CHAPTER 6

PRIVATE RETIREMENT SCHEME INVESTMENTS

Learning objectives

This chapter explores the investments that are allowed in the Scheme and their suitability for the member. It provides the PRS Distributor and Consultant, the necessary steps to perform a suitability analysis for the member in recommending funds to him. There are also various discussions on the exposure and concentration limits for the different types of funds in the Scheme.

At the end of the chapter, you should be able to:

(a) assess the suitability of a PRS and its funds for a member;

(b) determine whether the funds offered in the PRS are relevant, Consistent and appropriate with respect to the investment objective of the Schemes;

(c) explain the types of investments possible for a PRS;

(d) recognise the exposure and concentration limits imposed on each type of fund in the PRS;

(e) recognise the remedial action to be taken on any breach of those limits; and

(f) assess investment performance and returns.

6.1 Suitability assessment

Each PRS has different fund objectives and hence, different types of funds that may be offered to the members. The PRS Distributor and Consultant should only recommend a fund(s) under the Scheme to a member when the product is suitable. In order to determine whether the fund recommended to a member is suitable or otherwise, the PRS Distributor and Consultant must conduct a suitability assessment.

A suitability assessment refers to an exercise carried out by the PRS Distributor and Consultant that would entail them gathering the necessary information from the member in order to form a reasonable basis for recommendation.

The PRS Distributor and Consultant are considered to have a reasonable basis in making a recommendation when they have—

(a) taken all practicable measures to ascertain that the information

possessed and relied upon concerning the member’s investment

objectives, financial situation and particular needs are accurate and

complete; and

(b) given consideration and conducted a thorough review investigation of

the subject matter of the recommendation as may be reasonable in the

circumstances.

By having this information, the PRS Distributor and Consultant can recommend a fund to meet the member’s risk profile and needs.

A suitability assessment may be conducted face to face or over the telephone or via the Internet or by any other means. What is important is that the documentation of such assessment be accurately preserved. Recommendations obtained from a suitability assessment should be kept in writing.

Suitability assessment process

The table below sets out the processes that must be complied with when conducting the suitability assessment:

Stage 1 – Gather information pertaining to a member

Stage 2 – Analyse information gathered

Stage 3 – Match a suitable fund to meet the members risk profile arid needs

Stage 4 – Make a recommendation

(a) Information gathering for the suitability assessment

Central to the whole suitability assessment process conducted by the PRS Distributor and Consultant is the gathering of information pertaining to a member. Information gathered from the member can be grouped into three categories:

(a) Know-your-member;

(b) Member’s risk profiles and needs; and

(c) Member’s investment knowledge.

(i) Know-your-member

This part requires the PRS Distributor and Consultant to gather the

member’s person information to ascertain the type of investor the

member is. The information needed is:

– Member’s personal details

Includes date of birth, age at the time of recommendation, nationality, residential address, marital status, number of dependents and contact information.

– Member’s employment status

Includes current employment status, profession, nature of business if conducting a business, annual income, expected retirement age, category of investor (risk seeking or risk averse — is capital preservation important to the member?).

(ii) Member’s risk profile and needs

This part requires the PRS Distributor and Consultant to gather information on the member’s investment objectives, financial situation,

risk profile and current portfolio. By gathering this information, the PRS

Distributor and Consultant will be able to determine the investor’s risk

profile and needs. The information needed is-

– Investment objectives

Includes duration the member wishes to invest in the product, rationale for choosing the product, general expectation of outcome of the product and purpose of investment (saving for pecific purpose, supplementing income in retirement, lump sum investing for growth/income).

– Member’s financial situation

Includes member’s assets, liabilities, cash flow, income, proportion of investment out of net assets (excluding residential property) and member’s regular financial commitment (e.g. car loan).

– Member’s current portfolio

Includes existing portfolio and current performance of that portfolio.

(iii) Member’s investment knowledge

This part requires the PRS Distributor and Consultant to gather

information on the member’s educational qualification, training,

work experience and dealing or trading experience. By gathering this

information, the PRS Distributor and Consultant will be able to make

an assessment whether the member appreciates the risks associated

with PRS fund that the member proposes to invest in. The information

needed is—

– Member’s relevant knowledge

Includes whether the member has dealt in securities and/or

derivatives, relevant knowledge or experience to understand the

risks associated with the product and investment experience.

– Member’s relevant knowledge to understand the features

of the fund Includes whether the member appreciates the special features of the product, nature of the product and product specifications.

