Malaysia has a well-established fund management industry that caters to institutional investors as well as qualified retail investors. According to the Securities Commission Malaysia (SC), assets under management (AUM) typically originate from unit trust funds, corporate bodies, the Employees Provident Fund (EPF) and wholesale funds.

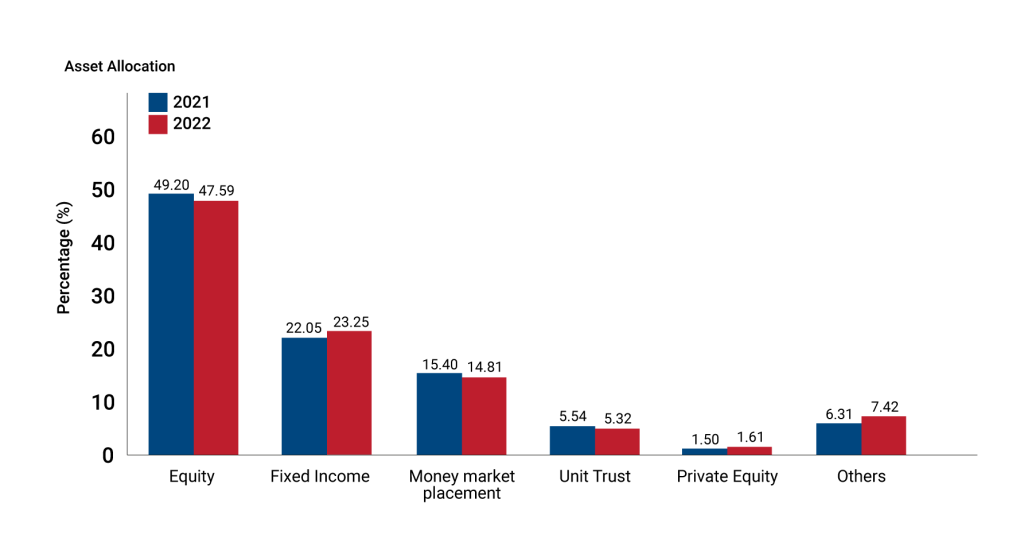

As at end-December 2022, the domestic fund management industry’s AUM stood at RM906.46 billion – somewhat lower than the RM951.05 billion of a year earlier. The bulk (47.6%) of these funds were invested in equities, followed by fixed-income securities (23.3%). At the same time, the top five fund management companies in Malaysia accounted for 55.4% of the industry’s total AUM (2021: 54.8%).

The unit trust segment remained the key contributor of the industry’s AUM as at end-December 2022, with a net asset value (or NAV) of RM487.94 billion (end-December 2021: RM526.89 billion). Of this, about 78% was attributable to conventional funds while the other 22% stemmed from their Shariah compliant counterparts.

Source: www.capitalmarketsmalaysia.com

Equity / Fixed Income / Money market placement / Unit Trust / Private Equity / Others

Eligibility requirements for fund management company

Local Company

As prescribed under Sections 288(2) and 289(1) of the Capital Markets and Services Act 2007 (CMSA), only a management company approved by the Securities Commission Malaysia (SC) can act as a fund management company. To be eligible for such a licence, a local company must comply with the following criteria:

(a) Be an entity incorporated in Malaysia

(b) Have at least 30% Bumiputera equity

(c) Not have more than 49% foreign equity

(d) Always have at least RM10 million of shareholders’ funds

Foreign Company

A foreign company, on the other hand, must adhere to the following requirements:

(a) Must have more than 50% foreign equity and be incorporated in Malaysia

(b) Must obtain a licence from the SC to undertake fund management activities

(c) Must have a paid-up capital of at least RM2 million

(d) Must conduct its operations from an office in Malaysia

(e) Must have a parent company or holding or related company with a sound track record in the international fund management industry

(e) At least 30% of its share capital must be held by locals if the foreign company intends to manage funds sourced from within Malaysia

(f) Must be 100%-owned by foreign interests if the foreign company intends to manage funds sourced from and on behalf of clients outside of Malaysia

Contents

Overview

Introduction

Objectives

What is the Fund Management Industry?

Significance of the Fund Management Industry

Providers of Fund Management Services

Banks

Investment Banks

Insurance Companies

Stockbrokers

Unit Trust Management Companies

Boutique Fund Management Companies

Foreign Fund Management Companies

Fund Structures in Malaysia

Provident and Pension Funds

Unit Trusts

Insurance Funds

Closed-End Investment Companies

Charitable Funds

Support Service Providers

Performance Measurement Services

Custodians

Investment and Asset Consultants

Why Does the Fund Management Industry Need to be Regulated?

Summary

Overview

Introduction

This topic introduces the fund management industry in Malaysia. We will examine those participants in the fund management industry who provide investment management services. We will also consider the various structures or ‘funds used in the industry to pool moneys prior to investment. This will provide us with an insight into the clients of fund management companies. We then review some of the other important participants in the industry. Finally, we introduce the rationale for regulation of the fund management industry.

Objectives

At the end of this topic you should be able to:

(a) define the fund management industry

(b) describe the significance of the fund management industry to the Malaysian economy

(c) identify the participants in the fund management industry and describe their role

(d) describe the major structures used in the industry to pool funds

(e) identify key differences between closed and open-ended funds

(f) understand the importance of performance management services

(g) explain why regulation of the fund management industry is required.

1 What is the Fund Management Industry?

Fund Management is the process in which a company that takes the financial assets of a person, company or another fund management company (generally this will be high net worth individuals) and use the funds to invest in companies that use those as an operational investment, financial investment or any other investment in order to grow the fund; post which, the returns will be returned to the actual investor and a small amount of the returns are held back as a profit for the fund.

Fund management is simply the management of a portfolio of securities or derivatives for the purpose of investment. The fund management industry therefore comprises all those involved in the process of managing investment portfolios on behalf of other persons (although those persons may be a part of the same company or group).

The most significant player in the process of managing investment portfolios is the fund management company.

A fund manager is responsible for implementing a fund’s investing strategy and managing its portfolio trading activities. The fund can be managed by one person, by two people as co-managers, or by a team of three or more people. He/She are paid a fee for their work, which is a percentage of the fund’s average assets under management (AUM). They can be found working in fund management with mutual funds, pension funds, trust funds, and hedge funds. Investors should fully review the investment style of fund managers before they consider investing in a fund.

In Malaysia, fund management companies licensed to carry on the regulated activity of fund management are holders of a Capital Markets Services Licence (CMSL).

Nevertheless, it is important to note that fund management activities can also be carried out by persons other than holders of a CMSL who carry on the business of fund management. S.58(1) of the Capital Markets and Services Act 2007(CMSA) provides that ‘no person shall whether as principal or agent, carry on a business in any regulated activity or himself out as carrying on such business unless he is the holder of a CMSL or is a registered person’. S.58(2) goes on to say that s.58(1) shall not apply to the persons or classes of persons as specified in schedule 3.

