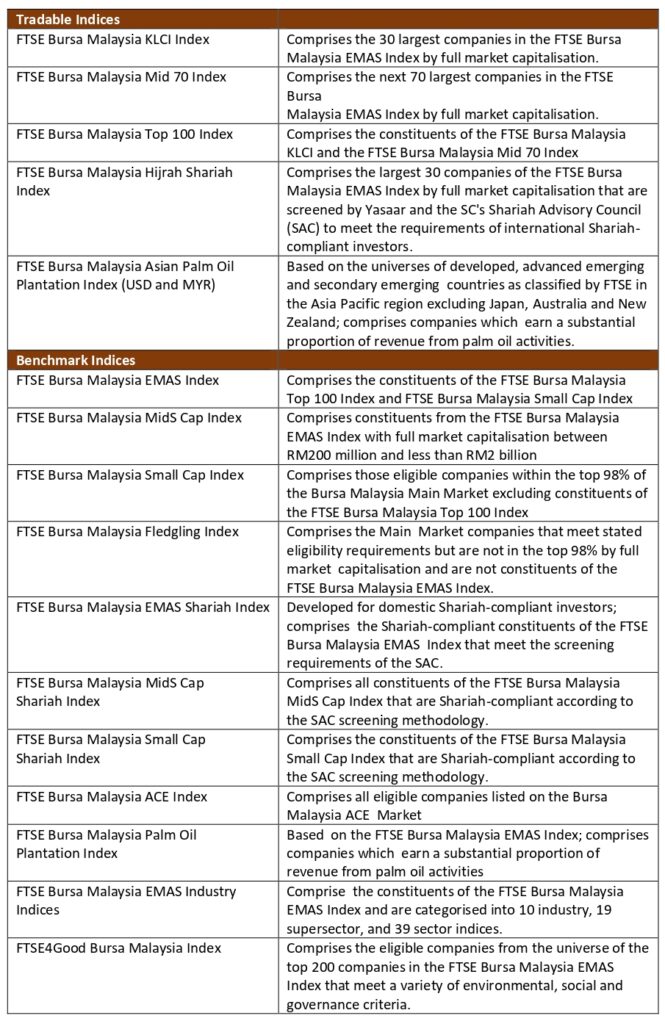

The FTSE Bursa Malaysia Index Series consists of five tradable indices and 11 benchmark indices as outlined below:

Table 1: FTSE Bursa Malaysia Index Series

The index series above covers all stock sizes within the market and provides the investors with a better tool to benchmark their investments. The indices are also suitable for the creation of investment products such as ETFs, derivatives, structured products and index tracking funds.

All Malaysian companies listed on the Main Market or ACE Market of Bursa Malaysia Securities Berhad are eligible for inclusion, subject to meeting FTSE’s international standards of free float, liquidity and investability. The FTSE Bursa Malaysia index methodology allows investors to do cross- border analysis and comparison, while a set of Ground Rules provides transparency to the management of the index series.

The two main eligibility requirements stated in the FTSE Bursa Malaysia Ground Rules are the free float and liquidity requirements:

(a) Free Float

A free float factor is applied to the market capitalisation of each company in accordance with the band specified in the FTSE Bursa Malaysia Ground Rules. The factor.is used to determine the attribution of the company’s market activities in the index. Each company is required to have a minimum free float of 15% to be eligible for inclusion.

The calculation of a company’s free float excludes restricted shareholding such as cross holdings, significant long-term holdings by founders, their families and/or directors, restricted employee share schemes, government holdings and portfolio investments subject to a lock-in clause, for the duration of that clause.

(b) Liquidity

A liquidity screen is applied to ensure the company’s stocks are liquid enough to be traded. Companies must ensure that at least 10% of their free float adjusted shares in issue are traded in the 12 months prior to an annual index review in December.

FTSE uses real-time and closing prices sourced from Bursa Malaysia to calculate the FTSE Bursa Malaysia KLCI. The calculation is based on a value-weighted formula and adjusted by a free float factor. The FTSE’13ursa Malaysia KLCI values are calculated and disseminated on a real-time basis every 15 seconds.

The FTSE Bursa Malaysia KLCI

The Kuala Lumpur Composite Index (KLCI), which was the primary benchmark index for Malaysia, was enhanced through a partnership between Bursa Malaysia Berhad and its index partner FTSE Group (FTSE) in July 2009 with the adoption of the FTSE global index standard.

The enhanced KLCI is now known as the FTSE Bursa Malaysia KLCI. It comprises the Main Market’s largest 30 companies by full market capitalisation that meet the eligibility requirements of the FTSE Bursa Malaysia Ground Rules.

ISLAMIC CAPITAL MARKET

The Islamic capital market (ICM) is represented by both equity and bond markets. The fundamental ICM criterion is that financial transactions must conform to Shariah principles. The prohibited conducts stated under Shariah principles are riba and gharar. Riba literally means an ncrease or addition. Technically, it denotes any increase of advantage in a loan transaction obtained by the lender as the condition of the loan. Gharar denotes deception, uncertainly or ambiguity, where there exists an element of deception in the trade or exchange through ignorance of the goods or price, or through faulty description of the goods.

Milestones

In Malaysia, Islamic equity investments started as early as the mid-1960s when Tabung Haji was established. This was followed by various initiatives through the decades. Notably in the 1980s, Malaysia enacted the Islamic Banking Act 1983 and the Takaful Act 1984 respectively. This paved the way for the creation of Malaysia’s first Islamic bank and first takaful company, and thereafter the development of more Islamic financial institutions and the growth of the industry as a whole.

In 1990, Shell MDS successfully issued the first Islamic private debt securities. Other notable developments and accomplishments included the establishment of the first Islamic equity unit trust fund in 1995 and the establishment of full-fledged Islamic stockbroking company BIMB Securities in 1994.

Today, Malaysia possesses one of the world’s most advanced Islamic capital markets, which grew by 13.6% annually from RM293.7 billion in 2000 to slightly over RM1 trillion in 2010. By June 2018, this has grown to RM1.9 trillion, comprising 60.49% of Malaysia’s capital market assets.

As in the first Capital Market Masterplan (CMP1) launched in 2001, the development of the ICM continues to be one of the SC’s main agendas in the Capital Market Masterplan 2 (CMP2). Launched in April 2011, the CMP2 provides the strategic blueprint for the development of the Malaysian capital market over the next 10 years, including growth strategies to strengthen Malaysia’s position as a global ICM hub.

