Contents

Overview

Introduction

Objectives

1.0 Short Selling

1.1 Penalty

1.2 Case Examples

2.0 Market Manipulation by Market Rigging

2.1 Stock Market Manipulation

2.2 False Trading and Market-Rigging Transactions

3.0 Market Manipulation by Information

3.1 False or Misleading Statements in Relation to Securities

3.2 Fraudulently Inducing Persons to Deal in Securities

3.3 Dissemination of Information About Illegal Transactions

3.4 Use of Manipulative and Deceptive Devices

3.5 Penalties for Contravention

4.0 Other Offences Relating to Dealing

5.0 Other Offences Relating to False and Misleading Statements

6.0 Insider Trading

6.1 Rationale

6.2 Capital Markets and Services Act Provisions

7.0 Other Offences

7.1 Destruction of Documents/Falsification of Records

7.2 Failure to Co-operate with the Securities Commission Malaysia

7.3 Offences which Carry a Civil Penalty

7.4 Liability of Directors/Employers

8.0 Summary

Suggested Answers to Activity

Overview

Introduction

One the measures applied in regulating the funds management industry is by prohibiting certain market activities.

The offences relate to both physical acts and the passing on of information, false statements and rumours. The relevant legislations are as follows:

(a) Capital Markets and Services Act 2007 (CMSA)

(b) Securities Commission Act 1993 (SCA)

(c) Securities Industry (Central Depositories) Act 1991 (SICDA)

(d) Companies Act 1965 (CA).

We examine each of the following areas that are regulated:

(a) short selling

(b) market manipulation and share rigging

(c) market manipulation by information

(d) insider trading

(e) false trading

(f) bucketing

(g) price manipulation and cornering

(h) employment of devices for defraud

(i) false or misleading

(j) falsification of records and false statements for licenses and

earings/compliance with the CMSA.

(k) other offences concerning destruction of documents/falsification of records, failure to co-operate with Securities Commission (SC) and the liability of directors/employers.

Objectives

At the end of this topic you will be able to:

• describe the practice of short selling and outline the circumstances under which it is permitted

• describe the provisions of the securities industry legislation designed to prevent market manipulation

• describe the elements of insider trading

• describe the defences available to persons charged with insider trading

• ist and describe other offences.

1.0 Short Selling

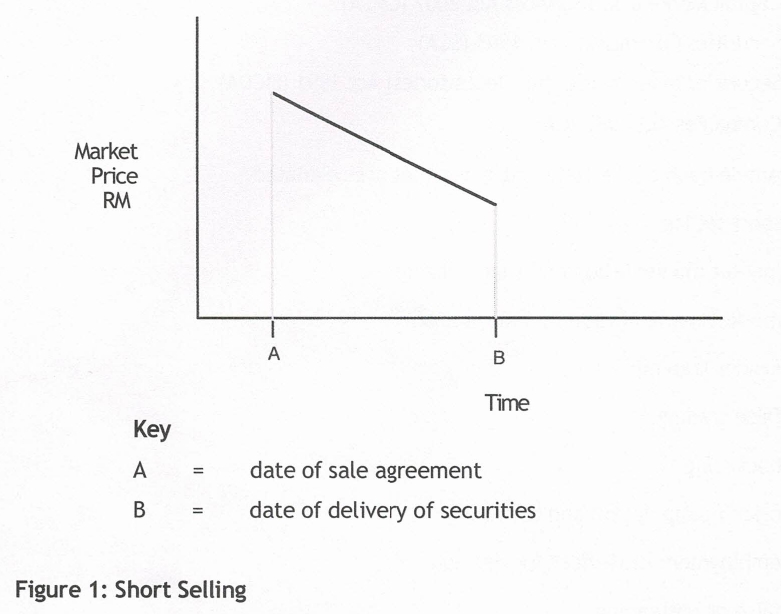

Short selling is the practice whereby the seller sells securities which, at the date of the agreement for sale, it does not own but intends to acquire before the delivery date. The seller that engages in short selling is relying on the market price of the securities falling between the date of the sale contract and the date for delivery under that contract, thus providing a profit. Naturally, short selling is more prevalent in a bear market where the odds of such a decline in price are considerably better than in a bull market.

