Risk management is intended to minimize financial and other potential losses associated with risks to your assets, health, or business. Part of our job as financial advisors is to protect your financial well‑being, and that may require us to help you insulate yourselves from certain risks.

Source: www.gwadvisors.net

“Risk” can be defined as a “deviation from the desirable result”. To estimate risk for a given investment properly, the experts use the risk management in wealth management. It is perceived as the process of the identification and analysis of risks connected with the capital investment. It is aimed at minimising losses which could occur in connection with using different investment products. Also another term, i.e. risk tolerance, is connected with the risk identification.

The wealth management service is connected with making investment decisions and multiplying the capital accumulated by the customer. This is why it is inseparably connected with the risk management. How to minimise the risk and thus protect the wealth deposited by investors efficiently?

Outline/Contents:

(1) Introduction

(2) Basic Concepts of Risk Management

(a) Basic risk management process

(b)Related Concepts of ‘Risk’

(c) Types of risk Management

(3) The Islamic View on Risk Management

(a) Basic Principles of Takaful

(4) Comparison between Insurance and Takaful

(b) Types of Takaful Plans

(5) Models for Takaful Operations

(a) Mudarabah Model

(b) Wakalah Model

(6) Basic Applications of Risk Management via Takaful Planning

(a) Pitfalls in purchasing Insurance/Takaful

(b) Calculating an Adequate Insurance Coverage

(c) Products of Family and General Takaful

Conclusion

Study/Learning Objectives:

Upon completion of this chapter you should have basic knowledge of:

Basic Concepts of Risk Management

Islamic View on Risk Management

Comparison between Insurance and Takāful

Models for Takāful Operations

Basic Applications of Risk Management

Protecting your wealth is an important component of your holistic financial plan. Appropriate insurance cover assists you in managing financial risks when unexpected problems occur, such as premature deaths, disabilities or employment disruption. At Blueprint Planning, we tailor insurance solutions to factor in the type and level of cover required to protect you and your family against a range of unexpected circumstances.

The various types of insurance cover we will consider for you include:

(a) Life insurance, (b) Trauma cover, (c) Total permanent disablement insurance, (d) Temporary salary continuance, and (e) Income protection

Islamic Wealth Protection

In order to protect your wealth, appropriate Takaful cover is necessary to manage financial risks when unexpected problems occur, such as premature deaths, disabilities or employment disruption. At Blueprint Planning, we also tailor Takaful solutions to factor in the type and level of cover required to protect you and your family against a range of unexpected circumstances. The various types of Takaful cover we will consider for you include: (a) Hibah Takaful or Life Takaful, (b) Critical Illness protection, (c) Total permanent disablement Takaful, and (d) Income protection

(1) INTRODUCTION

The objective of financial protection and wealth preservation is to ensure that the client and his family are not left financially disadvantaged as a result of major disasters such as death, disablement, loss of assets through fire, prolonged injury and other events that result in financial loss. Risk management through takāful is a form of cooperative insurance in which the participants share the risks. With that, the risks borne by each participant will be much less.

(2) BASIC CONCEPTS OF RISK MANAGEMENT

2.1 Basic Risk Management Process

The risk management process consists of the following:

(a) Establishing context and defining parameters.

(b) Assessing the risk – by identification, analysis and evaluation.

(c) Treating the risks – by transfering, sharing, reducing, avoiding or retention. During this step, the takāful solution becomes relevant.

(d) Monitoring and reviewing.

There is no single definition of ‘risk’. The term has a variety of meaning in business and everyday life. At its most general, ‘risk’ is used to describe any situation where there is uncertainty about the outcome. Generally, ‘risk’ is always related to unfavorable outcomes or unfortunate events. On the other hand, ‘chance’ is something which relates to favorable outcomes.

However, traditionally, ‘risk’ is defined in terms of uncertainty. It is defined as uncertainty because there is a possibility of a loss. For example:

(i). The risk of having lung cancer among smokers is high and the cost of the treatment of the disease is costly.

(ii). The risk of accident while driving a car.

Among the common definitions of ‘risk’ are:

(a) Variability in future outcomes

(b) Chance of loss

(c) Possibility of an adverse deviation from desired outcome

However, people working in the insurance industry often use the term ‘risk’ to mean the life or property being insured. Thus, we may hear statements from insurance agents, such as ‘a driver with drunken driving record is a poor risk’ or ‘that building is an unacceptable risk because it has poor wiring’.

