To ensure trust and confidence in the capital market, the SC regulates the capital market based on the principles of transparency and proportionality to commensurate with the risks posed.

We actively update and enforce our regulations and securities laws to ensure that the capital market operates in a fair and orderly manner as well as to reduce systemic risks. Here you will find a list of our Acts, guidelines, consultation papers, frequently asked questions on our regulations, technical notes, updates on our enforcement actions as well as licensing information.

Guidelines for the Offering, Marketing and Distribution of Foreign Funds

The Guidelines was revised to introduce the Foreign Exempt Scheme (FES) Framework, for the offering of foreign funds to certain accredited investors and high-net worth entities of Part 1, Schedules 6 and 7 of the CMSA 2007 by local fund management companies or their related corporations. Click here to find out more.

Contents

Learning Objectives

Introduction

Overview of the Law

Regulatory Bodies in Malaysia

Summary

Self-Assessment

Learning Objectives

At the end of this topic, you should be able to:

• Distinguish between an Act of Parliament, and enactment of a state assembly and regulations and rules

• Describe the common law

• List the source of securities industry law

• Explain why stock markets need to be regulated

• Briefly outline the history and development of the securities industry in Malaysia

• Explain the shift from merit-based to disclosure-based regulation in Malaysia

• Describe the regulatory structure of the securities and derivatives industry in Malaysia

• List the major regulatory bodies in the securities industry in Malaysia

• Explain the establishment of the Securities Commission Malaysia (SC)

• Describe the role and the function of the SC

• Outline the management structure of Bursa Malaysia Berhad

• Explain the objectives and duties of Bursa Malaysia Securities Berhad

• List the matters covered by the Rules of Bursa Malaysia Securities Berhad

• Explain the procedure of amendment of the Rules of Bursa Malaysia Securities Berhad

• Explain how Bursa Malaysia Securities Berhad can deal with complaints and.disputes

• Describe the Central Depository System (CDS)

• Explain the requirements for Rules of Bursa Malaysia Depository Sdn Bhd and amendments of those rules

• Describe the prerequisites for authorised depository agents and the rules which are related to them

• Explain the role of Bursa Malaysia Securities Clearing Sdn Bhd

• Explain the role of Bank Negara Malaysia

• Explain the role of the Companies Commission of Malaysia.

Introduction

This topic is about the regulation of the securities industry in Malaysia. We begin by looking at the different types of laws in Malaysia, some of the terms used and the legislative process.

The securities industry is governed by several different pieces of legislation, primarily to ensure orderly markets and encourage investment. We will then examine the securities industry and why it needs specific laws.

The industry players are many and varied, and include the following:

• Companies whose securities are traded

• The SC, which is the main regulatory body of the securities and derivatives industry

• Bursa Malaysia Securities Berhad, which is responsible for administration of the share market on which securities may be traded

• Financial intermediaries that deal in securities on behalf of their clients, e.g. stockbroking companies

• Investors.

We will consider briefly the history and development of the securities industry, the different approaches to securities regulations, as well as the shift in regulation in Malaysia and corporate governance.

We will also examine the various bodies, which are responsible for the supervision and management of the securities industry, as well as look at their organisation and structure, functions and powers.

The purpose of this topic is to give you background information that provides you with a feel for the regulation of the market as well as the key regulators. This gives you a good starting point to build upon as you continue with the later topics.

OVERVIEW OF THE LAW

The Law in Malaysia

• The main sources of Malaysian law are as follows:

• The Federal Constitution establishes a constitutional monarchy and a federal system of government. The Parliament functions under this written constitution and is governed by it.

• Constitutional provisions limit the Malaysian Parliament’s law-making powers; however, the Parliament can amend the constitution by a two-thirds majority vote of both chambers of Parliament, the House of Representatives (Dewan Rakyat) and the Senate (Dewan Negara).

• The Constitutions of the 13 states comprising the Federation. All 13 states comprising the Federation have individual constitutions, which provide for a single chamber legislative assembly in each state (state legislative assemblies).

• Federal laws made by Parliament.

• State laws made by state assemblies.

• Federal and state subsidiary legislation, also known as subordinate legislation or delegated legislation. This is made up of rules and regulations enacted by an authority under powers conferred on it by a statute. Rules of Bursa Malaysia Securities Berhad and regulations are as much law as the tatute under which they are made. However, they cannot govern matters further than those covered by the legislation which created them, and they are always read subject to the relevant legislation.

• Common Law.

• Principles of English law suitable to local circumstances. A consequence of British colonial rule was the spread of English law into those areas ruled by the British. Malaysia adopted English law in so far as it was suitable to local conditions. In those instances, English law was adopted indirectly because it was applied by the judiciary to cases that came before them.

In other instances, there was statutory authority for the introduction of English law that was suitable to local conditions in the absence of local laws, e.g. Royal Charters of Justice.

In Peninsular Malaysia, the courts apply “the common law of England and the rules of equity” as administered in England on 7 April 1956. In Sarawak, they apply the “common law of England and the rules of equity, together with statutes of general application”, as administered or in force in England on 12 December 1949. In Sabah, it is the same as in Sarawak but the date is 1 December 1951.

In the application of English legal principles to commercial transactions where there is no local law, English law as it stood on 7 April 1956 is received in the nine former Malay states.

On the other hand, in Penang, Malacca, Sabah and Sarawak, English commercial law in the corresponding period is received. This means that in these four states, which were former colonies, there is a continuing reception of English commercial law in the absence of local legislation.

The dates of reception that are specified are very important because later changes in English law are not automatically received. After the specified dates, it was up to the colonies of the Malay state to develop or change the inherited law as they saw fit. There is now an increasing number of local laws dealing with commercial transactions with a corresponding decrease in dependence on English law.

• Islamic law, which is only applicable to Muslims, is administered in the Shariah Courts. The power to administer Islamic law is primarily that of the states, except for the federal territories of Kuala Lumpur, Labuan and Putrajaya.

The Legislative Process

Legislation refers to laws made by a person or body, which has the power to make laws in Malaysia; both Parliament and the legislative assemblies of each state possess authority to enact laws in their respective areas. Laws made by the Parliament may apply throughout the country or even extra-territorially, but laws enacted by the state can only apply to that state. A Federal law is referred to as an Act. A state law is called an enactment except in Sarawak where it is called an ordinance.

The Common Law

Common law, as opposed to statute law enacted by legislature, is judge-made law or precedent. A binding precedent is a judgment of a decision of a court of law cited as an authority for deciding a similar set of facts; a case, which serves as an authority for the legal principle embodied in its decision. A court is bound by decisions of a superior court where the superior court had decided a case in the same area of law and on similar facts. While this technique may be English in origin, the resulting common law is naturally Malaysian, although principles of English law may have found their way into the precedent established by the courts.

Securities Industry Law

The legislation, which affects the securities industry, is as follows:

• Securities Commission Malaysia Act 1993 (SCMA)

• Capital Markets and Services Act 2007 (CMSA)

• Securities Industry (Central Depositories) Act 1991 (SICDA)

• Companies Act 2016 (CA)

The SCMA, CMSA and SICDA are collectively referred to as the securities laws under section 2 of the SCMA. Subsidiary legislation such as regulations, orders and guidelines issued by the SC supplement the regulatory requirements of the securities industry. Two other legislation affects the securities industry primarily through the entities that issue securities or conduct a regulated activity: the Companies Act 2016 (CA) and the Companies Commission of Malaysia Act 2001 (CCMA).

Later in this topic, we will look in detail at the bodies which administer these Acts, and the subsidiary legislation which governs the supervision and management of the Malaysian capital market industry.

