Our Business Activities

We Provide Financial Intermediaries (Depository) Services

Bank

Credit Union

Mutual Funds

Financial Advisors

Empowering Finance Leaders of Tomorrow

Financial Intermediaries

Financial intermediaries offer the following advantages:

Spreading risk - Financial intermediaries provide a platform where individuals with surplus cash can spread their risk by lending to several people rather than to only one individual. Lending to just one person comes with a higher level of risk. Depositing surplus funds with a financial intermediary allows institutions to lend to various screened borrowers. This reduces the risk of loss through default. The same risk reduction model applies to insurance companies. They collect premiums from clients and provide policy benefits if clients are affected by unforeseeable events like accidents, death, and disease.

Economies of scale - Financial intermediaries enjoy economies of scale since they can take deposits from a large number of customers and lend money to multiple borrowers. The practice helps to reduce the overall operating costs that they incur in their normal business routines. Unlike borrowing from individuals with inadequate funds to loan the requested amount, financial institutions can often access large amounts of liquid cash that they can loan to individuals with a strong credit rating.

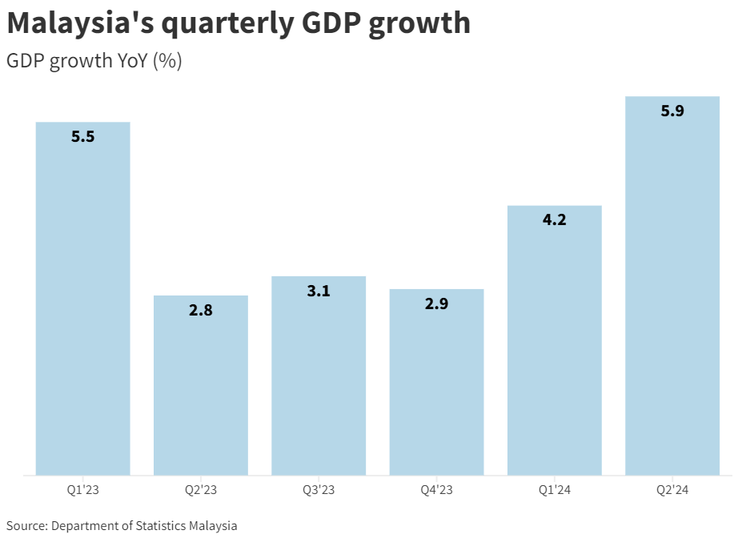

Growth on divergent paths amid elevated policy uncertainty - IMF

Capital market up 6% to RM3.8 trillion in 2023, total AUM hits new record high of RM975.5 billion

A dynamic and deep market with diverse opportunities and strong growth potential.

A vibrant economy that offers both portfolio diversification and long-term returns.

An ideal gateway to Southeast Asia’s thriving markets.

Reasons To Invest In Malaysia

business & mindset mentor