In this regard, fund management activities would thus be permitted to be carried out by the following persons without requiring a CMSL:

(a) any corporation whose carrying on of the regulated activity of fund management is solely for the benefit of its related corporation (Paragraph 7 of Schedule 3)

(b) any public statutory corporation constituted under any written law who carries on the regulated activity dealing in securities or fund management (Paragraph 14 of Schedule 3)

(c) an insurance company licensed under the Insurance Act 1996 or a takaful operator registered under the Takaful Act 1984 whose carrying on of the regulated activity of fund management is solely incidental and to the management and administration of its insurance or takaful business, as the case may be (Paragraph 21 of Schedule 3)

(d) KAF Investment Bank Berhad and Islamic banks, in acting or offering to act as portfolio managers for customers or as investment or co-investment manager of country funds, trust funds, venture capital funds, unit trust funds, or other funds, including-

(i) the provision of investment advice; and

(ii) the acquisition or disposal through a holder of a CMSL who carries on dealing in securities

In relation to such activity (Item 4, Part I of Schedule 4)

Our discussion on fund management throughout this module however would focus on the holders of a CMSL who carry on the business of fund management. Under the CMSA, a holder of a CMSL who carries on the business of fund management entails:

….”undertaking on behalf of any other person the management of-

(a) a portfolio of securities or derivatives or a combination of both, by a portfolio fund manager, whether on a discretionary authority or otherwise; or

(b) an asset or a class of asset in a unit trust scheme by an asset fund manager.”

The definition therefore addresses both the management of single account funds and funds which are pooled.

Fund management companies are typically engaged in the process of managing investment portfolios in the following ways:

(a) the management of portfolios of securities such as shares and bonds, as well as real property, cash and other assets. Such a service may be offered on a discretionary or non-discretionary basis, and may include the function of asset allocation

(b) the management of pension funds or other pooled funds such as internal portfolios of insurance companies

(c) the management and operation of collective investment schemes such as unit trusts and closed-end funds

(d) risk managed-hedging with derivatives including futures to manage the market risk through a systematic form of management

(e) the provision of investment advice to corporate, institutional, governmental and other clients (including private clients).

In Malaysia, investors generally complete their own asset allocation (perhaps in conjunction with an asset consultant) before appointing a fund management company to manage the securities element of their total investible funds. In this module, we generally exclude consideration of real property and other forms of non-securities investment. Many fund management companies are part of companies or groups that provide a range of non-fund management services such as corporate finance advice, stockbroking services, banking, etc.

As mentioned, licensed fund management companies, namely the holders of a CMSL who carry on the business of fund management, are not the only participants in the fund management industry. Pool (or ‘funds’) of investment to be managed by fund management companies have to be gathered – and many fund management companies work closely with organizations whose role is to gather monies that are required to be invested under the guidance of fund management companies. An example of this is a unit trust management company, within which the savings of smaller investors are pooled and a fund management company becomes responsible for achieving the investment objectives of the unit trust. Trustees of pension funds, charitable foundations etc. play a role in the fund management industry by employing one or more fund management companies to invest the monies for the employees or the beneficiaries of the funds for which they are ultimately responsible.

We will assess the size of the fund management industry in Malaysia in the next section, but any large industry will attract a number of specialists and professionals that provide support services to the key players. In the fund management industry there are a number of specialists providing services to fund management companies and those responsible for the moneys invested by fund management companies. These include asset consultants and investment consultants as well as those providing performance measurement, custody and actuarial services.

We will also consider the role of those involved in the capital and financial markets, in which fund management companies may transact business on behalf of their clients (these include other holders of a CMSL such holders of a CMSL who carry on the business of dealing in securities and holders of a CMSL who carry on the business of dealing in derivatives as well as money market dealers, etc).

Given the globalisation of the financial services industry, we should be aware that many participants in the fund management industry operate on a global basis and/or operate in international markets.

We will consider the important role played by regulators within the fund management industry. In an industry that is heavily dependent upon trust and confidence in the proper management of large sums of investment capital — often on behalf of relatively unsophisticated investors with limited resources — the role of government regulators, such as the Securities Commission (SC); frontline-regulatory organisations such as Bursa Malaysia Securities Berhad and Bursa Malaysia Derivatives Berhad, professional associations, such as the Malaysian Association of Asset Managers (MAAM) and self-regulatory organization such as the

Federation of Investment Managers Malaysia (FIMM), is paramount.

2 Significance of the Fund Management Industry

With a population of 27 million people who invest a rather substantial amount each year, the flow of money into the fund management industry seems assured.

Furthermore, government policy encourages the need for a high level of savings to be channelled toward productive investments. Consequently, the government is committed to the local fund management industry and has taken various measures to promote the industry and Kuala Lumpur as a regional fund centre.

These measures include:

• establishment of wholly-owned or majority-owned foreign fund management companies, with tax concessions for income derived from non-Malaysian activities

• allowing foreign fund management companies to tap local institutional funds to form joint ventures with a maximum foreign-equity share of 70%

• allowing major companies to manage their own provident funds

• establishment of the Vision 2020 Fund for all Malaysians

• allowing EPF to invest up to 25% of its funds in shares listed on Bursa Malaysia Securities Berhad

• allowing eligible EPF contributors to transfer up to 20% of their retirement account for investment in approved fund management institutions

• further liberalisation of the operations of unit trusts. For example, there is no Limit imposed on the initial size of the scheme as well as on the percentage of foreign investments.

• promotion of the Labuan International Offshore Centre as a base for the management of investment portfolios within the ASEAN region.

The SC neatly summarises the benefits to Malaysia, to the capital market, and to investors of a vibrant, developed and dynamic fund management industry.

To the Nation:

• it promotes the efficient mobilisation of domestic savings

• it provides a large and stable source of long-term capital for the privatisation of infrastructure and other projects

• it reduces the burden of taxation needed to provide retirement and social benefits

• it obligates companies to enhance funding efficiency and standards of corporate governance

• it develops Kuala Lumpur as a regional fund management centre.

To the Capital Market:

• it ensures successful launching of new and more sophisticated products

• it allows development of markets such as the Ringgit bond market

• it increases domestic institutional participation in the capital market

• it accelerates development of the fund management industry and other capital market related services.

To Investors:

• it allows the development of collective investment vehicles which provide retail investors with alternatives to traditional savings (i.e. bank deposits) yet with affordable diversification and professional funds management as well as economies of scale.

3 Providers of Fund Management Services

While many institutional investors develop their own in-house fund management expertise (such as EPF), a number of organisations typically provide fund management services to investors — either indirectly (through other parts of the group of which they are part) or directly to those investors. In this section we identify the types of organisations that may offer fund management services to third party investors.