2.2 Related Concepts of ‘Risk’

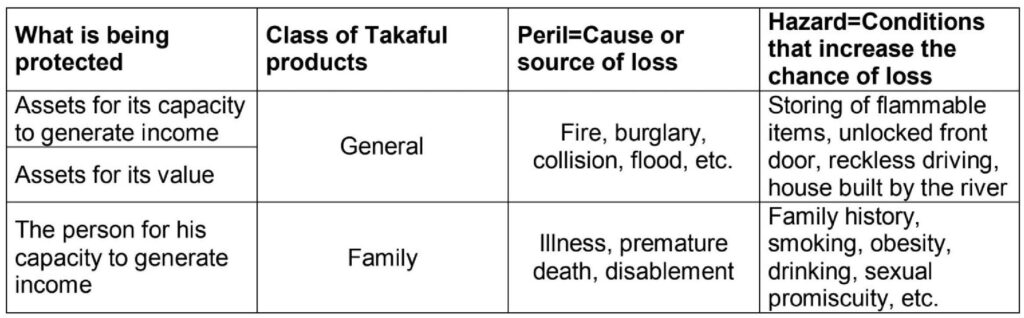

Concepts other than ‘risk’ that relate to risk management are ‘peril’ and ‘hazard’.

1. Peril

‘Peril’ refers to a cause of loss. Common perils include fire, flood, collision, earthquakes, sickness and premature death. When a peril occurs, property may be destroyed or lost and persons could be injured or killed. Any loss of property or lives will invariably lead to financial losses. Examples of ‘peril’: a. If your car is damaged in an accident, the accident is the peril or the cause of loss. b. If a restaurant is destroyed in a fire, the fire is the peril.

2. Hazard

‘Hazard’ refers to the condition that increases the chance of loss. There are four (4) types of hazards: (a) Physical Hazard It refers to physical conditions that increase the chances of loss, i.e. defective wiring in a building that increases the chance of fire.

(b) Moral Hazard It refers to the character defect (dishonesty) in an individual that increases the chance of loss. Moral hazard is present in all forms of insurance and it is difficult to control, i.e. intentionally burning unsold merchandise that is insured to collect from an insurer.

(c) Morale Hazard It refers to carelessness or indifference to a loss because of the existence of insurance. Careless acts will likely increase the chance of loss, i.e. leaving a door unlocked, hence, allowing a burglar to enter the house because all the major household items are well- covered by insurance.

(d) Legal Hazard It refers to the characteristics of the legal system or regulatory environment that increases the frequency or severity of losses, i.e. large damage awards in liability lawsuits.

2.3 Types of Risk Management

(i) Risk avoidance

One of the methods in managing risks is to avoid performing any activity that could carry risks. The risk of getting lung cancer can be avoided by not smoking. One can also avoid car accidents by not using a car. Similarly, those who are afraid of being in a plane crash could avoid it by using land transportation. However, this is not the answer to managing all risks. An extreme example of managing risks by avoidance is that of a wealthy American in the 1970s who was so afraid of death that he avoided everything he could that presented a risk to his life. To remain ‘safe’, he kept himself in a sealed room. In the end, death still took him in that sealed room.

Avoidance may seem the answer to managing risks, but avoiding risks also means losing out on the potential gain that accepting (retaining) the risks may have allowed. Not entering a business to avoid the risk of loss also avoids the possibility of earning profits.

(ii) Loss control: Loss Prevention & Minimization

Loss control is to reduce the likelihood of financial loss occurring or lightening the severity of the occurrence of financial loss. For example, to reduce the risk of meeting with an accident, one has to wear a helmet when riding a motorcycle or fasten the seat belt when driving a car. One can also drive a car within the specified speed limit to lessen the chance of being involved in a car accident. The concept of loss prevention and minimization is essential to minimization of financial loss. This concept is adopted in takāful and insurance by way of introducing access fee for the participants who do not observe the loss prevention measures. For examples, parking cars in the driveway where it may be exposed to greater danger as compared to if it is parked in the garage.

(iii) Risk retention Risk retention is accepting loss when it occurs. This method may be an effective way of handling risk when the potential of loss is very minimal. For example, one can accept the risk of losing a pair of shoes which cost him only RM50 rather than try to manage the risk with takāful products or insurance. Risk Sharing In takāful, the risk is shared among all the takāful participants. Instead of risk transfer, you share the risk with other participants.

(3) THE ISLAMIC VIEW ON RISK MANAGEMENT

In Islam, risk has to be managed for a better future of the family during bad times and death of the breadwinner. Risk management in Islam is guided by the Qur’ān: “Would any of you wish to have a garden with date palms and vines, with rivers flowing underneath, and all kinds of fruits for him therein, while he is striken with old age, and his children are weak (not able to look after themselves), then it is struck with a fiery whirlwind, so that it is burnt. Thus does Allah make clear His Ayat to you that you may give thought” (al-Baqarah (2): 26).

This Qur’ānic revelation speaks on the need of a breadwinner to take precautions regarding the wealth that will provide a living for his family when he is stricken by the old age and if his children are young and incapable of providing for themselves. In this case, risk management of the assets as well as income-generation by the breadwinner is necessary.

