Crypto - The most trusted wallets/platforms globally...

Binance

Bybit

WHY YOU SHOULD

INVEST IN

CRYPTOCURRENCIES?

Powering the Digital Economy

Connecting

for Better Future

Acc ID: 2458477131202122

Top-up address / USDT (TRC20/TRON):

TQqDAWzEhHfyKqrigG7uZN26Mz1RMDUX4k

EveningCrest

Global reach with no hassle

VC Fund Performance

(Q1 2024)

Cryptocurrencies

Most importantly, cryptocurrencies allow individuals to take complete control over their assets.

Cryptocurrencies are usually not issued or controlled by any government or other central authority.

It’s secure because all transactions are vetted by a technology called a blockchain.

A cryptocurrency blockchain is similar to a bank’s balance sheet or ledger. Each currency has its own blockchain, which is an ongoing, constantly re-verified record of every single transaction ever made using that currency.

Digital currencies

Digital currencies provide equality of opportunity, regardless of where you were born or where you live.

Digital asset

Digital wallet

Our mission is to increase economic freedom in the world.

Join us and make an impact at a global scale.

Blockchain Technology

Crypto Fundamentals

Crypto Investing and Trading

Decentralized Finance (DeFi)

Security and Risk Management

Youth & Digital Economy

Youth unemployments

Cryptocurrency - Market Capitals...

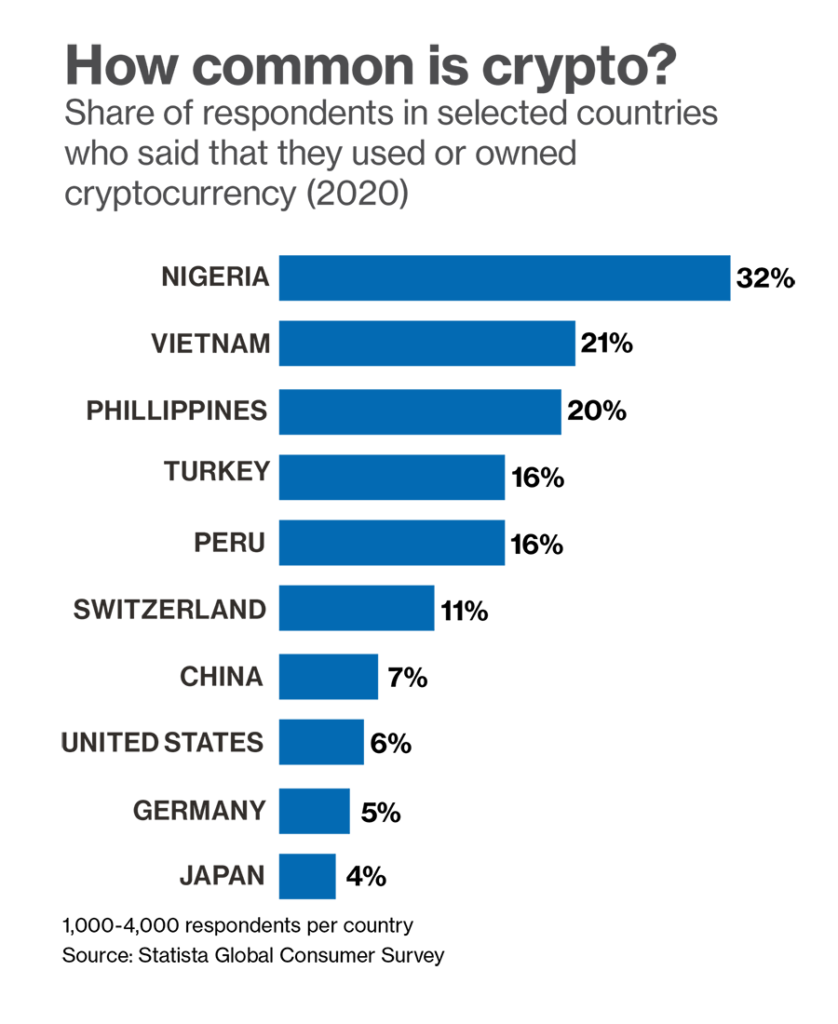

Crypto is big money.

Financial Times

Cryptocurrency - Digital assets...

Cryptocurrency - Crypto News...

Cryptocurrency - By News Canvass...