The providers of fund management services can be broadly analysed as follows:

3.1 Banks

Banks often have subsidiaries that provide fund management services to in-house clients, such as staff pension funds, as well as to the pension funds of corporate clients and other third parties. With a strong retail deposit base, banks are well-placed to provide additional services to retail clients and many banks have formed unit trusts.

3.2 Investment Banks

Investment banks often form fund management subsidiaries to manage the investment portfolios of corporate clients (mainly pension funds) and sometimes the investment portfolios of high net worth individuals. Some investment banks (and some banks) have set up separate divisions to handle the investment and other banking needs of high net worth individuals.

Investment banks, too, may offer unit trusts through a subsidiary and the management of the investments may be carried out by the unit trust management company, investment management division of the investment bank or its fund management company.

3.3 Insurance Companies

Traditionally, insurance companies — both life and general — have managed investment portfolios representing the reserves that support their prospective liabilities under the insurance policies they have written. Now however, life companies offer their investment management expertise to the public in the form of insurance policies with increasingly greater components of investment.

In Malaysia, these insurance companies are not subjected to the requirement of a CMSL to manage their funds as they would fall under the category of ‘specified persons’. Schedule 3 of the CMSA includes in its list of specified persons ‘an insurance company licensed under the Insurance Act 1996 or a takaful operator under the Takaful Act 1984 whose carrying on of the regulated activity of fund management is solely incidental to the management and administration of its insurance and takaful business, as the case may be’.

3.4 Stockbrokers

The emphasis of stockbrokers has been, and will probably continue to be, the trading of securities on behalf of clients. However, partly as a result of the inherent volatility of stockbroking commissions derived from such transactions, many stockbrokers are providing funds or portfolio management services to their clients. In some cases stockbrokers have formed subsidiaries to manage their own unit trusts to offer to existing clients and to attract new clients. Being fee-based, both portfolio management services and unit trusts potentially provide stockbroking companies with a less volatile income stream than traditional brokerage commissions.

Further, with the existence of Universal Brokers and Investment Banks, fund management services would be made more accessible to potential clients.

3.5 Unit Trust Management Companies

We have already seen that unit trusts can be provided by a range of promoters whose primary activity may be the provision of fund management services to in-house or external clients. However, in many markets overseas, there are a number of specialist unit trust promoters whose main activity is the operation of unit trusts. Such organisations derive fee income from management of the unit trust (including the management of the investment pool) and also derive income from the sale or distribution of units to investors. The clients of such unit trust management companies are predominantly retail rather than institutional.

3.6 Boutique Fund Management Companies

A noticeable overseas trend in the fund management industry has been the formation of independent fund management companies whose ownership lies all or mainly amongst its senior executives. Usually such organisations start as a ‘breakaway’ by some or all of the executives of a larger fund management organisation and hence tend to be much smaller (in terms of funds under management and resources). Often, boutique fund management companies perform well (albeit with limited funds to manage in the early years) and consequently grow to be significant in terms of funds under management and in relative investment performance.

Alpha Asset Management Sdn. Bhd. is an example of boutique fund management companies.

3.7 Foreign Fund Management Companies

We have already noted the government’s policy of developing the fund management industry by allowing foreign fund management companies to operate in Malaysia.

There are two categories of fund management companies operating in Malaysia:

(a) fund management companies with up to 70% foreign ownership

(b) fund management companies with 100% foreign ownership

Examples of fund management companies 100% foreign owned, operating in Malaysia are Nomura Asset Management Malaysia Sdn Bhd, BNP Paribas Asset Management Malaysia Sdn Bhd and Aberdeen Asset Management Sdn Bhd (established under the Application for Establishment of Foreign Fund Management Companies under the Special Scheme)

Two other foreign fund management companies 100% foreign owned, namely AIGIC (M) Sdn. Bhd. — American International Assurance Company (Bermuda) Limited and Navis Asset Management — Navis Capital Partners Limited were established under the Guidelines for the Establishment of Foreign Fund Management Companies. These foreign fund management companies manage funds sourced from outside Malaysia.

4.0 Fund Structures in Malaysia

In the previous section we examined the providers of fund management services in Malaysia. In this section we will review the major structures used in the fund management industry to gather monies into pools to allow efficient management of those funds.

4.1 Provident and Pension Funds

We have seen that the bulk of funds managed are represented by public and private provident and pension funds i.e. investment pools that provide the retirement income of employees. The largest of all provident and pension funds in Malaysia is the Employees Provident Fund (EPF) which accounts for over 80% of such funds (by value).

Other large funds include the Pensions Trust Fund, the Social Security Organisation, the Armed Forces Pension Fund, the Malaysian Estates Staff Provident Fund and the Teachers Provident Fund.

A pension fund is a pool of investments held in trust for the benefit of its members (past and present employees). The trustees of the fund are responsible to the members for the operation of the fund and may appoint external fund management companies to manage the funds operation. The use by trustees (and others) of a mix of internal and external fund management expertise is becoming increasingly common in international fund management markets.

There are various types of private provident and pension funds in Malaysia, each of which is regulated in a different manner.

4.2 Unit Trusts

A unit trust is a trust fund through which investors (called unitholders) pool their savings to be collectively managed on their behalf by a management company. The management company employs investment professionals to make investments in accordance with the funds investment objectives, and a trustee holds the assets of the trust fund in its own name on behalf of the unitholders. The ‘rules of the trust fund are recorded in a document called a trust deed. Ownership of the trust fund is divided into units each of which represents a proportional share of all the assets of the fund. Investors buy and sell units at a unit price determined by dividing the market value of the trusts investments and other assets by the number of units issued.

The price of units in unit trust funds can be found in most daily newspapers.

Shariah Funds

A variation of unit trusts is the Shariah Funds. Sharjah funds are funds that are invested in accordance with Islamic principles, i.e. in Shariah-compliant securities. Classification of Shariah-compliant securities is undertaken by the Shariah Advisory Council (SAC) which has identified seven standard criteria. Among other things, the company must not be involved in riba-based operations, including the typical activities undertaken by conventional commercial and merchant banks, finance companies and insurance companies; gambling operations; manufacturing, selling or distribution of non-halal products such as alcoholic beverages and non-halal meat and pork.

Malaysia is currently positioning itself as a leading Islamic financial centre and in 1996 the SAC was formed to provide advice to the SC on various matters necessary for the development of the Islamic capital market. The SAC serves as a focal point of reference on all issues relating to the Islamic capital market and shariah, including Islamic unit trusts and other Islamic capital market products, schemes and institutions.

There is a list of shariah-compliant securities (refer to SC’s website address: www.sc.com.my) and unit trust funds that are managed in accordance with shariah principles. Examples of some of the Islamic unit trust funds are:

(b) AmIttikal

(b) ASM Dana Mutiara

4.3 Insurance Funds

Insurance companies maintain investment portfolios to support their potential Liabilities in relation to actual and prospective claims. Life companies also offer a range of life insurance policies which combine term insurance (i.e. death cover) with an investment component. Whole of life, endowment and investment bonds are examples of life insurance policies with various combinations of death cover and investment return elements.