The danger of short selling, from the securities market point of view, is that the seller may be unable to purchase the securities in time for delivery and will therefore default on the contract.

Section 98 of the CMSA prohibits a person from selling securities to a purchaser unless at the time of the sale, the person (or their agent) has a presently exercisable and unconditional right to vest the securities in the purchaser.

The CMSA however, also sets out a limited number of circumstances in which short selling is permitted. Read s.98(4) and note these exceptions.

1.1 Penalty

The penalty for short selling is a fine up to RM5 million or imprisonment for up to ten years or both.

1.2 Case Examples

Mustapha Ibrahim

On 17 June 1993 a business consultant, Mustapha Ibrahim sold 10 lots of UPHB share, at RM5.65 through Apex Securities Sdn. Bhd. On 23 June 1993, the accused bought back five lots of UPHB shares from the market at RM6.20 per unit. On 9 July 1993, KLSE (now Bursa Malaysia Securities Berhad) instituted a buying-in for another five lots of UPHB at RM15.20. On 17 September 1993, Mustapha Ibrahim was charged under s. 41(1) of the SIA (now s.98(1) of the CMSA) for shortselling 10 tots of UPHB shares at the Sessions Court, Selangor. The accused pleaded guilty on 24 September 1993, and was convicted and fined a sum of RM90,000; in default nine months imprisonment. The accused paid the fine.

Yap Swee Yeow

On 25 June 1993, Yap Swee Yeow, an accounts clerk sold 20 lots of UPHB shares at RM7.50 per lot through K ü N Kenanga Sdn. Bhd. At that time, the UPHB counter had been designated, and delivery of the shares was on an immediate basis. When the accused failed to deliver the scrips on T + 1 days (i.e. on 28 June 1993), a buying-in was instituted at RM15.20 per lot on 9 July 1993. Yap Swee Yeow was charged on 21 September 1993 at the Sessions Court, KL and he pleaded guilty. He was fined a sum of RM100,000; in default six months imprisonment. The accused paid the fine.

2.0 Market Manipulation by Market Rigging

The prohibitions on false trading and market rigging transaction and stock market manipulations are contained in s.175 and s.176 of the CMSA. A fund management company is in a powerful position in relation to these prohibited activities since it is often able to deal in large amounts without reference to clients, and can place deals (or recommend clients to place deals) which together may have the effect of breaking one or both of these sections. In most cases a client will be totally unaware of the investment transactions of other clients of a fund management company. Client A may therefore be acquiring shares from, or selling shares to, client B. It is therefore vital that staff of fund management companies are fully aware of the law and their responsibilities in this area.

2.1 Stock Market Manipulation

Transactions that are not entered into for legitimate trading purposes, but with the intention of creating a false impression of a genuine demand for securities, are prohibited by s.176. This section is drafted very broadly and relates to multiple transactions designed to raise, lower, maintain or stabilise the relevant price with the intention of inducing others to buy, sell or subscribe for the securities. A ‘transaction includes the making of offers of sale or purchase and any express or implied invitation with respect to the offer or sale of securities. Hence, an offence can result from making bids that have an effect on the price for the securities even if the bids do not develop into sales or purchases.

S.202 of the CMSA prohibits the creation or the cause for the creation of a false or misleading appearance of a active trading in derivatives on a derivatives market.

Bucketing is also prohibited under s.203. It is stated under this section that no

person shall execute or hold himself out as having executed, an order for the purchase or sale of derivatives on a derivatives market without having effected a bona fide purchase or sale of the derivatives in accordance with the rules and practices of the derivatives market.

Cornering is prohibited in the futures market under s.205 of the CMSA. Under this section it is stated that no person shall directly or indirectly corner or attempt to corner, any underlying instrument which is the subject of a derivative.

2.2 False Trading and Market-Rigging Transactions

This section prohibits the creation of:

▪ a false or misleading appearance of active trading in any securities on a stock market

• a false or misleading appearance of a fluctuation in the price of any securities on a stock market.