In managing their daily life, Muslims are also encouraged to do their utmost to be prepared and seek protection for their activities as stated in the ḥadīth: “The Prophet (s.a.w.) told a Bedouine Arab who left his camel untied to the will of Allah: Tie the camel and then leave it to the will of Allah” (as reported by al-Tirmidhī and Ibn Mājah).

According to the ḥadīth, the Prophet (s.a.w.) urged Muslims to work hard to achieve their desired goals and blessings with the will of Allah. By managing risks, the breadwinner will provide financial protection to his beneficiary if an unexpected tragedy occurs. Another ḥadīth that reiterates this practice is that narrated by Amir ibn Saʿad ibn Abī Waqqāṣ. The Prophet (s.a.w.) said: “Verily it is better for you to leave your offspring wealthy than to leave them poor asking others for help.”

The Prophet (s.a.w.) advises Muslims to safeguard the future welfare of family members. As death for example, is certain to everyone, the loss of income suffered by the beneficiary of the deceased can be reduced through the compensation awarded to them.

The concept of aqilah practiced by ancient Arab tribes before Islam resembles that of insurance. Aqilah is a custom among Arab society whereby whenever one family member of a tribe kills a person from another tribe, the killer’s family, particularly a male, will donate money to the deceased’s family. It is a duty, especially of the paternal family of the accused or aqila, to help him accumulate funds to be paid to the deceased’s relatives. The money paid to the deceased’s beneficiary is known as ‘blood money’. This practice shows the responsibility and willingness of family members in helping a fellow member in his time of need. Furthermore, the spirit of brotherhood, solidarity and mutuality will flourish among the community.

The Prophet permitted this practice as shown in the following ḥadīth narrated by Abū Hurayrah: “Once, two women from the tribe of Huzail clashed and one of them hit the other with a stone, which killed her and also the foetus in the victim’s womb. The heirs of the victim brought an action to the court of the Holy Prophet (s.a.w.), who gave a verdict that the compensation for the infanticide is freeing of a male or female slave while the compensation for the killing of a woman is the blood money (diyah), to be paid by the aqilah (the paternal relatives) of the accused.”

While the aqilah concept is not practiced at present, the spirit of brotherhood, mutuality and solidarity can be extended through takāful practice. Every policyholder in a takāful scheme has agreed to pay a specified amount to a special fund known as tabarruʿ. In the event of an accident to any policyholder, the compensation will be taken from this fund to ease the financial burden that might be experienced by the beneficiary of the deceased in the case of family takāful; as well as provide financial protection against damages and destruction to the properties in general takāful.

3.1 Basic Principles of Takāful

The prevalent use of gharar, gambling and ribā has rendered the activity of conventional insurance impermissible according to the Shariah. These three elements exist in the contract and investment activities of the insurance companies as explained below:

(a). Gharar

In conventional insurance, contract of buying and selling between the policyholder and insurance operator contains gharar or uncertainty and ambiguity regarding the subject matter of the contract. While the policyholder act as a buyer by paying premium and the insurance company operates as a seller by promising to pay compensation, both parties do not know when the subject matter of the contract, which is the insurance coverage, will occur and how much money will be involved in the compensation. Thus, gharar in conventional insurance pertains to three issues, namely; the unknown outcome of the exchange, the unknown rate of exchange and the unknown time of exchange. In conventional insurance, these three issues are unknown thus introducing gharar to the contract, which renders the contract invalid.

(b). Gambling

The SAC of SC in its 5th meeting on 23 August 1995 resolved that securities with gharar features are not ḥalāl. Company activities categorized as gharar include conventional insurance activities. Excessive uncertainty on the compensation to be paid to the policyholder leads to gambling.

(c). Ribā

Insurance companies will invest the pool of funds accumulated from the premium paid by the policyholders to get a good return. Most of the financial instruments offered in the primary and secondary markets such as bonds, money market instruments and derivatives are based on interest rate which is prohibited in Islam. Because of this reason, conventional insurance is considered ḥarām by the jurists and takāful serves as the alternative.

Since conventional insurance practices contain the prohibitive elements of gharar, gambling and ribā, Islamic insurance has introduced the concepts of tabarruʿ and muḍārabah in the contract and investment activities, to eliminate these elements.

A tabarruʿ contract refers to an agreement to contribute a certain amount for donation or charity. The policyholders in takāful schemes have agreed to channel a portion of premium paid to a special fund known as tabarruʿ fund. If catastrophe or untoward incidents occur to any of the policyholders during the period covered, the compensation will be taken out from this account. The sense of brotherhood and solidarity among the policyholders will flourish because they are contributing towards helping unfortunate fellow members through payments to the tabarruʿ fund. In addition, muḍārabah and wakalah contracts are also incorporated between the participants and takāful operators as commerce and investment activities are involved.