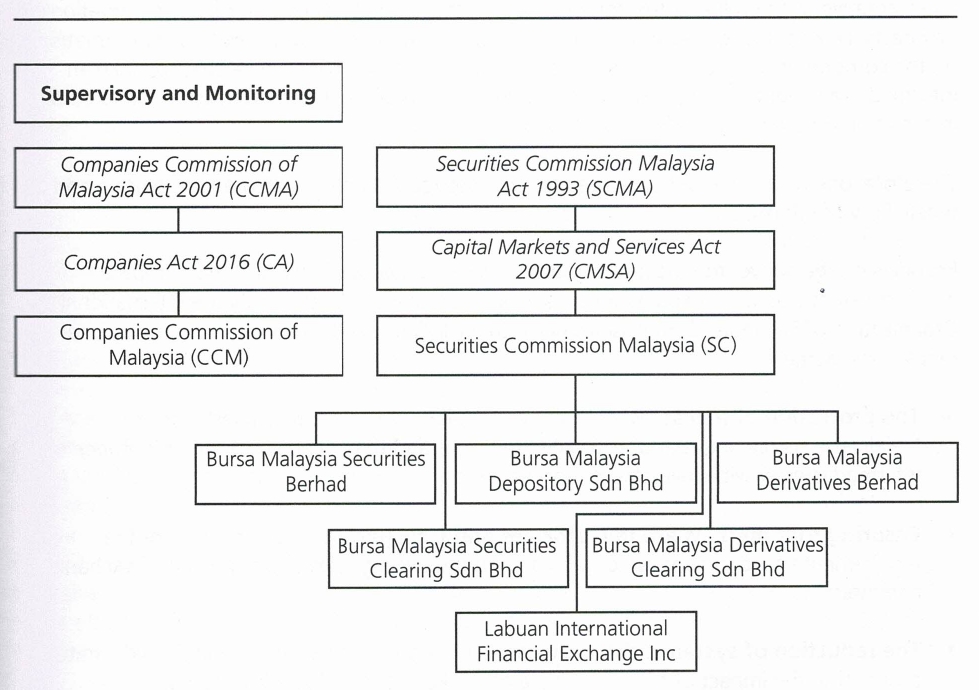

Figure 1: Regulatory Structure of the Capital Markets and Services Industry.

Regulatory Structure

The regulatory structure of the securities and derivatives industry encompasses:

• Supervisory and monitoring

• Licensing

Why does the securities industry have specific laws?

Specific laws are required to regulate the securities industry, primarily due to the distinct nature of securities themselves which are different from other types of properties or assets. Securities are intangible and on their own have no inherent worth. The value of securities is representative of the value of the corporation, which in turn is dependent on the corporation’s prospects. Due to this connection, it is in the corporation’s interest that favourable information on the corporation’s performance is disclosed to the capital market. Conversely, to make an informed investment decision the investing public should be provided with accurate and current information on the corporation.

Therefore, one of the primary objectives of securities regulation is to ensure the accurate and timely flow of information to the investing public.

Recognising the above, the Malaysian capital market regulatory framework has adopted — and is constantly benchmarked against — the universal standards set out by the International Organization of Securities Commissions (10SCO), including the 3 key objectives of securities regulations, namely:

• The protection of investors — this entails regulations that protect investors from fraudulent, manipulative and misleading practices and that ensure only “fit and proper” intermediaries provide investment services

• Ensuring that markets are fair, efficient and transparent — this provides for the requirement of regulations, among others, on the trading rules and approvals of exchanges and intermediaries.

• The reduction of systemic risk — regulators through securities regulation should aim to ensure that the impact of financial failure of market intermediaries is reduced.

Thus, a large part of securities regulation is directed at disclosure standards, ensuring that markets are kept informed and ensuring fair-trading on securities markets. Securities regulation is also concerned with the definition and maintenance of appropriate standards of conduct by participants. These objectives help to give the public confidence in the market. Ensuring full and fair disclosure of information helps protect those investors proposing to invest in securities.

The legal and regulatory framework forms the basis on which capital markets work. It should provide the foundation to effect practices necessary for the efficient function of modern capital markets. Building on the legal infrastructure, the regulatory authorities make markets fair, efficient and safe.

The hypothesis is that without regulation, capital markets would be open and vulnerable to market imperfections and negative externalities. Fair markets are those where the investor is protected from abuse and fraud, and similar market participants are treated equally. Efficient markets are competitive and have efficient infrastructure and information systems. Safe markets are protected against systemic risk.

The functions of regulation are:

• To define the key features of the capital market system and the role of the securities market institutions, including the development of new types of market activities

• To steer market participants towards the adoption of best practices

• To create disincentives against behaviour that would be detrimental to the market.

History and Development of the Securities Industry in Malaysia

The Malaysian securities industry effectively commenced in the 19th century with the emergence of British companies in Malaya which traded in the rubber and tin industries informally as a sideline to pure commodity broking. In 1930, the Singapore Stockbrokers’ Association, the first formal organisation of stockbrokers, was established. It was re-registered as the Malayan Stockbrokers’ Association in 1938.

In 1960, the Malayan Stock Exchange was formed and public trading of shares began. The Stock Exchange of Malaysia was established in 1964. However, with the secession of Singapore from the Federation of Malaysia in 1965, the Stock Exchange of Malaysia became known as the Stock Exchange of Malaysia and Singapore (SEMS). Also in 1965, the Companies Act came into force, laying the first statutory foundation for investor protection as it provided the legal framework in governing companies. This was followed by the formation of the Capital Issues Committees (CIC) in 1968 to guide the orderly development of the securities industry by regulating the issue of securities by public-listed companies and the listing of securities on the stock exchange.

Note that the Companies Act 2016 (CA) was implemented on a staggered basis with the first phase effective from 31 January 2017. With the enforcement of the first phase of the CA, the Companies Act 1965 was repealed.

In 1973, with the termination of currency interchangeability between Malaysia and Singapore, SEMS was separated into the Kuala Lumpur Stock Exchange Berhad and the Stock Exchange of Singapore. It was also at this time, given the rapid development of the securities industry, that the first Securities Industry Act was passed to regulate the industry and provide for better investor protection. In July 1973, a new company limited by guarantee, the Kuala Lumpur Stock Exchange (KLSE) took over the operations of the Kuala Lumpur Stock Exchange Berhad as the stock exchange.

The new Securities Industry Act 1983 (SIA) came into effect in July 1983, replacing the 1973 Act. The new SIA contained enhanced provisions for enforcement and investigation matters related to the securities industry.

Computerisation of the clearing system began with the formation of a central clearing house, Securities Clearing Automated Network Services Sdn Bhd (SCANS) in 1984, replacing manual clearing and settlement. The Kuala Lumpur Composite Index (KLCI), regarded as the main market barometer, was launched in 1986. In 1988, the Second Board was launched to enable smaller companies, which were viable and had strong growth potential, to be listed.

In 1989, the System on Computerised Order Routing and Execution (SCORE) was implemented initially as a semi-automated system where order entry was automated while matching remained manual. A fully automated (i.e. both order entry and matching) trading system was – introduced in 1992. The Malaysian Central Depository Sdn Bhd was set up in 1990 to implement and operate the Central Depository System (CDS). The delisting of Singapore incorporated companies from the KLSE and vice versa was made effective also in 1990.

The Malaysian government, recognising the importance of having a single regulatory body to govern the securities market more efficiently, established the SC by passing the Securities Commission Act 1993. The SC’s mission is to promote and maintain fair, efficient, secure and transparent securities and futures markets and to facilitate the orderly development of an innovative and competitive capital market.

The year 2004 marked a new era for the Malaysian capital market. The KLSE was demutualised as a consequence of the passing of the Demutualisation (Kuala Lumpur Stock Exchange) Act 2003. In this demutualisation exercise, the KLSE converted itself from a compaq limited by guarantee to a public company limited by shares. The demutualisation exercise adopted a new structure which includes an exchange holding company at the top with subsidiaries carrying out the functions of the stock exchange, derivatives exchange, clearing house and depository.

The demutualised KLSE became the Exchange Holding Company known as Kuala Lumpur Stock Exchange Berhad (KLSEB) whilst the stock change operations as well as all property relevant to the existing exchange’s operations were transferred and vested in a new company known as Malaysia Securities Exchange Berhad (MSEB).

