Chapter 2:

REGULATORY FRAME WORK

Learning Objectives

The Securities Commission Malaysia (SC) has developed the regulatory and supervisory framework for the PRS industry. The overall design of the regulatory framework, which includes the relevant legislation, regulations and guidelines, is in line with best practices and will build confidence in the PRS industry.

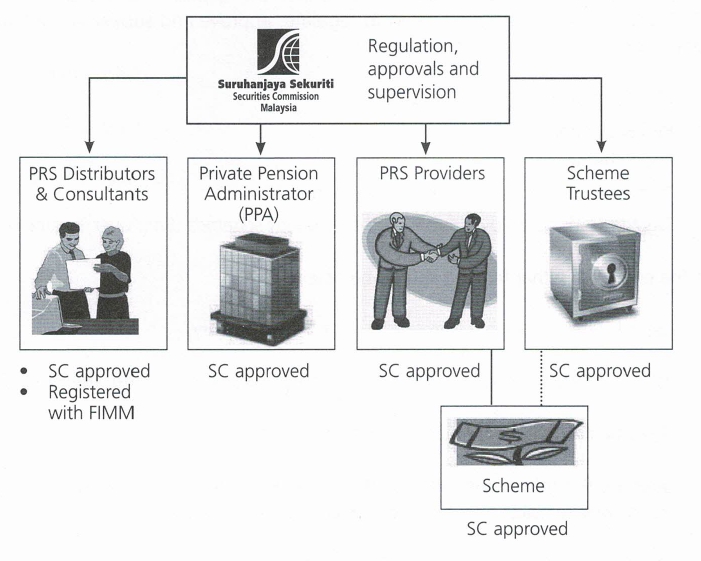

Under the regulatory framework set out under the Capital Markets & Services Act 2007 (CMSA), the SC is empowered to regulate, approve and supervise the following components of the PRS industry:

(a) PRS Administrator;

(b) PRS Providers;

(c) The Scheme;

(d) Trustee to the PRS (Scheme Trustee); and

(e) Trustee to the employer-sponsored retirement schemes (Employer Trustee).

At the end of this chapter, you should be able to—

(a) describe the regulatory framework of the PRS industry;

(b) list the different legislation, regulations and guidelines governing the PRS industry;

(c) describe the role of the SC in the PRS industry;

(d) describe the role of the PRS Providers, the PRS Distributors and Consultants, and the private pension administrator (PPA) in the framework;

(e) recognise the need for the PPA to maintain security and confidentiality of information;

(f) recall the penalty for failure to perform the duty to maintain the confidentiality of member information; and

(g) list the functions of the PPA.

2.1 Introduction

The introduction of the PRS framework resulted from recommendations made by the SC to the Government to accelerate the development of the private pension industry in Malaysia.

It was recognised that a robust PRS industry needed to be underpinned by a strong regulatory structure. The objective of regulation is to ensure the proper functioning of the PRS industry that promotes system stability and protects members and beneficiaries, via prudential and investor protection requirements.

To achieve this aim, the SC has put in place duties and responsibilities with adequate powers and resources to regulate, supervise and enforce regulations over the PRS industry.

2.2 Role of the Securities Commission Malaysia over the PRS

industry

(a) General

The SC is empowered by law to regulate and supervise the PRS industry, which includes the Scheme, PRS Providers, PRS Distributors and Consultants, Scheme Trustees, Employer Trustees and PRS Administrator to be known as the Private Pension Administrator.

In this respect, the CMSA, the PRS Regulations and the PRS Guidelines are

aimed at providing a regulatory environment that protects the security of the savings within the PRS framework and safeguard the interest of the contributors to the PRS. The SC may take enforcement action under the securities laws for any contravention of these guidelines.

(b) Develop the private pension industry

Given the responsibility entrusted by the Government, the SC develops the PRS as an integral part of the private pension landscape in Malaysia to—

(I) provide a well regulated and supervised PRS industry;

(ii) provide choice and flexibility to the members in their effort to save for retirement;

(iii) build trust and confidence in the PRS industry and its framework;

(iv) facilitate a cost effective private pensions framework; and

(v) safeguard the interests of the members through prudent operational

guidelines.

2.3 Legislation, regulations and relevant guidelines

As of 5 April 2012, the regulatory framework of the PRS industry is set out in the following:

(i) Capital Markets & Services Act 2007 (CM SA);

(ii) Capital Markets and Services (Private Retirement Scheme Industry)

Regulations 2012 (PRS Regulations); and

(iii) New guidelines issued by the SC, which include:

– Eligibility Requirements for PRS Providers; and

– Guidelines on Private Retirement Schemes (PRS Guidelines).