Regulatory Framework

The sub-components of the ICM are Islamic equity, sukuk, Islamic funds, unit trusts, Islamic real estate investment trusts (i-REITs), Islamic structured products, Islamic venture capital, Islamic derivatives, Islamic exchange traded funds (i-ETFs), Shariah indices and Islamic stockbroking. There are various stakeholders or participants who play different roles in the ICM, including investment and commercial bankers, investors, issuers, trustees, fund managers, stock brokers and takaful operators.

As the ICM runs parallel to the conventional capital market, the regulatory frameworks of the capital market are applicable to the ICM, except in a few circumstances where specific laws, regulations and guidelines are provided exclusively for the operation of the ICM.

All matters pertaining to the conventional and the Islamic capital markets come under the jurisdiction of the Ministry of Finance. The governing authorities of the ICM are the SC, Bank Negara Malaysia, Labuan Financial Services Authority (Labuan FSA) and Bursa Malaysia.

The SC set up the Shariah Advisory Council in May 1996 to assist in the development of the ICM.

Shariah Advisory Council (SAC)

The Shariah Advisory Council (SAC) is tasked with assessing and evaluating existing instruments and ensuring the operations and workings of the ICM are in accordance with all Sharjah principles.

The core functions of the SAC are:

• To be responsible for advising the SC on all matters pertaining to the systematic development of the ICM, including the development of new instruments based on the various Islamic concepts; and

• To serve as a focal point of reference on all matters and issues relating to the ICM and Shariah principles.

State muftis, Shariah scholars and academics and leading corporate figures in Islamic finance represent the SAC. The members of the SAC are appointed every two years.

Shariah Principles and Concepts

The verification of existing capital market instruments and the structuring of new1CM instruments to ensure compliance with the Shariah principles involve the application and reference of various Islamic concepts. Some of the frequently used principles and concepts are listed below:

• Al-kafalah refers to the guarantee provided by a person to the owner of goods, who has placed or deposited his/her goods with a third party. The guarantor must meet any subsequent claim by the owner with regard to his/her goods, if the third party does not meet it.

• Al-wakalah refers to a situation where a person nominates another person to act on his/her behalf.

• Istisna’ is a contract of acquisition of goods by specification or order, where the price is paid progressively in accordance with the job completion progress. This is practised, for example, in the purchase of a house that is to be constructed and where the payments made to the builder or developer are according to the stage of work completed. In the case of bai al- salam, the full payment is made in advance to the seller, i.e. before the delivery of the goods. In Islamic financing, the applications of bai al-salam and istisna’ are purchasing mechanisms, whereas murabahah and bai bithaman ajil are used for financing sales.

• Al-wadiah yad dhamanah (safekeeping with guarantee) refers to goods and deposits which have been deposited with another person, who is not the owner, for safekeeping. As wadiah is a trust, the depository becomes the guarantor and therefore, guarantees repayment of the whole amount of the deposits, or any part thereof, outstanding in the account of the depositors, when demanded. The depositors are not entitled to any share of profits but the depository may provide returns as a gift or as a token of appreciation.

• Bai al-dayn (debt trading) refers to debt financing, i.e. the provision of financial resources required for production, commerce and services by way of sale/purchase of trade documents and papers. Only documents evidencing debts arising from bona fide commercial transactions can be traded.

• Bai al-istijirar refers to an agreement between the client and the supplier, whereby the supplier agrees to supply a particular product on an ongoing basis, for example monthly, at an agreed price and on the basis of an agreed mode of payment.

• Bai bithaman ajil (deferred payment sale) is similar to the concept of murabahah, except that the sale of goods is on a deferred payment basis at a price which includes a profit margin agreed to by both parties.

• Balsa/am refers to an agreement whereby payment is made immediately (price is fully settled) while goods are delivered by an agreed date (future delivery).

• ljarah (leasing) refers to a contract under which a bank buys and leases out equipment required by its clients for a rental fee. The duration of the lease and the rental fees are agreed in advance. Ownership of the equipment remains in the hands of the bank. This type of contract is a classic Islamic one, and is now gaining popularity worldwide.

• Mudharabah (trust financing) is an agreement between two parties: one provides 100% of the capital for the project, and the other party known as mudha rib manages the project using his/her entrepreneurial skills. Profits arising from the project are distributed according to a predetermined ratio. Any losses accruing are borne by the provider of capital. The provider of capital has no control over the management of the project.

• Murabahah (cost-plus financing) is a contract of sale between the bank and its client for the sale of goods at a price, which includes a profit margin, agreed by both parties. As a financing technique, it involves the purchase of goods by the bank as requested by its clients. The goods are sold to the client with a mark-up. Repayments, usually in instalments, are specified in the contract.

• Musharakah (partnership financing) is an Islamic financing technique that involves a partnership between two parties who both provide capital towards the financing of a project. Both parties share profits on a pre-agreed ratio but losses are shared on the basis of equity participation. Either both or one of the parties may carry out management of the project. Musharakah is a very flexible partnership arrangement where the sharing of the profits and management of the project can be negotiated and pre-agreed by the parties.

Bursa Malaysia Securities Berhad

Bursa Malaysia Securities Berhad has established an Islamic Markets division dedicated to the development of Shariah-compliant capital market products and services as well as trading platforms. Among others, the ICM products and services available in Bursa Malaysia are as follows:

(a) Bursa Suq AI-Sila’

(b) Bursa Malaysia-i

(c) Islamic Capital Market

(i) Shariah-compliant listed equities

(ii) Sukuk

(iii) Islamic Real Estate Investment Trusts

(iv) Islamic Exchange Traded Funds

(v) Islamic Securities Selling and Buying — Negotiated Transaction

Bursa Suq

Bursa Suq Al-Sila’ (BSAS) is a commodity trading platform specifically dedicated to facilitate Islamic liquidity management and financing by Islamic financial institutions. The fully electronic web-based platform provides industry players with an avenue to undertake multi-commodity and multi-currency trades from all around the world.

All businesses and activities of BSAS are managed by Bursa Malaysia Islamic Services Sdn. Bhd. (BMIS), a wholly-owned subsidiary of Bursa Malaysia which is regulated, transpqrent and fully Shariah-compliant.

Market days of BSAS are from Sunday to Friday, with Saturday closed for trading but open for settlement. The main trading session is from 9.00 a.m. to 11.40 p.m., with pre-opening from 7.00 am. There is continuous trading except on Fridays where the market is closed from 1.00 p.m. to 2.00 p.m.