An example of this would be if a person makes an offer to purchase securities at a specified price when he or she has also made an offer to sell the same number at substantially the same price.

Trading is, of course, one of the most effective ways of ensuring that prices will vary;

the more shares that are purchased, the better the chances are of raising the price (all other things being equal). It is not the only way, however, of creating an appearance of active trading. For example, if a person indicates that he or she wishes to buy large parcels of shares of a particular kind when they are not available through the normal channels of the stock market, it may give the appearance of activity in a particular market for securities.

Note that this section covers actions that are calculated to create the necessary appearance of active trading, i.e. it is not necessary for active trading to have, in fact, occurred. This prohibition appears wide enough to cover all kinds of market rigging and the distortion of market prices by fictitious sates.

A person is also prohibited from causing a change in the market price of securities by buying or selling legal title to the securities, without a change in the beneficial ownership, or by using some fictitious device.

The aim of this prohibition is to stop fictitious activities through intermediaries such as fund management companies which may create what appears to be an active market in securities. The purpose of such an illusion is to influence other investors to purchase securities of a similar or related class. For example, a company may have issued a limited number of class A shares, but a large number of class B shares. The perpetrators of the fictitious activities may wish to stimulate trading in class B shares by creating false trading in class A shares.

In this context, transactions include offers and invitations to purchase or to sell, as

the case may be.

3.0 Market Manipulation by Information

The prohibitions in s.175 and s.176 do not deal with the peddling of false or misleading information on the securities market. Hence, there are two other sections, s.177 and s.178 of the CMSA, which are designed to prevent market manipulation through the circulation of false or misleading information.

3.1 False or Misleading Statements in Relation to Securities

A person must not make a statement or disseminate information that:

• is false or misleading in a material particular

• is likely to induce the subscription, sale or purchase of securities by other persons, or is likely to have the effect of raising or lowering, maintaining or stabilising the market price of securities

• when he or she makes or disseminates it, the person:

(i) does not care whether the statement or information is true or false

(ii) knows or ought reasonably to know that it is false or misleading.

In relation to derivatives, market manipulation by means of information is stated under s.204, 206 and 207 of the CMSA.

Section 204 relates to dissemination of information about false trading. This relates to the circulation, dissemination or authorisation or anything concerning these which would likely effect the price of trading derivative or a class of derivatives.

3.2 Fraudulently Inducing Persons to Deal in Securities

It is an offence to induce or to attempt to induce another person to deal in securities by:

• making or publishing any statement, promise or forecast that the maker knows to be misleading, false or deceptive

• dishonestly concealing material facts

• recklessly making or publishing (dishonestly or otherwise) any statement, promise or forecast that is misleading, false or deceptive

• recording or storing in, or by means of any mechanical, electronic or other device, information that they know to be false or misleading in a material particular.

Persons who could be subject to this prohibition are officers of a company in relation to a company prospectus, a stockbroking company advising clients about an issue or sale of securities, or a fund management company recommending a client to purchase or sell shares in a particular company.

False means that the statement was incorrect. ‘Misleading requires one to look at the potential effect of the statement on a hearer. If it is capable of leading an ordinary member of the public into a false belief then it is misleading.

The section extends to promises and forecasts which the maker knows to be misleading, false or deceptive, e.g. a forecast of dividends payable in the future.

Finally, the section extends liability to a situation where a person is not necessarily acting dishonestly. The requirement that the statement be ‘reckless is not met by mere negligence, being the failure to take ‘reasonable care’.

The effect of s.178 is, therefore, to impose on directors and other persons making statements by way of inducement, a duty to enquire whether the information they have been given is correct and reliable.

With regard to derivatives, false or misleading statements is stated under s.207.

Under this section, no person shall directly or indirectly, for the purpose of inducing the entering into a derivatives, make any statement which at the time and in the light of the circumstances in which it is made, is false, misleading or deceptive with respect to any material fact.