Shortly thereafter, KLSE Berhad and its group of companies undertook a branding exercise on 20 April 2004 and converted its name to Bursa Malaysia. As a consequence of this, Malaysia Securities Exchange Berhad became Bursa Malaysia Berhad; Malaysia Central Depository is now known as the Bursa Malaysia Depository Sdn Bhd and Securities Clearing Automated Network Services Sdn Bhd was renamed Bursa Malaysia Securities Clearing Sdn Bhd.

The Approach to Regulation of Stock Markets in Malaysia

The regulation of the financial markets has been undertaken in a more streamlined fashion in recent times following the establishment of the SC in 1993 under the SCA. Henceforth, there was one principal regulatory body to plan and to rationalise issues in the market from a broad developmental perspective and to formulate a practical, efficient and competitive regulatory system.

The SC is the principal regulator of the capital market, with Bank Negara Malaysia and the Companies Commission of Malaysia (CCM) playing supplementary roles specific to areas within their respective regulatory jurisdictions.

Shift towards Disclosure-based Regulation

The decision to purchase or sell a security at a given price requires sufficient, accurate and timely relevant information about the business, finances and prospects of the issuing entity. It is on this premise that securities regulation is based. The main objective of securities regulation is the protection of investors, be it via the adoption of a “merit-based” or a “disclosure-based” system of regulation.

In simple terms, the merit-based regulation requires any issue or offer of new securities to be subjected to a review of their investment merit by regulators who may prohibit an offering of such securities if they were judged not to be “fair, just and equitable”. On the other hand, a disclosure-based regulation system is one in which access to the public securities markets for issuers is conditional upon providing full and accurate disclosure of relevant information in accordance with parameters established by the securities law and regulations.

The securities industry regulatory framework in Malaysia has shifted from being merit-based to disclosure-based. This progression was considered necessary for the Malaysian capital market to become more efficient and to develop into a sound and credible market of international standing.

Merit-based Regulation

The recognition of the need for a securities regulator to ensure investor protection and market integrity is embedded in the SCA, under which the SC is established. S.15(1) of the SCA requires the SC to, among others, regulate all matters relating to securities and to take all reasonable measures to maintain the confidence of investors in the securities market by ensuring adequate protection for such investors.

S.212 of the CMSA mandates that all proposals involving issues or offers of securities be subjected to the SC’s prior approval. The SC has the discretion to approve the proposal with such revisions and subject to such terms and conditions as it deems fit. The SC also has the power to reject corporate proposals if it is reasonably satisfied that these proposals are not in the best interests of the public company and/or the investing public.

In reviewing proposals for the issue or offer of securities, the SC follows a set of guidelines, which have been formulated with the primary objective of protecting the interests of the public investors at large, and is applied in consonance with the government policies. With this objective in mind, the SC has an obligation to ensure that various mechanisms for the protection of the investing public are in place in most proposals considered by it.

Merit-based regulation is a paternalistic attempt to improve fairness between sellers and buyers of securities in the capital market, as well as to shield public investors from the risks involved in acting on impulse.

It must, however, always be borne in mind that the ultimate investment decision and evaluation of security being issued or offered lies with the investing public. The SC does not guarantee the likelihood of a return from any investment made.

Disclosure-based Regulation

The framework

The guiding principle in a disclosure-based regulatory structure is the need for issuers or offerors of securities to provide the investors with sufficient and accurate disclosure of all relevant information pertaining to the company’s business, finance, prospects and terms of the securities to allow potential investors to make their own informed investment decisions. Of particular importance is the need to disclose any adverse situations or known risks connected with the securities being issued/offered or the issuer itself.

Disclosure-based regulation, therefore, focuses on whether the applicable standards of disclosure are complied with and whether due diligence work is performed by the issuers or offerors of securities and their advisers in respect of the accuracy and completeness of the information disclosed by them. Although there will still be a review by the regulators of the information disclosed by the issuers or offerors, the burden of disclosure rests firmly with the issuers and their advisers and cannot be shifted to the regulators. Investors, too, will have to assume a higher level of responsibility in evaluating the riskiness of a particular security based on the disclosed information before investing.

The role of the regulator

The regulator, under disclosure-based regulation, will not assess or validate the investment merits or quality of any securities to be issued or offered. It will no longer function to approve or disapprove a new issue or offer of securities, and will have nothing to say about the fairness to the investing public of a security to be issued or offered, or on the likelihood of a return on investment. Instead, it is the investors who will have to determine whether or not the security being offered is a good investment based on their own assessment of the potential risks and rewards, given the information disclosed by the issuer or offeror. Thus, even the riskiest security may be issued or offered so as long as the public is made well aware of the risks involved in the investment through appropriate disclosure in the prospectus and continuous disclosure requirements after listing on the Bursa Malaysia Securities Berhad.

Bursa Malaysia Securities Berhad’s capital adequacy requirements address both liquidity and solvency issues together with risks faced by Participating Organisations. Liquidity is represented by liquid capital in the nearest form; solvency is represented by liquid margin after accounting for a series of identified risks inherent in the operating environment and the composition of liquid capital. These risks are operational risk, position risk, counterparty risk, large exposure risk and underwriting risk as described in Chapter 13 of the Rules of Bursa Malaysia Securities Berhad.

Note that the large exposure risk is defined to include a proportionally large amount of exposure to a particular client or counterparty, a single issuer of debt securities and/or a single equity.

Apart from the capital adequacy requirements prescribed, a Participating Organisation other than an Investment Bank must have paid-up capital and minimum shareholders’ fund unimpaired by losses of at least RM100million each if it is a Universal Broker. For any other Participating Organisations, the minimum amount is RM20 million.

The Guidelines on Investment Banks in chapter 5.1 sets out that Investment Banks must comply with the minimum capital funds unimpaired by losses requirement of RM2 billion on a banking group basis if they are part of banking groups, while Investment Banks that are not part of banking groups will be required to comply with a minimum capital funds requirement of RM500 million.

Rule 12.01 and 12.02 of the Rules of Bursa Malaysia Securities Berhad further prescribe that all Participating Organisations must maintain on a continual basis accounting and other books and records in the form and manner prescribed in the rule and prepare and submit such financial reports to Bursa Malaysia Securities Berhad from time to time as the exchange may stipulate. The records must be kept for a minimum period of seven years.

The Capital Market Compensation Fund Corporation (CMC), set up by the SC, is the compensation fund of last resort for customers of licensed brokers, derivatives dealers, fund The role of regulator will, under this scenario, focus more on the protection of potential investors by ensuring that the information disclosed is sufficient, true and timely. In this capacity, the regulator has an obligation to insist that every issue or offering of securities is accompanied by full disclosure of all material information required to form an investment decision and that there is no material concealment of information from the investing public.

Disclosure-based regulation puts the burden of telling the whole truth on the seller. So long as the investor is fully and honestly informed about the issuer and the security to be issued, the offering would be able to proceed. Any information found to be false or misleading and any material omissions of information would subject the promoters and their advisers to stiff penalties.

Under a disclosure-based regime, the role of the regulator is to ensure the incentives and structure of the market is consistent with efficiency, fairness and safety. The regulatory framework should be such that timely and accurate information is available so that investors can judge the merits of alternative investments; hence the regulatory emphasis on disclosure and education.

The shift towards disclosure-based regulation has already been implemented for initial offerings. ‘The shift has resulted in a more efficient, competitive and mature capital market in Malaysia with increased confidence.

Capital Market Masterplan

First Capital Market Masterplan (CMP1) (2001 to 2011)

in 2001, the SC introduced its first Capital Market Masterplan (CMP1), which mapped out the strategic development and direction of the Malaysian capital market for a span of 10 years.

The CMP1 outlined six broad objectives as well as a set of strategic initiatives and 152 recommendations to be implemented to deliver each of the six objectives as follows:

-To be the preferred fund-raising centre for Malaysian companies

-To promote an effective investment management industry and a more conducive environment for investors

-To enhance the competitive position and efficiency of market institutions

-To develop a strong and competitive environment for intermediation services

-To ensure a stronger and more facilitative regulatory regime

-To establish Malaysia as an international Islamic capital market centre

Capital Market Masterplan 2 (CMP2) (2011 to 2020)

On 12 April 2011, the SC launched the Capital Market Masterplan 2 (CMP2), which is the strategic blueprint for the development of the Malaysian capital market for the next 10 years.