Currently, the following approved commodities are traded on BSAS: Crude Palm Oil, Plastic Resins, Palm Olein, Softwood Timber-Softwood, Timber-Hardwood.

Bursa Malaysia-i

Bursa Malaysia-i is a fully integrated Islamic securities exchange platform with listing, trading, clearing, settlement and depository services, leveraging the existing Bursa Malaysia infrastructure while incorporating Shariah-compliant features.

Investors who wish to participate in end-to-end Shariah investing can invest in Shariah-compliant securities listed on Bursa Malaysia through the Bursa Malaysia-i platform by interfacing with Islamic Participating Organisations. Islamic Participating Organisations offering services on a “full-fledged” basis means Islamic stockbroking services are provided on a fully Shariah-compliant basis. Participating Organisations that offer Islamic stockbroking services on a “Window” basis means Islamic stockbroking services are provided not on a full-fledged basis.

The investment instruments of Bursa Malaysia-i platform are those listed on the Markets of Bursa Malaysia Securities Berhad that are Shariah-compliant. Shariah-compliant securities in an investor’s CDS account are tagged with the “SP” code, which indicates “Shariah-compliant

securities”. Islamic Participating Organisations and conventional Participating Organisations have segregated trading channels and post-trade clearing of trades done via the Islamic Participating Organisations will be undertaken and guaranteed by Shariah-compliant Bursa Malaysia Securities Clearing Sdn Bhd. Settlement of trades between the Islamic Participating Organisations and Bursa Malaysia will be done through Islamic Financial Institutions.

All types of investors, whether retail or institutional, domestic or international, can have access to Bursa Malaysia-i.

An investor who wishes to trade on Bursa Malaysia-i must open a Shariah-compliant trading account and not use a conventional trading account to trade on Bursa Malaysia-i. The trading of Shariah non-compliant securities is prohibited on Bursa Malaysia-i. However, there is no restriction to investing in Shariah-compliant securities through conventional Participating Organisations as these securities are listed on Bursa Malaysia.

An investor is allowed to execute trading transactions on Bursa Malaysia-i using margin financing provided by the Islamic Participating Organisation, whereby the financing structure is Shariah-compliant in nature. However, the investor’s eligibility for margin financing and collaterals is determined by the Islamic Participating Organisation.

Shariah-compliant Listed Equities

The SAC approves and updates stocks listed on Bursa Malaysia classified as Shariah-compliant securities. The list of Shariah-compliant securities is updated and published every May and November and provides investment reference for Islamic indices and unit trust funds, takaful funds, Islamic stockbroking companies’ services and investors looking for Shariah-compliant investments. The list meets the following objectives:

(a) Facilitate investors seeking investment in Shariah-compliant shares listed on Bursa Malaysia

(b) Centralise Shariah decisions related to securities domestically

(c) Enhance disclosure and transparency

(d) Promote the development of ICM

(e) Encourage the development of Islamic instruments.

The SAC screens listed shares based on a certain methodology comprising quantitative and qualitative assessments. As a preliminary screening, companies which activities are not contrary to Shariah principles will be classified as Shariah-compliant securities. Listed companies will be deemed as Shariah non-compliant if they are involved in the following core activities:

(a) Financial services based on riba (interest)

(b) Gaming and gambling

(c) Manufacture or sale of non-halal products or related products

(d) Conventional insurance

(e) Entertainment activities that are non-permissible according to Shariah

(f) Manufacture or sale of tobacco-based products or related products

(g) Stockbroking or share trading on Shariah non-compliant securities

(h) Other activities deemed non-permissible according to Shariah

For companies with activities comprising both permissible and non-permissible activities, the SAC measures level of contribution of these activities towards turnover and profit before tax of a company. The SAC uses benchmarks based on ljtihad (Shariah-based reasoning). The contributions of non-permissible activities have to be less than the benchmark of 5% or 20% (depending on the type of activity) in order to be classified as Shariah-compliant.

The SAC subsequently assesses the financial management of the company by applying financial ratio benchmarks (it must be less than 33%). The financial ratio benchmarks are Cash over Total Assets and Debt over Total Asset and are intended to measure riba and riba-based elements within a company’s statements of financial position. Note that these financial ratios are not calculated in the same manner as its conventional counterparts.

In addition, the SAC takes into account the qualitative considerations at the same time. These include public perception or image of the company’s activities from the perspective of Islamic teaching. Furthermore, the core activities of the company are important and considered maslahah (‘beneficial’ in general) to the Muslim ummah (nation) and the country, and the non-permissible element is very small, and involves matters such as umum balwa (common plight) and the rights of the non-Muslim community which are accepted by Islam.

