How important is international trade?

Take a look at the labels on some of your clothing. You are likely to find that the clothes in your closet came from all over the globe. Look around any parking lot. You may find cars from Japan, Korea, Sweden, Britain, Germany, France, and Italy—and even the United States! Do you use a computer? Even if it is an American computer, its components are likely to have been assembled in Indonesia or in some other country. Visit the grocery store. Much of the produce may come from Latin America and Asia.

The international market is important not just in terms of the goods and services it provides to a country, but as a market for that country’s goods and services. Because foreign demand for U.S. exports is almost as large as investment and government purchases as a component of aggregate demand, it can be very important in terms of growth. The increase in exports from 2000 to 2007, for example, accounted for almost 20% of the gain in U.S. real GDP during that period. For the period 2004 to 2007, the increase in exports accounted for about 30% of the gain…Read more

The International Sector

Overview

The Malaysian economy is a small but open economy. It is expected to grow between 4 and 5 percent next year, 2024 to RM1.64 trillion after reading an estimated RM1.57 trillion in 2023. Growth will be broad-based, led by sustained domestic consumption and driven by sustained domestic consumption and improved export activities. Malaysia spending bill in 2024 will be whopping RM393.8 billion, 77%t of which will go to paying for emoluments and subsidies among others, under opening expenditure. The subsidy bill is expected to hit RM52.77 billion, despite a planned move towards targeted subsidies.

Understanding the country’s balance of payments is crucial to understanding growth, monetary policy, exchange rates and globalisation.

This topic introduces basic aspects of the balance payments and the exchange rates and how they affect the economy.

Objectives

– Examine the concepts, structure of and issues in the balance of payments.

– Discuss the concept of exchange rates, and

– Study Malaysia’s exchange rate experience

Balance of payments and its relevance

Concept of balance of payments (ROP)

Definition

The balance of payment is a summary statement of all the economic transactions of the residents of a nation with the rest of the world during a particular period, usually a year.

Three principles of the BOP compilation.

– Only economic transaction between residents and non-residents are entered in the BOP.

– A distinction is made between debit and credit, and

– The recording system of BOP is based on double-entry bookkeeping system.

Concept of residence

Residence should not be confused with the legal notion of citizenship or nationality.

– Individuals are considered as residents of a country in which they have a permanent residence or in which they find their “centre of invest”. In the event of a conflict the permanent residence over the “centre of interest”.

– Individuals who represent their government in foreign countries are considered as residents of their own countries, e.g. diplomat, military personnel.

– A corporation is a resident of the country in which it is incorporated, but its foreign branches or subsidiaries are viewed as non-residents or residents of foreign countries, and

– All government agencies are residents of their own country regardless of location.

Types of international transactions

With the exception of unilateral or unrequited transfers such as gifts and aids, all international transactions represent a two-way exchange between residents and ono-residents. International transactions can be classified as real or financial transactions.

– Exchange of good and services for other goods and services, barter or counter trade. Bothe sides of the transaction are real transactions.

– Exchange of good and services for money or other financial claims. One side of the transaction is real and the other is financial.

– Exchange of financial claims such as bonds or bonds or stocks for other financial claims, such as money. Both sides of the transaction are financial.

– Transfer of goods and services such as gifts, aids in kind or aids in the form of technical assistance without a corresponding supply of goods and services (quid pro quo); and

– Transfer of financial items such as gifts of money without a quid pro quo.

Structure of the balance of payments

Current account

All international transfer of goods and services are recorded in the current account;

Goods are physical products commonly referred to as merchandise.

Services are intangible products such as transportation, travel, capital services (interest and dividends), construction, technical assistance, industrial property, rights (income from patents, trademarks and copyrights), education, and business services; and

The unilateral transfers account records the offsetting entries for real or financial unilateral transfers that appear elsewhere in the BOP.

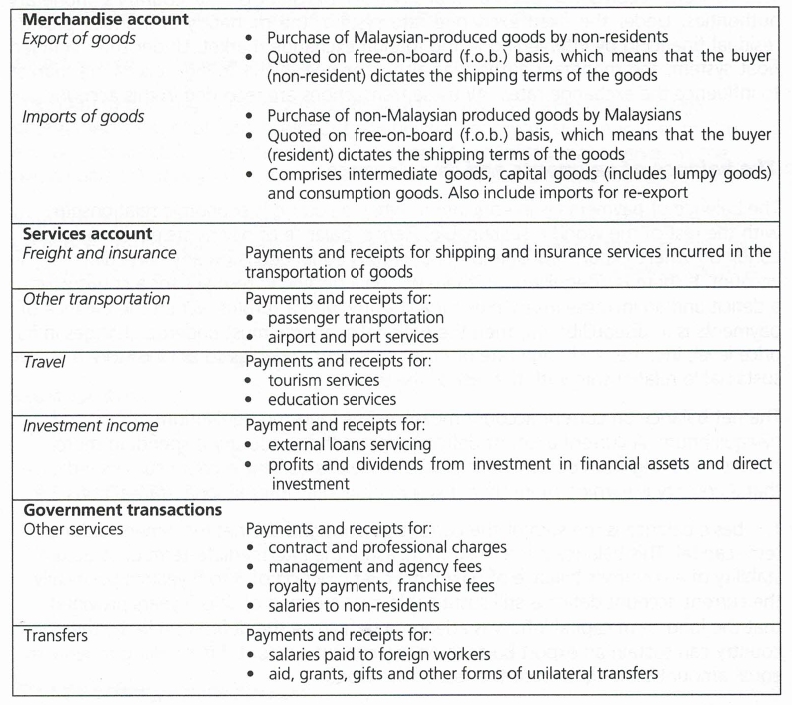

Table 3: Component of the Current Account

Capital account

The capital account includes all financial claims liabilities between residents and non-residents except for official reserve transfers.