The regulatory framework developed by the SC aims at ensuring that the PRS industry operates in a safe and secure environment where the general public have full confidence to voluntarily contribute and save for their retirement needs.

(a) Capital Markets & Services Act 2007 (CMSA)

The CMSA stipulates the legislative requirements for the PRS Providers, PRS, Scheme Trustees, Employer Trustees and PRS Administrator. The PPA is intended to perform the duties and functions of an approved PRS Administrator as set out in the CMSA.

The SC’s powers and authority as regulator of the PRS industry are clearly set out in the recent amendments to the CMSA. These amendments which came into operation on 3 October 2011 introduced the new Part IIIA that sets out the relevant legal provisions on the PRS industry. The provisions under the CMSA are divided as follows:

(i) Division 1 entitled Preliminary;

(ii) Division 2 on the PRS which includes subdivisions on private retirement scheme administrator, PRS Providers, PRS and Scheme Trustees;

(iii) Division 3 on Trustee for employer-sponsored retirement schemes; and

(iv) Division 4 entitled General.

Some of the requirements that are provided for are as follows:

(i) Monies received from members are kept in a trust account;

(ii) Vesting of contributions made by members as accrued benefits which

members are entitled to; and

(iii) Preservation of accrued benefits for its members.

(b) PRS Regulations

he regulatory framework set out in the CMSA empowers the SC, with the approval of the Minister to make regulations on all matters relating to the PRS, private retirement scheme administrator, PRS Providers, the Scheme Trustees and the Employer Trustees. The regulations may also prescribe standards and conducts of the approved participants involved in this new industry.

The PRS Regulations which came into operation on 19 March 2012 seek to

supplement the operationalisation of the new Part IIIA on the PRS industry in the CMSA. Key provisions in the PRS Regulations include—

(i) Requirements for the registration and lodgement of deed and disclosure

document;

(ii) Duties and responsibilities of the PRS Provider, Scheme Trustee and

Employer Trustee;

(iii) Indemnity and replacement of a Scheme Trustee;

(iv) The powers of the court in specific instances; and

(v) Requirements relating to maintaining register of members, rights with

regard to deceased members, meeting of members and prior approval

of the SC for winding ‘Up of a Scheme.

(c) Eligibility requirements

The primary criteria in assessing the application for approval as a PRS Provider are based on compliance with the Eligibility Requirements for Private Retirement Scheme Providers (Eligibility Guidelines). The Eligibility Guidelines set out the expectation and requirements that must be satisfied by an applicant. The promotion of high governance was evidenced by the stringent eligibility requirements (e.g. relevant expertise in the management of funds and good track record) and operating requirements (e.g. capital, investment limits, governance and risk management) required of a PRS Provider under the Eligibility Guidelines.

In this respect, applicants also need to outline their business model for offering the PRS including the proposed range of funds, indicative fees and charges structure, as well as their ability to meet the specific administrative requirements of the PRS, such as resourcing capabilities, systems and process capabilities, and member servicing. Qualitative factors such as governance structure, reputation and professional standing, as well as track record and the commitment to grow the PRS industry have also been taken into consideration.

(d) PRS Guidelines

The PRS Guidelines are issued by the SC pursuant to section 377 of the CMSA and it stipulates the operational requirements for the PRS, PRS Providers and Scheme Trustees. The PRS Guidelines further clarify in detail, the requirements to be complied with by the PRS Providers in establishing, offering a Scheme or presenting themselves as establishing, offering or providing a Scheme as well as requirements to be complied with by a Scheme Trustee. The PRS Guidelines are aimed at providing a regulatory environment that will protect the security of the savings within the PRS framework and safeguard the interest of contributors to

the Scheme.

The SC is given the power under section 92A(1) of the CMSA to specify the information to be given to a person who makes a contribution to a PRS.

Regulation 7 of the PRS Regulations further provides that, a person shall not issue, circulate or distribute any form of application for contribution to a PRS without registering and lodging a disclosure document with the SC containing information as set out in the PRS Guidelines.

(e) Other applicable guidelines

Where a PRS Provider carries on any regulated activity specified in Schedule 2 of the CMSA, the PRS Provider must be a holder of a Capital Markets Services Licence to carry on the regulated activity of fund management, and must observe and comply with the relevant guidelines issued by the SC for licence holders, including—

(i) SC Licensing Handbook; and

(ii) Guidelines on Compliance Function for Fund Management Companies.