Insurance companies are regulated by Bank Negara Malaysia.

4.4 Closed-End Investment Companies

A closed-end investment company is a company that invests in the shares of other companies. Shares acquired are held as passive portfolio investments rather than with the objective of taking control or to take part in the management of the company.

In many respects a closed-end investment company is similar to a unit trust except that the company’s share capital is fixed (i.e. ‘closed’). Units in a unit trust can generally be issued and redeemed on a daily basis. (A unit trust is therefore an example of an open-ended investment fund).

Shares in a closed-end investment company are issued through an Initial Public Offering (IPO) and, after the issue is completed, the shares are usually listed on a stock exchange. All transactions in shares are made on a stock exchange (i.e. through the secondary market) although share capital may be increased from time to time through a rights issue to existing shareholders or through a placement of shares.

In Malaysia a closed-end investment company listed on Bursa Malaysia Securities Berhad is Icapital.Biz Bhd. Shares in closed-end investment companies often trade at prices below the (per share) market value of the underlying investments owned by the investment company.

4.5 Charitable Funds

Charitable funds and foundations represent funds held for various philosophical, educational, religious, medical or other benevolent purposes. Generally, funds are under the control of trustees who may appoint a fund management company to manage the investment portfolio, or to provide advice on the management of the charity’s funds.

5 Support Service Providers

5.1 Performance Measurement Services

The measurement and analysis of past investment performance achieved by a fund management company is clearly vital in the assessment of the ability of those responsible for the management of investment funds. In recent years, a number of organisations have started to offer a comparative analysis of fund management company’s performance and to measure the quality of the investment returns achieved against appropriate benchmarks (risk profile).

In addition, apart from providing an independent assessment of fund management company’s returns, consultants are also moving towards analysis of the risks fund management companies take in achieving those returns, thereby profiling the risk preference or adversity of fund management companies. This is usually done by also measuring the volatility of a fund’s performance and evaluating the fund on a risk adjusted return basis.

By so categorising fund management companies, it would be easier for a potential client to, say, undertake a combination of a high risk and a conservative strategy for the portfolio by selecting recommended fund management companies from each particular class.

Micropal is an independent organisation that measures, over various periods, the relative investment performance of unit trusts offered to Malaysian investors. Watson Wyatt and Mercer are also consulting on aspects of performance measurement.

5.2 Custodians

As we shall see later, one of the requirements of the CMSA is that a holder of a CMSL who carries on the business of fund management must hold client assets in a separate trust account(s) and must make arrangements for a custodian to maintain the account(s).

Where the holder of a CMSL who carries on the business of fund management is a subsidiary of a financial institution, the financial institution usually has a nominee company that provides custodian services for its clients. However, some clients may require a holder of a CMSL who carries on the business of fund management to use an independent custodian service to avoid any conflict of interest.

5ection 121 of the CMSA prescribes the list of persons eligible to act as a custodian to maintain these trust accounts:

(a) a licensed bank as defined in the Banking and Financial Institutions Act 1989 appointed by the fund manager with the prior written consent of the client;

(b) a licensed merchant bank as defined in the Banking and Financial Institutions Act 1989 appointed by a fund manager with the prior written consent of the client;

(c) a trust company registered under the Trust Companies Act 1949;

(d) Amanah Raya Berhad;

(e) a participating organisation;

(f) a wholly owned subsidiary of any institution specified under paragraphs (a), (b) and (e) that provides nominee services;

(fa) any institution licensed or authorised to provide custodian services outside Malaysia; or

(g) any other person as may be specified in writing by the Commission.

We have noted that one of the functions of a trustee of a unit trust is to act as a custodian (registered owner or holder) of investments and other assets belonging to the investors in the trust (i.e. to a third party). Other investment structures such as pension funds and insurance companies may require similar services as the custodial function is becoming increasingly complex and therefore expensive. Internal custody arrangements are therefore becoming less common, particularly among smaller entities.

As Malaysian investment in overseas stockmarkets increases it is clear that overseas custodians will be required to hold shares in the country in which those shares are traded. Consequently, local custodians generally have arrangements with overseas custodians such that offshore investments are held on their behalf. In this way, settlements may be completed on a timely basis and all income and other entitlements collected.

5.3 Investment and Asset Consultants

This group of service providers to the fund management industry offer investment and asset allocation advice to their clients — for example, either directly to trustees of provident and pension funds, or to the fund management companies appointed to manage those funds.

Investment and asset consultants generally do not manage funds themselves. Rather, specialist fund management companies are identified and selected to invest the funds in line with the asset allocation recommendations provided by the consultant to its client.

Internationally, the provision of asset allocation advice by consultants is-a rapidly growing support service as pension funds switch from investing in accordance with a balanced investment mandate through a single fund management company toward a mandate that involves the selection of specialist sector managers. However, in Malaysia — because the choice of assets is restricted in comparison with overseas — it is the fund management company’s client who generally decides on the asset allocation.

It should also be noted that certain types of funds, such as approved pension funds, are subject to regulatory guidelines which specify maximum limits of exposure to various classes of securities (e.g. foreign equities). It is within these limits that an independent asset consultant can provide most value.

6 Why Does the Fund Management Industry Need to be Regulated?

We have seen that the fund management industry is an important part of the securities industry and the Malaysian economy. It represents the savings of a large proportion of ‘ordinary Malaysians. It allows the savings of individuals and others to be pooled to provide a source of (usually) long-term capital necessary to allow the continuing growth of the Malaysian economy. The fund management industry encourages the development of an increasingly sophisticated and developed capital market.

Regulation of the industry aims to ensure information is disclosed to investors, to keep markets informed and to ensure fair trading. Regulation is also concerned with the definition and maintenance of appropriate standards of conduct by participants in the fund management industry. All of these objectives aim to develop and maintain the confidence of investors in the industry.

Furthermore, with the current high savings rate, Malaysians are increasingly looking for alternative long term investments (other than the traditional fixed deposits) that will consistently outperform the rate of inflation. However, higher returns are almost always accompanied by higher risks. In most cases, a fund management company’s returns from equity investment are not guaranteed and therefore there is need for transparency in how the fund management company operates, the risks associated with various investments and asset classes, the risks taken by the fund management ompany to achieve returns, etc.

In Summary

In this topic we have provided an introduction to the fund management industry. We have identified and reviewed many of the participants in the industry. We have considered the significance of the fund management industry to the Malaysian economy.

Finally, we have considered the importance of proper regulation of the industry. In the remaining topics we will examine in detail various aspects of the regulation of funds management companies and those individuals who work for them.

In the next topic we will look at the organisations that are involved in regulating the fund management industry and the laws and regulations that affect the industry.