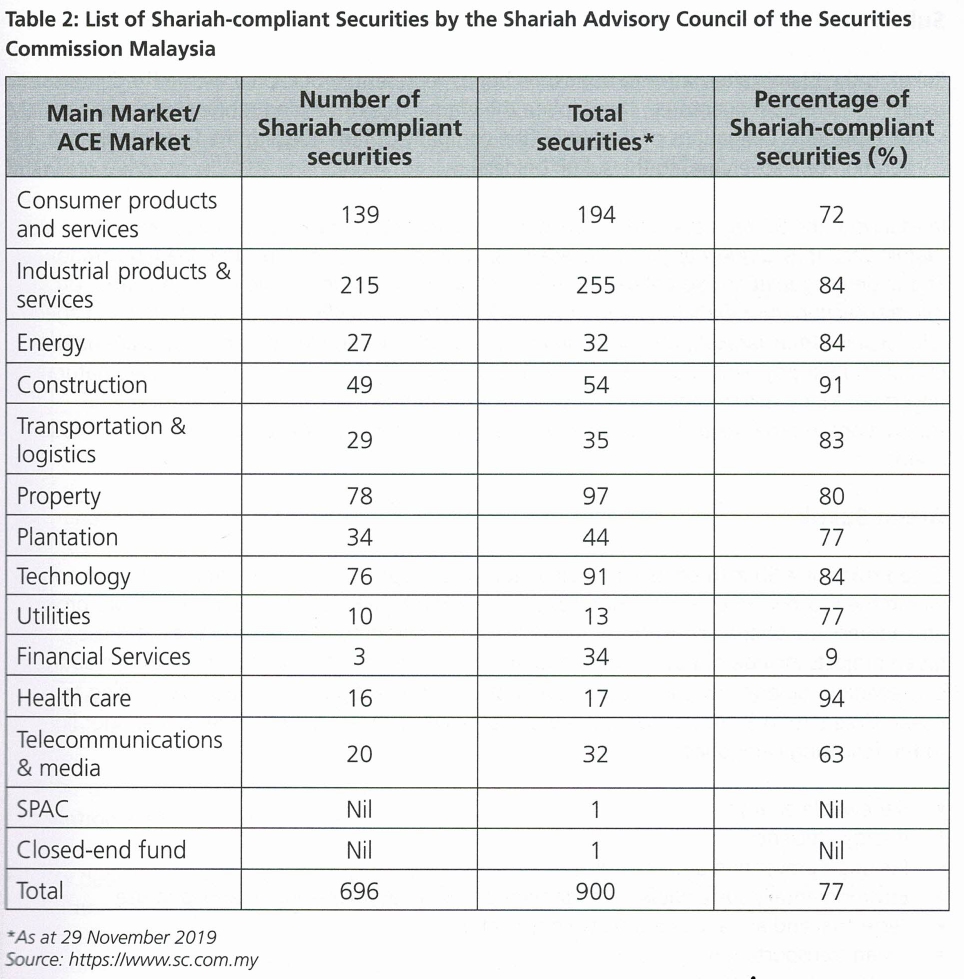

As at the November 2019, 696 securities are classified as Shariah-compliant, representing 77% of securities listed on the Main Market and ACE Market of Bursa Malaysia.

Shariah-compliant indices

Bursa Malaysia together with FTSE Russell, has launched three Shariah indices:

(a) FTSE Bursa Malaysia Hijrah Shariah Index

(b) FTSE Bursa Malaysia EMAS Shariah Index

(c) FTSE Bursa Malaysia Small Cap Shariah Index

In addition to serving as performance benchmark, the indices are designed for the creation of structured products and are referred to by tracking funds. The consultants of these indices are screened as tested on market capitalisation, free float and liquidity.

Sukuk

Sukuk is the Islamic alternative to bonds. As bonds represent debt capital with a fixed interest return and principal guarantee, they violate the Islamic rule of earning money from riba. A sukuk represents obligations of the issuer (the company or firm needing the funding, be it a corporation or a sovereign) to the sukuk holders.

In Malaysia, the SC regulates the issuance of sukuk via the framework provided under the Islamic Securities Guidelines (Sukuk Guidelines) while the SAC regulates the Shariah component. The underlying relationship between the issuer and sukuk-holders could be based either on a sale transaction (murabahah, salam, or istisna’), a lease transaction (ijarah) or equity and agency relationships (musharakah, mudharabah and wakalah). Sale and lease transactions are naturally certain in their payment characteristics, whereas the equity and agency structures are naturally uncertain. Many sukuk transactions have been executed by combining different forms of transactions in order to craft a sukuk which has fixed income characteristics similar to traditional bonds.

Green Sukuk

Green sukuk is a Shariah-compliant Sustainable and Responsible Investment (SRI) instrument where the proceeds are used to fund specific environmentally sustainable infrastructure projects and address the Shariah concern for protecting the environment. The objectives of these green projects include climate change mitigation, climate change adaptation, natural resource conservation, biodiversity conservation and pollution prevention and control. According to the Asean Green Bond Standard 2018, the green projects can be included under but are not limited to the following categories:

• Renewable energy

• Energy efficiency

• Pollution prevention and control

• Environmentally sustainable management of living natural resources and land use

• Terrestrial and aquatic biodiversity conservation

• Clean transportation

• Sustainable water and waste water management

• Climate change adaptation

• Eco-efficient and/or circular economy adapted products, production technologies and processes

• Green buildings which meet regional, national or internationally recognised standards or certifications.

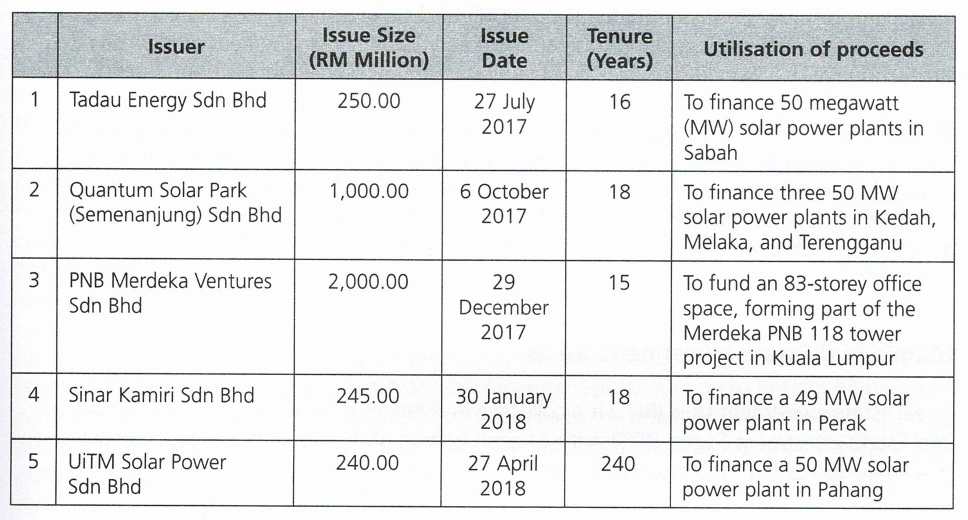

The world’s first green sukuk was issued in Malaysia by Tadau Energy Sdn Bhd on 27 July 2017 for RM250 million under the SC’s Sustainable and Responsible Investment (SRI) Sukuk Framework. The framework is the result of collaboration between the SC, Bank Negara Malaysia and the World Bank group to develop an ecosystem that facilitates the growth of green sukuk and introduces innovative financial instruments to address global funding gaps in green financing. As at April 2018, there were five green sukuk issued in Malaysia as below:

Table 3: Green Sukuk Issuance in Malaysia as at April 2018

In order to promote greater utilisation of green sukuk as a fundraising channel, several incentives were introduced to attract green issuers which include:

(a) Tax deduction until year of assessment 2020 on issuance cost of green sukuk approved or authorised by or lodged with the SC

(b) Income tax exemption for green sukuk issuers for applications received by!he SC from 1 January 2018 to 31 December 2020.

(c) Tax incentive for green technology activities in energy, transportation, building, waste management and supporting services activities.

(d) Financing incentives under the Green Technology Financing Scheme (GTFS) with total funds allocation of RM5 billion until 2022.