A PRS Provider may outsource its back office functions to external parties. In this regard, a PRS Provider must observe and ensure compliance with the requirements in the Guidelines on Outsourcing for Capital Market Intermediaries issued by the Sc.

2.4 Key components of the framework

(a) PRS Providers

Under section 139P of the CMSA, only approved PRS Providers will be allowed to offer PRS (and retirement funds under the Schemes) to the general public.

Section 139Q of the CMSA provides that applications for approval as a PRS

Provider may be made in such manner and form as may be specified by the Sc.

In approving the application, the SC may impose conditions or restrictions as it deems fit (section 139Q(3) of the CMSA).

To qualify as a PRS Provider, the applicant, among other things, must hold or apply to hold a Capital Markets Services Licence for the regulated activity of fund management.

The PRS Providers are approved by the SC to establish or provide a PRS and offering the Scheme to the investing public including employers. The PRS Provider will manage and administer the funds under the Schemes according to the deed and disclosure documents. The PRS Provider owes a duty of care to the members of the PRS to observe high standards of integrity and fair dealing in administering the PRS and managing the funds to the best interest of the members of the Scheme.

The PRS Regulations also provide certainty and crystallise the main role of the PRS Providers. Key duties of the PRS Provider under Regulation 10 include:

(I) Exercise the PRS Provider’s powers for a proper purpose and in good

faith, in the best interest of the members as a whole;

(ii) Exercise the degree of care and diligence that a reasonable man would

exercise if he was in the PRS Provider’s position;

(iii) Perform the function of the PRS Provider and the management and operation of the PRS in accordance with the CMSA, the PRS Regulations,

and any guidelines issued by the SC and the deed;

(iv) Give priority to the interest of members in the event of a conflict;

(v) Keep complete and accurate records of all information and make available such records to the Scheme Trustee and auditors, as well as the deed to the public;

(vi) Not act as principal in the sale and purchase of securities, property and assets to and from the PRS unless specified otherwise by the SC; and

(vii) Not make investments in which it could have a financial interest or derive a benefit without approval of the Scheme Trustee.

The main thrust of its duties is the proper and efficacious operation of the Scheme, run in the interests of its members. The PRS Provider performs a central function in terms of receiving contributions, processing transactions by members and managing the funds within the Scheme.

A further duty imposed via Regulation 11 is on the duty of the PRS Provider to prepare and send the annual report of the PRS to the SC and all members. The proposed regulation also provides the time frame within which such annual report must be sent to members and that it must be provided without charge to members. PRS Providers are only permitted to charge a reasonable sum for additional copies requested by members.

(b) PRS Distributors and Consultants

The PRS Distributors would be licensed for the new regulated activity of dealing in PRS under Schedule 2 of the CMSA or fall within the types of registered persons under Schedule 4 of the CMSA. Representatives of the PRS Distributors to be termed as PRS Consultants must be registered with the Federation of Investment Managers Malaysia (FIMM).

The underlying principle is to ensure all PRS Consultants obtain a minimum standard of knowledge of the PRS industry. The PRS Consultants meet potential members and employers and are often the first point of contact for the members. The PRS Consultants owe a duty of care to the members and potential members of the PRS to act with integrity and with a high level of professionalism. The duties of the PRS Consultants are listed out in Chapter 7 of this study guide and these include—

(i) acting with honesty, integrity and dignity and conducting themselves in a professional and ethical manner;

(ii) treating members with respect and disclosing fully, all information pertinent for members to make informed investment decisions; and

(iii) not misrepresenting the PRS, funds or past performances of the funds in the marketing of the PRS.

(c) Private Pension Administrator

The establishment of the PPA is a critical component in the private pension landscape to enhance the efficiency and convenience to members as well as overall administration of an effective PRS industry. The PPA will be responsible for ensuring the establishment and operationalisation of an efficient administrative system for the overall private pension industry in Malaysia. Overall, it will be responsible for facilitating and maintaining all PRS related transactions made by contributors and members. The PPA will also function as a resource centre for data and research relating to the PRS industry in Malaysia.

(i) Duties and responsibilities

The PPA is an entity approved by the SC to perform the function of

record keeping, administration and customer service for the members

and contributors in relation to contributions made in respect to the

PRS.

Some of the specific duties are—receiving and transmitting instruction in a manner specified by the Sc;

– keeping records of all transaction or monies paid or received;

– providing information to the PRS Provider, Scheme Trustee or member; and

– such duties as may be specified by the Sc.