Malaysia has a well-established fund management industry that caters to institutional investors as well as qualified retail investors. According to the Securities Commission Malaysia (SC), assets under management (AUM) typically originate from unit trust funds, corporate bodies, the Employees Provident Fund (EPF) and wholesale funds.

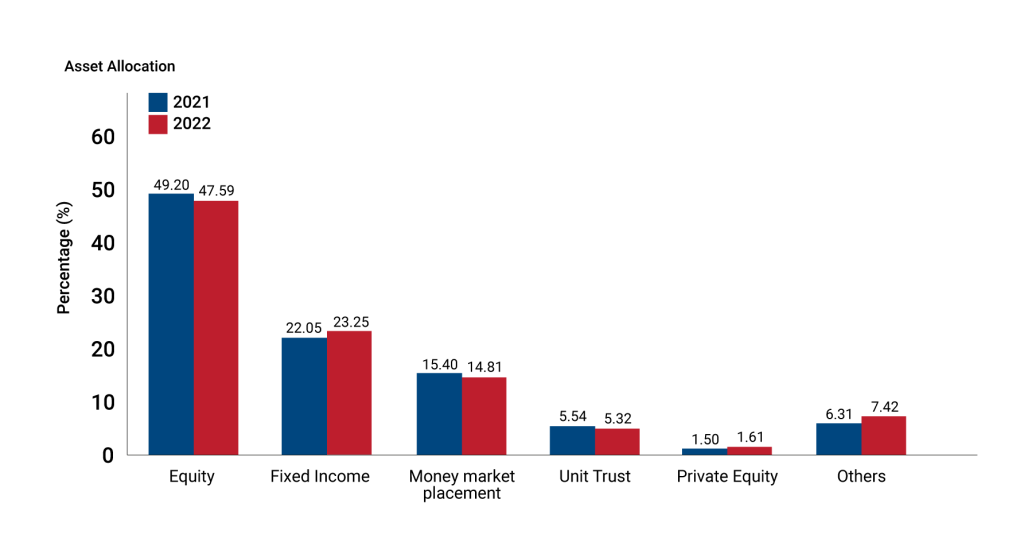

As at end-December 2022, the domestic fund management industry’s AUM stood at RM906.46 billion – somewhat lower than the RM951.05 billion of a year earlier. The bulk (47.6%) of these funds were invested in equities, followed by fixed-income securities (23.3%). At the same time, the top five fund management companies in Malaysia accounted for 55.4% of the industry’s total AUM (2021: 54.8%).

The unit trust segment remained the key contributor of the industry’s AUM as at end-December 2022, with a net asset value (or NAV) of RM487.94 billion (end-December 2021: RM526.89 billion). Of this, about 78% was attributable to conventional funds while the other 22% stemmed from their Shariah compliant counterparts.

Source: www.capitalmarketsmalaysia.com

Equity / Fixed Income / Money market placement / Unit Trust / Private Equity / Others

Eligibility requirements for fund management company

Local Company

As prescribed under Sections 288(2) and 289(1) of the Capital Markets and Services Act 2007 (CMSA), only a management company approved by the Securities Commission Malaysia (SC) can act as a fund management company. To be eligible for such a licence, a local company must comply with the following criteria:

(a) Be an entity incorporated in Malaysia

(b) Have at least 30% Bumiputera equity

(c) Not have more than 49% foreign equity

(d) Always have at least RM10 million of shareholders’ funds

Foreign Company

A foreign company, on the other hand, must adhere to the following requirements:

(a) Must have more than 50% foreign equity and be incorporated in Malaysia

(b) Must obtain a licence from the SC to undertake fund management activities

(c) Must have a paid-up capital of at least RM2 million

(d) Must conduct its operations from an office in Malaysia

(e) Must have a parent company or holding or related company with a sound track record in the international fund management industry

(e) At least 30% of its share capital must be held by locals if the foreign company intends to manage funds sourced from within Malaysia

(f) Must be 100%-owned by foreign interests if the foreign company intends to manage funds sourced from and on behalf of clients outside of Malaysia

Contents

Overview

Introduction

Objectives

What is the Fund Management Industry?

Significance of the Fund Management Industry

Providers of Fund Management Services

Banks

Investment Banks

Insurance Companies

Stockbrokers

Unit Trust Management Companies

Boutique Fund Management Companies

Foreign Fund Management Companies

Fund Structures in Malaysia

Provident and Pension Funds

Unit Trusts

Insurance Funds

Closed-End Investment Companies

Charitable Funds

Support Service Providers

Performance Measurement Services

Custodians

Investment and Asset Consultants

Why Does the Fund Management Industry Need to Regulated?

Summary

Overview

Introduction

This topic introduces the fund management industry in Malaysia. We will examine those participants in the fund management industry who provide investment management services. We will also consider the various structures or ‘funds used in the industry to pool moneys prior to investment. This will provide us with an insight into the clients of fund management companies. We then review some of the other important participants in the industry. Finally, we introduce the rationale for regulation of the fund management industry.

Objectives

At the end of this topic you should be able to:

(a) define the fund management industry

(b) describe the significance of the fund management industry to the Malaysian economy

(c) identify the participants in the fund management industry and describe their role

(d) describe the major structures used in the industry to pool funds

(e) identify key differences between closed and open-ended funds

(f) understand the importance of performance management services

(g) explain why regulation of the fund management industry is required.

1 What is the Fund Management Industry?

Fund Management is the process in which a company that takes the financial assets of a person, company or another fund management company (generally this will be high net worth individuals) and use the funds to invest in companies that use those as an operational investment, financial investment or any other investment in order to grow the fund; post which, the returns will be returned to the actual investor and a small amount of the returns are held back as a profit for the fund.

Fund management is simply the management of a portfolio of securities or derivatives for the purpose of investment. The fund management industry therefore comprises all those involved in the process of managing investment portfolios on behalf of other persons (although those persons may be a part of the same company or group).

The most significant player in the process of managing investment portfolios is the fund management company.

A fund manager is responsible for implementing a fund’s investing strategy and managing its portfolio trading activities. The fund can be managed by one person, by two people as co-managers, or by a team of three or more people. He/She are paid a fee for their work, which is a percentage of the fund’s average assets under management (AUM). They can be found working in fund management with mutual funds, pension funds, trust funds, and hedge funds. Investors should fully review the investment style of fund managers before they consider investing in a fund.

In Malaysia, fund management companies licensed to carry on the regulated activity of fund management are holders of a Capital Markets Services Licence (CMSL).

Nevertheless, it is important to note that fund management activities can also be carried out by persons other than holders of a CMSL who carry on the business of fund management. S.58(1) of the Capital Markets and Services Act 2007(CMSA) provides that ‘no person shall whether as principal or agent, carry on a business in any regulated activity or himself out as carrying on such business unless he is the holder of a CMSL or is a registered person’. S.58(2) goes on to say that s.58(1) shall not apply to the persons or classes of persons as specified in schedule 3.