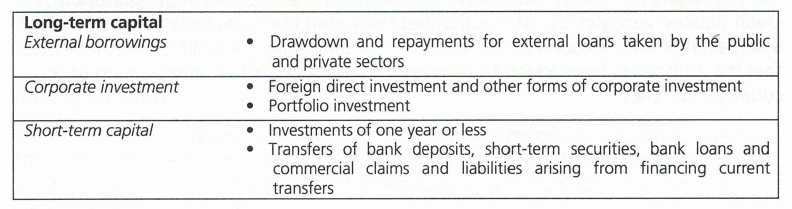

Table 4: Component of the Capital Account

Official reserve account

This account records the international financial transfers of the country’s monetary authorities. Under the fixed exchange rate system, the monetary authorities provide residual financing by intervening in the foreign exchange market. Under the managed float system, the monetary authorities also intervene in the foreign exchange market to influence the exchange rates. All these transactions are recorded in the account.

The balance of payments and its relevance

The balance of payments is in equilibrium when a country’s economic relationship with the rest of the world is sustainable. Hence, balance of payments equilibrium is a condition where exports equal imports or credits equal debits on any particular account. If there is disequilibrium, there will be a decline in reserve for a country with a deficit and an increase in reserves for a country with a surplus. When the balance of payments is in equilibrium, then the national economy must undergo changes in its price level, income, exchange rate or other economic variables so as restore a sustainable relationship with the rest of the world.

The net balance on current account measures the long-run equilibrium or disequilibrium. A current deficit indicates that a country is spending more than it is earning from other countries. Conversely, a current surplus indicates that a country is earning more than it is spending in its international transactions.

The basic balance is the sun of the current account and the net movement of long-term capital. The balance is intended to measure the intermediate-term or structural stability of a country’s balance of payments over a period of 3 to 5 years. Specifically, the current account deficit is still sustainable over a period of 3 to 5 years provided that the long-term capital inflow is adequate to finance the deficit. Similarly, the country can sustain an export balance on the current account if it is willing to lend an equal amount on long term to the rest of the world.

A basic balance deficit implies that the current account deficit is not sustainable because of inadequate long-term capital inflow to finance the deficit. A basic balance surplus indicates that long-term capital outflow is inadequate to sustain a long-term relationship with the rest of the world. The basic balance is assumed to be insensitive to short run changes in exchange rates and interest rates and respond only to long run changes in factors of production, productivity, technology, consumer preferences, competition and other real economic variables.

The net balance on the official reserve account measures the short-run equilibrium. A credit balance indicates that the authorities have used their reserve to prevent or limit a depreciation of the country’s currency. On the other hand, a debt balance indicates that the authorities have added to reserves to prevent or limit an appreciation of the country’s currency.

The exchange rate

The theoretical framework of the exchange rate system

Floating exchange rate system

The floating exchange rate system is one in which the exchange rate is always determined by market forces, without any government intervention in the foreign exchange market. Theoretically, there is no need for international reserves as the overall balance of payments will be in equilibrium, adjusted by the exchange rate.

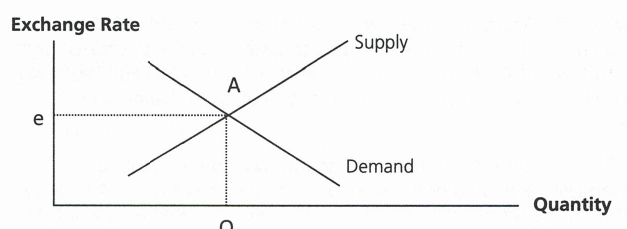

Based on the system, the supply and demand curve for currencies will determine the exchange rate for that currencies as demonstrated below. Based on the graph in Figure 7, equilibrium between the supply and demand for a currency is achieved at point A and the exchange rate would be ate.

Based on the system, the supply and demand curve for currencies will determine the exchange rate for that currency as demonstrated below. Based on the graph in Figure 7, equilibrium between the supply and demand for a currency is achieved at point A and the exchange rate would be ate.

Figure 7: Floating Exchange Rate System

Fixed exchange rate system

Under the system, the exchange rate is pegged to another currency. Usually, the exchange rate is allowed to fluctuate within a narrow range predetermined by the monetary authorities. The market plays little role and the monetary authorities through market intervention will ensure the stability of the exchange rate. The monetary authorities will provide any of shortfall and also absorb any surplus in foreign exchange. In the face of persistent balance of payments deficits, the country, which adopts a pegging system, may resort to devaluation. On the other hand, if the country encounters payments surplus for a significant period od time, the country may re-evaluate its currency. Such a system is known as the adjustable peg system.