The most popular cryptocurrencies, by market capitalization, are Bitcoin, Ethereum, Tether and Solana. Other well-known cryptocurrencies include Tezos, EOS, and ZCash. Some are similar to Bitcoin. Others are based on different technologies, or have new features that allow them to do more than transfer value.

Crypto makes it possible to transfer value online without the need for a middleman like a bank or payment processor, allowing value to transfer globally, near-instantly, 24/7, for low fees.

Cryptocurrencies are usually not issued or controlled by any government or other central authority. They’re managed by peer-to-peer networks of computers running free, open-source software. Generally, anyone who wants to participate is able to.

If a bank or government isn’t involved, how is crypto secure? It’s secure because all transactions are vetted by a technology called a blockchain.

A cryptocurrency blockchain is similar to a bank’s balance sheet or ledger. Each currency has its own blockchain, which is an ongoing, constantly re-verified record of every single transaction ever made using that currency.

Unlike a bank’s ledger, a crypto blockchain is distributed across participants of the digital currency’s entire network

Cryptocurrencies can be used to buy goods or services or held as part of an investment strategy, but they can’t be manipulated by any central authority, simply because there isn’t one. No matter what happens to a government, your cryptocurrency will remain secure.

Digital currencies provide equality of opportunity, regardless of where you were born or where you live. As long as you have a smartphone or another internet-connected device, you have the same crypto access as everyone else.

Cryptocurrencies create unique opportunities for expanding people’s economic freedom around the world. Digital currencies’ essential borderlessness facilitates free trade, even in countries with tight government controls over citizens’ finances. In places where inflation is a key problem, cryptocurrencies can provide an alternative to dysfunctional fiat currencies for savings and payments.

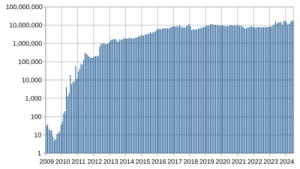

As part of a broader investment strategy, crypto can be approached in a wide variety of ways. One approach is to buy and hold something like bitcoin, which has gone from virtually worthless in 2008 to thousands of dollars a coin today. Another would be a more active strategy, buying and selling cryptocurrencies that experience volatility.

One option for crypto-curious investors looking to minimize risk is USD Coin, which is pegged 1:1 to the value of the U.S. dollar. It offers the benefits of crypto, including the ability to transfer money internationally quickly and cheaply, with the stability of a traditional currency. Coinbase customers that hold USDC earn rewards, making it an appealing alternative to a traditional savings account.

Related Links

Article contributed by Ruth Wickham -

Chief Editor & Writer

Expert Explains

Watch amazing documentaries...

Crypto regulations in Malaysia—2024 Guide

FAQ

Is cryptocurrency legal in Malaysia?

Crypto in Malaysia is legal. However, Malaysia doesn’t recognize digital assets as legal tender or as a payment instrument. According to the Prescription Order 2019, they are recognized as securities.

Who regulates crypto in Malaysia?

The main regulator for digital asset service providers in the country is the Securities Commission Malaysia (SCM).

Does the Travel Rule apply to crypto in Malaysia?

Yes, it applies. Information between initiator and beneficiary company has to be shared whenever a crypto transfer occurs.

What is a digital asset exchange?

A digital asset exchange is an electronic platform that facilitate the trading of digital assets. DAX platforms allows investors to trade permitted digital asset such as Bitcoin (BTC), Ether (ETH), Ripple (XRP), Litecoin (LTC) and Bitcoin Cash (BCH).

Is digital asset trading regulated in Malaysia?

Useful links

List of Registered Digital Asset Exchanges

5 Places You Can Invest In Cryptocurrency In Malaysia

In this article, we’ll be looking at some of the top and most lucrative crypto platforms you can give a go. Here, we list down the pros and cons of some of these platforms, so you can decide wisely before investing...Read more.

financemagnates.com

Malaysia Explores Crypto Policies: Consults with the UAE and Binance Founder

lowyat.net

Malaysia, UAE And Binance Reportedly Discussing Policy For Blockchain Technology In Malaysia

markets.businessinsider.com

Malaysia Weighs Introduction of Crypto, Blockchain Legislation

Blockchain Technology Simply Explained

Blockchain technology is an innovative distributed ledger technology that is changing how we store and share information. It is a decentralised computing system that lets users store data safely and do business without trusting each other. Many different fields, from finance to health care, are starting to use this technology.