Sauces: https://www. sc. corn. My and http://www.fm .net

Shariah-compliant Exchange Traded Funds

An Exchange Traded Fund (ETF) is a financial product that exhibits the best of open-ended fund and listed stock features such as diversification, cost effectiveness, simplicity and transparency. An ETF is passively managed in general as ETF aims to replicate the performance of a particular market index, either by investing all (full replication) or substantially all (strategic sampling) in the constituent securities.

A Shariah-compliant Exchange Traded Fund (i-ETF) tracks a benchmark index where its constituents are Shariah-compliant companies. In addition, the management of i-ETF has to strictly observe the Shariah principles and Islamic investment guidelines.

The operation of i-ETF is also overseen by a Shariah board, committee or advisor that would conduct Shariah-compliant audits and reviews. To ensure continuous Shariah compliance, Shariah screening is undertaken at the time of investment decision and subsequently throughout the investment period. The i-ETF is purified from time to time by identifying, separating and donating to charity any Shariah non-compliant income.

Islamic Real Estate Investment Trusts

A real estate investment trust (REIT) is a collective investment scheme in real estate. An Islamic Real Estate Investment Trust (i-REIT) is the Shariah version of the conventional REIT. Compared to a conventional REIT, the income of i-REIT:

(a) Must be from Shariah-permissible activities; or

(b) In case of mixed activities, must adhere to the 20% benchmark as determined by the SAC.

In addition, a Shariah committee or Shariah advisor must also be appointed to advise the fund manager on Shariah compliancy matters. Both REIT and i-REIT receive similar tax treatment on stamp duty, real property gains tax as well as corporate tax in Malaysia. The regulatory framework is also similar for both, with the exception that i-REIT must additionally comply with Shariah requirements.

Islamic Securities Selling and Buying — Negotiated Transaction

In late 2017, Bursa Malaysia introduced the Islamic Securities Selling and Buying — Negotiated Transaction (ISSBNT) framework for parties to undertake a transaction that delivers the equivalent outcome of a conventional securities borrowing and lending transaction but is structured based on Shariah principles. The ISSBNT framework is based on the Securities Borrowing and Lending — Negotiated Transaction (“SBLNT”) model which has been in existence since 2009.

Other Shariah-compliant Instruments

Besides ordinary shares, other existing capital market instruments which have been classified as Shariah-compliant by the SAC are warrants, call warrants, transferable subscription rights (TSRs), crude palm oil and crude palm kernel oil futures contracts. In addition to this, the SAC has also endorsed the structure and issuance of Khazanah Zero-Coupon Bonds as a Shariah-compliant instrument. The structuring and trading of Khazanah-Zero Coupon Bonds involved the application of Islamic principles such as murabahah and baial-dayn. In addition, there are many issues of sukuk.

For the whole of 2017, sukuk based on various Islamic concepts such as mudharabhah, murabahah, musharakah, istisna, ijarah and bai bithaman ajil amounting to RM168.68 billion were issued. The amount of sukuk issued in proportion to the entire issuance of bonds and sukuk (both corporate and government) in 2017 was 53.05%. The amount of sukuk outstanding in the same year was RM759.64 billion and it constituted 58.80% of the total amount of bonds and sukuk (both corporate and government) outstanding.

In the fund management industry, as at end of 2017, approved Islamic funds in collective investment schemes (including unit trusts, wholesale funds, REITs, ETFs that are Shariah-compliant) had assets under management (AUM) of RM135.76 billion. This amount added to private mandate investments totalled RM170.83 billion, which was 22.01% of AUM in the fund management industry.

PARTICIPANTS AND INTERMEDIARIES IN THE MALAYSIAN STOCK MARKET

There is a diverse range of investors, investment strategies and products in the stock market.

Users of the stock market can be categorised into two groups: institutional investors and retail investors.

Institutional Investors

Institutional investors are represented by a variety of institutions that include pension funds, life and general insurance funds, unit trust funds, corporate investors and international investors.

Institutional investors tend to use stock selection methods, such as the bottom-up approach (i.e. an investment approach that focuses on the analysis of individual stocks and de-emphasises the significance of economic and market cycles), top-down approach (i.e. opposite of bottom-up approach) and technical analysis.

Retail Investors

Retail investors in the Malaysian stock market include short-term and long-term investors. Some retail investors in the Malaysian stock market are speculators. Others are more conservative and tend to deal only in blue chip stocks. Some retail investors who have a high net worth may have professional fund managers who manage their portfolio in accordance with their specific investment requirements. Other investors may have a portfolio of investments that they manage personally. It may include a spread of investments across equity, property, fixed interest and cash investment vehicles. Often, such a portfolio will have an emphasis on low-risk capital growth and high-income bearing investments via dividends and interest.

Some individuals may wish to obtain diversity in their portfolios but may not have sufficient funds for direct equity investment. They may, therefore, gain exposure to the stock market through a unit trust fund.

Sophisticated Investors (please refer to Part 1, Schedules 6 and 7 of the CMSA).

These are investors who fall into any of the following categories with the respective qualifying criteria:

(a). High-Net-Worth Individuals

(i) An individual whose total net personal assets, or total net joint assets with his/her spouse, exceeds RM3 million or its equivalent in foreign currencies, excluding the value of the individual’s primary residence;

(ii) An individual who has a gross annual income exceeding RM300,000 or its equivalent in foreign currencies per annum in the preceding 12 months; or

(ii) An individual who, jointly with his/her spouse, has a gross annual income exceeding RM400,000 or its equivalent in foreign currencies per annum in the preceding 12 months.

(iv) An individual whose net personal investment portfolio or total net join investment portfolio with his or her spouse, in any capital market products exceeding one million ringgit or its equivalent in foreign currencies.

(b) High-Net-Worth Entities

(i) A corporation with total net assets exceeding RM10 million or its equivalent in foreign currencies based on the last audited accounts;

(ii) A partnership with total net assets exceeding RM10 million or its equivalent in foreign currencies;

(iii) A company that is registered as a trust company under the Trust Companies Act 1949 which has assets under management exceeding RM10 million or its equivalent in foreign currencies;

(iv) A corporation that is a public company under the Companies Act 2016 which is approved by the SC to be a trustee under the CMSA and has assets under management exceeding RM10 million or its equivalent in foreign currencies;

(v) A pension fund approved by the Director General of Inland Revenue under the Income Tax Act 1967; or

(vi) A statutory body established by an Act of Parliament or an enactment of any State in Malaysia.