In this regard, fund management activities would thus be permitted to be carried out by the following persons without requiring a CMSL:

(a) any corporation whose carrying on of the regulated activity of fund management is solely for the benefit of its related corporation (Paragraph 7 of Schedule 3)

(b) any public statutory corporation constituted under any written law who carries on the regulated activity dealing in securities or fund management (Paragraph 14 of Schedule 3)

(c) an insurance company licensed under the Insurance Act 1996 or a takaful operator registered under the Takaful Act 1984 whose carrying on of the regulated activity of fund management is solely incidental and to the management and administration of its insurance or takaful business, as the case may be (Paragraph 21 of Schedule 3)

(d) KAF Investment Bank Berhad and Islamic banks, in acting or offering to act as portfolio managers for customers or as investment or co-investment manager of country funds, trust funds, venture capital funds, unit trust funds, or other funds, including-

(i) the provision of investment advice; and

(ii) the acquisition or disposal through a holder of a CMSL who carries on dealing in securities

In relation to such activity (Item 4, Part I of Schedule 4)

Our discussion on fund management throughout this module however would focus on the holders of a CMSL who carry on the business of fund management. Under the CMSA, a holder of a CMSL who carries on the business of fund management entails:

….”undertaking on behalf of any other person the management of-

(a) a portfolio of securities or derivatives or a combination of both, by a portfolio fund manager, whether on a discretionary authority or otherwise; or

(b) an asset or a class of asset in a unit trust scheme by an asset fund manager.”

The definition therefore addresses both the management of single account funds and funds which are pooled.

Fund management companies are typically engaged in the process of managing investment portfolios in the following ways:

(a) the management of portfolios of securities such as shares and bonds, as well as real property, cash and other assets. Such a service may be offered on a discretionary or non-discretionary basis, and may include the function of asset allocation

(b) the management of pension funds or other pooled funds such as internal portfolios of insurance companies

(c) the management and operation of collective investment schemes such as unit trusts and closed-end funds

(d) risk managed-hedging with derivatives including futures to manage the market risk through a systematic form of management

(e) the provision of investment advice to corporate, institutional, governmental and other clients (including private clients).

In Malaysia, investors generally complete their own asset allocation (perhaps in conjunction with an asset consultant) before appointing a fund management company to manage the securities element of their total investible funds. In this module, we generally exclude consideration of real property and other forms of non-securities investment. Many fund management companies are part of companies or groups that provide a range of non-fund management services such as corporate finance advice, stockbroking services, banking, etc.

As mentioned, licensed fund management companies, namely the holders of a CMSL who carry on the business of fund management, are not the only participants in the fund management industry. Pool (or ‘funds’) of investment to be managed by fund management companies have to be gathered – and many fund management companies work closely with organizations whose role is to gather monies that are required to be invested under the guidance of fund management companies. An example of this is a unit trust management company, within which the savings of smaller investors are pooled and a fund management company becomes responsible for achieving the investment objectives of the unit trust. Trustees of pension funds, charitable foundations etc. play a role in the fund management industry by employing one or more fund management companies to invest the monies for the employees or the beneficiaries of the funds for which they are ultimately responsible.

We will assess the size of the fund management industry in Malaysia in the next section, but any large industry will attract a number of specialists and professionals that provide support services to the key players. In the fund management industry there are a number of specialists providing services to fund management companies and those responsible for the moneys invested by fund management companies. These include asset consultants and investment consultants as well as those providing performance measurement, custody and actuarial services.

We will also consider the role of those involved in the capital and financial markets, in which fund management companies may transact business on behalf of their clients (these include other holders of a CMSL such holders of a CMSL who carry on the business of dealing in securities and holders of a CMSL who carry on the business of dealing in derivatives as well as money market dealers, etc).

Given the globalisation of the financial services industry, we should be aware that many participants in the fund management industry operate on a global basis and/or operate in international markets.

We will consider the important role played by regulators within the fund management industry. In an industry that is heavily dependent upon trust and confidence in the proper management of large sums of investment capital — often on behalf of relatively unsophisticated investors with limited resources — the role of government regulators, such as the Securities Commission (SC); frontline-regulatory organisations such as Bursa Malaysia Securities Berhad and Bursa Malaysia Derivatives Berhad, professional associations, such as the Malaysian Association of Asset Managers (MAAM) and self-regulatory organization such as the

Federation of Investment Managers Malaysia (FIMM), is paramount.

2 Significance of the Fund Management Industry

With a population of 27 million people who invest a rather substantial amount each year, the flow of money into the fund management industry seems assured.

Furthermore, government policy encourages the need for a high level of savings to be channelled toward productive investments. Consequently, the government is committed to the local fund management industry and has taken various measures to promote the industry and Kuala Lumpur as a regional fund centre.

These measures include:

• establishment of wholly-owned or majority-owned foreign fund management companies, with tax concessions for income derived from non-Malaysian activities

• allowing foreign fund management companies to tap local institutional funds to form joint ventures with a maximum foreign-equity share of 70%

• allowing major companies to manage their own provident funds

• establishment of the Vision 2020 Fund for all Malaysians

• allowing EPF to invest up to 25% of its funds in shares listed on Bursa Malaysia Securities Berhad

• allowing eligible EPF contributors to transfer up to 20% of their retirement account for investment in approved fund management institutions

• further liberalisation of the operations of unit trusts. For example, there is no Limit imposed on the initial size of the scheme as well as on the percentage of foreign investments.

• promotion of the Labuan International Offshore Centre as a base for the management of investment portfolios within the ASEAN region.

The SC neatly summarises the benefits to Malaysia, to the capital market, and to investors of a vibrant, developed and dynamic fund management industry.

To the Nation:

• it promotes the efficient mobilisation of domestic savings

• it provides a large and stable source of long-term capital for the privatisation of infrastructure and other projects

• it reduces the burden of taxation needed to provide retirement and social benefits

• it obligates companies to enhance funding efficiency and standards of corporate governance

• it develops Kuala Lumpur as a regional fund management centre.

To the Capital Market:

• it ensures successful launching of new and more sophisticated products

• it allows development of markets such as the Ringgit bond market

• it increases domestic institutional participation in the capital market

• it accelerates development of the fund management industry and other capital market related services.

To Investors:

• it allows the development of collective investment vehicles which provide retail investors with alternatives to traditional savings (i.e. bank deposits) yet with affordable diversification and professional funds management as well as economies of scale.

3 Providers of Fund Management Services

While many institutional investors develop their own in-house fund management expertise (such as EPF), a number of organisations typically provide fund management services to investors — either indirectly (through other parts of the group of which they are part) or directly to those investors. In this section we identify the types of organisations that may offer fund management services to third party investors.