The CMP2 leverages the solid foundation built during the CMP1. Over its 10-year period, 95% of the 152 recommendations set out in the CMP1 were implemented, building a diversified market with strong intermediaries operating in a well-regulated environment.

The CMP2 outlines different strategies and approaches to move the Malaysian capital market to the next level. Themed ‘Growth with Governance’, the CMP2 comprises growth as well as governance strategies.|

Growth strategies prioritise key areas such as:

• Promoting capital formation

• Expanding intermediation efficiency and scope

• Deepening liquidity and risk intermediation

• Expanding growth boundaries through internationalisation

• Building capacity and strengthening information infrastructure.

Governance strategies are aimed at fostering an enabling environment for expansion and innovation by:

• Enhancing product regulation to manage risks

• Expanding accountabilities as the intermediation scope widens

• Strengthening the regulatory framework to make it more robust for a changing market landscape

• Ensuring an effective oversight of risks

• Strengthening corporate governance

• Broadening participation in governance.

Key changes to the Companies

The Companies Act 2016 (CA) has several key changes in the legislation governing companies, such as:

• Introduction of single member/single director

• Change of “certificate of registration” to “notice of registration”

• Abolition of authorised capital concept

• Abolition of concept of shares with nominal value

• Abolition of constitution or memorandum and articles of association for companies

• Abolition of common seal for companies

• Abolition of the requirement of annual general meeting for private companies

• Decoupling of lodgement of Annual Returns and Financial Statements.

REGULATORY BODIES IN MALAYSIA

Securities Commission Malaysia

The SC was officially established and began its operations on 1 March 1993 with the enforcement of the Securities Commission Malaysia Act 1993 (SCMA).

The SC’s mission statement is:

“To promote and maintain fair, efficient, secure and transparent securities and derivatives markets and to facilitate the orderly and development of an innovative and capital market.”

The SC acts as the single regulatory body to promote the development of the capital market and provides the regulation of, and advises the Minister of Finance on, all matters relating to the securities and derivatives industries.

Notably, the SC’s statutory mandate was not merely to regulate but also to develop the capital market. Underpinning the above is the SC’s ultimate responsibility of protecting the investor. The SCMA gave the SC regulatory and investigation powers with regard to compliance under the SIA (which has now been repealed by the Capital Markets and Services Act 2007 (CMSA) and the Securities Industry (Central Depositories) Act 1991 (SICDA)).

The SC comprises eight members, who must be appointed by the Minister of Finance as below:

(a) An executive chairman

(b) Seven private and government representatives

The functions of the SC as listed under 5.15 of the SCMA are:

•To advise the Minister on all matters relating to the securities and derivatives industries

•To regulate all matters relating to securities and derivatives contracts

•To ensure that the provisions of the securities laws are complied with

•To regulate the take-overs and mergers of companies

•To regulate all matters relating to unit trust schemes

To be responsible for supervising and monitoring the activities of any exchange holding company, exchange, clearing house and central depository

•To take all reasonable measures to maintain the confidence of investors in the securities and futures markets by ensuring adequate protection for such investors

•To promote and encourage proper conduct amongst participating organisations, participants, affiliates, depository participants and all licensed or registered persons of an exchange, clearing house and central depository, as the case may be

• To suppress illegal, dishonourable and improper practices in dealings in securities and dealings in derivatives, and the provision of investment advice or other services relating to securities or derivatives

• To consider and make recommendations for the reform of the law relating to securities and derivatives

• To encourage and promote the development of the securities and derivatives markets in Malaysia, including research and training in connection thereto

• To encourage and promote self-regulation by professional associations or market bodies in the securities and derivatives industries

• To license, register, authorise and supervise all persons engaging in regulated activities or providing capital market services as may be provided for under any securities law.

• To promote and maintain the integrity of all licensed persons in the securities and derivatives industries.

• To register or recognise all auditors of public interest entities for the purposes of this Act, and to promote and develop an effective audit oversight framework in Malaysia.

• To take all reasonable measures to monitor, mitigate and manage systemic risks arising from the securities and derivatives markets.

• To promote and regulate corporate governance and approved accounting standards of listed corporations.

• To set and approve standards for professional qualification for the securities and derivatives markets.

Securities Commission Malaysia’s Regulatory Philosophy

The SC regulates the capital market to:

• Protect investors

• Ensure fair, efficient and transparent markets

• Reduce systematic risk

In carrying out its regulatory functions, the SC works closely with other government agencies, regulatory bodies and industry associations such as the Attorney-General’s Chambers, Bank Negara Malaysia, Royal Malaysian Police, Ministry of Domestic Trade and Consumer Affairs, as well as the

Companies Commission of Malaysia.

The SC intends to pursue the following regulatory outcomes:

Regulatory neutrality

Regulatory neutrality means regulation should not confer an undue advantage to any particular market, participant, product or service without clear regulatory or policy justification. It supports consistent and fair application of regulation across the market and at the same time minimises risk of regulatory arbitrage or conduct that is not in the spirit of the regulatory intent.

Principles-based, outcomes-oriented approach

Principles-based and outcomes-oriented regulation represents an evolution in the regulatory relationship between regulator and stakeholder, from one of directing and controlling to one that is based on collaboration and mutual trust where articulated standards have been met. The success of this approach relies upon a strong collaboration between the regulator and stakeholder.

Principles-based regulation emphasises broad-based standards over prescriptive and detailed rules, with greater focus on outcomes rather than dictating processes. Clearly articulated desired outcomes provide some latitude to firms to achieve their own business goals without compromising those regulatory outcomes.

Adopting this approach does not mean that rules are done away with. While broad principles may be suitable for business and investment conduct, precise and clear rules are put in place when imposing mandatory obligations.

Empowerment of investors

The capital market continues to grow in size and complexity. At the same time, investors have greater and easier access to information and variety of products in global capital markets. Traditionally, regulators including the SC placed reliance on disclosure and taking enforcement action as a means to protect investors.

To strengthen investor protection in the capital market, regulators are placing greater emphasis on investor empowerment, which can result from fair treatment of investors and investor literacy. Investors can also be empowered through advocacy efforts by various stakeholders.

Competitive capital market

A competitive capital market attracts and retains capital, investment, talent and participation within a globalised economy. For the capital market to be competitive, the regulatory framework needs to encourage development, competition and innovation while ensuring that the capital market operates in a fair, orderly and transparent manner. In formulating its policies and regulations, the SC considers how it can promote and facilitate current and potential market participants in their pursuit of wealth creation in a sustainable manner.

Recognising that competition promotes productivity and innovation, the SC will:

• Uphold rules and principles that support an effective competition culture within the capital market.

• Embrace regulatory neutrality to ensure consistent and fair application of regulation across the capital market.

• Adopt a more principles-based, outcome-oriented approach to regulation to provide market participants with increased flexibility in how they deliver outcomes determined by the regulator.

• Continuously review its regulatory framework or approach to remove unnecessary barriers that may restrict competition and access to the capital market.

Good governance as an integral part of business culture

The focus of the SC’s regulation is to encourage and reward ethical behaviour and good governance, both of which are necessary ingredients to promote growth and progressive liberalisation of the capital market.

The SC’s efforts in promoting good governance are complemented by proactive corporate surveillance aimed at detecting corporate misconduct and enhancing the quality of disclosures.

While regulation imposes minimum standards and conduct rules, firms must ensure that they comply with these standards and rules, both in substance and in form, and should endeavour to go beyond the prescribed minimum.

Promoting good governance requires all stakeholders in the governance ecosystem to assume responsibility for upholding it.

Responsible financial innovation

Financial innovation without good governance and effective disclosure can lead to significant detrimental consequences within markets. The SC’s role is to provide a conducive environment for businesses to operate and grow responsibly, where the benefit of financial innovation is balanced with responsible management of any possible negative outcomes that may be associated with it.