(b) Analyse the information gathered

Upon obtaining the know-your-member information, the PRS Distributor and Consultant should analyse the information to determine whether the member

has the means and capability to invest and withstand the risks associated with the investment.

(c) Matching and making a recommendation

Having assessed the member’s information and financial standing, the PRS Distributor and Consultant must ascertain whether the Scheme they market has a fund that is suitable for the member. If so, they should proceed and make their recommendation to the member.

In making the recommendation of a suitable fund to the member that matches

the member’s profile and needs, the PRS Distributor and Consultant should also explain to the member the features and risks associated with the fund (both the upside and downside of the fund) before the member makes an informed decision on whether to proceed with the investment. The member should then be given a copy of the disclosure document and a product highlight sheet and advised to read through it before making the investment decision.

If there is no suitable fund available in the PRS that the PRS Distributor and Consultant market, the PRS Distributor and Consultant should inform the member. The PRS Distributor and Consultant should ensure that the recommendation provided to the member is clear and not misleading. They should then document their recommendation in writing for record purposes.

The PRS Distributor and Consultant should obtain a written acknowledgement from the member that—

(a) all information disclosed by the member is true, complete and

accurate;

(b) the member understood the features and risks of the fund having

obtained the explanation from the PRS Distributor and Consultant;

and

(c) the member has received a copy of the disclosure document.

As the case may be, the PRS Distributor and Consultant should also obtain from the member a written acknowledgement where the member—

(a) declines to provide information requested by the PRS Distributor and

Consultant; or

(b) decides to purchase another fund that is not recommended by the PRS

Distributor and Consultant.

The PRS Distributor and Consultant are required to furnish the member with a copy of the document containing the recommendation made and the basis of the recommendation. This document should be signed by the PRS Consultant and the member.

6.2 Relevance, consistent and appropriate

The funds offered within the PRS must be relevant, consistent and appropriate given the investment objectives of the Scheme. Over time, the investment performance of the funds can be measured and tracked to determine whether the fund adhered to its objectives and mandate.

One measure to consider is the target investment return and the target volatility of the fund and to compare it with actual investment performance and volatility of returns.

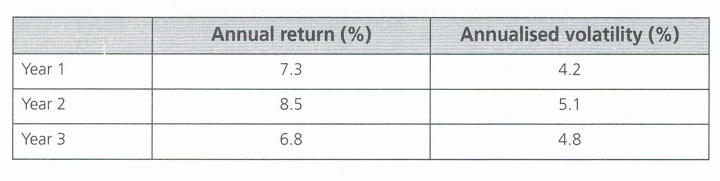

Example 1:

A fund within the PRS holds itself out to be a traditional fixed income fund and has an investment objective to return mid to high single digit percentage returns per annum with medium to low volatility.

The actual returns of the fund for the past three years are:

6.3 Types of investments

Please refer to Chapter 8 of the PRS Guidelines (Investments of the Scheme) to determine the types of investments allowed in the PRS.

(a) General

The fund’s property must be consistent with the investment objective of the PRS which is to help members accumulate savings for use in their retirement and the prudent man rule suggests that assets be diversified with no excessive concentration in any particular risk.

The PRS Guidelines permit a wide universe of investable instruments including the following:

(I) Transferable securities** in an eligible market;

(ii) Cash, deposits and other money markets instruments;

(iii) Units/shares in collective investment schemes;

(iv) Derivatives; and

(v) Real estate.

** Transferable securities are equities, debentures and warrants.

6.4 Investment limits

The investment limits under this section do not apply to the securities issued or guaranteed by the Government or Bank Negara Malaysia.

(a) Non-specialised fund

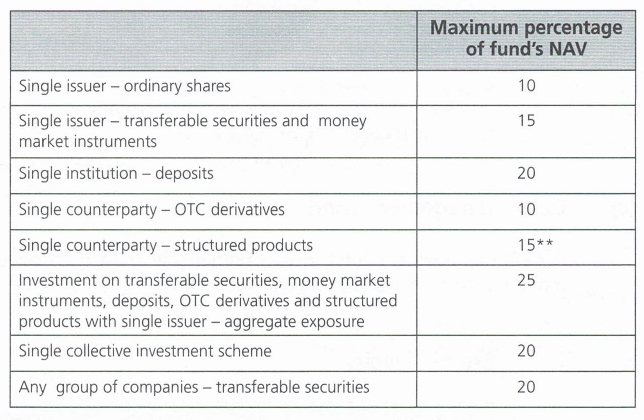

The investment limits and restrictions are detailed in Schedule A and Al of the PRS Guidelines which are as set out below.