3.3 Dissemination of Information About Illegal Transactions

If a transaction is entered into in contravention of s.175 – 178, it is an offence for a person to circulate or disseminate a statement or information that indicates that the transaction will affect the price of the securities if that person has entered into the transaction.

3.4 Use of Manipulative and Deceptive Devices

By virtue of s.179, it is an offence if, in connection with the subscription, purchase or sate of any securities, a person:

• uses any device, scheme or artifice to defraud

• engages in an act, practice or course of business which does, or would, operate as a fraud or deceit

• makes any statement which is untrue of a material fact or omits to state a material fact necessary to make a statement not misleading in the context in which it was made.

This section extends the circumstances in which the act applied in respect of materially untrue statements and omissions and incorporates the common law actions of fraud and deceit.

In addressing derivatives, s.207 of the CMSA provides for the prohibition of making false statements of a material fact, or omit to state a material fact necessary in order to make the statement made in the light of the circumstances under which they are made, not misleading.

Case Examples

In 1995 Haron Jambari (a remisier from Arab Malaysian Securities Sdn. Bhd.) and Nik Abdul Aziz (an accountant with Majlis Ugama Islam) were charged under s. 87A of the SIA 1983 (now s.179 of the CMSA) for making a false statement in connection with RM2 million entrusted to them by MAI in relation to the first accused person, and for abetting Haron Jambari (sees. 40 and s.109 of the Penal Code) in relation to the second accused. They pleaded not guilty and the trial continued in May 1997.

3.5 Penalties for Contravention

The penalty for a contravention of the sections of the CMSA discussed above is a fine of at least RM1 million and imprisonment for up to ten years (see s.182 and s.209)

In addition, under s.374 a person who suffers loss or damage as a result of the contravention may recover the amount of toss or damage from a person convicted of an offence under those sections.

Note also that where an offence is committed by a corporation, such as a funds management company, liability extends to directors, chief executive officer, officer or a representative under s.367, unless:

• he or she proves that the offence was committed without consent or connivance; and

• he or she exercised all such diligence to prevent the commission of the offence as ought to have been exercised.

In addition, a holder of a CMSL is liable for a contravention of any of those sections by one of its representatives. See s.367(3).

It is also an offence for a person to attempt to commit such an offence, abet an offence or be engaged in a criminal conspiracy to commit any offence. See s.370.

The penalties for a contravention of the sections discussed earlier are also found in:

• S.374 in addition, provides that the convicted person shall be liable to pay compensation to any other person who has suffered a loss or damage as a result of the offence committed by the convicted person

• S.367(1) provides that when a corporation is guilty an offence, the director, chief executive, officer or a representative shall also be guilty of that offence.

• 5.367(2) provides that when an employee is guilty of an offence, the principal shall also be deemed to be guilty of that offence.

4.0 Other Offences Relating to Dealing

Apart from the offences discussed above there are several offences which relate to dealing in securities and derivatives:

• carrying on a business in any regulated activity without a licence or is a registered person (s.58 CMSA)

• duty to maintain secrecy of information relating to depositors’ accounts in the Central Depository System (see s.43 SICDA)

• fraudulently inducing persons to invest money (s.366 CA)

5.0 Other Offences Relating to False and Misleading Statements

The following are offences which relate to false and misleading statements:

• false statements made to the SC in connection with an application for a licence, or variation (s.71 CMSA)

• false reports to the Sc, exchange or approved clearing house with intent to deceive (s.369 CMSA)

• false or misleading statement to the SC in connection with proposal in relation to securities required by s.212 (s.214 CMSA)

• furnishing false or misleading information in connection with an application or in purported compliance with the Act (s.49 SICDA)

• false and misleading statements in relation to the nominal or authorised capital of a company, or in returns, reports, certificates, balance sheets or other documents required by, or for the purposes of, the Act (s.364 CA)

• false reports made with the intent to deceive (s.364A CA).

6.0 Insider Trading

In addition to the provisions of the CMSA, the Bursa Malaysia Securities Berhad’s Corporate Disclosure Guide on insider trading states that insiders should not trade on the basis of material information which is not known to the investing public.