(c) Accredited Investor

(i) Central Bank of Malaysia established under the Central Bank of Malaysia Act 2009;

(ii) A holder of a Capital Markets Services Licence;

(iii) An executive director or chief executive officer of a holder of a Capital Markets Services Licence;

(iv) A unit trust scheme or a prescribed investment scheme;

(v) A closed-end fund approved by the SC;

(vi) A licensed institution as defined in the Banking and Financial Institutions Act 1989 or an Islamic bank as defined in the Islamic Banking Act 1983;

(vii) A bank licensee or insurance licensee as defined under the Labuan Financial Services and Securities Act 2010;

(viii) An Islamic bank licensee or takaful licensee as defined under the Labuan Financial Services and Securities Act 2010

– An insurance company registered under the Insurance Act 1996 or a takaful operator registered under the Takaful Act 1984;

– A takaful operator registered under the Takaful Act 1984; or

– A private retirement scheme as defined in the CMSA.

Intermediaries

Participating Organisations

A Participating Organisation is a company that carries on the business of trading in securities on the Exchange’s stock market and is admitted as a Participating Organisation under Rule 3.02 of the Rules of Bursa Malaysia Berhad and includes all the Participating Organisation’s Branch Offices. Participating Organisations, or dealers as they are commonly known, play a critical role in the securities industry as the link between the client and the stock market. Therefore, a stockbroking company or an Investment Bank may become a Participating Organisation subject to the fulfilment of the relevant requirements set out under Rule 3.01.

Only a company incorporated in Malaysia can carry on a business of dealing in securities2. It can be privately or publicly owned. The operation of a stockbroking business in the form of a partnership is not allowed in Malaysia.

Participating Organisations must comply with the minimum financial requirements as set out in Chapter 4, Table 1 of the SC’s Licensing Handbook. In addition, stockbroking companies must comply with capital adequacy requirements that address both liquidity and solvency issues together with risks faced.

A stockbroking company, other than a Special Scheme Broker and Investment Bank’, shall have a minimum of 30% local shareholders. The licence to operate a stockbroking company is issued to the company and not to the shareholders. However, the licence is endorsed with the names of those owning the shares, and the directors and the company secretary of the stockbroking company.

What does a Participating Organisation do?

While the operations of each Participating Organisation (dealer) may vary slightly from one to another, depending on the size of business, the type of clientele and level of computerisation of the Participating Organisation, the functions within are essentially similar.

Primarily, Participating Organisations carry out the regulated activity of “dealing in securities” whether as principal or agent.

Schedule 2, Part 2 of the CMSA provides that “dealing in securities” means:

• Acquiring, disposing of, subscribing for or underwriting securities; or

• Making or offering to make with any person, or inducing or attempting to induce any person to enter into or to offer to enter into:

– Any agreement for or with a view to acquiring, disposing of, subscribing for or underwriting securities; or

– Any agreement, other than a derivatives, the purpose or avowed purpose of which is to secure a profit to any of the parties from the yield of securities or by reference to fluctuations in the value of securities.

Chapter 6 of the Rules of Bursa Malaysia Securities Berhad sets out the scope of permitted businesses of Participating Organisations. A Participating Organisation intending to carry out any other business apart from trading in securities on the stock market of the Exchange must comply with the relevant requirements imposed by the SC or Bank Negara Malaysia. It must notify the Exchange in writing prior to the commencement of the permitted businesses.

The Exchange may require the Participating Organisation to take such steps as the Exchange thinks fit to manage the potential risks or conflicts of interests arising from carrying out both the Permitted Businesses and the Participating Organisation’s business of trading in securities on the stock market of the Exchange.

Generally, depending on whether they are Universal Brokers, Investment Banks or non-Universal Brokers, Participating Organisations may do some or all of the following:

• Take orders from clients to buy or sell securities transactions via Bursa Malaysia Securities Berhad’s fully automated trading system

• Advise clients on possible investments

• Ensure payment is received from buying clients

• Ensure when a client buys or sells shares that all appropriate benefits flow, e.g. dividends, new issues, etc.

• Conduct research and report on the performance of listed companies and other securities

• Underwrite new issue of securities

• Provide advice on corporate finance

• Transact business as a principal and arbitrage between markets.

The main operations of a Participating Organisation will usually include dealing or trading, accounts and contracts departments because the stockbroking business revolves around the buying and selling of shares.

Categories of Participation Organisations are as follows:

• Investment Bank – An Investment Bank is an entity that holds a Capital Markets Services Licence (CMSL) pursuant to s.58 of the CMSA for the regulated activity of dealing in securities and holds a licence under s.10 of the Financial Services Act 2013 to carry on an investment banking business, and duly established pursuant to the Guidelines on Investment Bank issued jointly by Bank Negara Malaysia and the SC.

• Universal Broker – A Universal Broker is a stockbroking company that has merged with or acquired at least three other stockbroking companies and has satisfied all the conditions and requirements stipulated by the SC under the Policy Framework for Stockbroking Industry Consolidation.

• Special Scheme Broker – A Special Scheme Broker is a foreign stockbroking company that is licensed to carry out regulated activities pursuant to the Application for Establishment of Foreign Stockbroking Companies under the Special Scheme.

• 1 + 1 Broker – 1+1 Broker is a stockbroking company that has complied with the Policy Framework for Stockbroking Industry Consolidation and has acquired, taken over, amalgamated or merged with at least one other stockbroking company.

• Standalone Broker – A Standalone Broker is a Participating Organisation that has not complied with the SC’s Policy Framework for Stockbroking Industry Consultation as stated in the Licensing Handbook.

Dealer’s Representatives

A dealer’s representative is a holder of a Capital Markets Services Representative’s Licence (CMSRL) for dealing in securities.

There are three types of dealer’s representatives:

(a) Commissioned Dealer’s Representatives

A Commissioned Dealer’s Representative is a dealer’s representative the Participating Organisation engages on a non-salaried basis. He/she is more commonly known as a “remisier”. He/she can trade on behalf of clients only and cannot execute proprietary trades on behalf of his/her Participating Organisation. He/she can execute any other trading activity the SC permits except Day Trading.

Day Trading means the taking of proprietary positions by the Participating Organisation on an intraday buy and sell and vice versa, and for the avoidance of doubt excludes Direct Business transactions.

(b) Salaried Dealer’s Representatives

A Salaried Dealer’s Representative is a dealer’s representative a Participating Organisation employs on a salaried basis. He/she can trade on behalf of clients or execute proprietary trades on behalf of his/her Participating Organisation (only if not trading on behalf of clients). However, he/she cannot perform as a Salaried Dealer’s Representative and at the same time execute proprietary trades.