The SC’s regulatory approach will ensure that innovation does not come at the expense of investor protection and market integrity. It will constantly review its approach to regulation and supervision in order to adapt to the challenges presented by market innovation and will work in partnership with market participants to better understand and assess the structure, risks and implications of innovation in products, markets and services.

Fair and orderly capital market

A fair market means that the market should be free from manipulative or deceptive practices. It also means fair access to the market and market information. Orderly markets imply regularity, reliability and economy of operation with appropriate transparency of material information. Fair and orderly markets have more competitive prices, lower price volatility, lower total transaction costs, and lesser information asymmetry.

Maintaining a fair and orderly capital market is the joint responsibility of the regulators and market participants. A part of the SC’s efforts goes towards ensuring surveillance of the market is effective in detecting unusual activities at an early stage, taking pre-emptive action to contain risk and to protect investors and the market, and supporting self-reporting and whistle-blowers.

Forward-looking and risk-focused supervision

The SC’s approach to supervision of market intermediaries, markets, financial market infrastructures and the surveillance of public listed companies has shifted from one solely based on disclosure and regulatory compliance to one that is more forward looking, and has been expanded to include risk identification of these various stakeholders.

In this regard, the SC has been raising its surveillance and supervisory efforts and effectiveness, developing greater regulatory agility and stronger capacity and capabilities, and heightening collaboration across boundaries and jurisdictions.

Strong and effective strategic enforcement approach

Strong and effective enforcement of laws, regulations and rules is not only important for the preservation of public confidence in the integrity of capital markets but is essential in achieving the regulations’ intended objectives. The SC takes a strategic approach to enforcement by utilising a variety of enforcement tools, including taking administrative, civil and criminal actions to deliver a strong and effective response to illegal and unethical activities in the capital market.

The use of civil and administrative sanctions enables the SC to differentiate between conduct which is wrongful in itself and conduct which is prohibited, where the aim of such civil and administrative sanctions will be to control conduct or an activity without necessarily implying social condemnation.

The regulatory outcomes above are underpinned by two important pillars:

• Proportionality

This principle is applied in order to achieve a balanced, efficient and effective regulatory environment. It is an approach that facilitates growth and development as it recognises that market participants differ in the risks they pose and the benefits they generate.

• Transparency

This principle supports the SC’s accountability to the public and its stakeholders, and helps it to design proportionate regulation. Transparency means communicating relevant and meaningful information concerning the delivery of its functions.

The SC will disclose relevant information where it believes that the public has a legitimate interest and where it is legally permitted to do so. However, it will not disclose information that could harm public interest.

Stakeholder engagement remains an important aspect of the SC’s regulation as it is considers its decisions and how such decisions impact stakeholders and the industry. It continuously conducts engagements and consultations with relevant stakeholders and has established a two-way relationship with domestic industry associations and investor groups. In its new consultative framework for capital market policy and regulatory reforms, it has established three advisory groups, which draw on the expertise and knowledge of capital market professionals, to provide global perspectives on capital market issues and advise on developmental aspects.

To communicate its expectations to our stakeholders, the SC will continue to publish additional guidance on its regulatory approach, and may publish further details on its regulatory principles and outcomes.

Securities Industry Dispute Resolution Centre

The Securities Industry Dispute Resolution Centre (SIDREC) is an independent corporate body stablished for the settlement of monetary disputes between investors and SIDREC members who are Capital Markets Services Licence (CMSL) holders or are registered by the SC for the following regulated ctivities:

• Dealing in Securities

• Dealing in Derivatives

• Dealing in Unit Trusts

• Dealing in Private Retirement Schemes (PRS)

• Fund Management

SIDREC is the alternative dispute resolution body that handles disputes involving monetary claims relating to capital market products and services that an investor may have against capital market intermediaries. Its members include banks, brokers, fund management companies, unit trust management companies, and Private Retirement Scheme (PRS) providers and distributors.

An investor may only refer a dispute to SIDREC after he has lodged a complaint with the SIDREC member concerned and either did not received a response within 90 days or is not satisfied with the response from the member. SIDREC aims to resolve all claims within 90 working days from receiving complete documentation.

SIDREC conducts preliminary review of eligibility, which includes the amount of claim. For claims not exceeding RM250,000 (excluding any fair interest that may be charged), SIDREC handles the case free of charge and participation by the SIDREC member is compulsory.

For claims exceeding RM250,000, participation by both the claimant and SIDREC member is voluntary and the fees payable by both parties are RM500 per claim for case management, RM2,000 per day for mediation and RM5,000 per claim for adjudication (when mediation, fails).

For court-referred mediation, participation by both the claimant and SIDREC member is also voluntary and the fees payable by both parties are RM500 per claim for case management and RM2,000 per day for mediation.

SIDREC cannot accept claims that are time-barred. There are generally two time limits:

• The six-year limitation period imposed by the I, Limitation Ordinance (Sabah) (Cap.72) and Limitation Ordinance (Sarawak) (Cap.49) on civil claims; or

• The requirement in SIDREC’s Rules to file a claim within 180 days from the date of receipt of a final reply on the claimant’s complaint from the SIDREC member.

SIDREC accepts claims from any person regardless of nationality or residency, but only if the claim is in relation to a capital market product or service provided to the claimant by a SIDREC member.

Development of Securities Industry Development Centre as a Premier Capital

Market Education Centre

As a result of the Asian financial crisis in 1997-1998, much that had been developed economically in the capital markets by the SC was under severe threat. In its Business Plan for 1998-2000, the SC accorded an important emphasis on strengthening the capital market regulatory framework with ongoing efforts of consolidation and enhancement. The specific challenges running into the new millennium, in particular Y2K, were taken into account, and there was a particular focus to develop education and training through the Securities Industry Development Centre, the training and education arm of the SC established in July 1994.

The Securities Industry Development Centre became known as the Securities Industry Development Corporation (SIDC) after corporatisation in March 2007. As the leading capital markets education, training and information resource provider in ASEAN, SIDC’s objective is creating investor awareness; raising professional standards; and enhancing skills of Malaysian capital market participants as well as training and developing Malaysian and emerging market regulators.

Capital Markets and Services Act 2007 (CMSA)

The Capital Markets and Services Act 2007 (CMSA) came into effect on 28 September 2007 and repealed the SIA and the FIA. It consolidated the provisions of the S1A, F1A and the fund-raising provisions contained in Part IV of the SCMA. The SC updates the CMSA from time to time.

Recent amendments were gazetted in 2012 and 2015.

The CMSA is the cornerstone of the legal and regulatory framework governing the Malaysian capital market. It sets out the provisions relating to the regulation of markets, licensing and conduct of intermediaries, the regulation of market misconduct, fund-raising and takeovers.

The CMSA accords greater protection to investors by:

• Enhancing the SC’s power to take civil action and administrative actions

• Allowing the SC to recover three times the amount of losses through civil action for a wider range of market misconduct including market manipulation

• Requiring application monies of sophisticated investors to be held on trust in fund-raising exercises

• Enhancing the standards of trustees for debenture holders

• Extending investor protection provisions to clients of financial institutions.

A key CMSA measure benefiting capital market intermediaries is the introduction of the single licensing regime, where a capital market intermediary will only need one licence to carry on business in any one or more regulated activity.