Moreover, insiders should refrain from trading, even after material information has been released to the press and other media, for a period sufficient to permit thorough public dissemination and evaluation of the information.

6.1 Rationale

The rationale for prohibiting insider trading includes the following:

• fairness in the marketplace, equal access to information to all market participants

• market integrity

• fiduciary duty of company officers to the company and its shareholders

• prevention of injury to the company, its shareholders and investors.

Those who trade on privileged or price-sensitive information to make quick profits in the market are said to be profiteering at the expense of those who do not have access to the same inside information. Those occupying privileged positions may hoard information or keep it away from the public because they feel or they know that once the information is made public it will cause the price of the shares issued by the company to rise or fall. By keeping this information to themselves they may make large profits by buying or selling the stock before its price rises or they may protect themselves by selling stock before its price falls. If the information was made freely available then they would not have had the unfair advantage.

In Public Prosecutor v. G. Choudhury [1981], ML) 76, the judge said:

“Recently, in the Court of Appeal (UK) in AG’s Reference (NO. 1 of 1988),

Lord Lane in a reference to insider dealing stated that gaining an unfair advantage amounts to cheating the other party to the transaction”. There can be no doubt that offence such as these are serious. Their description with the seemingly innocuous title “Insider dealing” or trading which to a layman may not even suggest an offence should be stripped of this artificial veneer and exposed in what Lord Lane likened them to, as plain cheating.

But the real gravman of the offence, lest this be missed, is the abuse of corporate confidence.”

Source: The Malayan Law Journal

6.2 Capital Markets and Services Act Provisions

The CMSA, in s.208 provides that a person (such as an officer, agent or employee) shall not make improper use of Information’ to gain an advantage for himself or herself or any other person. The ‘information’ caught by this section must:

• Be price-sensitive information

• Be obtained by virtue of his or her official capacity or former official capacity

• Be information that except for the proper performance of his or her official duties, would not be disclosed

• Be known by the person to be unpublished price-sensitive information relating to an underlying instrument which is the subject of a derivatives or relating to the dealing in derivative

Insider trading of securities is provided for in s.183 – s.198 (Subdivision 2 of Division 1 in Part V). Section 183 defines ‘information’ as:

• Matters insufficiently definite so as to inform the public about it

• Matters relating to the intentions or likely intentions of a person

• Matters relating to negotiations or proposals relating to commercial dealings or dealings in securities

• Information relating to the financial performance of a corporation

• Information relating to the future transactions or proposed transactions or agreements in relation to securities

For the context of this sub-division, information is categorised as becoming generally available if it has or tend to have a material effect upon the price or the value of securities. It is noted that a material effect arises when the information, once becoming generally available, will influence a reasonable person who invests in securities to decide whether to acquire or dispose or enter into agreement to acquire

or dispose such securities.

Inside information in the context to this sub-division relates to a person who possesses information that is not generally available to the public. Such information, once disseminated to the public would have a material effect on the price or the value of securities. Such a person would be performing an act of insider trading if/when that person acquires, disposes or enters into an agreement with the intention either to acquire or dispose of such securities. This is inclusive of whether the person acted as an agent or principal in the transaction. In addition to this, such a person would also be performing an act of insider trading when that person procures, either directly or indirectly, an acquisition or disposal of such securities.

This includes the act of procuring another person to enter into an agreement to acquire or dispose of such securities.

As for corporations, the CMSA provision is under s.190. Here, a corporation is deemed to possess any information when the officer of the corporation is in possession of such information which arise in the course of his duties as an officer of the corporation. This includes when the officer receives in his duties to a related corporation either through his involvement in a transaction or agreement in the acquisition or disposal of the first corporation in relation to particular securities. It

must also be of reasonable expectation that the person would communicate the information to the first mentioned corporation.

Exceptions from s.188(2), with respect to corporations, are provided under s.194.

• A corporation is not in breach of s.188(2) merely because the corporation is aware that it proposes to enter or has previously entered into one or more transactions or agreements relating to those securities.