Managed float

Under the managed floating exchange rate system, the monetary authorities are entrusted with the responsibility to intervene in foreign exchange markets to smooth out any short-run fluctuations without attempting to affect the long-run trend in exchange rates.

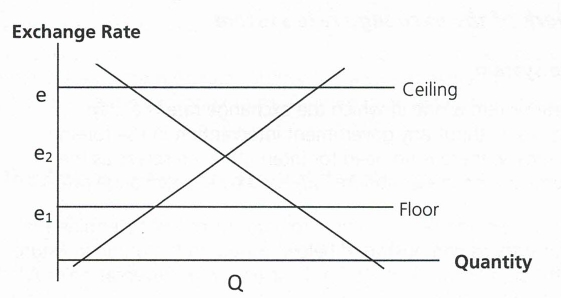

The monetary authorities manage the exchange rate between the floor and the ceiling by selling when the exchange rate hits ceiling at ‘e’ (i.e. excess supply will bring the exchange rate down) and buying when rate hits the floor at ‘e1’ (excess demand will result in an increase in rates). This is illustrated in the graph below.

Figure 8: Managed Float Exchange Rate System

Current exchange rate arrangements recognised by the IMF

Since the breakdown of the Bretton Woods par value system in the early 1970s, countries have adopted a wide variety of exchange rate systems. In 1978, the Second Amendment to the Articles of Agreement of the International Monetary Fund formally recognised each member’s sovereignty as far as the choice of an exchange rate system is concerned.

The most basic decision on adoption of the exchange rate system is wether a currency should essentially be floated or pegged to some external value. A country opting for the floating rate system has to make a further decision whether it wants to let its currency float independently, in a group float, such as the European Monetary System (EMS) or to let it ‘crawl’ according to some set of indicators. The external value of a crawling currency is typically linked to one or more domestic indicators, such as the inflation rate and the balance of payments position. A country opting for a pegged currency has to choose between a single foreign currency and a composite or ‘basket’ of foreign currencies. If the decision made is in favour of a single currency peg, then a determination has to be made as to the most desirable currency, e.g., the U.S. dollar, the French franc, or some other currencies. A country opting for a basket peg, can choose between available baskets, such as the Special Drawing Rights (SDR) and other currency baskets which are often based on the country’s most important trading partners.

The above describes the spectrum of exchange rate practices between the extremes of a right peg and a free float. Sometimes there may be some ambiguity in identifying whether a currency is floating or pegged. Some countries that are officially pegged avail themselves to relatively wide margins around the peg or adjust the peg frequently so that they resemble floaters, while some formally floating currencies are managed to a degree which makes them little different from strict peggers.

For example, the EMS currencies resembles both peggers and floaters in that they maintain ‘narrow exchange rate margins’ (i.e. they peg their currencies) with respect to the members in the group, but they float as a group against all other currencies. Similarly, the crawlers, whose currency values are adjusted frequently according to a set of indicators, resembles peggers in that their monetary authorities intervene regularly in the foreign exchange market, but are akin to floaters in that the values of their currencies change frequently. Furthermore, currencies that are pegged to other currencies that float may be considered as an amalgamation of the characteristics of both. In general, differences between alternative pegging arrangements are likely to be a matter of degree, rather than kind.

Pegging to any currency under the adjustable pegging system (Bretton Woods system) implies pegging to all currencies. However, based on the generalised floating system adopted globally since March 1973, pegging to a currency implies maintaining a floating system with all other currencies except the one that the home currency is pegged to. If a currency was to be pegged to one of the EMS currencies, the currency is automatically pegged to other currencies in the EMS.

Exchange rate are essentially determined in foreign exchange markets where, in the absence of foreign exchange controls, they play the equilibrating role of balancing foreign demand for domestically-issued financial assets and domestic demand for foreign financial assets. Many factors will influence the exchange rates in the short run, for example, market participants expectations on feature spot exchange rates, interest rate differentials, the external current account balance, the amount of central bank intervention, etc.

Exercise:

1. Malaysia is a nation which is:

A. a closed economy

B. an open economy

C. a self-sufficient economy

D. a non-trading nation

2. Which one of the following is NOT included in the current account of the balance of payments?

A. Exports of goods and services

B. Transfers

C. External debt inflow

D. interest payments

3. A deficit of a surplus in the balance of payments is measured by the balances recorded in the;

A. current account

B. basic balance and short-term capital

C. basic balance, short-term capital and errors and omissions

D. current and capital account

4. The rate of exchange between the domestic and foreign currency is defined as the:

A. foreign price of a unit of the domestic currency

B. domestic currency price of a unit of the foreign currency

C. foreign currency price of gold

D. domestic currency price of gold

5. Under the freely flexibility exchange rate system, a deficit in the balance of payments is corrected by:

A. a decline in the domestic currency price of the foreign currency

B. an appreciation of the domestic currency

C. a depreciation of the domestic currency

D. a depreciation of the foreign currency