The providers of fund management services can be broadly analysed as follows:

3.1 Banks

Banks often have subsidiaries that provide fund management services to in-house clients, such as staff pension funds, as well as to the pension funds of corporate clients and other third parties. With a strong retail deposit base, banks are well-placed to provide additional services to retail clients and many banks have formed unit trusts.

3.2 Investment Banks

Investment banks often form fund management subsidiaries to manage the investment portfolios of corporate clients (mainly pension funds) and sometimes the investment portfolios of high net worth individuals. Some investment banks (and some banks) have set up separate divisions to handle the investment and other banking needs of high net worth individuals.

Investment banks, too, may offer unit trusts through a subsidiary and the management of the investments may be carried out by the unit trust management company, investment management division of the investment bank or its fund management company.

3.3 Insurance Companies

Traditionally, insurance companies — both life and general — have managed investment portfolios representing the reserves that support their prospective liabilities under the insurance policies they have written. Now however, life companies offer their investment management expertise to the public in the form of insurance policies with increasingly greater components of investment.

In Malaysia, these insurance companies are not subjected to the requirement of a CMSL to manage their funds as they would fall under the category of ‘specified persons’. Schedule 3 of the CMSA includes in its list of specified persons ‘an insurance company licensed under the Insurance Act 1996 or a takaful operator under the Takaful Act 1984 whose carrying on of the regulated activity of fund management is solely incidental to the management and administration of its insurance and takaful business, as the case may be’.

3.4 Stockbrokers

The emphasis of stockbrokers has been, and will probably continue to be, the trading of securities on behalf of clients. However, partly as a result of the inherent volatility of stockbroking commissions derived from such transactions, many stockbrokers are providing funds or portfolio management services to their clients. In some cases stockbrokers have formed subsidiaries to manage their own unit trusts to offer to existing clients and to attract new clients. Being fee-based, both portfolio management services and unit trusts potentially provide stockbroking companies with a less volatile income stream than traditional brokerage

commissions.

Further, with the existence of Universal Brokers and Investment Banks, fund management services would be made more accessible to potential clients.

3.5 Unit Trust Management Companies

We have already seen that unit trusts can be provided by a range of promoters whose primary activity may be the provision of fund management services to in-house or external clients. However, in many markets overseas, there are a number of specialist unit trust promoters whose main activity is the operation of unit trusts. Such organisations derive fee income from management of the unit trust (including the management of the investment pool) and also derive income from the sale or distribution of units to investors. The clients of such unit trust management companies are predominantly retail rather than institutional.

3.6 Boutique Fund Management Companies

A noticeable overseas trend in the fund management industry has been the formation of independent fund management companies whose ownership lies all or mainly amongst its senior executives. Usually such organisations start as a ‘breakaway’ by some or all of the executives of a larger fund management organisation and hence tend to be much smaller (in terms of funds under management and resources). Often, boutique fund management companies perform well (albeit with limited funds to manage in the early years) and consequently grow to be significant in terms of funds under management and in relative investment performance.

Alpha Asset Management Sdn. Bhd. is an example of boutique fund management companies.

3.7 Foreign Fund Management Companies

We have already noted the government’s policy of developing the fund management industry by allowing foreign fund management companies to operate in Malaysia.

There are two categories of fund management companies operating in Malaysia:

(a) fund management companies with up to 70% foreign ownership

(b) fund management companies with 100% foreign ownership

Examples of fund management companies 100% foreign owned, operating in Malaysia are Nomura Asset Management Malaysia Sdn Bhd, BNP Paribas Asset Management Malaysia Sdn Bhd and Aberdeen Asset Management Sdn Bhd (established under the Application for Establishment of Foreign Fund Management Companies under the Special Scheme)

Two other foreign fund management companies 100% foreign owned, namely AIGIC (M) Sdn. Bhd. — American International Assurance Company (Bermuda) Limited and Navis Asset Management — Navis Capital Partners Limited were established under the Guidelines for the Establishment of Foreign Fund Management Companies. These foreign fund management companies manage funds sourced from outside Malaysia.

4 Fund Structures in Malaysia

In the previous section we examined the providers of fund management services in Malaysia. In this section we will review the major structures used in the fund management industry to gather monies into pools to allow efficient management of those funds.

4.1 Provident and Pension Funds

We have seen that the bulk of funds managed are represented by public and private provident and pension funds i.e. investment pools that provide the retirement income of employees. The largest of all provident and pension funds in Malaysia is the Employees Provident Fund (EPF) which accounts for over 80% of such funds (by value).

Other large funds include the Pensions Trust Fund, the Social Security Organisation, the Armed Forces Pension Fund, the Malaysian Estates Staff Provident Fund and the Teachers Provident Fund.

A pension fund is a pool of investments held in trust for the benefit of its members (past and present employees). The trustees of the fund are responsible to the members for the operation of the fund and may appoint external fund management companies to manage the funds operation. The use by trustees (and others) of a mix of internal and external fund management expertise is becoming increasingly common in international fund management markets.

There are various types of private provident and pension funds in Malaysia, each of which is regulated in a different manner.

4.2 Unit Trusts

A unit trust is a trust fund through which investors (called unitholders) pool their savings to be collectively managed on their behalf by a management company. The management company employs investment professionals to make investments in accordance with the funds investment objectives, and a trustee holds the assets of the trust fund in its own name on behalf of the unitholders. The ‘rules of the trust fund are recorded in a document called a trust deed. Ownership of the trust fund is divided into units each of which represents a proportional share of all the assets of the fund. Investors buy and sell units at a unit price determined by dividing the market value of the trusts investments and other assets by the number of units issued.

The price of units in unit trust funds can be found in most daily newspapers.

Shariah Funds

A variation of unit trusts is the Shariah Funds. Sharjah funds are funds that are invested in accordance with Islamic principles, i.e. in Shariah-compliant securities. Classification of Shariah-compliant securities is undertaken by the Shariah Advisory Council (SAC) which has identified seven standard criteria. Among other things, the company must not be involved in riba-based operations, including the typical activities undertaken by conventional commercial and merchant banks, finance companies and insurance companies; gambling operations; manufacturing, selling or distribution of non-halal products such as alcoholic beverages and non-halal meat and pork.

Malaysia is currently positioning itself as a leading Islamic financial centre and in 1996 the SAC was formed to provide advice to the SC on various matters necessary for the development of the Islamic capital market. The SAC serves as a focal point of reference on all issues relating to the Islamic capital market and shariah, including Islamic unit trusts and other Islamic capital market products, schemes and institutions.

There is a list of shariah-compliant securities (refer to SC’s website address: www.sc.com.my) and unit trust funds that are managed in accordance with shariah principles. Examples of some of the Islamic unit trust funds are:

(b) AmIttikal

(b) ASM Dana Mutiara

4.3 Insurance Funds

Insurance companies maintain investment portfolios to support their potential Liabilities in relation to actual and prospective claims. Life companies also offer a range of life insurance policies which combine term insurance (i.e. death cover) with an investment component. Whole of life, endowment and investment bonds are examples of life insurance policies with various combinations of death cover and investment return elements.