(c) Proprietary Day Traders

Proprietary Day Traders can only execute Day Trading on behalf of their Participating Organisation and cannot execute client trades nor act as Futures Broker’s Representatives. They can execute any other trading activity the SC permits.

Trading Representatives

Apart from the dealer’s representatives mentioned above, Trading Representatives (TR) and Marketing Representatives (MR) also play a role in dealing in securities. TR means a person who executes securities trades for a Participating Organisation and is registered with the SC under s.76 of the CMSA.

The permitted activities and obligations of a TR are listed as below:

(a) A TR must only act on behalf of one Participating Organisation at all times

(b) A TR is only permitted to accept clients’ order (order taking) and execute securities trades

(c) In carrying out the above activities, a TR must not induce, or attempt to induce, any client to enter into, or make or offer to any client to enter into, any transaction to trade

(d) A TR must continuously comply with the fit and proper criteria as set out under Schedule 1 – Fit and Proper Criteria for Trading Representative and Recognised Representative of the Licensing Handbook.

The registration and entry requirements to be a TR are set as follows:

(a) The applicant must be at least 21 years old

(b) The applicant satisfies fit and proper criteria as set out under Schedule 1 of the Licensing Handbook

(c) The applicant has completed a familiarisation programme and passed the required assessment at the end of the familiarisation programme

(d) The applicant must possess a Degree or professional qualification from an institution recognised by the Government of Malaysia or Diploma from an institution recognised by the Government of Malaysia or Sijil Pelajaran Malaysia (SPM) or equivalent qualification recognised by the Government of Malaysia, provided that the applicant has at least three years’ prior experience as a trading clerk registered with Bursa Malaysia Securities Berhad.

For further details, please see Chapter Security Offences and Schedule 1 of the Licensing Handbook.

Marketing Representatives

A Marketing Representative (MR) means a person who acts as an introducer for a principal, undertakes marketing of the services, provides client support services and is registered with the principal under the Guidelines For Marketing Representative which is issued by the SC pursuant to s.377 of the CMSA. A principal carrying out any of the regulated activities pursuant to Schedule 2 of the CMSA may register a person as an MR.

The permitted activities and obligations of an MR are listed as below:

(a) An MR is prohibited from carrying out any regulated activity and must not hold himself/herself out as a licensed person or a registered person under s.76 of the CMSA.

(b) An MR may act on behalf of multiple principals.

(c) An MR is permitted to carry out referral and marketing activity which includes the following:

(i) Arranging for the client to meet with or speak to the principal

(ii) Forwarding client’s particulars to the principal

(iii) Providing the client with factual information relating to products and services offered by the principal including conducting presentations

(iv) Providing client support services such as forwarding information on performance of fund to clients.

(d) An MR must make appropriate disclosures to the client which includes the following:

(i) That he/she is carrying out referral and marketing activities on behalf of his/her principal

(ii) That he/she is not allowed to give advice or provide recommendation in relation to the regulated activity.

(e) An MR is prohibited from carrying out suitability assessment of clients and providing clients with specific recommendation.

(f) An MR must refer a client to a licensed person if the client asks for specific recommendation or advice on a capital market product.

(g) An MR must not take clients’ orders, execute trades, handle or accept clients’ monies or give transactional advice to clients.

(h) An MR must inform the client of any remuneration scheme and its amount in relation to such marketing activity, if requested by the client.

(i) An MR must conduct his/her activities efficiently, honestly and fairly.

(j) An MR must ensure continuous compliance with the fit and proper criteria as set out in Schedule 1 of the Guidelines For Marketing Representative.

The Registration and entry requirements to be an MR are set as follows:

(a) An individual may be registered with any principal as an MR.

(b) The individual must be at least 21 years old and possess a Degree or professional qualification or diploma from an institution recognised by the government of Malaysia

(c) The individual has completed a familiarisation programme and passed the required assessment at the end of the familiarisation programme.

(d) A principal may only register a person as an MR where it is satisfied that:

(i) The applicant complies with the requirements set out in the Guidelines For Marketing Representative

(ii) The applicant is fit and proper in accordance with the criteria set out in the Guidelines For Marketing Representative

(iii) The applicant has satisfied the entry requirements set out in the Guidelines For Marketing Representative.

Another important department in any Participating Organisation is the investment research department which comes out with research material for clients on companies, market trends, industry trends and general economic news.

DEVELOPMENT6 AND IMPACT OFR TECHNOLOGY OMN SECURITIES TRADING

Technology is a core enabler of securities trading as the modern-day stock exchanges no longer run on an open outcry system. Advances in technology have also helped reduce transaction costs for all participants and have also made trading more efficient, convenient and accessible.

Online Trading

Online trading is a process by which individual investors and traders buy and sell securities using an electronic network, typically with a brokerage firm. It first started in America in 1994 and subsequently grew in popularity globally along with the growth of the internet. Brokerage firms offer a lower trading commission through this medium of transaction, hence the term “discount brokerage”. Online trading got a further boost when smart mobile phones were invented in 2007. Today, online trading orders can be transmitted via a web-browser or mobile phone application offered by most brokerage firms.

Many Participating Organisations in Malaysia have been offering online trading via the web or mobile phone application to their customers for over a decade now. While the trading and settlement process remains the same as an offline transaction, online trading allows clients to check prices and transaction status in a convenient manner. Through online trading accounts, clients can execute their trades at a lower commission rate.

Hitherto, Participating Organisations offered multiple channels for trading and allowed customers to trade on a “contra” basis. In May 2017, a fully online trading platform which required payment upfront was launched. Such platforms charge a flat fee that is lower than conventional online trading platforms.

Algorithmic Trading

Algorithmic trading (algo-trading) is the process of using computers programmed to follow a define set of instructions for placing a trade. The defined sets of rules may be based on timing, price, quantity or any mathematical model. Apart from profit opportunities for the trader, algo-

trading makes markets more liquid and trading more systematic by ruling out emotional human impacts on trading activities. A subset of algo-trading is high frequency trading (HFT), where the set of instructions are carried out at a speed and frequency that is impossible for a human trader.

Besides short-term traders, algo-trading is also used by mid- to long-term institutional investors to transact a large block of securities without adversely affecting their position, by executing the trades with smaller and discreet transactions. Systematic traders also use algo-trading to operationalise their trading rules and allow the programme to trade for them automatically.