The PPA must act in the public interest at all times particularly taking

into considerations the needs for protection of the members. The

PPA must immediately notify the SC if there are adverse circumstances

likely to affect the members. The PPA should also not impose fees or

vary charges on a PRS Provider or member without the prior approval

of the Sc. Its terms of reference or operating rules also require prior

approval of the Sc.

Other duties of the PPA include undertaking general promotion and

awareness of the PRS and to act as a resource centre for data and

research for the PRS industry. The PPA would also monitor fees charged

and performance offered by the different PRS Providers.

None of the duties and responsibilities of the PPA can be delegated or

outsourced without the approval of the S.

(ii) Prior approval for directors and CEO and board composition

Directors and the CEO of the PPA must be approved by the SC.

The board of directors must comprise of at least one-third public interest directors.

(iii) Need to maintain security and confidentiality of information

(a) Duty to take reasonable security measures•

The PPA should take all reasonable measures to protect the

information and documents relating to the members against any

unauthorised access, alteration, disclosure and dissemination.

The PPA must put in place the necessary administrative

infrastructure and security measures to perform this duty.

(b) Duty to maintain secrecy

The PPA will have access to sensitive and personal information

and documents relating to the members of the PRS. The PPA

is duty, bound not to divulge such information to any person

unless under specifically expressed circumstance provided for

under section 139N and 1390 of the CMSA.

This duty is very important and the person who fails in this duty

can be liable to a fine not exceeding three million ringgit or

to imprisonment for a term up to five years or both. This is to

reassure the public that privacy of their data is paramount.

(iv) Functions of the PPA

In performing its functions, the PPA will undertake the following:

(a) Receive registration information from PRS Providers and issue a

lifetime private pension account number to members;

(b) Maintain databases of all private pension account numbers

issued and transactions relating to each member’s account;

(c) Transmit members’instructions to update account details,

transfer between PRS Providers and withdraw monies;

(d) Issue consolidated account statements to all members;

(e) Maintain a website providing members with online access

to their accounts, detailing the Scheme offered by each PRS

Provider and general education/awareness;

(f) Operate a call centre and deal with complaints; and

(g) Generate reports, including statistical and compliance reports,

on developments in the PRS industry.

(v) Private pension account

A life-time private pension account will be opened for the potential

member by the PPA by completing the required opening form, payment

of a small fee and providing proof of identification. The account

opening procedure may vary for online transactions.

After the account is opened, the PPA will send the member a letter or

an email containing a unique username and password to access their

account online at www.ppa.my.

The private pension account will reflect all the contributions made by

the member or employer as contributor to all PRS Providers. In addition,

each PRS Provider will also maintain an account for each member of its

Schemes. ‘

The PPA will send members consolidated statements of all their holdings

whereas each PRS Provider will send statements of accounts to members

subscribed to their Schemes.

(vi) Fees and charges involved

All PRS Providers will charge the member fees for investment

management, trustee and administrative costs. The disclosure

document will set out the fees they charge. Each member will have to

refer to their respective PRS Provider for a complete list of fees/charges

involved.

The PPA would also charge fees for opening, facilitating transactions

and maintaining the PPA account for each member. The PPA website

will detail the main fees and charges by each PRS Provider for easy

comparison.

(vii) Keeping track of their PRS investments

Members can check their PRS investments online with the PPA or contact

their respective PRS Providers. Members will receive statements on a

periodic basis from PRS Providers and consolidated statements on the

investments, including contributions held by every PRS Provider from

the PPA.

Question 1

The following are the duties of the Private Pension Administrator, EXCEPT:

A.’undertake general promotion and awareness of the Scheme

B. act as a resource centre for data and research for the PRS industry

C. monitor fees charged and performance offered by the different PRS

roviders

D. appoint the Scheme Trustee for each Scheme

[Answer: D]

Question 2

Which of the following requires the approval from the Securities Commission Malaysia?

I. PRS Providers

II. The Private Retirement Schemes

III. PRS Consultants

IV. Scheme Trustees

A. II only

B. I and II only

C. I, II and IV only

D. All of the above

[Answer: C]

Question 3

Which of the following are legislation, regulations and guidelines relevant to the Private Retirement Schemes?

I. Capital Markets & Services Act 2007

II. Capital Markets & Services (Private Retirement Scheme Industry) Regulations 2012

III. Guidelines on Private Retirement Schemes

IV. Eligibility Requirements for Private Retirement Scheme Providers

A. I only

B. I and II only

C. II, III and IV only

D All of the above

[Answer: D]