The investment ventures undertaken by takāful operators must also be free from the element of ribā as it is ḥarām in Islam. Takāful companies, thus, must place their funds only in Shariah compliant instruments such as SUKUK and EQUITIES. To make sure the investment activities of takāful operators are fully compliant with the teachings of Islam, in Malaysia, it is mandatory for the companies to have Shariah Advisory Boards (SAB) to monitor and advise them in matters relating to Shariah. Besides its main role in supervising takāful operators in Shariah issues, SABs also play an important role in maintaining the confidence of Muslims in their participation in takāful plans.

(4) COMPARISON BETWEEN INSURANCE AND TAKĀFUL

The word ‘takāful’ originated from the Arabic word “kafālah” which means “guaranteeing each other” or joint guarantee. The Takāful Act (1984) defines ‘takāful’ as “a scheme based on mutual assistance, which provides for mutual financial aid and assistance to the participants in case of need whereby the participants mutually agree to contribute for the purpose”.

In takāful, participants contribute a sum of money to a common takāful fund in the form of participative contribution which is called tabarruʿ. Those who participate agree to become one of the participants by agreeing to mutually help each other, should any of the participants suffer a defined loss. Some part of the contribution goes to participants’ accounts for savings or investment.

4.1 Types of Takāful Plans

(a) Term The term plan provides protection for a specific period of time. The beneficiaries can only utilize the benefits when the participants pass away or suffer from total or permanent disability during the policy’s term. Despite the low amount of contribution, this plan offers the highest coverage compared to other takāful plans. However, it does not offer savings and investment elements. On top of that, the returns in the tabarruʿ accounts are very minimum as the main purpose of this plan is for protection.

(b) Whole life

This is a lifetime protection with a fixed death benefit. The contribution is fixed and paid throughout the participant’s life. This plan combines both protection and savings. The investment portion will accumulate savings (cash value) where the participants can withdraw for his personal use. Comparatively, this plan is more expensive as it has both protection and savings.

(c ) Endowment This plan combines the need for protection and also savings. The main advantage of this plan is it provides a stream of income at the end of a specific period. If the participants die, then the money will be paid to the beneficiaries. Just as the whole life plan, an endowment plan is costly, too.

(d) Investment-linked

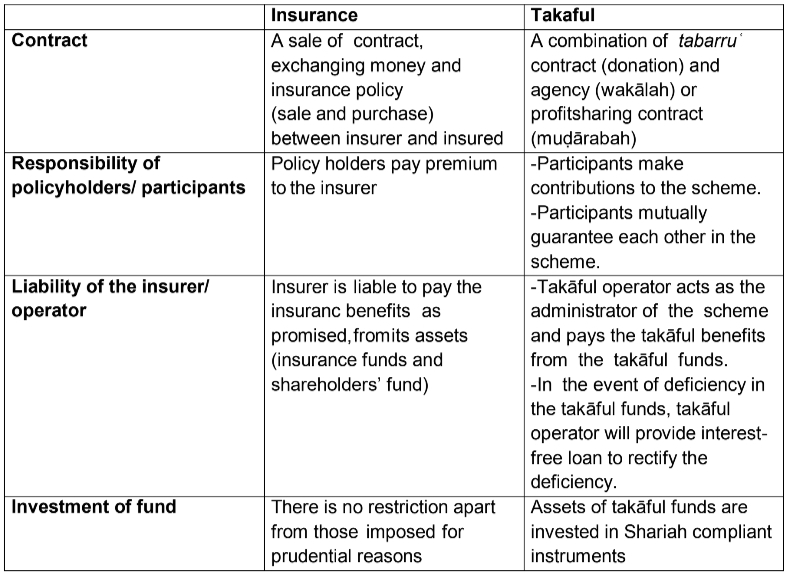

In an investment-linked takāful plan, part of the contribution will be invested in a variety of Shariah approved investment funds and the other part is used to provide the participants coverage against death and permanent disability. Participants have the right to decide on the allocation of the contribution between investment and protection, and also, in terms of the funds they prefer. The following table illustrates the differences between insurance and Takāful:

Table 1(a): Differences between insurance and Takāful

The definition of insurance is given as: “A promise of compensation for specific potential future losses in exchange for a periodic payment. Insurance is designed to protect the financial wellbeing of an individual, company or other entity in the case of unexpected loss. Some forms

of insurance are required by law, while others are optional. Agreeing to the terms of an insurance policy creates a contract between the insured and the insurer. In exchange for payments from the insured (called premiums), the insurer agrees to pay the policyholder a sum of money upon the occurrence of a specific event. In most cases, the policyholder pays part of the loss (called the deductible) and the insurer pays the rest”.

As for takāful, it is an Islamic alternative to traditional insurance, providing similar protection without violating the principles of Shariah. A group of participants mutually agree to pool donations in a fund that is used to indemnify each of the participants against certain losses.

(5) MODELS FOR TAKĀFUL OPERATIONS

The following is an explanation on general takāful to illustrate the models for takāful operations.