Insurance companies are regulated by Bank Negara Malaysia.

4.4 Closed-End Investment Companies

A closed-end investment company is a company that invests in the shares of other companies. Shares acquired are held as passive portfolio investments rather than with the objective of taking control or to take part in the management of the company.

In many respects a closed-end investment company is similar to a unit trust except that the company’s share capital is fixed (i.e. ‘closed’). Units in a unit trust can generally be issued and redeemed on a daily basis. (A unit trust is therefore an example of an open-ended investment fund).

Shares in a closed-end investment company are issued through an Initial Public Offering (IPO) and, after the issue is completed, the shares are usually listed on a stock exchange. All transactions in shares are made on a stock exchange (i.e. through the secondary market) although share capital may be increased from time to time through a rights issue to existing shareholders or through a placement of shares.

In Malaysia a closed-end investment company listed on Bursa Malaysia Securities Berhad is Icapital.Biz Bhd. Shares in closed-end investment companies often trade at prices below the (per share) market value of the underlying investments owned by the investment company.

4.5 Charitable Funds

Charitable funds and foundations represent funds held for various philosophical, educational, religious, medical or other benevolent purposes. Generally, funds are under the control of trustees who may appoint a fund management company to manage the investment portfolio, or to provide advice on the management of the charity’s funds.

5 Support Service Providers

5.1 Performance Measurement Services

The measurement and analysis of past investment performance achieved by a fund management company is clearly vital in the assessment of the ability of those responsible for the management of investment funds. In recent years, a number of organisations have started to offer a comparative analysis of fund management company’s performance and to measure the quality of the investment returns achieved against appropriate benchmarks (risk profile).

In addition, apart from providing an independent assessment of fund management company’s returns, consultants are also moving towards analysis of the risks fund management companies take in achieving those returns, thereby profiling the risk preference or adversity of fund management companies. This is usually done by also measuring the volatility of a fund’s performance and evaluating the fund on a risk adjusted return basis.

By so categorising fund management companies, it would be easier for a potential client to, say, undertake a combination of a high risk and a conservative strategy for the portfolio by selecting recommended fund management companies from each particular class.

Micropal is an independent organisation that measures, over various periods, the relative investment performance of unit trusts offered to Malaysian investors. Watson Wyatt and Mercer are also consulting on aspects of performance measurement.

5.2 Custodians

As we shall see later, one of the requirements of the CMSA is that a holder of a CMSL who carries on the business of fund management must hold client assets in a separate trust account(s) and must make arrangements for a custodian to maintain the account(s).

Where the holder of a CMSL who carries on the business of fund management is a subsidiary of a financial institution, the financial institution usually has a nominee company that provides custodian services for its clients. However, some clients may require a holder of a CMSL who carries on the business of fund management to use an independent custodian service to avoid any conflict of interest.

5.121 of the CMSA prescribes the list of persons eligible to act as a custodian to maintain these trust accounts:

(a) a licensed bank as defined in the Banking and Financial Institutions Act 1989 appointed by the fund manager with the prior written consent of the client;

(b) a licensed merchant bank as defined in the Banking and Financial Institutions Act 1989 appointed by a fund manager with the prior written consent of the client;

(c) a trust company registered under the Trust Companies Act 1949;

(d) Amanah Raya Berhad;

(e) a participating organisation;

(f) a wholly owned subsidiary of any institution specified under paragraphs (a), (b) and (e) that provides nominee services;

(fa) any institution licensed or authorised to provide custodian services outside Malaysia; or

(g) any other person as may be specified in writing by the Commission.

We have noted that one of the functions of a trustee of a unit trust is to act as a custodian (registered owner or holder) of investments and other assets belonging to the investors in the trust (i.e. to a third party). Other investment structures such as pension funds and insurance companies may require similar services as the custodial function is becoming increasingly complex and therefore expensive. Internal custody arrangements are therefore becoming less common, particularly among smaller entities.

As Malaysian investment in overseas stockmarkets increases it is clear that overseas custodians will be required to hold shares in the country in which those shares are traded. Consequently, local custodians generally have arrangements with overseas custodians such that offshore investments are held on their behalf. In this way, settlements may be completed on a timely basis and all income and other entitlements collected.

5.3 Investment and Asset Consultants

This group of service providers to the fund management industry offer investment and asset allocation advice to their clients — for example, either directly to trustees of provident and pension funds, or to the fund management companies appointed to manage those funds.

Investment and asset consultants generally do not manage funds themselves. Rather, specialist fund management companies are identified and selected to invest the funds in line with the asset allocation recommendations provided by the consultant to its client.

Internationally, the provision of asset allocation advice by consultants is-a rapidly growing support service as pension funds switch from investing in accordance with a balanced investment mandate through a single fund management company toward a mandate that involves the selection of specialist sector managers. However, in Malaysia — because the choice of assets is restricted in comparison with overseas — it is the fund management company’s client who generally decides on the asset allocation.

It should also be noted that certain types of funds, such as approved pension funds, are subject to regulatory guidelines which specify maximum limits of exposure to various classes of securities (e.g. foreign equities). It is within these limits that an independent asset consultant can provide most value.

6 Why Does the Fund Management Industry Need to be Regulated?

We have seen that the fund management industry is an important part of the securities industry and the Malaysian economy. It represents the savings of a large proportion of ‘ordinary Malaysians. It allows the savings of individuals and others to be pooled to provide a source of (usually) long-term capital necessary to allow the continuing growth of the Malaysian economy. The fund management industry encourages the development of an increasingly sophisticated and developed capital market.

Regulation of the industry aims to ensure information is disclosed to investors, to keep markets informed and to ensure fair trading. Regulation is also concerned with the definition and maintenance of appropriate standards of conduct by participants in the fund management industry. All of these objectives aim to develop and maintain the confidence of investors in the industry.

Furthermore, with the current high savings rate, Malaysians are increasingly looking for alternative long term investments (other than the traditional fixed deposits) that will consistently outperform the rate of inflation. However, higher returns are almost always accompanied by higher risks. In most cases, a fund management company’s returns from equity investment are not guaranteed and therefore there is need for transparency in how the fund management company operates, the risks associated with various investments and asset classes, the risks taken by the fund management ompany to achieve returns, etc.

In Summary

In this topic we have provided an introduction to the fund management industry. We have identified and reviewed many of the participants in the industry. We have considered the significance of the fund management industry to the Malaysian economy.

Finally, we have considered the importance of proper regulation of the industry. In the remaining topics we will examine in detail various aspects of the regulation of funds management companies and those individuals who work for them.

In the next topic we will look at the organisations that are involved in regulating the fund management industry and the laws and regulations that affect the industry.