At its heart, blockchain technology creates a shared digital ledger of transactions that can't be changed. Each transaction is recorded as a block, which is linked to the block before it in a chain. The blockchain gets its name from this chain of blocks, which makes it a very secure technology.

When it comes to security, blockchain technology is very safe because it uses advanced cryptography to protect data and make sure that only authorized users can access and change it. This makes it perfect for applications that need the highest level of security, like those in finance, health care, and government.

By the end of this video, you will have a better understanding of blockchain technology and its potential use cases. So, if you are interested in learning more about blockchain technology, then this video is for you!

Caitlin Long

The Development of Digital Assets and Their Implications for Portfolio Construction

The Digital Economy:

What is it and how will it transform our lives?

Digital Currencies

The Crypto Question: Bitcoin, Digital Dollars, and the Future of Money

SOME SIMPLE BITCOIN ECONOMICS

Economist/Cryptocurrency

Cryptocurrencies: an economist's view

Video:

Explore Tether

October 26-31, 2024

Create a Coinbase account to buy and sell Tether and start your crypto journey!

Explore Bitcoin

Friday, November 01, 2024

Create a Coinbase account to buy and sell Tether and start your crypto journey!

Expert Explains

Digital Currencies

Cryptocurrency Scams:

How to Spot, Report, and Avoid Them

What To Do If You Are A Crypto Scam Victim – How To Report And Recover

Economist/Cryptocurrency

Forbes Advisor

5 Crypto Scams To Watch Out For

14 cryptocurrency scams to avoid in 2024.

14 cryptocurrency scams to avoid in 2024.

Most Common Crypto Scams To Look Out For

Video:

Digital Currencies

Economist/Cryptocurrency

Written by Dalia Ramirez

BEST WALLET – A trending new non-custodial hot wallet that supports Ethereum, Polygon, and BSC Mainnet, with future Bitcoin integration. Offers an integrated DEX, portfolio analytics, market insights, upcoming airdrops, and NFT integration.

EXODUS – This versatile iOS, Android, Windows, and Mac wallet caters to long-term investors. It offers real-time portfolio valuation in the user’s local currency and supports over 260 cryptocurrencies.

ZENGO – One of the best mobile hot wallets that allows users to buy, sell, and trade over 120 cryptocurrencies and NFTs from multiple blockchains in-app. Zengo wallet is built on top of open-source cryptography.

BINANCE Wallet – A popular custodial web wallet integrated with Binance’s ecosystem. It supports multiple cryptos and NFTs and offers staking rewards and low-fee trading starting at 0.1%.

BYBIT Wallet – A versatile hot wallet with high security that Supports 400+ cryptos across multiple chains, offers NFT trading, and provides access to dApps.

OKX - Part of the OKX trading platform, this wallet has a built-in bridge aggregator, which facilitates the discovery of optimal interest rates for staking and yield farming.

Gate.io - CoolWallet...

14 cryptocurrency scams to avoid in 2024.

14 cryptocurrency scams to avoid in 2024.

Most Common Crypto Scams To Look Out For

Video:

ForbesAdvisors

Written By: David Rodeck

Expert Explains

The risks of different cryptoassets

Cryptocurrency Market Cap Approaching $2 Trillion, What Comes Next?

Contributed by:

Rohit sharma

Accounting Manager at Megatron Powerplants - India

February 17, 2024

Yahoo!Finance - Latest Crypto & Bitcoin News

Cryptocurrency Prices by Market Cap

The global cryptocurrency market cap today is $3.82 Trillion,

Wealth management is the process of making decisions about your assets, sometimes with a wealth manager. This includes, but isn’t limited to, financial investments, tax planning, estate planning and other financial matters.

The goal of wealth management is to help you achieve financial security and grow and protect your wealth.

A wealth manager is a certified professional who provides financial advice and services to clients who need wealth management help. They are a licensed financial professional who typically provides a comprehensive range of services. These may include investment management, financial planning, insurance sales, tax advice and estate planning.

Wealth management is an investment advisory service that uses financial services to address the needs of affluent clients.

Using a consultative process, the advisor gleans information about a client’s wants and specific situation. They then tailor a personalized strategy that uses a range of financial products and services to help the client achieve their goals.

Wealth management often takes a comprehensive approach. That is, to meet the complex needs of an affluent client, a broad range of services—such as money management, financial planning, investment advice, estate planning, accounting, life insurance, retirement, and tax services—may be provided.

EveningCrest's Crypto Deposit Address

BITCOIN

USDT ECR20

USDT TRC20