Bursa Malaysia Berhad

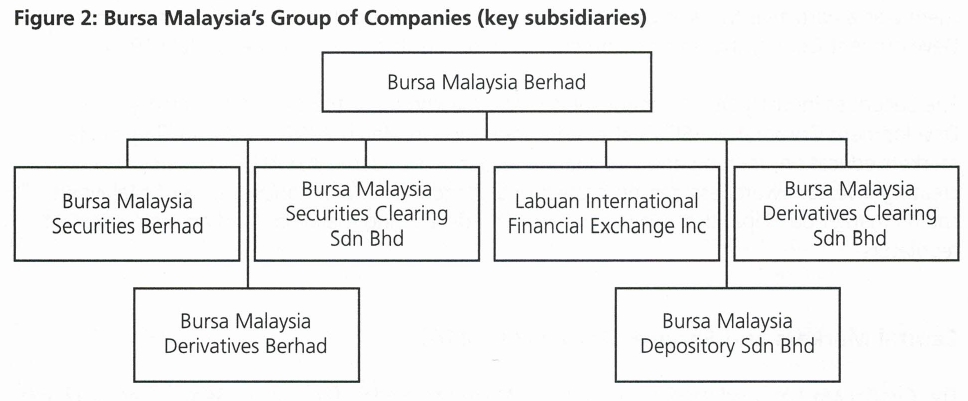

Bursa Malaysia Berhad is an exchange holding company approved under section 15 of the CMSA. It operates a fully integrated exchange, offering the complete range of exchange-related services including trading, clearing, settlement and depository services. The wholly-owned subsidiaries of Bursa Malaysia Berhad own and operate the various businesses, as set out and described below in Figure 2:

Bursa Malaysia Berhad is the frontline regulator of the Malaysian capital market and has the duty to maintain a fair and orderly market in the securities and derivatives that are traded through its facilities. As an integrated exchange, Bursa Malaysia Berhad also has the duty to ensure orderly dealings in the securities deposited with Bursa Malaysia, and orderly, clear and efficient clearing and settlement arrangements for transactions cleared and settled through its facilities.

In furtherance of these duties, Bursa Malaysia Berhad has a comprehensive and effective regulatory and supervisory framework to regulate the market and its participants, including the listed issuers and their directors and advisers, Participating Organisations, Trading Participants, Clearing Participants, Authorised Depository Agents and Authorised Direct Members.

In this respect, Bursa Malaysia Berhad has a set of rules to stipulate the requirements that need to be met by the regulated entities either upon admission and/or on a continuing basis.

It administers and monitors compliance with these rules and takes enforcement action for breaches of these rules. The Bursa Malaysia Berhad supervises the listed issuers and the brokers.

It also undertakes surveillance over the trading activities in the marketplace.

Bursa Malaysia Berhad’s overriding objectives, in addition to discharging its statutory duties, are investor protection, transparency, high standards of conduct and governance, market integrity and confidence for all relevant persons to participate in the Malaysian capital market.

Bursa Malaysia Securities Berhad

Bursa Malaysia Securities Berhad provides, operates and maintains the Malaysian securities exchange. It is responsible for the surveillance of its Participating Organisations, the market place, as well as the enforcement of its listing requirements which spell out the criteria for listing, disclosure requirements and standards to be maintained by public-listed companies.

Bursa Malaysia Securities Berhad closely supervises the business conduct of its Participating Organisations and their representatives with the aim to achieve the following objectives:

(a) To ensure secure, fair and orderly (s.11 of the CMSA) trading environment through effective monitoring and supervision.

(b) To ensure adequate protection of investors who engage the services of the brokers for trading.

(c) To effectively monitor the activities of brokers to ensure that they are providing secure and trusted services to investors.

Chapter 2 Part A, Chapter 3 Part J and Chapter 15 Part A of the Rules of Bursa Malaysia Securities Berhad further prescribe the powers of Bursa Malaysia Securities Berhad.

Rules of Bursa Malaysia Securities Berhad

The Rules of Bursa Malaysia Securities Berhad are a comprehensive set of rules that prescribe conduct and procedures through which Bursa Malaysia Securities Berhad monitors the affairs of AS participants, referred to as Participating Organisations. This self-regulatory process constitutes flexible and wide-ranging system of surveillance and control of the participants, designed to preserve the integrity of the market place and to inspire confidence in the industry.

Participantship in Bursa Malaysia Securities Berhad

The business of dealing in securities is carried out by Participating Organisations of-Bursa Malaysia Securities Berhad.

Rule 3.05 of the Rules of Bursa Malaysia Securities Berhad states that once admitted as a participating Organisation, a Participating Organisation may:

(a) Have access to the markets or facilities established, maintained and operated by the Exchange, subject to its Rules and Directives.

(b) Describe itself as a Participating Organisation of the Exchange.

To qualify to be registered as a Participating Organisation of Bursa Malaysia Securities Berhad, the company must (among others) be incorporated or established in Malaysia with the primary objective of carrying out the business in dealing in securities, or in the case of an Investment Bank, having as one of its objects, the carrying out of the business of dealing in securities. It must also be a company that holds a valid Capital Markets Services Licence (CMSL) for dealing in securities issued by the SC. The Participating Organisation shall at all times satisfy the financial requirements set by the Rules of Bursa Malaysia Securities Berhad, or in the case of an Investment Bank, the financial requirements set by the Guidelines on Investment Banks, have at least three Heads (Head of Dealing, Head of Operations and Head of Compliance) Rule 3.02 of the Rules of Bursa Malaysia Securities Berhad sets out the application procedures for a company to be registered as a Participating Organisation and is required to meet the qualification criteria set out in Rule 3.01.

Part A of Chapter 5 of the Rules of Bursa Malaysia Securities Berhad prescribes the General Requirements on the conduct of business of the Participating Organisations in the following areas:

• Standard of conduct

• Conflicts of interest and risk management

• Structures, internal control, policies and procedures

• Records

• Business Premises

• Advertising

• Communication within the Participating Organisation

• Disputes

• Statements, information and reports to the Exchange

• Currency

• Segregation of clients’ securities

Capital Adequacy and Other Requirements

Capital adequacy requirements are designed to ensure that Participating Organisations are entities of substance so as to foster confidence in the stock market as well as to achieve an environment in which a Participating Organisation is able to wind down its stockbroking business without its clients or the clients of other Participating Organisations incurring losses, and without disrupting the orderly functioning of the stock market.

Chapter 13 of the Rules of Bursa Malaysia Securities Berhad sets out the capital adequacy requirements governing Participating Organisations other than Investment Banks. An Investment Bank must comply with the capital adequacy requirements Bank Negara Malaysia prescribed in the Investment Bank Capital Adequacy framework found in the Guidelines on Investment Banks issued by the central bank and the SC. In relation to the capital requirements stipulated in Chapter 13, only Rules 13.03 and 13.05 are applicable to an Investment Bank.

Bursa Malaysia Securities Berhad’s capital adequacy requirements address both liquidity and solvency issues together with risks faced by Participating Organisations. Liquidity is represented by liquid capital in the nearest form; solvency is represented by liquid margin after accounting for a series of identified risks inherent in the operating environment and the composition of liquid capital. These risks are operational risk, position risk, counterparty risk, large exposure risk and underwriting risk as described in Chapter 13 of the Rules of Bursa Malaysia Securities Berhad.

Note that the large exposure risk is defined to include a proportionally large amount of exposure to a particular client or counterparty, a single issuer of debt securities and/or a single equity.

Apart from the capital adequacy requirements prescribed, a Participating Organisation other than an Investment Bank must have paid-up capital and minimum shareholders’ fund unimpaired by losses of at least RM100million each if it is a Universal Broker. For any other Participating Organisations, the minimum amount is RM20 million.

The Guidelines on Investment Banks in chapter 5.1 sets out that Investment Banks must comply with the minimum capital funds unimpaired by losses requirement of RM2 billion on a banking group basis if they are part of banking groups, while Investment Banks that are not part of banking groups will be required to comply with a minimum capital funds requirement of RM500 million.

Rule 12.01 and 12.02 of the Rules of Bursa Malaysia Securities Berhad further prescribe that all Participating Organisations must maintain on a continual basis accounting and other books and records in the form and manner prescribed in the rule and prepare and submit such financial reports to Bursa Malaysia Securities Berhad from time to time as the exchange may stipulate. The records must be kept for a minimum period of seven years.

The Capital Market Compensation Fund Corporation (CMC), set up by the SC, is the compensation fund of last resort for customers of licensed brokers, derivatives dealers, fund managers, unit trust management companies and Private Retirement Scheme providers. The CMC provides an avenue for individual investors in the event a relevant Capital Markets Services Licence (CMSL) holder fails to pay amounts owing to its investors. Participating Organisations are required to contribute RM30,000 to this Fund upon being licensed. Participating Organisations which are Investment Banks need to make a recurring contribution of RM10,000 upon the anniversary date of their licence. As for non-Investment Bank Participating Organisations, the recurring contribution is RM5,000.