Algo-trading was mainly the domain of professional traders and institutional investors and has been in practice since online trading was made possible with the advent of the world-wide web. With improvements in technology, especially since the smartphone era and liberalisation of securities trading rules, retail traders have also got involved in algo-trading in the developed markets in the last decade. Algo-trading is limited to the markets and types of assets that can be traded. For instance, it is more likely to be available on platforms for trading in over-the-counter (OTC) products such as foreign exchange and OTC derivatives than for exchange traded stocks.

Distributed Ledgers

A distributed ledger is a set of digital data which is replicated, shared, and synchronised, and geographically spread across multiple sites with no central administrator or centralised data storage. One form of the distributed ledger design is the blockchain system, which can be either public or private.

A blockchain is a list of records, called blocks, which are linked and secured using cryptography. Each block typically contains a hash pointer as a link to a previous block, a timestamp and transaction data. It is an open, distributed ledger that can record transactions between two parties in a verifiable way. Foruse as a distributed ledger, a blockchain is typically managed by a peer-to-peer network collectively adhering to a certain protocol for validating new blocks. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority. This makes blockchains inherently resistant to modification of the data.

Blockchains are secure by design and are an example of a distributed computing system with high resistance to Byzantine failures. Decentralised consensus has therefore been achieved with a blockchain. This makes blockchains suitable for the recording of events, medical records, and other records of management activities, such as contracts, currencies or voting. The first blockchain was conceptualised in 2008 by an anonymous person or group known as Satoshi Nakamoto and implemented in 2009 as the technology enabling the world’s first cryptocurrency, Bitcoin. The Bitcoin design has been the inspiration for other crypto-currencies and applications.

The use of blockchain in Malaysia is still at its infancy and mostly involve or is associated with digital currencies. Many countries, including Malaysia, do not license, authorise or endorse any digital currency exchanges or any entities involved in providing services associated with digital currencies.

Digital currencies are not legal tender in Malaysia. Accordingly, digital currency businesses are not covered by prudential and market conduct standards or arrangements that are applicable to financial institutions regulated by Bank Negara Malaysia.

Crowd-funding

Crowdfunding is the practice of funding a project or venture by raising many small amounts of money from a large number of people, typically via the Internet. It combines the best of crowdsourcing and microfinance and is an industry that is in excess of RM1 trillion globally as of early 2017. The following are some common types of crowdfunding.

(a) Reward-based

With reward-based crowdfunding, people can pledge money to a new creative project or a novel technology product in development. The persons providing the funds expect to receive the output of the project that is being funded.

(b) Donation-based

The persons providing the funds are just giving away their money outright and do not expect any reward or returns.

(c) Peer-to-peer (P2P) lending

This enables the borrower to get access to funds outside of traditional banking channels. The persons willing to take a little risk to lend out money to others can create portfolios consisting of microloans through these online P2P platforms. Companies licensed by the SC as at July 2018 include B2B Finpal Sdn Bhd, Ethis Kapital Sdn Bhd, FBM Crowdtech Sdn Bhd, Modalku Ventures Sdn Bhd, Peoplelender Sdn Bhd, and QuicKash Malaysia Sdn Bhd.

(d) Equity Crowdfunding

Equity crowdfunding enables real investments in private companies without investors having to transact through their stockbrokers. This is the smallest segment of the crowdfunding industry but can significantly change the way individuals invest their money. Companies licensed by the SC as at July 2018 are Ata Plus Sdn Bhd, Crowdo Malaysia Sdn Bhd, Eureeca SEA Sdn Bhd, FBM Crowdtech Sdn Bhd, Funnel Technologies Sdn Bhd, Pitch Platform Sdn Bhd, and CrowdPlus Sdn Bhd.

Robo-Advisors

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning and investing services with little to no human intervention. A typical robo-advisor collects information from clients about their financial situation and future goals through an online survey, and then uses the data to offer advice and could automatically invest client assets.

Initially developed to complement financial advisors at the institutional or high-net-worth client segments, these platforms are now available to retail investors. This is possible because of the smaller lot size for securities transactions, lower trading commissions, and availability of more ETFs to allocate the client assets to.

In May 2017, the SC introduced the Digital Investment Management framework, setting out licensing and conduct requirements for the offering of automated discretionary portfolio management services to investors.

Although several fintech firms are reportedly seeking to be licensed to provide robo-advisory in Malaysia, as of July 2018 none has been issued such a licence by the SC.

SUMMARY

The topic provided an introduction to securities, stock markets and the operation of a stock exchange. We noted the different exchanges in Malaysia, and also looked at a stock exchange as a medium whereby listed companies can raise funds via the issuing of securities. These shares can then be traded so that shareholders may participate in the benefits available, i.e. income through dividends and capital growth. In essence, a stock exchange enables both financing and investing.

We then considered the specific characteristics of Bursa Malaysia Securities Berhad, the types of securities that are traded and the indices used as indicators of the market performance with emphasis on FTSE Bursa Malaysia. We also considered the Islamic Capital Market.

In addition, we looked at the various market participants and intermediaries, including different types of investors and what Participating Organisations do.

We concluded the topic by discussing how technology has made investing and trading quicker and more convenient and in the process, lowered the cost of execution. Some new technologies, such as blockchain, have yet to find their way into mainstream finance.

As this topic is an overview, many of the areas covered here are considered in more detail in later topics.

Sample Question

Question 1

Which of the following defined as securities according to the Capital Markets and Services Act 2007 (CMSA)?

I. Unit Trust

II. Stocks

III. Bonds

IV. Crude Palm Oils

A. I only

B. II and IV only

C. I, II and III only

D. All of the above

Question 2

AC is the central market place provided by the stock exchange where people can buy and sell securities that have been previously issued to the market.

AC is an auction system and the price of the share is determined by supply and demand.

Which of the following describes AC?

A. Primary Market

B. Secondary Market

C. Main Market

D. Stock Market

Question 3

Please indicate whether the following statements in relation to sophisticated investors, listed companies and Proprietary Day Traders are TRUE or FALSE.

1. Only sophisticated investors can trade on the LEAP Market. (TRUE/FALSE)

2. In Malaysia, companies are either listed on the Main Market or ACE Market only (TRUE/FALSE)

3. Proprietary Day Traders can only execute Day Trading on behalf of their Participating Organisation and cannot execute client trades. (TRUE/FALSE)

Answer: 1. = TRUE, 2. = FALSE and 3. = TRUE