General takāful schemes are contracts of risk sharing, on a shortterm basis (normally one year), between a group of participants to provide mutual compensation in the event of a defined loss. The schemes are designed to meet the needs for protection of individuals and corporate bodies in relation to material loss or damage resulting from a catastrophe or disaster inflicted upon properties, assets or belongings of the participants.

In the event of a catastrophe or disaster resulting in a loss or damage to a property or bodily injuries or other physical disability to a person, the owner of the property or the person concerned may suffer substantial financial losses. For instance, if a house is destroyed or damaged by fire, the owner would certainly require a sum of money to repair the house or rebuild it. In addition, enough money is needed to replace the damaged furniture fixtures and fittings. Similarly, a person who is injured in an accident would require an adequate sum of money to pay for medical treatment. By participating n any of the various general takāful schemes offered in the market, that person will be assured of takāful benefits in case of misfortune which may result in loss or damage.

There are two types of general takāful models practiced in Malaysia, namely, muḍārabah (profit sharing basis) and wakālah (agency basis).

(a) Muḍārabah Model

In this model, the contract stipulates the right and obligations of the participants as well as the company. Participants in this type of schemes agree to pay the takāful contributions as tabarruʿ.

The company manages the general takāful business including managing the investment of the general takāful fund assets. As the muḍārib (takāful operator), the takāful company will invest the general takāful fund in line with Shariah principles and all returns on the investment will be

pooled back to the fund. The participants, having putting their money in the General Takāful Fund, are now the rabb al-māl as portions of fund will be invested by the takāful operators. At the end of the year, after considering all claims and other expenses, they are entitled to share

the profit in the endeavor to the stipulated profit sharing ratio.

In line with the virtues of cooperation, shared responsibilities and mutual help as embodied in the concepts of takāful, the participants agree that the company shall pay from the general takāful fund, compensation or indemnity to fellow participants who have suffered a defined loss upon the occurrence of a catastrophe or disaster.

The fund shall also pay for other operational costs of general takāful business, such as, for the re-takāful arrangements and the setting up of technical reserves.

This contract specifies how the profit from the operations of takāful is managed by muḍārib to be shared, in line with the principle of muḍārabah, between the participants as the providers of capital and the Muḍārib as the entrepreneur. The sharing of such profit may be in a ratio 60:40,

70:30, etc. as mutually agreed between the contracting parties.

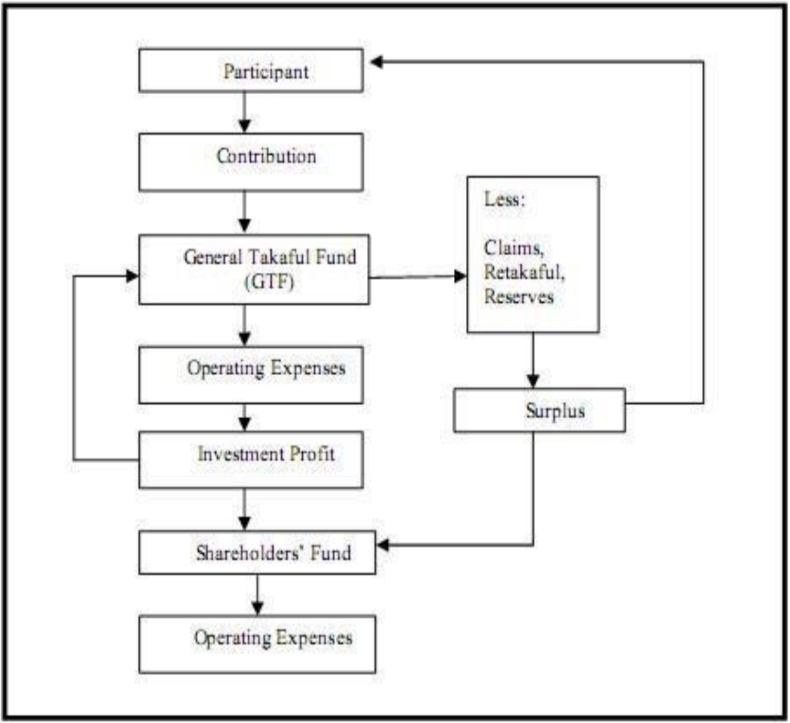

Figure 1(b) below shows the process flow of the muḍārabah model for general takāful. It shows how participants in any general takāful protection scheme, such as motor protection and fire protection, pay contribution as a donation (tabarruʿ) to help each other, to the takāful operator. The funds will be put into a General Takāful Fund (GTF) which will be channeled by the takāful operator into Shariah compliant investment activities. All profits that come from the investment

will be put back into the General Takāful Fund (GTF). Surplus, at the end of the year after deducting claims, re-takāful and reserves, will be distributed to the takāful operator and participants based on the pre-agreed ratio as stipulated in the contract.