Disciplinary Actions

Part A of Chapter 15 of the Rules of Bursa Malaysia Securities Berhad sets out the disciplinary powers to the Exchange as follows:

Where the acts or omissions of a Registered Person(s), employee or agent of a Participating Organisation would have been subject to these Rules had such acts or omissions been committed by the Participating Organisation, then such acts or omissions are deemed to be committed by that Participating Organisation.

• Actions that can be taken by the Exchange in exercising its disciplinary powers.

• The Exchange may vary the procedures applicable to any disciplinary proceedings under Chapter 15 to adapt to the circumstances of any particular case.

• The Exchange may accept, reject or vary a proposed settlement of the disciplinary action against a Participant based on the terms the Exchange deems fit.

• The Exchange may allow or disallow any request made by a Participant to have an oral representation to make submissions or to procure a witness or legal representation at such oral representations for proceedings against the Participant.

• The standard of proof is based on the balance of probabilities.

Under Rule 15.02, the Exchange’s disciplinary powers include the taking of one or more of the following actions:

• Reprimanding (publicly or privately) a Participant.

• Imposing a fine not exceeding RM1 million on a Participant.

• Suspending a Participant in accordance with the terms prescribed by the Exchange.

• Striking a Participant off the Register where the Participant will immediately cease to enjoy the privileges of Participantship.

• Imposing any restrictions or conditions in relation to the breach committed or on activities that a Participant undertakes.

• Imposing one or more conditions for compliance including issuing a directive to take such steps to remedy or mitigate the breach.

• Directing a Participant to take appropriate action against any of the Participant’s employees or agents if such a person caused the Participant to commit the breach.

• Mandating education, training or such other types of programme as may be determined by the Exchange to be undertaken or implemented by the Participant for its employees or any other action the Exchange considers appropriate, subject to consultation with the SC.

Part B of Chapter 15 of the Rules of Bursa Malaysia Securities Berhad sets out violations that Participants will be liable for and can be dealt with in accordance with the Rules relating to the same:

• Commits a breach of or violates any of the Rules of the Exchange.

• Fails to comply with any of the Exchange’s decisions, directives rulings or guidelines.

• Violates any provisions of the Clearing House Rules or Depository Rules.

• Is found by the Exchange guilty of misconduct.

• Fails to pay, when due, any debt incurred by it to another Participant in respect of any dealing in securities.

• Becomes insolvent.

• Fails to perform its duty efficiently, honestly and fairly.

• In the case of a Participating Organisation:

(i) It fails to inform the Exchange of its inability to comply with the minimum financial requirements after being aware of it.

(ii) It fails to submit financial reporting statements or annual audited accounts within the stipulated time frame.

(iii) It provides false representations or omits to provide material information to the Exchange.

• In the case of a Dealer’s Representative:

(i) He/she falsely declares authentication of an account opening application.

(ii) He/she makes use of another person’s particulars or accounts without proper authority.

(iii) He/she falsifies particulars of an account.

(iv) He/she unlawfully transacts on another person’s account.

(v) He/she breaches his/her fiduciary duty in respect of another person’s account.

(vi) He/she unlawfully delegates powers or assign duties vested in him/her to unauthorised person(s).

(ii) He/she applies amounts paid or securities deposited by a client to any person not entitled thereto or for payment other than the said client’s trading account.

Part C of Chapter 15 of the Rules of Bursa Malaysia Securities Berhad sets out the disciplinary proceedings. The Exchange will serve on a Defaulting Participant against whom disciplinary action is proposed to be taken a written notice, known as a Requisite Notice, specifying the nature and particulars of the breach the Defaulting Participant is alleged to have committed.

The Defaulting Participant may submit to the Exchange a written response to the Requisite Notice within the time stipulated in the Requisite Notice. After the conclusion of the disciplinary proceedings, the Exchange will notify the Defaulting Participant in writing of the decision including the penalty imposed, if any.

Part D of Chapter 15 of the Rules of Bursa Malaysia Securities Berhad sets out that the Exchange may, under circumstances that it deems fit, initiate expedited proceedings, such as. in respect of a breach of the Rules which does not typically attract a penalty beyond a reprimand or a fine exceeding RM10,000.

Part E of Chapter 15 of the Rules of Bursa Malaysia Securities Berhad set out a Participant’s Fight of appeal against any decision of disciplinary proceeding as well as general provisions on disciplinary proceedings under the Rules.

Accounts, Reports and Supply of Information by Participants

Bursa Malaysia Securities Berhad must keep proper books of account for the exchange. The accounts are laid before the annual general meeting of Bursa Malaysia Securities Berhad. In addition, Bursa Malaysia Securities Berhad keeps the following registers of:

(a) Participating Organisations:

(i) Investment Bank

(ii) Universal Broker

(iii) Special Scheme Broker

(iv) 1 + 1 Broker

(v) Standalone Broker

(b) Registered Persons:

(i) Chief Executive Officer

(ii) Director

(iii) Executive Director

(iv) Head of Dealing

(v) Head of Operations

(vi) Head of Compliance

Chapter 14 of the Rules of Bursa Malaysia Securities Berhad empowers Bursa Malaysia Securities Berhad to require a participant or employee of a participant to give information to Bursa Malaysia Securities Berhad or to provide Bursa Malaysia Securities Berhad with documents or information for its inspection, which relate to a matter under investigation by Bursa Malaysia Securities Berhad.

Complaints from Clients

A Participating Organisation must, in relation to a complaint from a client (whether written or otherwise) relating to the Participating Organisation’s business, handle the complaint in a timely and appropriate manner and take steps to investigate and respond immediately to the complainant (please see Rule 5.16 (5)).

If a dispute arises between Participating Organisations in relation to share transactions, either party can bring the dispute to the notice of Bursa Malaysia Securities Berhad in writing. Bursa Malaysia Securities Berhad may decide within 30 days of receiving such a notice, to act and appoint one or three arbitrators to adjudicate the dispute. The parties to the dispute can resort to any outside tribunal or court only if Bursa Malaysia Securities Berhad decides not to act within 30 days of receiving the notice of dispute.

Amendments to Rules of Bursa Malaysia Securities Berhad

The Rules of Bursa Malaysia Securities Berhad to be complied with can be amended or repealed by the SC. The requirements of the CMSA must be complied with. Any changes to the Rules which affect any right or privilege of Participants must be approved by an ordinary resolution of the Participants and the SC. Otherwise, the SC must approve the changes.

Bursa Malaysia Depository Sdn Bhd

As explained earlier, Bursa Malaysia Depository Sdn Bhd is a wholly-owned subsidiary of Bursa Malaysia Berhad. It operates and maintains the central depository, which is Bursa Malaysia Berhad’s scriptless electronic settlement process.

The Securities Industry (Central Depositories) Act 1991 (SICDA) regulates the central depository.

Securities Industry (Central Depositories) Act 1991 (SICDA)

Part ll of the SICDA sets out the provisions for the establishment of a central depository and the duties of a central depository. S.4(1) prescribes that a company which proposes to establish and maintain a central depository must apply to the Minister of Finance in writing under the SICDA for approval.

Bursa Malaysia Depository Sdn Bhd was incorporated on 26 October 1987 and approved by the Minister of Finance to run the central depository in Malaysia.

Rules of Central Depository

A copy of the rules applicable to the central depository must accompany the application for its establishment (s.4(2)((e), SICDA). The approval will not be granted by the Minister unless the rules make satisfactory provisions for the matters specified in section .5(1)(b), SICDA.

The Rules of Bursa Malaysia Depository Sdn Bhd are the specific rules applicable to Bursa Malaysia Depository Sdn Bhd in its operations and maintenance of the Central Depository.

Authorised Depository Agents (ADA)

S.13, SICDA sets out that a person can be appointed as an Authorised Depository Agent (ADA) to:

(a) Facilitate the deposit of securities

(b) Open, maintain and close securities accounts

(c) Make entries in securities accounts

(d) Collect fees and charges provided for under the rules

(e) Take other incidental and ancillary actions specified in the rules.