(i) Exposure limits

(a) The investments in unlisted securities cannot exceed 10% of

the fund’s NAV.

(b) The investments in real estate cannot exceed 15% of the fund’s

NAV.

(ii) Investment spread limits

**The limit is waived for structured products if the counterparty has a minimum long-term rating provided by acceptable rating agency that indicates strong capacity for time payment of obligations and the product has a capital protection feature.

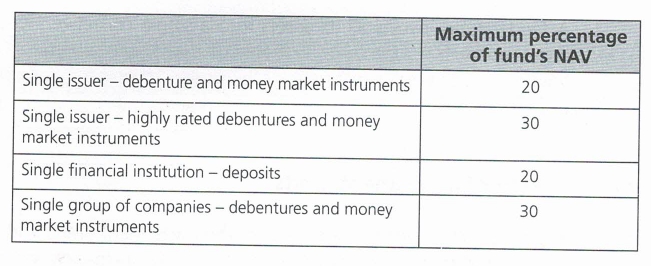

(iii) Investment concentration limits

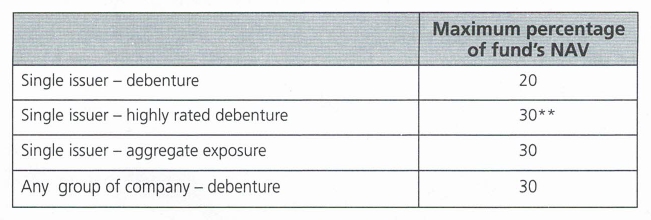

(b) Bond/fixed income fund

(I) Investment spread limits

** The single issuer limit may be increased to 30% if the debentures are rated by any domestic or global rating agency to be of the best quality and offering highest safety for timely payment of interest and principal.

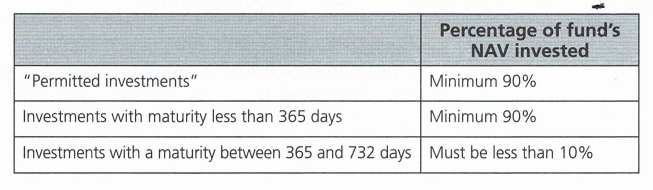

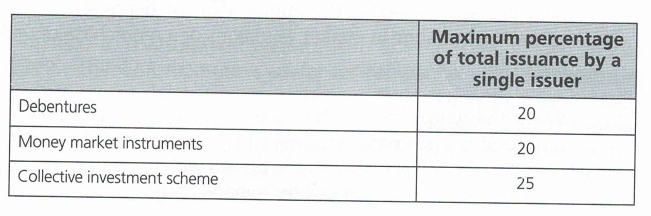

(c) Cash management fund

A cash management fund invests primarily in short-term debentures, money

market instruments and short-term deposits.

(i) Exposure limits

(ii) Investment spread limits

(iii) Investment concentration limit

(d) Fund of Funds

A fund is one that invests all its assets in other collective investment schemes and hence, all its assets must comprise units/shares in other funds. A fund of funds must not invest in other fund of funds, feeder funds or any sub-fund of an umbrella fund which is a fund of funds or feeder fund.

(i) Investment spread limits

A fund of funds must invest in at least five collective investment

schemes at all times and the value of a fund’s investment in units/shares

of any collective investment scheme cannot exceed 30% of the target

fund’s NAV.

(ii) Investment concentration limit

A fund’s investment in a collective investment scheme must not exceed

25% of the units of any single collective investment scheme.

(e) Feeder fund

A feeder fund invests all its assets into a single collective investment scheme and thus must only hold units/shares of that single scheme. The feeder must adhere to the requirements stipulated under Schedule A — Appendix III, in the PRS Guidelines.

(f) Breach of investment limits

The fund manager must ensure that the investment limits and restrictions are complied with at all times based on the most up-to-date value of the fund’s assets.

A 5% allowance in excess of the limits and restrictions is permitted where such breaches are caused by the appreciation or depreciation of the fund’s NAV caused by a change in market valuations or a repurchase of units or a payment out of the fund.

When the fund is in breach of the investment limits, the fund manager must not make any purchases that will aggravate the breach situation and must take the necessary steps to correct the breach within a reasonable time but not more than three months is allowed for remedial action.

6.5 Measuring performance and returns

It is important that the members are able to assess the performance of a fund under the PRS as it allows the member to make informed decisions on whether to stay invested with a current fund or to make a switch into another fund or for that matter another PRS altogether.

Fund performances are available in the disclosure documents and annual and interim report of the funds under the Scheme.