Figure 1(b): Muḍārabah model for general takāful

Source: Source: Bank Negara Malaysia, Annual Report-2005

(b) Wakalah Model

The concept of wakālah refers to an agent-principal relationship, where the takāful operator acts as an agent on behalf of the participants and earns a fee (wakālah fee) for services rendered. The fee can be a fixed amount or based on an agreed ratio of investment profit or surplus of the takāful funds.

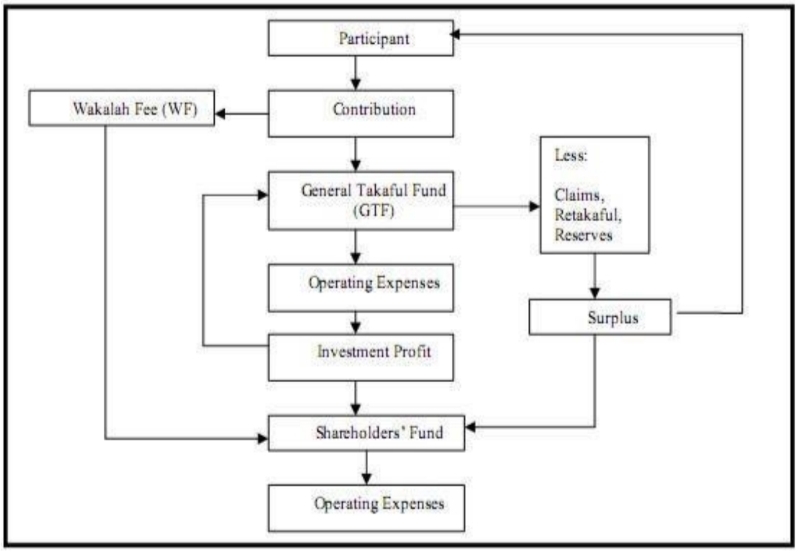

Figure 1(b): Wakalah model for general takaful

Source: Bank Negara Malaysia, Annual Report-2005

Figure 1(c) shows the wakālah contract process flow for general takāful. It should be noted that in a pure wakālah model, surpluses is not shared. In this contract, participants will pay contribution as a donation (tabarruʿ) to help each other and the contribution will be divided into two types of accounts namely, Wakālah Fee (WF) and General Takāful Fund (GTF).

The allocation between Wakālah Fee and General Takāful Fund is based on the pre-agreed ratio between participant and the takāful operator as specified in the contract. Participants’ contribution to the General Takāful Fund will be invested by the takāful operators, resulting to

investment profit, which in turn to be deposited into the GTF. The surplus from GTF after deducting claims, retakāful and reserves will be distributed to the participants. The Wakālah Fee consists of commission and management expenses which will be paid to shareholders’ fund.

(6) BASIC APPLICATIONS OF RISK MANAGEMENT

The main reason for participating in a takāful plan is protection.

The plan replaces income loss to a family upon death, temporary isability and permanent disability of the takāful participant. When these untoward circumstances happen, the funds from takāful can be used to pay for medical bills, pay off outstanding loans, provide for the children’s

education, etc. For example, participating in a takāful mortgage plan ensures that the house remain with one’s family if one dies.

Besides giving protection, a takāful plan also provides savings and as an investment plan. One can kill two birds with one stone: purchasing an appropriate takāful plan will ensure not only protection but also savings and investment which still provides returns on one’s contribution after

the takāful plan expires Tax shelter is also given to those who own takāful plans. For a family takāful plan, the maximum amount of tax relief is RM5,000 per year while for medical or education plans the relief is

RM3,000 per year.

6.1 Pitfalls in Takāful Participation

(a) Purchasing too little (Little coverage)

The most common mistake that people make is having too little coverage. They go for the cheapest contribution or premium without considering the goals of buying the plan and underestimate the amount that is adequate for their family. This mistake is only realized when claims are made.

(b) Purchasing too much (Too much coverage)

Another mistake that people tend to make is to be so obsessed with takāful plans that they buy whatever plans that are promoted to them. Takāful is not the only source of fund that one needs to have for protection. There are many other financial resources one can use to supplement

temporary cut of income or for protection. Among them are EPF contributions, SOCSO, investments and savings. Buying too much insurance can be very expensive. Some plans only permit one to claim once. For example, one is not allowed to claim from more than one insurance company for the same accident. In this case, it is useless to have the same plan from different takāful providers.

(c). Absence of “essential” covers (Not enough coverage: riders)

Having insufficient coverage is very detrimental to one’s financial planning. Many takāful providers offer a variety of riders for takāful participants to choose from. For example, you may need coverage for personal accident, critical illness, temporary disability etc. One must evaluate thoroughly the family’s needs and whether the riders offered are worth taking up for the additional small amounts of contribution.