• A corporation does not contravene s.188(2) on the basis that the officer of the corporation is aware that it proposes to enter into or has previously entered into, one or more transactions or agreements in relation to those securities.

This however, shall not be applicable if the person became aware in the course of his said duties.

In accordance with s.188(4), a person who contravenes and performs the act of insider trading is liable on conviction, to imprisonment for a term not exceeding ten years and to a fine of not less than RM1 million.

It is important to note that the insider trading is inclusive of those acts or omissions regarding securities outside Malaysia or insider trading performed outside Malaysia relating to securities in Malaysia.

7.0 Other Offences

7.1 Destruction of Documents/Falsification of Records

The CMSA contains a general penalty in relation to the falsification of records by directors, employees and agents and also a penalty for destroying, concealing or altering records or sending records of other property out of Malaysia in relation to accounts and audit, s. 47 and 48 of the SICDA, as well as the provision under the SCA,

contain similar provisions.

7.2 Failure to Co-operate with the Securities Commission

A person who fails to co-operate with the SC in any of the instances listed below is guilty of an offence:

• failure to appear before Investigating Officer or refusal to answer questions put by an Investigating Officer (s.134(5) SCA)

• failure to produce records on request (s.53(6) SICDA)

• failure to disclose information to SC as required (s.56 SICDA).

7.3 Offences which Carry a Civil Penalty

A licensed person is liable to a person who suffers loss or damage as a result of acting or refraining from acting in reliance on a recommendation of that licensed person (where it was reasonable in the circumstances to do so) and if the licensed person did not have a reasonable basis for making the recommendation. See s.92 of the CMSA.

Where a person makes improper use of confidential price-sensitive information, he or she will be liable to a person who suffers a loss in relation to a dealing in those securities. The amount of the toss will be the difference between the consideration paid or received by that person and the amount that would have been reasonable if the price-sensitive information had been generally known at the time of the dealing. (See s.201). See also s.200 and 211.

7.4 Liability of Directors/Employers

As we have noted above, directors, chief executives, officers and representatives of a company are deemed to have committed an offence if a corporation is charged with an offence unless they can prove that the offence was committed without their consent or connivance. They also need to establish that they had exercised all such diligence to prevent the commission of the offence as ought to have been exercised having regard to their position and functions and to all the circumstances.

See s.367(1) CMSA. Similarly, principals are liable for the conduct of their representatives. See s.367(3) CMSA.

Activity 1

Which of the following statements are true or false?

1. Short selling is likely to be most profitable in a bull market bull market.

2. The penalty for short selling includes up to ten years imprisonment.

3. A fund management company provides information to a client that is subsequently found to be a false and misleading statement under s.177 CMSA. A defence for the directors of the fund management company includes that they had in place proper controls to prevent the offence taking place.

8.0 In Summary

In this topic we considered how the various pieces of legislation that regulate securities and futures dealings prohibit certain activities. We examined practices such as short selling, market rigging, the creation of false markets and insider trading. For completeness we also looked briefly at some other offences in relation to dealing, false and misleading statements, destruction of documents and falsification of records, failure to co-operate with the SC, offences which carry a

civil penalty and the liability of directors and employers.

The offences discussed carry severe criminal penalties.

In the next topic we will examine some other important aspects of a fund management company’s business.

Suggested Answers to Activity

Activity 1

By way of illustration note whether the following statements are TRUE or FALSE:

NOTE: For answers, refer to right column (answer is in BOLD)

1. Short selling is likely to be most profitable in a bear market).

Answer: FALSE – short selling is most likely to be profitable in a bull market

2. The penalty for short selling includes up to ten years imprisonment.

Answer: TRUE – the penalty may be up to ten years imprisonment or a fine of up to RM5 million

3. A fund management company provides information to a client that is subsequently found to be under s.177 CMSA. A defence for the directors of the fund management company includes that they had in place proper controls to prevent the offence taking place.

Anawer: TRUE – under s.367, liability for an offence committed by a corporation extends to the directors (and others) unless the directors can prove the offence was committed without their consent or connivance and the directors had exercised all such diligence to prevent the offence from taking place.