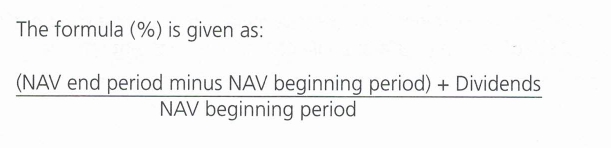

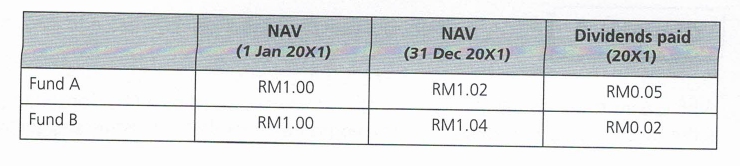

(a) Average total return

The average total return is a standard measure of performance for unit trusts and funds. It measures the total return for a measurement period (usually a year) by taking both the income distribution (dividends) and the change in the NAV per unit of the fund (the capital gains).

An example with illustrate the point

Average total return for Fund A = ((W1.02 – RM1.00) + RM0.05)/ RM1.00 = 7% for 20X1

Average total return for Fund B = ((RM1.04 – RM1.00) + RM0.02) / RM1.00 = 6% for 20X1

(b) Compounded annual return

Another method to measure performance is to use the compounded annual return (CAR). The CAR measure is useful for comparing fund performances that differ in holding period. For example, how do you compare a fund where your investment grew from RM1,000 to RM1,300 in five years against another where your RM1,000 grew to RM1,700 in 10 years? In the first instance, the CAR rate is 5.39% while in the second, it is 5.45%. The CAR standardises the time dimension so that returns over different periods can be compared.

There are drawbacks to this method as it assumes that the returns are compounded at the same rate for each period (year). Another drawback is

that this focuses on the return element without looking at the risk element (the volatility of returns). The third drawback is that the CAR measure must be put into context when assessing performance. Say Fund A has a CAR of 9.50% over the past 15 years whereas Fund B has a CAR of 10% over the last two years. Is Fund B superior to Fund A? Not necessarily. The longevity of Fund A and their ability to produce returns over 1 5 years (over many market cycles) is certainly a good attribute to have even if it has a lower CAR over the last two years.

Nevertheless, even with these drawbacks, the CAR is a useful tool to have in assessing fund performances.

(c) Income distribution

Another aspect to consider is the income distribution. Two funds may provide the same average total return but one fund pays a higher dividend. If a member has some short-term liquidity preference, then the higher dividend income would appeal to the member even if both the fund returns are the same.

For the PRS investor, any dividend income must be paid out in the form of units and withdrawal of the dividend must be deferred until the member has reached retirement age. This is the same for dividends declared by the EPF which is also not accessible by the EPF member until he reaches retirement age.

PRACTICE QUESTIONS

Question 1

With regard to the suitability assessment process conducted by a PRS Consultant, what is the MAIN purpose of seeking information on the member’s investment objectives?

A. To ascertain the member’s financial knowledge

B. To ascertain the member’s risk profile and needs

C. To ascertain a suitable PRS Providers for the member

D. To ascertain the member’s appreciation of the potential returns of the PRS funds

[Answer: B]

Question 2

Question 2 is based on the scenario below:

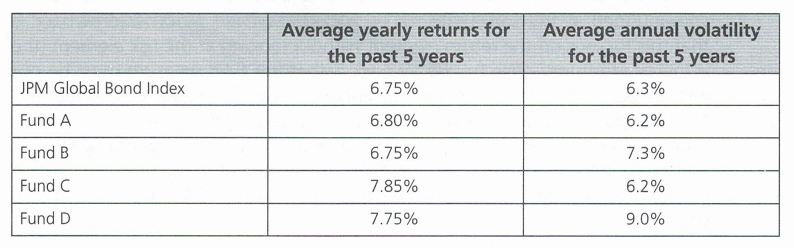

The Investment objective of the Private Retirement Scheme (PRS) is to track the returns and volatility of the JPM Global Bond Index over a 5-year period.

Which of the funds would be considered relevant, consistent and appropriate to the investment objectives of the PRS?

A Fund A

B Fund B

C Fund C

D Fund D

[Answer: A]

Question 3

Investments of a cash management fund may include

I. a corporate debenture maturing in three years

II. Cagamas Notes maturing in 20 months

III. a six-month MYR deposit with a foreign bank in Kuala Lumpur

IV. a bank debenture maturing in seven months

A. I and II only

B. I, II and III only

C. II, III and IV only

D. III and IV only

[Answer: C]