(d) Purchasing an inappropriate takāful plan (Plan does not match needs)

Since there are many takāful plans in the market, one needs to choose one which is most appropriate to suit one’s family needs. For example, a children’s education plan may not be appropriate for single takāful participants. Furthermore, one who cannot afford to pay higher

contributions, but needs a high level of protection should not participate in a whole life plan but should, instead, go for a term plan.

(e) Too late to participate in takāful plan

Procrastination is the main enemy of human beings. Delaying in purchasing a takāful plan might result in higher amounts of contribution. In general, the older the person the higher would be the contribution for the same amount of coverage. This is so because of the concept of time value of

money. The worst case scenario is procrastinating only to find that it is too late for one to

purchase a takāful plan as one has been diagnosed with a critical illness.

Calculating an Adequate Insurance Coverage

The Need Analysis Method

(i) Determine the Objective of Having a Takāful Plan

One can only know how much protection is required after one decides the purpose of purchasing the takāful plan. Some people may buy takāful plans because they want to prepare themselves in case they die before they can settle their housing loans. Takāful may be needed to provide for one’s children’s education in case one (the breadwinner) is no longer able to work due to permanent disability. In summary, some of the reasons people opt for takāful plans are:

(a) To provide for children’s education.

(b) To pay any outstanding debts, e.g., housing loans, car loans etc.

(c) To provide a stream of income flow in case of permanent disability.

(d) To supplement family income in case of any misfortune.

(e) To provide retirement planning.

If one knows the reasons behind purchasing a takāful plan clearly, then one can decide how much coverage is enough for one’s family. For example, one may need to purchase a takāful plan with coverage of RM 500,000 if one expects that one’s children need this approximate amount for their future education. If one has other objectives, such as to pay for outstanding

debts, one may have to buy another takāful plan which is designed to provide funds to settle outstanding loans in case of death or permanent disability. Today, takāful providers have diversified their products by designing specific plans for specific purposes or objectives;

therefore, it is possible to identify the correct takāful plan to suit one’s needs.

(ii) Estimate Amount of Funds Needed

The next step is for one to decide how much the funds should cover. One has the option for the funds to cover all (100 percent) of one’s needs or partially. For those who can’t afford total cover, partial coverage will at least help to lighten the burden of having to deplete all sources of

funds or savings when the time comes.

(iii) Compute Amount of Financial Resources Available

Besides takāful plans, there are other financial resources that one can fall back on should the breadwinner dies. Examples of these resources are EPF, pension, insurance or takāful provided by employers, savings, properties, unit trust funds and other types of investment funds. One

needs to consider these resources to avoid participating in too many plans that one does not really need.

(iv) Estimate Amount of Takāful Cover Needed

After considering all of the above only the client can decide how much coverage is adequate for is family. However, this is not a one-off planning. One needs to review one’s family needs every three to five years as these needs may change. One may have additional family members

or new obligations or commitments.

(v)) Design the Takāful Plans

There are options for one to add to one’s takāful plan. This is called riders. There are many types of riders such as those for temporary disability, etc.

(vi) The Human Life Value Method/Multiple Earnings Method

This is the simplest method. Using this method one only needs to multiply an arbitrary number to the annual income. In general, 3-10 times of the annual income is used to estimate the amount needed in the future (after retirement).

6.3 Products of Family and General Takāful

The products under family takāful are:

(a) family takāful

(b) investment-linked takāful

(c) hild education takāful

(d) medical and health takāful

In general, takāful products under general takāful consist of home takāful, motor takāful and personal accident takāful. The table below illustrates further the coverage available under general and family takāful.

The coverage available under general and family takāful.

The following financial information is related to a couple. The analysis of takaful protection is provided in this section.

Cash Flow statement for One Year

For income protection, the amount of coverage should at least cover outstanding liabilities, such as, home mortgages, credit cards and other financing. Additional cover should depend on the client’s attitude towards the necessity of surviving spouse having to work for income,

maintenance of lifestyle, number of dependents and the stage of life. Selection of type and amount of cover should be appropriate to client’s needs to cushion a crisis.