To become an ADA, the person or company must fall within the categories listed in s.3(2) of the SICDA and be appointed in writing. A person who is an ADA must comply with the Rules of Bursa Malaysia Depository Sdn Bhd.

Rules Relating to Authorised Agents

Part II of the Rules of Bursa Malaysia Depository Sdn Bhd provides the rules relating to ADAs.

In addition to the provisions in the rules which relate to ADAs, there are certain duties and restrictions imposed upon them by the SICDA, as follows:

(a) The duty to take reasonable security measures to protect information and documents relating to the affairs of the depositors against unauthorised access, alteration, disclosure or dissemination (s.42).

(b) The duty to maintain secrecy of information and documents relating to the affairs of the depositors in their access unless permitted to disclose information or documents as provide by s.45 of the SICDA (s.43 and 44).

(c) Prohibition of committing an offence in relation to the falsification of records or accounts kept or maintained by the central depository (s.47)

(d) Prohibition of committing an offence in relation to the destruction, concealment, mutilation and alteration of records or accounts kept or maintained by the central depository with intent to defraud or prevent, delay or obstruct any examination, investigation, audit or exercise of power under the SICDA (s.48)

(e) Prohibition of committing an offence in relation to furnishing false or misleading information (s.49).

Rules Relating to Authorised Direct Members (ADMs)

Part III, Chapter 14 of the Rules of Bursa Malaysia Depository Sdn Bhd sets out the persons, which are eligible for appointment as an Authorised Direct Member (ADM). An eligible person must make an application to Bursa Malaysia Depository Sdn Bhd in writing, accompanied by the information necessary to assist Bursa Malaysia Depository Sdn Bhd in determining the application and the suitability of the applicant. Bursa Malaysia Depository Sdn Bhd can request further information or documents. There is no obligation for Bursa Malaysia Depository Sdn Bhd to appoint every person eligible to be an ADM; however, if appointed an ADM must pay a fee and thereafter an annual subscription fee.

Powers of the Securities Commission Malaysia

As we discussed earlier, the SC has powers of investigation, can enter and search premises and can take action against a person who hinders or obstructs the exercise of its powers or the powers of an investigating officer. See s.52-57 of the SICDA.

The Central Depository System will be discussed further in Topic Clearing, Delivery, Settlement and Corporate Actions…

Bursa Malaysia Securities Clearing Sdn Bhd

Bursa Malaysia Securities Clearing Sdn Bhd is the central clearing house for the Malaysian securities market.

Memorandum of Association

Bursa Malaysia Securities Clearing Sdn Bhd is a wholly owned subsidiary of Bursa Malaysia Berhad. It was set up in 1984 as a centralised clearing house to do away with clearing and settlement of scrips on an interbroker basis.

Bursa Malaysia Securities Clearing Sdn Bhd’s objectives, as set out in its memorandum of association, include:

(a) To provide clearing participants with facilities for clearing contracts between them and for delivering stocks and securities to, and receiving stocks and securities from each other and for receiving or paying any amounts payable to, or payable by, such clearing participants.

(b) To provide clearing participants with facilities for clearing contracts between them and for delivering stocks and securities to, and receiving stocks and securities from their clients and for receiving or paying any amounts payable to, or payable by, such clearing participants.

(c) To provide and to maintain facilities for the custody of scrips on behalf of clearing participants in particular, and other organisations or individuals in general

(d) To make, amend and repeal by-laws for the management and control of its affairs and the regulation of its business.

Rules of Bursa Malaysia Securities Clearing Sdn Bhd

The Rules of Bursa Malaysia Securities Clearing Sdn Bhd (Clearing House Rules) are examined in detail in Topic Clearing, Delivery, Settlement and Corporate Actions.

The Clearing House Rules are binding on clearing participants, and can be amended with the approval of the SC as provided under the CMSA.

The rules cover the following areas:

General rules

(a) Clearing participantship:

(i) Trading clearing participant

(ii) Non-trading clearing participant

(b) Disciplinary action

(c) Default rules

(d) Clearing and settlement — Institutional settlement service

We examine two of the rules above here:

Disciplinary Action

If a clearing participant violates any of the rules, CMSA or any regulation of the CMSA, or fails to comply with the decision of Bursa Malaysia Securities Clearing Sdn Bhd, among other things, then if found guilty under a disciplinary proceeding, any of the actions set out in Rule 3.1.2 can be taken. These include withdrawal of participantship, suspension, fine, reprimand, and other action considered appropriate by Bursa Malaysia Securities Clearing Sdn Bhd.

Default Rules

The default rules relate to action which Bursa Malaysia Securities Clearing Sdn Bhd can implement in the event that a participant is unable, or likely to become unable to meet its obligations under any unsettled market contracts. An event of default is defined in Rule 4.1 and includes failure to pay, bankruptcy, winding up, appointment of receivers, passing of a resolution to wind up the participant, etc.

Bank Negara Malaysia

The central bank, Bank Negara Malaysia (BNM), was set up in 1959. It acts as the licensing and regulatory body over banks and other financial institutions, and provides the stimulus for the expansion and growth of the country’s financial sector.

The Financial Services Act (FSA) and the Islamic Financial Services Act (IFSA) came into force on 30 June 2013, replacing the repealed Payment System Act 2003 (PSA). Under the FSA and IFSA, financial institutions shall carry on any authorised business if they fulfil either of the following requirements:

(a) Licensed by the Minister of Finance to carry on banking business, insurance business or investment banking business; or

(b) Approved by BNM for the operation the following businesses: operation of a payment system that enables transfer of funds between banking accounts or provides payment instrument network operation, issuance of a designated payment instrument, insurance broking business, money-broking business or financial advisory business.

Pursuant to section 76 of the CMSA and as stated in the Licensing Handbook, BNM is responsible for supervising financial institutions that fall under the category of “registered persons” (see Part I of Schedule 4 of the CMSA). BNM’s responsibility with regard to these registered persons is the supervision of the registered persons in terms of ensuring that they comply with the integral investor protection provisions in section 91, 92, 93 and 97 of the CMSA and any regulation or guideline made pursuant to these sections. BNM’s supervision also extends to ensuring that individuals employed by this category of registered persons (the financial institutions) are fit and proper and that the registered persons maintain a register of these individuals.

Companies Commission of Malaysia

The Companies Commission of Malaysia (CCM) is a statutory body that regulates matters relating to corporations, companies and businesses in relation to laws administrated, which includes the Companies Act 2016 (Act 777) (CA). The functions of the CCM are set out in the s.17 of the Companies Commission of Malaysia Act 2001 (Act 614) (CCMA). The functions of the CCM shall be:

(a) To ensure that the provisions of this Act and the laws specified in the First Schedule of the CCMA are administered, enforced, given effect to, carried out and complied with.

(b) To act as agent of the Government and to provide services in administering, collecting and enforcing payment of prescribed fees or any other charges under the laws specified in the First Schedule of the CCMA.

(c) To regulate matters relating to corporations, companies and businesses in relation to the laws specified in the First Schedule of the CCMA.

(d) To encourage and promote proper conduct amongst directors, secretaries, managers and other officers of a corporation, and self-regulation by corporations, companies, businesses, industry groups and professional bodies in the corporate sector in order to ensure that all corporate and business activities are conducted in accordance with established norms of good corporate governance.

(e) To enhance and promote the supply of corporate information under any laws specified in the First Schedule of the CCMA and to create and develop a facility whereby any corporate information received by, or filed or lodged with the CCM may be analysed and supplied to the public.

(f) To carry out research and commission studies on any matter relating to corporate and business activities.

(g) To advise the Minister generally on matters relating to corporations, companies and businesses in relation to the laws specified in the First Schedule of the CCMA.

(h) To carry out all such activities and do all such things as are necessary or advantageous and proper for the administration of the CCM, or for such other purpose as may be directed by the Minister.

The CCM shall have all such powers as may be necessary for or in connection with, or reasonably incidental to, the performance of its functions under the laws specified in the First :Schedule of the CCMA.

Summary