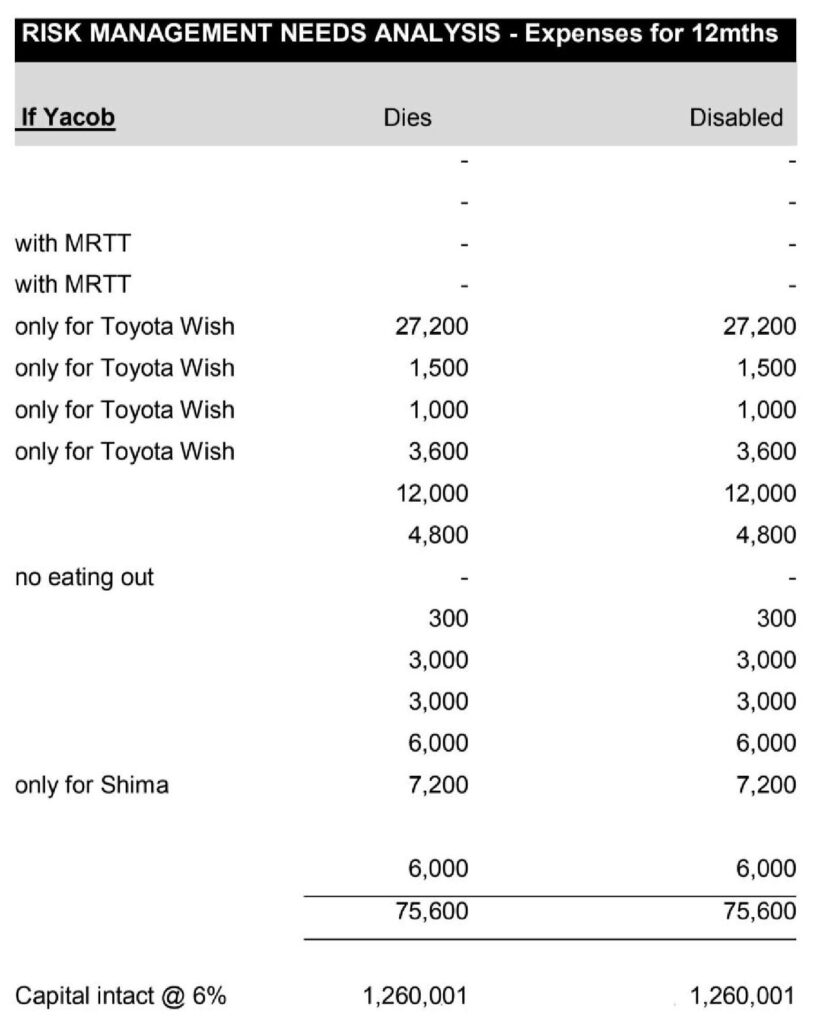

Risk Management Needs Analysis – Expenses for 12 Months

Other than that, the couple has to determine the purpose of risk management that they would like to cover, for example:

(a) For liability protection – MRTT, credit card balance coverage, motor vehicle takāful.

(b) Wealth target protection – vehicle to build assets immediately for ḥajj or education plan.

(c) Other income/disability protections – medical card for hospitalization and surgery.

Self-Assessment Test

Circle the letter of the correct choice for each of the following.

1. In Islamic insurance, financial losses are associated with

A. Risk sharing

B. Depreciation

C. Loss sharing

D. Profit sharing

2. The following are the pitfalls of participating in takaful schemes EXCEPT:

A. Not having enough cover.

B. Too much cover.

C. Participating too early.

D. Not having enough riders.

3. Which of the following is a peril?

A. Defective wiring in a building.

B. Damage awards in liability lawsuits.

C. Burning unsold stocks intentionally.

D. An accident causes damage to a car.

4. Which of the following statements about Aqilah is NOT TRUE?

A. A concept of risk management practiced by ancient Arab tribes before Islam.

B. A situation where whenever one family member of the tribe kills a person from another

tribe, the killer’s family donates money to pay to the deceased’s family.

C. This practice is not allowed in Islam.

D. Money paid in an aqilah situation is called blood money.

5. “This plan combines the need for protection and also savings that provides a stream of income at the end of a specific period.” This statement is true about which type of Takaful?

A. Term

B. Whole life

C. Investment-linked

D. Endowment

6. GHARAR, in conventional insurance contract, exists in the following conditions, EXCEPT:

A. The outcome of the exchange

B. Unknown rate of return to the investment portion

C. The time of exchange

D. The rate of exchange

7. Which of the following is not a factor to consider when a person would like to participate in the ‘income-protection’ takaful scheme?

A. Amount of liabilities held

B. Necessity of surviving spouse having to work for income

C. Number of dependents

D. The amount of cover for car owned

8. From which account would compensation to a takaful participant be taken out from?

A. General Fund

B. General Takaful Fund

C. Special Fund

D. Special Investment Fund

9. All of the following are perils in family takaful EXCEPT?

A. Illness of the takaful participant

B. Liability lawsuits against the takaful participant

C. Disablement of the takaful participant

D. Premature death of the takaful participant

10. The following are products under family takaful, EXCEPT:

A. Investment-linked takaful

B. Damage to the shelter of the family

C. Medical and health takaful

D. All the above

Answer: 1-a, 2-c, 3-d, 4-c, 5-d, 6-b, 7-d, 8-b, 9-b,10-b.

Useful links

Risk management in wealth management

What Is Risk Management in Finance, and Why Is It Important?

Protect Your Wealth With Smart Risk Management Strategies

Risk Management: The Importance Of Protecting Your Wealth